I wish every agent would be proactive about talking with appraisers, yet not everyone is on board with that. In fact, someone recently told me he thinks using my appraiser information sheet is a violation of Dodd-Frank. So I’d like to unpack two thoughts when it comes to influencing appraisers, and then give a helpful statement that might be useful for agents when sharing information with appraisers. I’d love to hear your take in the comments.

Two Things About Influencing Appraisers:

- Providing Data: As an appraiser I want as much information about the property as possible. I want to hear how the market responded to the home. How many offers were there? What price levels? What type of feedback was given from buyers and other agents? What recent upgrades have been made? The answers to these questions can be helpful since my end goal is to figure out how the subject property fits into the context of the market. Sometimes these insider details really can help paint context, so I need to be in tune with the details. I definitely prefer agents to share any sales, listings and data that were used to price the property too if possible because I want to understand the mindset of the agent or seller. Yet I am not a lawyer, so I cannot tell anyone for sure that providing sales is okay in the eyes of Dodd-Frank. I recommend each agent and brokerage to figure that out. However, on a practical level as an appraiser I know I want to get as much information as possible about the property, so I am in the habit of asking many questions. This is one of the reasons why I developed an appraiser information sheet so agents can be proactive about answering questions appraisers tend to ask.

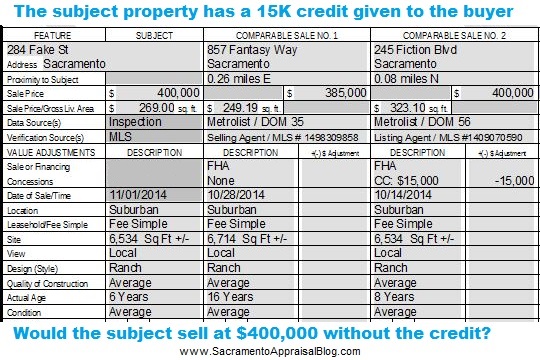

- Hiding Stuff: Sometimes I hear the real estate community say, “It’s not okay to give appraisers comps because it’s an attempt to influence the value.” I get that because trying to pressure or coerce for a certain value is off-limits. That’s so 2005, right? Yet is giving appraisers “comps” the only way influence can happen? What about all the documents that are hidden on purpose from the appraiser? Pest reports, agent visual disclosures, contract addendums, repairs negotiated between the seller and buyer not mentioned on purpose in the contract, documents uploaded to MLS during the listing but then removed before the appraisal is ordered, etc… I’m not pointing fingers or sitting on a moral high horse by any means, but only saying influencing an appraiser can show up in many different ways. Sometimes it’s about what is said, but can it also be about what is not said or disclosed? Thus the conversation about influence seems to be about more than just giving an appraiser “comps”.

Agents need to take Dodd-Frank very seriously because it is professional and ethical to give appraisers space to be an unbiased neutral party in the transaction. Bottom line. Yet in my mind it is also professional for agents to serve their clients well and be proactive and prepared to answer questions appraisers tend to ask. Bottom line. Thus if you use my info sheet or something like it, I recommend using a statement like the following to explain why you are providing this type of information to the appraiser during the appraisal inspection.

A Statement I Recommend Agents to Use:

“Appraisers normally ask me questions like this, so I answered them for you to be proactive and professional. Would you like this information?”

I hope this was helpful.

Action Steps:

- Consider using the statement I mentioned above to help clarify and describe your actions as being proactive about answering questions rather than trying to steer a value. If an appraiser doesn’t want to take your information, respect that decision and move on.

- Feel free to use the “information sheet” I developed. If you think any portion of it could potentially improperly pressure an appraiser, then edit or change that portion. You be the judge.

A Quick Year in Review to Use: Here is a quick year in review graphic for the Sacramento housing market. Feel free to use it unaltered on your blog, on Facebook, Twitter, etc… I always appreciate a link back.

Questions: Agents, what do you tend to hear in your office about what is okay and not okay to share with appraisers? Appraisers, in what ways are you being pressured right now to “hit the number”?

If you liked this post, subscribe by email (or RSS). Thanks for being here.