It’s graduation season for school, and it’s also that time of year where the spring housing market crests or graduates for the year so to speak. Let’s talk about the signs of a peak, the weirdness of today’s market, and bro rating.

UPCOMING (PUBLIC) SPEAKING GIGS:

6/1/23 Thrive in Real Estate (register here)

6/07/23 SAFE Credit Union event for agents (sold out)

6/08/23 Made 4 More event (in-person & Zoom)

7/20/23 SAR Market Update (in-person & livestream)

MORTGAGE RATES ARE AN X-FACTOR

The second half of 2023 will be greatly influenced by what happens with mortgage rates. Today rates hit 7% for the national average. I don’t know about you, but so many people in January were saying rates would be 5% in May. This is a good reminder that predicting rates is very difficult to get right. But backing up, if rates persist at a higher level, it should take some demand out of the market (thanks Captain Obvious). At the same time, if rates go down, it should bring some buyers back into the market (thanks again). For now, there’s uncertainty with mortgage rates, inflation, the debt ceiling, and so many other things. It seems like there is something new every week to freak out about (but honestly, freaking out is a choice).

BRO RATING IS A REAL THING

Here’s an image I’ve been making for my presentations. It’s not meant to insult anyone, but I’m definitely jabbing the drama and comedy of rate narratives. By the way, I’m calling this “bro rating.” Is there a better description?

“DATE THE RATE” POSTS

I don’t hear “date the rate & marry the mortgage” too much right now in real estate, but it still pops up once in a while in housing conversations. I’m all for creative word pictures, especially ones that push the line. Haha. But I’m not a huge fan of dating the rate because the opportunity to refinance in the future isn’t guaranteed. Ultimately, be cautious about narratives that promise a future you can’t control or that might not age so well. My advice? Buy or don’t buy, but be confident in your decision and comfortable with the monthly payment.

LOOKING FOR A SEASONAL PEAK

Okay, let’s talk about the spring. We’ve had a glowing market in recent months, and it’s about that time of year where we should start to see housing demand peak for the season. Some people say stuff like, “Summer is the hottest time in real estate,” but that’s not statistically true in so many areas.

WEIRDNESS & QUESTIONS

Right now there’s a weird dynamic of low demand and low supply, but unless the market behaves atypically ahead, we should expect to see a seasonal peak very soon. Will it happen exactly on time, or will the spring season be extended because the market is so lopsided right now? I think we should get strong clues into the answers over the next few weeks.

WHAT TO WATCH FOR A SPRING PEAK:

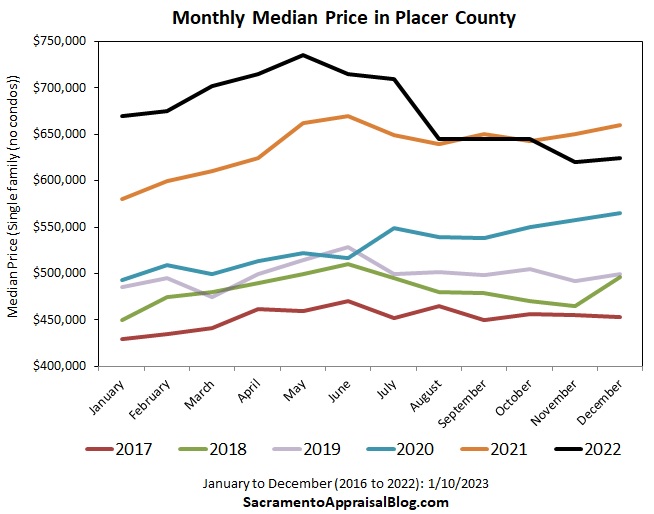

PRICES:

The median price typically peaks in June locally, but sometimes it’s May. However, let’s remember properties that close in June likely got into contract in May, so the real price top happened in the pendings in May.

VOLUME:

Typically, volume peaks in June in the Sacramento region. Sometimes it happens in May, but most of the time it’s June.

DAYS ON MARKET:

It’s normal to see days on market bottom out in either June or July in Sacramento County. The red line is the pre-pandemic average in Sacramento County, and the black line is 2023 (which has really sped up lately).

MULTIPLE OFFERS:

It’s normal for the percentage of multiple offers to peak between March and May. This year looks like it could be May based on what I’m seeing in pendings. Over the past couple of weeks, I’ve noticed the percentage of multiple offers has been hovering around 58% or so in the region, so it’s possible we’ve started to level. Time will tell.

There are many other metrics we can watch, but that’s the short list.

BEING AN EXPERT & SAVE YOUR HATE MAIL

I’m not saying the market is dull right now. That’s not what the stats are showing, and it’s not what I’m hearing from agents either (so save your hate mail). If anything, it’s been more aggressive than normal for the time of year, which is stunning to see in a market that is missing so many buyers. What I am saying is it’s normal to peak around this time, so part of being a real estate expert is knowing the normal seasonal pattern so we can interpret the trend and spot anything that is not normal.

IF YOU DON’T HAVE SEASONAL STATS

If you want to see the seasonal peak for your area, check out Redfin’s weekly numbers to see when prices, sales, listings, and pendings tend to top out.

I hope this was helpful.

MARKET STATS: I’ll have lots of market stats out this week on my social channels, so watch Twitter, Instagram, LinkedIn, and Facebook.

Thanks for being here.

Questions: What are you seeing out there right now? How has open house traffic been? What are you seeing in the offers? How do you typically know when the seasonal market starts to peak?

If you liked this post, subscribe by email (or RSS). Thanks for being here.

We are in a market of change, and change continued last month.

We are in a market of change, and change continued last month.

The market is still moving, but lots of buyers are missing in action, prices have dropped faster than normal, and it’s taking much longer to sell. Sellers aren’t quite up to speed with proper pricing, but they’re offering credits to buyers more frequently, which shows they’re listening. Sellers haven’t been rushing to list as we’re still missing a few hundred listings from a normal trend.

The market is still moving, but lots of buyers are missing in action, prices have dropped faster than normal, and it’s taking much longer to sell. Sellers aren’t quite up to speed with proper pricing, but they’re offering credits to buyers more frequently, which shows they’re listening. Sellers haven’t been rushing to list as we’re still missing a few hundred listings from a normal trend.