Everyone is entitled to an opinion, but I find some people sounding off about housing seem disconnected from the actual market. I want to talk about that below and share some trends. Skim by topic or digest slowly.

UPCOMING SPEAKING GIGS:

4/25/24 HomeSmart iCare Realty (details TBA)

4/26/24 Prime Real Estate (private)

5/9/24 Empire Home Loans (details TBA)

5/15/24 Investor Meetup (details TBA)

6/6/24 Golden 1 Credit Union (details TBA)

6/11/24 Elk Grove Regional MLS Meeting 8:30am

6/13/24 Sacramento Realtist Association (details TBA)

CONSUMERS ARE JUGGLING

This is a meme I made a few days back, and unfortunately it perfectly describes the moment. And this is why mortgage rate increases lately aren’t easy to digest since buyers are already juggling so much.

STRONG OPINIONS ABOUT THE HOUSING MARKET

Look, you don’t have to be a practicing real estate professional to have a housing take or know the market. I’ll be honest. It bugs me when people are told to stay in their lane because they don’t work in a field. As if I can’t have an opinion about Taylor Swift since I’m not a musician. Or I can’t talk about basketball because I don’t play for the Kings (put me in coach). Or an athlete can’t talk about politics because she isn’t a politician (oh, that one got real). Of course, there is such a thing as expertise, so I’m not planning to lecture today about paleontology or the history of communism. Haha.

When it comes to housing, there are some people spewing opinions that are pretty disconnected from the actual market since the narrative just doesn’t line up with what it’s like in the trenches. I find this to be especially prominent with a housing crash narrative that paints everything with darkness, but doesn’t tend to concede it’s been competitive.This can happen on the rosy side too when people aren’t willing to look at red flags in the marketplace because they’re distracted by multiple offers. Ultimately, some people only want to promote a narrative, and I find that to be very limiting because the market isn’t just one thing. We ARE really struggling with affordability, AND the market has been intense considering the lack of affordability.

In short, everyone gets to have an opinion, but not every opinion has credibility. On that note, how do you gauge credibility for a housing analyst? And does credibility even matter to people today?

Long story short. 54% of pendings over the past week had multiple offers in the Sacramento region in the midst of rate hikes, so it’s not totally frozen like some people are saying. Of course, could the housing temperature change very quickly ahead if rates continue to rise? You betcha. Do you know what would be surprising? If the temperature didn’t change with rates around 7.5%.

GETTING CLARIFICATION ON CONCESSIONS

In light of the NAR lawsuit, Fannie Mae and Freddie Mac clarified yesterday that if a seller pays for the buyer’s agent commission, it will NOT count within the allowable amount for concessions (as long as it remains customary for sellers to cover the buyer’s side of the commission in the marketplace). This isn’t new policy, but it’s nice to have some clarity since we’ve been wondering. I wrote about concessions a few weeks ago, and I updated the post with links to the press releases. I also posted on my socials yesterday, and the posts have quite a bit of attention.

SELLER GREED ISN’T SEXY

I talked to a real estate agent this week who has an upset seller that the property didn’t go even higher above the asking price. Bro, it’s not 2021 out there, so don’t expect that dynamic. Technically, if you’re a seller wanting a bidding war, just price lower. Don’t expect buyers to go substantially above value though in a market where affordability is a struggle.

LOOKING FOR HOUSING TEMPERATURE CHANGE

One of the things I’m watching closely right is what sellers are giving buyers in terms of concessions. What are you noticing? About 38% of sales last month had concessions in Sacramento County, and it’s normal to see this number decline during a traditional spring. Do we start to see sellers have to offer more to buyers ahead if rates persist higher? My advice to sellers is to listen closely to what buyers need, and be open to lowering the price and/or offering concessions if the market requires. Please don’t take rate increases lightly. Go to a mortgage calculator to see how much it costs to buy your house right now.

MORE ADVICE FOR BUYERS PLEASE

Agent friends, I’d love to see more content that focuses on the buyer side. How do you get an offer accepted? How can a buyer get concessions in a market like today? What types of situations do you recommend offering below the list price? When do you need to go above? Often real estate professionals focus heavily on sellers, but buyers need attention and help right now.

EXPECT LOWER DEMAND

In coming weeks, we’re going to understand more about how higher rates are affecting buyers and sellers. I’d be shocked if the number of pendings didn’t dip if rates keep this high, but only time will tell. No matter what, we’ll see the trend first in the listings and pendings. If we only look to sales, it’ll be a month or two to see the trend since it takes time for properties to get into contract and close. Remember, the stories of today turn into the stats of tomorrow.

So far, pendings and new listings for April as a whole have been pretty normal seasonally (still way lower than usual though). But let’s watch very closely ahead from this week onward.

SOME ENCOURAGEMENT

A few thoughts I shared on my social channels yesterday. Just some things on my mind. I wanted to offer some encouragement in the midst of what feels like uncertainty salad in the economy and real estate market.

WATCH GROWTH IN LISTINGS

I had the hardest time explaining this until I used blocks. In the fall of 2023, I made a reel with blocks to explain how listings can grow. At the time, we were seeing more active listings, but it wasn’t really due to sellers rushing the market. Well, today we’re legit having more new listings, but it’s still buyer behavior that can make the biggest difference.

View this post on Instagram

Thanks for being here.

Questions: What are you seeing in the market right now? What are buyers and sellers saying? What do you think of Fannie Mae’s clarification on commissions? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

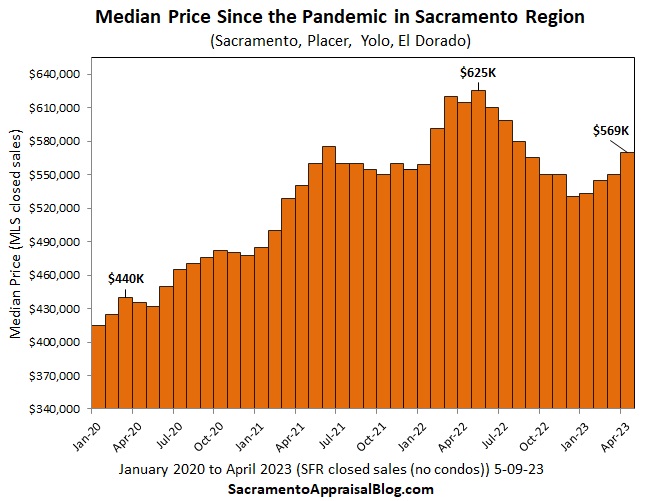

The spring started out more subdued, but it’s really become competitive. When looking at median price change from January to April, we’ve seen about 7% growth so far in the region. This is pretty decent for the time of year (slightly lower than normal). Based on what I’m seeing in the pendings, we should see some standard if not strong growth ahead in May closed sales. Keep in mind this does NOT mean prices are up 7% for every property. Please look to the comps. The median price does NOT translate rigidly to every parcel or area.

The spring started out more subdued, but it’s really become competitive. When looking at median price change from January to April, we’ve seen about 7% growth so far in the region. This is pretty decent for the time of year (slightly lower than normal). Based on what I’m seeing in the pendings, we should see some standard if not strong growth ahead in May closed sales. Keep in mind this does NOT mean prices are up 7% for every property. Please look to the comps. The median price does NOT translate rigidly to every parcel or area.