Lots of us are wondering about the future as COVID-19 cases are rising. When will this be over? What’s it going to take to beat it? And in terms of real estate, what would happen to the market if we went on lockdown again?

This isn’t about fear or politics, but conversation. This isn’t a prediction post either. My only purpose is to consider things that might affect housing. So let’s talk.

LOCKDOWN THOUGHTS:

1) Suppressed demand: There are many things that can affect a housing market. Mortgage rates, jobs, the economy, access to financing, etc…. and even the government. A mandated lockdown, whether national or statewide, is something that can suppress demand because the market isn’t able to operate as it normally would. When I say “lockdown” I’m talking about something akin to earlier in the year where occupied properties were not allowed to be shown.

2) Buyers & agents have learned: This time around we have more experience. The real estate community has learned to show homes virtually and buyers are more used to the idea also. However, if buyers and agents don’t have full access to real estate because of imposed rules then it’s hard to imagine seeing no effect on the housing market.

3) Sellers: One thing to watch is sellers pulling their listings from the market or waiting to sell if strict rules were imposed or if COVID numbers got out of control. Throughout the pandemic we’ve seen substantially fewer listings and it wouldn’t be surprising to see fewer during a lockdown or grave situation. Yet not all sellers are the same and there will be people who list no matter what.

4) Buyers: I imagine mortgage rates below 3% will keep propelling lots of buyers to hunt for homes because that’s exactly what’s been happening these past months. In short, mortgage rates have pulled far more buyers into the market than the coronavirus has pulled people out. In other words, so far the pandemic hasn’t hampered buyer demand. But what happens if access to real estate is limited or a feeling of uncertainty about the economy, housing, or future ensues? All I’m saying is we need to continue to watch buyer sentiment because it’s not something that always stays the same.

5) It is a real market: When the pandemic first began I heard things like, “This isn’t a real market,” but that wasn’t true. Prices slowed. There were far fewer pending contracts. And the market felt dull. In other words, we had real trends and stats even though there was an element of the market feeling suppressed due to governmental regulations. That didn’t make it a fake market though.

6) No effect whatsoever: Our market has done very well within the confines of current restrictions, so if those persist we may not see too much difference as long as demand remains high. But if the rules change and access to the market changes, that’s where we might expect to see a difference in the way the market feels (or a change in the stats). As a guy who follows the market closely what I am looking for is a change in buyer or seller sentiment or a change in something that would affect access to real estate.

7) Could we see a “W”? When the pandemic began we saw a huge drop in volume and then a massive recovery. This created a “V” shape because there was a drop and then an increase. Well, if we have a second round of outbreak and a lockdown, could we see another “V” which would then form a “W”? I wrote about this a few months back in a conversation with an economist. Or would the crazy momentum we have right now simply press through a lockdown? This is the question and we’re going to have to wait to see how it pans out. If anything we ought to be wary of predictions. I don’t think anyone at the beginning of the year predicted the market we’re in right now… This doesn’t mean we need to be shy about asking questions about the future though.

8) Commercial real estate: This has been a brutal year for many business owners and a second round of lockdown could be a deathblow. What happens to business owners and commercial property owners over the next few years?

9) Other: What else do we need to consider? What is on your mind? I’d really like to hear your take in the comments or via email.

Free webinar: I’m doing a big market update this week for SAFE Credit Union on November 19th from 9-10am PST. It’s free to anyone and it’ll hopefully be some good background noise while working. Register here.

Free webinar: I’m doing a big market update this week for SAFE Credit Union on November 19th from 9-10am PST. It’s free to anyone and it’ll hopefully be some good background noise while working. Register here.

Thanks so much for reading my post today.

Any thoughts?

———————- (skim or digest slowly) ———————–

For those interested, here’s a big Sacramento market update:

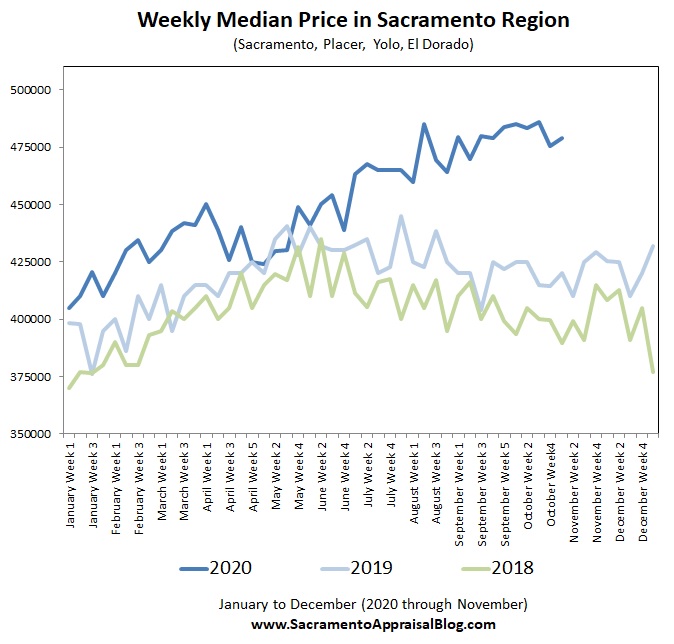

MARKET SUMMARY: In short, the market has been slowing for the season, but it’s still best described as a “hot” market. I keep saying that this fall has not been normal because the market hasn’t softened like it normally does. It’s really felt more like spring than anything… With that said we have begun to see sales volume drop for the fall, but properties are still selling very quickly. In fact, half of all home sold in six days or fewer in the region last month. We literally have about 50% fewer listings right now, inventory is at historic lows, and we had 39% more multiple offers last month compared to a year ago. The big news is sales volume has finally caught up to last year after being down due to a slump at the beginning of the pandemic. What I mean is as a result of the past four months of heightened demand we’re finally back to 2019 levels. Well, Sacramento County is still down, but El Dorado and Placer County being up has effectively pushed us back to normal.

MARKET SUMMARY: In short, the market has been slowing for the season, but it’s still best described as a “hot” market. I keep saying that this fall has not been normal because the market hasn’t softened like it normally does. It’s really felt more like spring than anything… With that said we have begun to see sales volume drop for the fall, but properties are still selling very quickly. In fact, half of all home sold in six days or fewer in the region last month. We literally have about 50% fewer listings right now, inventory is at historic lows, and we had 39% more multiple offers last month compared to a year ago. The big news is sales volume has finally caught up to last year after being down due to a slump at the beginning of the pandemic. What I mean is as a result of the past four months of heightened demand we’re finally back to 2019 levels. Well, Sacramento County is still down, but El Dorado and Placer County being up has effectively pushed us back to normal.

WAY TOO MANY VISUALS:

You are welcome to use these in newsletters and social media with proper attribution. Scroll quickly or digest slowly.

SACRAMENTO REGION:

SACRAMENTO COUNTY:

PLACER COUNTY:

EL DORADO COUNTY:

Other visuals: I have lots of other graphs. Check out my social media in coming days and weeks. I am posting daily stuff.

Thanks for being here.

Political comments: I will not approve any comments that are exclusively political because this is a blog about housing. We can touch on politics as it affects real estate, but overt political rants are best for other blogs.

Questions: Do you think we’ll go on lockdown? What are you seeing out there right now?

If you liked this post, subscribe by email (or RSS). Thanks for being here.