Let’s talk about adjustments. Last month I wrote about being a trigger-happy real estate adjustment giver, and I had some great feedback. One appraiser told me she is going to stop adjusting for some of the very minor stuff like fireplaces and covered patios, and an agent told me his list of adjustments was basically the one I shared as an example of what not to use. It’s great to hear of growth like this, and I love the honesty, yet I think anytime we start talking about adjustments, it can also make us feel insecure because we begin to question everything we are doing. So for the sake of growth and conversation, let’s kick around the topic a bit more. I’d love to hear your take in the comments (or send me an email).

4 questions to ask when giving real estate value adjustments

Does the adjustment represent how buyers behave? When valuing a property, we adjust the comps when there are value-related differences compared to the subject property. The adjustments are not about what one buyer would pay, but rather what a representative buyer in the market might pay. In other words, if you lined up a group of 100 interested and qualified buyers, and they would pay a difference for that certain feature, we then adjust by that difference. Remember, there is always going to be one buyer who is going to love a feature, and pay way more because of it, but we have to ask, “How much is the market going to pay for this?” Example: House shaped like Darth Vader’s light saber.

Does the adjustment seem reasonable? Take a step back from the adjustment you are giving and just ask, “Is this reasonable?” If you’re giving a $500 fireplace adjustment, does that really seem like a reasonable adjustment, or is it purely made up? Does a $10,000 location adjustment for the busy street really represent what the market is willing to pay? Or does a $25,000 condition adjustment between the fixer and remodeled home make reasonable sense? This is a big question to filter our adjustments through, and I recommend getting into the habit of asking it. By the way, I find sometimes when it comes to condition, the adjustment might be more like 20% instead of $20,000.

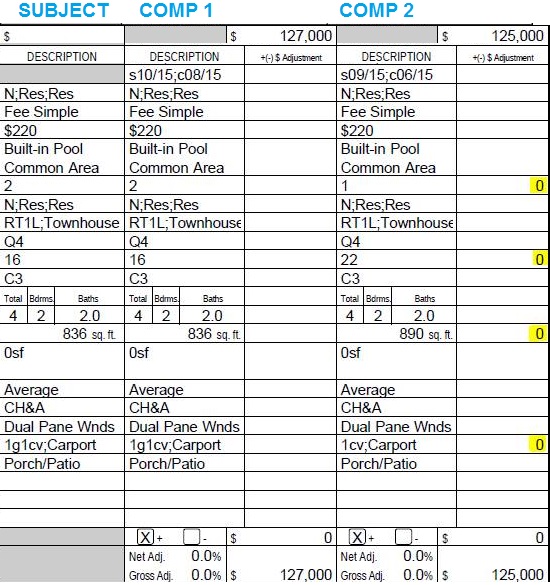

Is the adjustment supported? It’s easy in real estate to pull out a list of canned adjustments and start giving them whenever we see any difference between a comp and the subject property. So we see a built-in pool and automatically give a $10,000 adjustment for the difference. Yet we need to do some research in the neighborhood. Is there a price difference between similar homes with and without pools? At times our canned adjustment at $10,000 might actually make really good sense, so it’s perfect to use, but other times we might see a different story of value. It’s easy to get stuck giving that $10,000 adjustment in every case, but this is where we need to let the market speak to us. Research the sales and let them set the tone. This means the adjustment might look different in each valuation. Maybe you’ll have no adjustment at all for a pool if there really isn’t a discernible price difference, while other times you might adjust twice as much as you normally do because the pool is something special and it looks like buyers paid a premium for it. Remember, the goal ought to be to find other homes that actually don’t need any adjustments at all because they are truly comparable. I know that’s a fat chance, but keep that in mind.

Does the adjustment fall in the range of value? As much as we’d like to think there is one perfect and precise adjustment out there to give, it’s most likely we will see a range of value emerge. For example, if we surveyed a neighborhood and found homes with built-in pools were tending to sell between $8,000 to $15,000 higher in price, we have to make a decision. What should the adjustment be in the case of the subject property’s pool? If it’s an older pool, maybe we end up giving a value adjustment closer to $8,000. But if it is a higher quality newer pool we might reconcile the adjustment closer to the top of the range.

I hope this was helpful.

Questions: What is question #5? Anything else to add?

If you liked this post, subscribe by email (or RSS). Thanks for being here.