The honeymoon is over. That’s right. The real estate market in 2013 felt like a honeymoon because it was full of glittery optimism, sensational news headlines and the sweet aroma of a quick recovery. Just as a honeymoon in real life comes to an end, we all knew such rapid appreciation was not sustainable, inventory could not be that low forever and interest rates wouldn’t endlessly hover at historically low levels either. Of course this doesn’t mean the market is not still ripe for positive growth, but only that this year probably won’t feel as good as last year.

The honeymoon is over. That’s right. The real estate market in 2013 felt like a honeymoon because it was full of glittery optimism, sensational news headlines and the sweet aroma of a quick recovery. Just as a honeymoon in real life comes to an end, we all knew such rapid appreciation was not sustainable, inventory could not be that low forever and interest rates wouldn’t endlessly hover at historically low levels either. Of course this doesn’t mean the market is not still ripe for positive growth, but only that this year probably won’t feel as good as last year.

The Sacramento real estate market in 2013 was really driven in large part by massive amounts of cash buyers, abnormally low inventory and ridiculously low interest rates. Now that housing inventory and interest rates are beginning to increase, and investors are backing off, I expect the market in 2014 will be much slower and more sensitive to the local economy (so long as these trends persist and the government does not interfere).

Trends in 30 seconds or 3 minutes: Let’s take a look at some trends to get a visual picture of where we have been. You can probably scan these in 30 seconds or take a few minutes to digest them. Your call.  Housing inventory decreased last month below 2 months of supply, which is understandable in light of the holidays and colder weather. Otherwise inventory has been flirting with 2.5 months. I said above that the real estate “honeymoon” is over, but keep in mind inventory is still very low, which means there is still room for some growth ahead (though I do not believe we will see the same rapid appreciation like we did last year since the market is different this time around in terms of inventory, interest rates and cash investors). The median price in December saw a slight uptick from November, but overall is still hovering around the $250,000 range as it has been for about six months. Can you see why people are saying the market is flat?

Housing inventory decreased last month below 2 months of supply, which is understandable in light of the holidays and colder weather. Otherwise inventory has been flirting with 2.5 months. I said above that the real estate “honeymoon” is over, but keep in mind inventory is still very low, which means there is still room for some growth ahead (though I do not believe we will see the same rapid appreciation like we did last year since the market is different this time around in terms of inventory, interest rates and cash investors). The median price in December saw a slight uptick from November, but overall is still hovering around the $250,000 range as it has been for about six months. Can you see why people are saying the market is flat? Here is a broader picture of median price and inventory. Current values are tending to resemble values in both 2003 and 2007/2008.

Here is a broader picture of median price and inventory. Current values are tending to resemble values in both 2003 and 2007/2008.

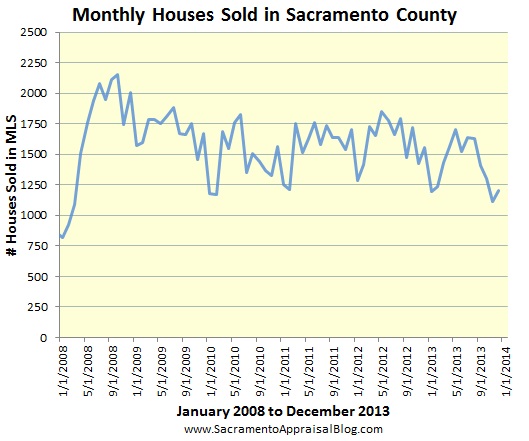

Sales were sparse for the second month in a row as there were only 1217 single family detached sales in Sacramento County in December. It is normal in colder months to see less sales.

Sales were sparse for the second month in a row as there were only 1217 single family detached sales in Sacramento County in December. It is normal in colder months to see less sales.

The jobless rate is thankfully going down in Sacramento County, but 8.1% is still not a pretty statistic. Can I be a resounding gong by saying we need more JOBS, JOBS & JOBS?

The jobless rate is thankfully going down in Sacramento County, but 8.1% is still not a pretty statistic. Can I be a resounding gong by saying we need more JOBS, JOBS & JOBS?

Here are a few important metrics on one graph. I’ll share some different versions of this graph in coming days. I like this one because it’s a reminder of how the market works. Real estate is not just about supply and demand, but a whole host of layers working together.

Overall cash sales have continued to decline while FHA sales have increased. In fact, there are now more FHA sales than cash sales in Sacramento County, which hasn’t happened in almost two years. At this time last year there were multiple offers on every single property, but these days that is becoming less common. The market is ultimately normalizing as inventory increases, which is leading to buyers generally having more power to negotiate. It is still a Seller’s market, but buyers are gaining ground.

Foreclosures have basically hit the bottom and short sales have persisted to decline too. There has been a 1% increase in foreclosures over the past quarter. At the same time it’s also important to realize inventory and the number of sales have been really low (which can skew stats).

The Final Word: The glorious “honeymoon” of 2013 may be over, but most analysts are still projecting mild appreciation in 2014. Moreover, the Sacramento market is still in a place where there is pent-up demand, so there is still room for growth. All indicators point toward a less-rapid market this year since the fundamentals seem to be poised to deliver just that. However, anything can happen. If inventory was still at one month or dropped that low again, this would be a different post. On a related note, I still think what Blackstone and other investors do is an X-factor. If they decide to ramp up their efforts and buy a few thousand local properties again, we should get ready for a second “honeymoon” in 2014.

Question: Any thoughts, insight or stories to share? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

Hey Ryan:

I am seeing the same as you report — at least in the median range of houses in Sacramento. Since we’ve been one of the ten cities in the US that has been heavily influenced by investment schemes, I would imagine this city will be particularly sensitive to policy from the Federal Reserve. Hence, changes here will start there. Until then, the market seems congealed, and although that mimics stability, I imagine that markets will change quickly once there is a change in QE.

I think you’re right about the Sacramento area being more sensitive to Fed policy. The market definitely is cool right now. This next quarter will be interesting to watch.

As you all know, the MEDIAN price is next to meaningless, except in Lake Woebegone where all the children are above average.

You’re never short on strong opinions, Truett. 🙂 I think you’re actually right about the importance of not relying too much on median price. I actually wrote about that here https://sacramentoappraisalblog.com/2013/04/16/dont-put-all-your-eggs-in-the-median-price-basket/. I think when we consider median price along with average price per sq ft and other metrics, we can start to get a pretty good picture of the way the market is moving.

Wow, lots of good data for your market Ryan. You seem to have a good handle on what’s going on and your charts really help to paint a clear picture of what is happening in your area.

Thanks so much Tom. I really enjoy watching closely, and I hope it’s helpful for others too (I think it is).

Hi Ryan,

I enjoyed reading the blog and the graphs. Having been an investor and employed in Real Estate for 30 years, I have to comment on one aspect of what you’ve provided. Make that two aspects, first I loved the clarity of the information provided on the graphs, (Truett, in a large sample, median price analysis is useful, it is only when the sample size is too small that it becomes completely meaningless), second and more importantly, it is the many layers that makes the housing market move. So while we see unemployment falling there is still too much underemployment and wage stagnation locally to propel the market. Further, if we had the decent paying jobs out there ala 1997, 1998 when the tech market provided jobs, we would see the number of real estate mortgage and sales people plummet, making life easier for those of us who a career real estate people, which would allow the pie to be sliced into bigger portions.

Quite frankly I’d prefer to see single digit gains in the 5-6% range for the next several years, to keep prices reasonable affordable.

Georg

Thanks George. I recognize your name from your email address (not listed publicly on your comment). I know you’ve been around for a long while, and I appreciate your take on things. I completely agree with you about the many layers moving the market. I just posted more on that this morning actually. It would be dangerous if the market was only moved by one metric, which is all the more reason to look at many metrics at once. I also agree with you about the unemployment situation. We have a long way to go, and I think our economy is still fragile. I just read an interesting article this morning that is somewhat related as it discusses how the unemployment rate is dropping, but the labor participation rate is actually at the lowest level since 1977, which shows that more people are not getting jobs. http://www.washingtonpost.com/blogs/wonkblog/wp/2014/01/10/the-biggest-question-facing-the-u-s-economy-why-are-people-dropping-out-of-the-workforce/. I’m with you on the single digit gains. Thanks again George.

Great post Ryan. I am in agreement with you on your analysis. But that’s not a huge surprise since we are usually feeling the same way about the market.

Keep up the great work.

Thanks Doug. I appreciate that. I know how closely you watch the market.