Are prices finally starting to slow? Can it really be happening? Have home prices likely started to crest for the year? The answer is YES. Here are two quick things on my mind. These trends are for the Sacramento region, but I suspect many markets across the country are starting to show similar stats (or will soon).

Glowing & slowing market update:

Glowing & slowing market update:

I’m doing a big market update for SAFE Credit Union in a few weeks. There is no cost. It’s totally free, but you have to register. It’ll be at 9am on Zoom on Wednesday August 18, 2021. It’ll be about an hour and packed with lots of stats and perspective. REGISTER HERE.

TWO THINGS ABOUT PRICES:

1) Prices have likely started to crest: This chart tracks prices by the week, so it gives a preview of trends before monthly stats come out. Check out the black line which represents the weekly median price in the Sacramento region. As you can see prices have started to dip over the past few weeks. This really isn’t surprising though because it’s been a pattern in recent years to see price changes around July (besides 2020). In short, unless something unexpected occurs to give another boost to the market, it looks like prices have started to crest for the year. In other words, it wouldn’t be surprising if regional prices hit their peak for the year. But here’s the thing. If 2020 has taught us anything, it’s impossible to predict the future. This is where we need time to see the trend.

Prices in the fall: Keep in mind not every fall season is exactly the same. Sometimes prices stay flat for a few months around July levels before dipping a bit more at the end of the year, and other times we see a more definitive slower season with a bigger dip. The future hasn’t happened yet, so we don’t really know what sort of fall we’re going to have.

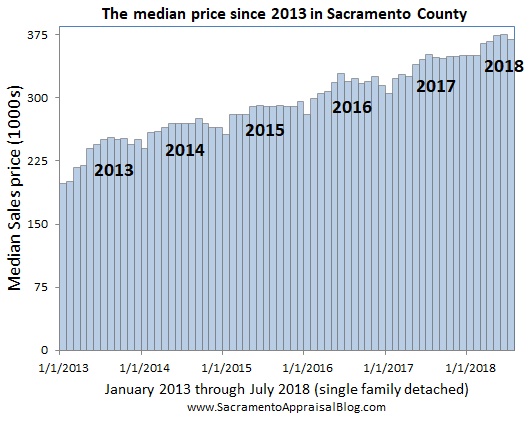

2) Monthly prices: Now let me show you how normal it is for prices to tick down in July by focusing on monthly prices. Here’s a look at the preliminary median price this month (July in black). As we know July is not over yet, so we need another ten days for stats to be solidified. With that said, when looking at multiple years it’s obvious we usually see a dip in July. And as far as we can tell that looks to be happening this month too. Not a shocker.

A bigger dip? I wouldn’t make too much of a bigger dip this year because this is still preliminary data. Honestly, I’m a bit hesitant to push out early stats because this monthly figure could change over the next two weeks. But I think it’s valuable to show it’s not just weekly prices that are softening. Anyway, let’s wait to see how this number looks in about ten days before having too much conversation.

FOUR QUICK TAKEAWAYS:

1) Not the same: The temperature of the housing market is not the same in every price range and neighborhood. In other words, it’s possible for prices to be doing different things in different areas, so it would be a huge mistake to assume prices are dipping everywhere.

2) Not dull: The housing market is still moving very fast and it’s super competitive. In short, it’s still not easy to get into contract. Yet it is easier than it was three months ago.

3) Just say NO to rosy narratives: When a market starts to soften it’s tempting for some in real estate to avoid talking about slowing. Here is part of a talk I gave last week where I mentioned this reality (three minutes).

4) Doom and gloom: While some interpret prices softening to mean the market is starting to “pop” so to speak, it’s important to recognize a dip in prices is what normally happens this time of year. I don’t say this to sugarcoat the narrative. This is simply a fact. In my mind it’s premature to be saying the sky is falling because the stats right now don’t support that idea. My advice? Be really careful about painting what looks like a seasonal trend with a doom and gloom brush. Also, be patient for more data in coming weeks and months so we can get a fuller picture of the trend. We need time. And as we get more data we can absolutely adjust what we say about the market.

Thanks for being here.

SHARING POLICY: I welcome you to share some of these images on your social channels or in a newsletter. In case it helps, here are 6 ways to share my content (not copy verbatim). Thanks.

Questions: What are you seeing out there in the market? What if anything strikes you above? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

Last year the fall season felt more flat than not, but this year is a different story. We are definitely having more of a dull seasonal lull that reminds us how the market felt in 2014 when the fall season was definitively soft. Here are some of the things I’m watching right now. I’d love to hear what you are seeing. Please comment below or send me an email.

Last year the fall season felt more flat than not, but this year is a different story. We are definitely having more of a dull seasonal lull that reminds us how the market felt in 2014 when the fall season was definitively soft. Here are some of the things I’m watching right now. I’d love to hear what you are seeing. Please comment below or send me an email.

The market has been

The market has been