It’s easy to get trigger-happy with making value adjustments. Appraisers do this and so do agents. This means whenever we see a difference between two homes, it’s tempting to give some sort of value adjustment. After all, there has to be one, right? Let’s talk about that.

My List of Adjustments (that I used to use): First off, here is the list of adjustments I used to give when I first came into the appraisal industry many years ago. Please DON’T blindly use these adjustments or any list of adjustments (unless they make sense to use). I’d like to say I was giving these adjustments because they were market-derived, but I was really giving them because that’s what I was taught to do. Are these legit?

The Problem: The problem with a list of adjustments is they won’t make sense for every house, price range, neighborhood, or market. Will the adjustments be the same at $100,000 as they would at $1,000,000? Nope.

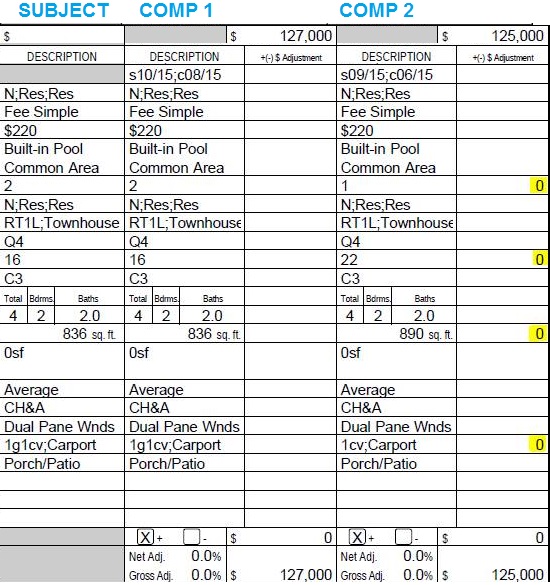

Adjustments I would’ve given years ago: I did a condo appraisal recently, and here is an example of what my appraisal might have looked like years ago (unfortunately).

I adjusted $5000 to Comp 2 for being located on the first floor since the subject is upstairs (it’s noisy on the first floor, right?). I also adjusted $500 for each year of age difference, a $30 per sq ft for square footage, and $5000 for the subject having a garage. What’s wrong with these adjustments though? Well, first off they are all made-up. Maybe they work, maybe they don’t. How do I know there is an issue with the adjustments in this case? Well, all other competitive sales besides the ones here are around $125,000, and the canned adjustments I gave make my comp adjust out to $136,500. That’s a tell that something clearly isn’t right. Most of all, let’s keep it simple. Do buyers really pay $500 for each year of difference in the age? Or do buyers really pay $5000 for the difference between upstairs and downstairs? In this case probably not.

Here are the adjustments I actually gave:

Why I gave no adjustments:

- Square Footage: The slightly different square footage really didn’t matter for the value. As I compared the 836 model and 890 model, they were selling at about the same price. I know this is a minor example, but there is a very real temptation to try to fill any difference with a value adjustment because it seems like there should be one. Yet sometimes the best thing to do is give no adjustment if that’s what it seems the market does. See this graph to compare both models (pay attention to the most recent sales). A similar instance is when we see an open floorplan at say 1500 sq ft compete very readily with a larger boxy floorplan that is maybe closer to 1700 sq ft. Our initial instinct might be to think the 1700 sq ft home is worth more, but sometimes we have to look at the market and let the market speak to us about value instead of bringing in adjustments right away.

- Garage Adjustment: It’s understandable to make garage adjustments any time we see a difference in garage count, but in this case properties with and without a 1-car detached garage were selling at about the same level. It’s easy to bust out a knee-jerk $5,000 or $10,000 garage adjustment, but in this case the garages were far away from the actual property, so occupants were using their nearby carports for parking instead, which seemed to lessen the value of the garage. The garage was probably still a marketing point, but I couldn’t justify giving a canned adjustment, so I didn’t give one.

- The Big Picture: All the comps adjusted out to $125,000 to $127,000 whether they were slightly larger or smaller and whether they had a garage or not. In this case I reconciled the value to $127,000 because the subject property was on the second floor (generally more appealing) and it did have a garage (still a marketing point). I didn’t give any actual adjustments in the report, but in a sense I adjusted for the value of the components in the final reconciliation since a buyer would consider the subject property as more of a complete package, and thus pay toward the higher end of the market range.

Three Takeaways:

- Would Buyers Make this Adjustment? I know the example above is an easy one, but even when a property is challenging we need to still ask the basic question of whether a value adjustment makes sense or not. If you lined up a group of interested and qualified buyers, would they really make the adjustment or not? One of the best ways to know is to begin digging into neighborhood sales. We might hear an owner say, “I paid $70,000 for the rear landscaping, so the adjustment is $70,000.” The key would be to find homes that are similar with decked-out landscaping. When sales already have similar features, they tell us what the market has been willing to pay. What we don’t want to do is guess by using only homes with very average landscaping. This is when we start to say, “Well, I think the adjustment is probably $15,000 or $20,000”. Maybe, maybe not. What have properties with similar features actually sold for?

- Focus on the Big Stuff: I recommend not giving small adjustments and instead focusing on the bigger items that probably drive value more such as square footage, condition, upgrades, market conditions, and location. Let’s not get bogged down giving $500 fireplace adjustments, $500 year adjustments, and $1000 covered patio adjustments.

- Your Canned List: It’s easy for any of us to get into a habit of giving canned adjustments. If you have a list of adjustments you tend to give, next time you are giving them, ask yourself if the market really behaves that way. If not, maybe it’s time to stop giving them?

Speaking at AI: I actually got to speak on a panel at the Appraisal Institute’s Fall Conference in San Francisco a few weeks ago about this very topic. What an honor!

I hope this was helpful (I promise not all posts will be longer like this).

Questions: What else would you add? What is takeaway #4?

If you liked this post, subscribe by email (or RSS). Thanks for being here.

I agree, too many appraisers use a list they were provided umpteen years ago. It’s how they were trained. But it’s long past time to move out of the dark ages of unsupported adjustments based on little more than “my experience” for support. It’s NOT that you experience is less important. it’s just that it should be applied primarily to the reconciliation of an opinion of market value and not arbitrary adjustments. A large dose of good old fashioned common sense is a good guideline when deciding whether or not to make an adjustment. Does the market really see a difference? Is it significant? (above 3% is my rule of thumb) Is it measurable? If so, go ahead and make that adjustment. If not, save it for the reconciliation based on your fabulous years of experience and expertise. Your readers will be grateful for a well written reconciliation.

Home run comment today, Mike. Thank you. I agree. When we consider a $500,000 house, an adjustment at $500 is pretty meaningless anyway. A look at the big picture is key because that’s what buyers are doing. They consider the total package.

Great topic and congratulations on speaking at the AI Conference. That is an honor. I’m always asking my appraisers to think if they need a particular adjustment or not. I often error on no adjustment and possible weighting in reconciliation over an adjustment with limited support. An individual adjustment is an easy sticking point if the appraisal is challenged.

Thanks so much Gary. It’s a good thing to think about the adjustments. I didn’t mention it in the post, but I will say nobody gets adjustments right all the time. Sometimes a typical “canned” adjustment might make sense too. There is nothing wrong with adjusting $5000 for a garage space if that makes reasonable sense. If someone wants to split hairs to say the adjustment is really $4000 or $7000, that’s okay too, and I don’t have a problem with that. There is going to be a range of what is a reasonable, and we simply have to explain why we gave an adjustment rather than only stating an adjustment was given.

I like the comment about what adjustments a buyer would make – obvious – but something we forget from time to time. Well put. In my market, being on the golf course of a local country club 15 years ago was huge – today it’s not near as important as age/condition. Conversely being waterfront on the local lake 20 years ago was big, but today it is huge – probably a $50,000 adjustment or greater on a $250,000 home.

Golden stuff, Ken. Thank you for the specific examples too. It’s always interesting to hear how a market can change over time. Your comment reminds me of an adverse location adjustment. An adjustment for an adverse location can be substantially different when there is a 10-month supply of homes for sale compared to a 1-month supply.

Im with you Ryan. As we’ve spoken before, I tend to do look at the big ticket adjustments as you’ve mentioned (SF, bathrooms, garage, condition, location, upgrades, etc). Smaller adjustments such as fireplace, actual age, patio, etc. are seemingly what CU is trying to help eliminate or at least encourage appraisers to reason through if going to make an adjustment. Im completing an appraisal as we speak that I’m going to argue that any adjustment is negligible for a slightly larger model (approx. 100sf) with no adjustment noted.

Good for you Bryan. Sounds like you are doing a great job.