I can see the headlines now. “Prices rose despite the coronavirus,” or “The housing market shows strength in March despite the pandemic.” But let’s step back and think critically about glowing stats from March and what they really tell us. I hope this will be helpful. Any thoughts?

Five things to consider about stats during the pandemic:

1) Prices rose last month (technically): If we’re not careful the hot headline can be the median price rose 3.5% last month in the Sacramento region despite the pandemic. In other words, the median price increased from $425,000 in February to $440,000 in March. On paper it looks like the market is fine and moving along without any effect. BUT we have to remember prices in March actually reflect pending contracts from mostly January and February. So sales in March actually tell us way more about previous months rather than March itself. If you don’t believe me, only 2.9% of all sales in March got into contract on or after March 12th (the day we found out Tom Hanks had coronavirus) and only fifteen properties have gotten into contract and closed since the lockdown went into place. So we have very little pandemic data to consider within March sales.

2) Pulling stats too soon: This sounds geeky, but it’s key to understand. Pulling sales stats on the first of the month is way too early because not all sales have been entered into MLS yet. In my experience on the first of the month we’re still missing about ten percent of the sales from March because not all sales have been entered into the system yet. So if we wait about a week instead to pull stats we end up getting a much more accurate picture. I quoted the median price above at $440,000, but that is preliminary and it could easily change based on ten percent of the market not being accounted for yet.

3) What to watch right now: If you want to see the current market, watch what is happening in the listings and pendings rather than recent sales in March. Are listings moving or sitting? Are we seeing more price reductions? Are properties spending less or more time on the market? What is the sentiment among buyers and sellers? Who is gaining or losing power? Has there been a change to the number of listings and pendings? Do sellers have to give more credits to buyers? Are contracts getting bid up? Are contracts falling apart more often? We need to ask these questions in every neighborhood and price range. My advice? Look to neighborhood stats and let the numbers inform your narrative about what is happening in the market.

4) Be objective about data: I find it’s so critical to be objective about prices. What I’m saying is if we’re not careful we can judge a market’s price direction based on what we think should be happening, recent sensational headlines, or even regional trends for pending contracts rather than looking to actual stats in a neighborhood or price range. Appraisers even need to do this. It can be tempting to say prices are declining, but we need to be sure that is the case based on what we are observing in the neighborhood market. Remember, it’s possible to be see pendings and listings start to slough, but that doesn’t always mean we’re seeing price declines at the moment. Could that be coming soon? Yes. But we need to let the data tell the story. Let’s remember the market is changing quickly, so what we’re saying today might be different tomorrow.

5) Upping your numbers game: If you work in real estate I can’t emphasize enough how important it is to be fluent in market trends and to be able to talk through current dynamics so you can offer informed real estate advice. If it’s helpful, I am posting a few YouTube videos each week right now as well as lots of content on Facebook and Twitter. Or let’s set up a Zoom meeting with your office so we can talk shop (local offices are free). My goal is to offer perspective and objectively share the story of the market without sensationalism.

A few closing things:

New market update video: Here is a new market update video from two days ago. This is 15 minutes. Watch below or here. I have some new stuff to share, so be on the lookout hopefully today.

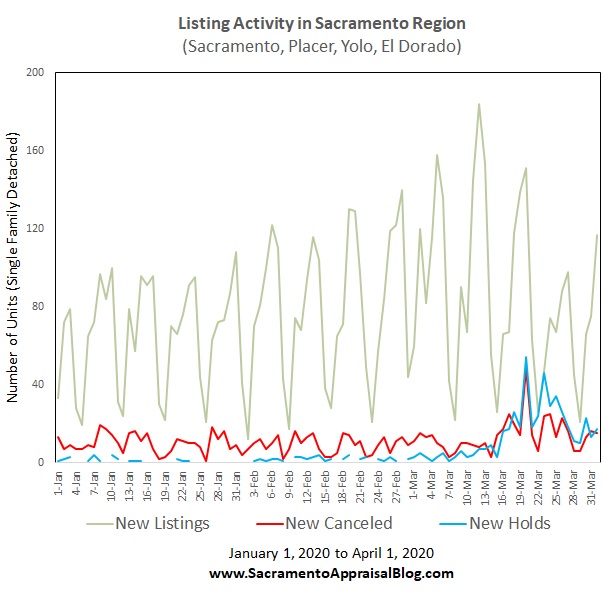

Fresh daily visuals: During this pandemic I’ve upped my stats game and I’m finding new ways to visualize how the market is moving. I’m not focusing on prices for now because we don’t have enough data yet.

Side note for appraisers: There are disclaimers being put into appraisal reports that talk about not being able to quantify the long-term or short-term effect of coronavirus, but if we pay close attention we likely have enough data right now to at least talk about some of the short-term dynamics. It’s easy to put boilerplate pandemic comments in an addendum for liability and that’s a really good idea, but what’s even better is our market analysis. Colleagues, would it help to have some tutorials for these types of graphs so you can make them in your market? If there is enough interest I’d be glad to put something together. Let me know.

I hope this was interesting or helpful. Thanks for being here.

Questions: What stood out to you about this post? What are you seeing out there in the market right now?

If you liked this post, subscribe by email (or RSS). Thanks for being here.

Thanks Ryan, You are always on top of things, and THIS blog is critical in informing the client what exactly going on!

Thank you Pia. That’s a huge compliment. Please keep me posted with what you are seeing out there. I’ll keep talking shop here too.

Your video is awesome! Can you give us a refresher on how to make the Pending, Holds and Listing graphs, or point us in the right direction towards making them in our own market?

I’m definitely considering this. As long as more appraisers or other real estate pros chime in, I’m cool with doing something. I’ve never done a tutorial for how to show this type of graph, but I’d love for colleagues to add more tricks in their bags.

I’m interested as well.

Right on. Thanks J.D.

Outstanding! Thanks, Ryan!

Thanks so much Chris.

Great information Ryan. It will be interesting to watch the numbers unfold. I still don’t know what will happen during the shutdown and I’m already wondering what will happen after everything opens back up. Will it be a slow climb, pent-up demand, or a Great Recession? I know you don’t know, we will just need to keep watching.

Thank you Gary. I agree. We must keep watching and remain objective. This doesn’t mean we have our minds and eyes closed. There are some glaring issues obviously with lenders and the job market. But what does that mean? We just don’t know for certain. I’ve heard lots of ideas about the future ranging anywhere from boom, bust, or balance. Everyone has their take and many people are extremely confident in their take too. But they’re not all right. Ha.

Thank you Ryan your insight is always very helpful! I am an appraiser and would love to learn how you go about pulling your data and creating your charts.

Thanks Mark. I appreciate it. Okay, we have one vote. I just need to have critical mass, so speak up if you want to learn some of these graphs. In the meantime, for any onlookers I have some graph tutorials at https://www.sacramentoappraisalblog.com/graphs I think adding in these types of graphs could be very useful. They use pivot tables so it’s a bit different than the other tutorials I have.

Hi Ryan, Thank you so much. “…let the data tell the story…” is the whole thing. I would love the opportunity to learn how to create your graphs for my market areas. Please count me in. Thanks again, Jerryb

Thank you Jerry.

Good afternoon, Ryan Lundquist

Excellent blog post.

I really like and agree with your suggestion, “Look to neighborhood stats and let the numbers inform your narrative about what is happening in the market.”

Keep up the good work.

Thank you

It’s a pleasure to know you

Sincerely,

Del BRBRAY

Thank you so much Del. I appreciate it. When all this is done I look forward to seeing you in person and getting that strong Del handshake.

Good afternoon, Ryan

You’re welcome

I appreciate you.

Here is a “virtual fist tap” in place of the handshake until we can meet again in person.

Stay safe and healthy.

Sincerely,

Del Barbray

Great points Ryan! I agree with you that we really need to know what’s going on in our market. I pull fresh stats and charts on every appraisal I perform. The disclaimers and extraordinary assumptions are for what we can’t see yet. But we have to watch this carefully. Thanks for you great points, as always.

Thanks Jamie. Good for you. I know you always do a great job. I didn’t want to sound critical with my last comment regarding disclaimers, but I’m just saying we need way more analysis beyond boilerplate CYA stuff. I have seen lots of comments that talk about not knowing what the market is doing yet and such, and I get that. But sometimes there actually is enough information to begin to gauge things. But I totally get the intent and like many appraisers I also have LIA’s comment in my report too.

Thanks Ryan! I totally agree! I appreciate your point. It is a great reminder for us all. I appreciate all that you are doing to share your data with others and at the same time, help fellow appraisers with these reminders! Keep up the good work. Give my best to your family and stay safe my friend!

Yes please.

Duly noted. Thanks Scott.

The problem with Data Models is their inability to see the human aspect of the outcome of it’s intent and or the human aspect of each data point with regard to validation of the definition of market value.

Market value is UNDUE DURESS not DURESS.

So if we take the current panic and fear due to the media sorry folks if your an appraiser then do the numbers.

Here they are.

Original projection 2.2 million to die in the US by August which now would equate to approx 550,000 per month going forward to die. NOT HAPPENING, NOT EVEN CLOSE.

New Data Model 100k-200k to die in the US

that is a 100k data range!!!

In 2018-2019 per the CDC approx 90,000 people in the US died from the flu.

My point it’s to early to know but the original data model started the PANIC AND FEAR it is undeniable when you go out in public. That is not market value.

So does your future market value opinion need to certify such? Cause the values are UNDER DURESS, did you include REO and Foreclosures against typically buyer and seller activity? Duress.

Is FEAR and DURESS Market value right now.

If this continues are we providing a valid market value opinion or providing a market value based on the emotions of duress during the pandemic.

I would at least put in disclaimers and wording during this time regarding as it really remains to be seen the result of all this.

If allowed FEAR will not just take away your equity but also your civil liberties and your remaining 10 amendments per the constitution.

Step back and assess the logic of it all.

Ryan great job, not hijacking but throwing this out there.

Thanks Alan. I appreciate your take and I welcome anyone to pitch in thoughts and kick around these ideas. That would be great. I’d agree with you that markets are emotional and there are many layers that cause value to move. In simple terms appraisers need to reflect what buyers are willing to pay in the midst of the current market. Then when the market changes in the future, appraisers will need to reflect that market too. We’ll eventually have a few datasets to consider as we strive to unpack what market value looks like: 1) Before Coronavirus data; 2) During the pandemic data; and 3) Post Coronavirus data. There are new things to sincerely consider right now as you’ve mentioned and the market is in an interesting spot because it isn’t totally free to act in light of a lockdown and a pandemic. Yet this is still a real market in front of us where real people are willing to pay real amounts, so my sense is appraisers need to simply reflect what is real right now. We don’t have to agree with why a market is the way it is or whether people are logical or emotional. That’s my take. I welcome further comments. Let’s kick these ideas around and figure out how to see value today…

Thanks, as always Ryan, for your insight on the market and for enlightening us on appraisals and being realistic in this time.

You are so appreciated!

You are so welcome. Thank you Tracey. Hope you are well.

I’m doing well and staying busy with renewing my license. I will probably complete the 45 hours in record time! 🙂

I pray that you and your family stay safe and well! ?

Great to hear. That’s a good use of time too. We are doing okay overall. The kids are bored and I think having them get back to school (online) is going to help. I think I’m recognizing the need to do more woodworking. I’ve been really busy with work and I have a ton of extra communication right now, but I also need downtime.

Hello all,

Another thing to consider is employment, or lack there of and the general market’s purchasing power and its effect on the markets.

In my state, unemployment applications went up from just above 4000 to over 76,000 on ONE WEEK, and doubled the following week. So, in that 2 week span over 150k people filed for UE. This is a HUGE factor and the numbers point out that the UE is higher than it was at the highest point of the 07-10 recession. These were numbers straight from the State labor bureau. This will undoubtedly have an effect for a few months as the able market participants “purchasers” in some markets have been reduced by 1/4 to a 1/3 at least. This is but one factor to consider in the pandemic effects on the market. The thing to consider here is that in some states 20-40% or more of the labor force, (depending on sector) just vanished and are now unemployed.

Thank you Kevin. I completely agree. This is an enormous factor to watch. We don’t know for certain how it will play out exactly in local markets, but it’s a huge issue. In California it’s said 1.5M applications were filed. Unreal numbers.

Okay my friends, it took me a while to get this done, but here’s the video for how to make graphs with a pivot table. I hope this helps. https://youtu.be/pUd6iNp2RRU