FHA loans have dominated the local market in the Sacramento area lately, haven’t they? This is why many buyers and sellers are paying careful attention to FHA guidelines. I get calls all the time from concerned sellers, prospective buyers, and real estate agents about FHA compliance issues. The question is usually, “will _________ be an issue for an FHA loan?”

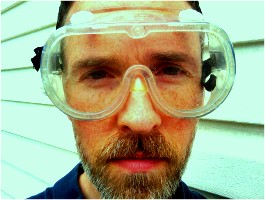

FHA has a very specific set of minimum requirements. If you are planning to sell your house and you think the most likely buyer is going to be using an FHA loan, then strap on your “FHA goggles” to view your property like HUD does. Or if you are purchasing a house, it’s important to be aware of condition issues that may impact qualification for an FHA loan.

FHA has a very specific set of minimum requirements. If you are planning to sell your house and you think the most likely buyer is going to be using an FHA loan, then strap on your “FHA goggles” to view your property like HUD does. Or if you are purchasing a house, it’s important to be aware of condition issues that may impact qualification for an FHA loan.

What does it take for a property to meet FHA minimum guidelines? FHA is primarily concerned that everything in a house functions properly and that there are no health and safety issues. FHA continually says, “Soundness, Safety & Security” as their motto. It’s okay if there is some deferred maintenance, but if there is any issue that may pose a threat to health, safety, soundness or security, then it needs to be solved. Examples might include chipping paint, mold, missing appliances, an inoperable HVAC, a broken water heater, dangling wires, trip hazards, etc… You can see a more detailed list of specific requirements in a previous post.

Quiz Time: Now that you have just a bit of information about FHA compliance, take a look at the image below. What do you see that might pose a safety risk and be unacceptable to FHA? Comment below.

Keep me in the loop if you have any questions or if you need to hire my “FHA goggles” to help you make a decision when selling or buying a house. And don’t worry, I don’t actually wear goggles like this on inspections.