Let’s talk about real estate cycles. Are we at the top of the market? Lots of people are wondering, so I figured I’d throw out some charts to help fuel conversation. My goal here isn’t to say YES or NO, but to focus on stats for the sake of discussion. Well, and if you need something to talk about at Thanksgiving dinner besides politics…

CYCLE CHARTS: Here’s some charts to show the annual median price in various local counties. What do you see? Look at price changes and cycle lengths. If you’re not local, what would charts like this look like in your market?

NOTE: The market started increasing in the late 90s, but stats from then are limited. Just know the first cycle above would have been a couple of years longer.

What about the ’70s and ’80s though?

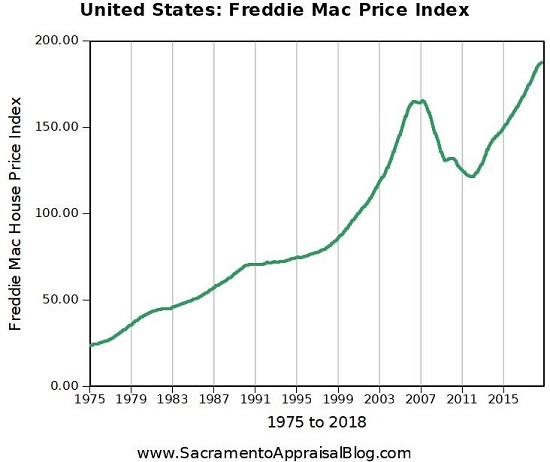

Someone in the comments wanted to see price trends in previous decades, so here’s the 70s and 80s for context from the Freddie Mac Price Index. I’d love to expand my charts above, but I don’t have quick access to mass stats to make that happen. I’ll keep my eyes open though.

THOUGHTS ON REAL ESTATE CYCLES:

1) Up and down: Sometimes we get stuck talking about real estate like it only increases in value, but that’s fiction. The reality is markets go up and down – just like relationships, the stock market, or my pants size. The truth is we see longer periods where prices increase, decline, or persist in stability.

2) The seven-year cycle: Some say the market changes every seven years, which is a nice idea, but there’s no universal rule that says the market has to behave a certain way after a specific period of time. I definitely buy into the idea of market cycles, but I’m not dogmatic about a fixed number of years.

3) Momentum change: Right now as charts show we’re seeing momentum slowing in the market. What I mean is we’re typically seeing more subdued appreciation rates over the past few years. That’s not really a surprise though as affordability is becoming more of an issue with today’s prices.

4) Other: What is point #4?

I hope that was interesting or helpful.

HAPPY THANKSGIVING: From my family to yours I wish you a very happy Thanksgiving. I’m glad we’re in this together and I appreciate our weekly conversations. Over coming days I hope you get some time off and find refreshment. I honestly hope you don’t bring up real estate cycles at the dinner table. But then again if you do, let me know how it goes….

Questions: What do you see in the charts above? What stands out to you most? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

This is a nice summary, but isn’t it misleading? Real Estate cycles are historically often local events. A National bust like the 2008 collapse is, to put it mildly, and unusual event. So characterizing it as part of some regular pattern is maybe not going to be useful for forecasting.

In fact, it was so unusual to have a national collapse that the assumption that it wouldn’t or couldn’t happen was central to CAUSING the collapse.

So if you do want to portray local cycles, why not go back a little farther. Say -to the 1950s. The data is out there and if there is a regular pattern, that’s bound to be more informative.

Hi Max. Thanks for chiming in. I agree the last bubble was a wild ride and there were many reasons why it happened. While we wouldn’t call that a normal cycle, we cannot deny it represented a cycle. You seem to be inferring I said it was normal because I showed the past 20 years. I get that, but I didn’t say that.

What I’ve showed above are portions of the past three real estate cycles in my market – no matter what the cause was for the cycle. A wider view would be awesome. I would love to find the time to track down much older stats to hopefully tell a compelling story one of these days. For now I have easy access to about 20 years of massive data for my market, which is why my focused on that time period.

I will share a graph soon in this post to help show the Sacramento MSA according to Freddie Mac’s Price Index. I hope that gives you a little more perspective. I’d love for you to pitch in two cents afterward too.

For any onlookers interested in the Freddie Mac Price Index since 1975, you can check it out at this link: http://www.freddiemac.com/research/indices/house-price-index.html

Thank you Ryan. With an appraiser at the Thanksgiving table, someone is likely to bring up real estate cycles. Enjoy your time off with the family.

Ha, you’re right about that. It’s bound to come up. My kids will be delighted if it does. They absolutely love market stats…. I’m kidding. Happy Thanksgiving Gary. I hope you and your family are well. I hope to get to Portland next year to see you.

I guess what I’m getting at is the term “cycle.” It doesn’t just mean things go up and down, but refers to a regularly occurring oscillation. If you look at Cash-Shiller from 1987, https://fred.stlouisfed.org/series/CSUSHPISA, “cycle” isn’t the word that comes to mind for me. That’s not to say there aren’t ups and downs. Also, I think cycles do occur in local markets. To see those clearly, I think it’s even more important to isolate local build/bust cycles from this particular national housing crisis.

Gotcha. That makes sense. Thank you. What I’m referring to is a longer period where the market shows a clear price trend before doing something else. It’s why I said above, “The truth is we see longer periods where prices increase, decline, or persist in stability.”

There really isn’t such a thing a a national housing market, so national indexes are only so valuable. I think we’re on the same page there. With that being said, how many “cycles” have there been since the 1980s? Since you brought it up, I wondered how you would answer. If you have an example of a local market, that would be even better. I’d love to hear your take. No pressure.

“Really isn’t such a thing as a national housing market”

Kinda. Sorta. That seemed to be true. Until we had that national bubble from about 2003-8. And national bust from about 2008- 2016.

Though I get your point. People aren’t shopping for houses nationally. A cheap house in Oklahoma City isn’t going to change the market in Sacremento.

What I mean is the “national” market is made up of thousands of local markets and the trends in each market may be distinct from each other. For instance, sometimes when appraiser colleagues see my graphs on Twitter they are blown away at the wild swings we saw in Sacramento that just didn’t happen in their markets. Or the Sacramento market burst in 2005, but we’d say the “national” market burst in 2007.

I added a few graphs for context as a result of our conversation (thank you). Check ’em out and let me know what you think. I used the Freddie Mac Price Index, which is a great tool. I find at least from the 80s it has tended to reflect the price trends in Sacramento pretty well (based on retrospective work I’ve done). Based on the graphs for Sac & California though I think it’s evident there were a few other ups and downs during the 80s and 90s despite the “national” market not really showing much of a dip as we saw in the Case Shiller link.

Opps, I meant the FRED index (not Case Shiller).

Thanks for feeding my obsession, Ryan. 🙂 Just to throw some more data out there, have you seen the Case Shiller long-term graph that goes back to 1890? It certainly shows some long periods of house price declines, and not just in the Great Depression. This one is inflation-adjusted: http://www.multpl.com/case-shiller-home-price-index-inflation-adjusted/ and there is a link there for the nominal graph, too. The inflation-adjusted one shows a lot of ups and downs, while the nominal data is more ups. And hey, we WILL be talking about this at Thanksgiving — this is California, people are obsessed with real estate! 😀

Thanks Steve. I appreciate it. This is great. It’s fascinating to see different metrics. Earlier in this thread Max posted a graph from FRED. It looks like since 1980 there have been six different swings (up or down). Best wishes for Thanksgiving conversation. For what it’s worth I’d take talking about real estate any day over politics (especially if family members are coming from a different place politically). 🙂

Oh, I forgot this. Robert Shiller has a direct link to download a spreadsheet with national housing data from his index (the series going all the way back to 1890 and updated monthly now). http://www.econ.yale.edu/~shiller/data/Fig3-1.xls

I appreciate his desire to share data broadly!

Very cool. I definitely appreciate it when people share freely. That’s likely the wave of the future with software like Tableau. On a side note, I wish Tableau wasn’t so pricey. I’d love to experiment with it. Anyway, thanks again Steve.

Thank you Ryan. Happy Thanksgiving to you and your family.

Thank you so much Brandon. Happy Thanksgiving!!

Hey Ryan! I thought it was interesting to see the trends going back to the 70’s. I appreciate your point that there’s nothing written in stone about when cycles change. Nice points as always. I hope you enjoy some well deserved time off and fun times with family and friends this week.

Thank you Jamie. Yeah, it is interesting to see. While I don’t buy into seven years dogmatically, the market does seem to have a rhythm to it, so I get it when people say things like that. Happy Thanksgiving to you and your family!! By the way, as Christmas unfolds, please take a picture for your blog of the house from A Christmas Story… Just saying. From an outsider’s perspective, it’s what the people want. 🙂

Thank you sir! Great idea! ?

Ryan, love this post so much! It provides so much insight. Here is what I would make as Point #4 – People often make comments like “here we go again” or “the crash coming”… In other words, we are tied up in recency bias. The roller coaster that was 2002-2011 is fresh in their minds because those were the most recent up and down cycles. However, my response is always the same and your graphs illustrate this point beautifully – this time around is different than the prior increasing market. You can see that the increases in values are measurably more subdued when compared to the prior increasing market. Where prices increased at 10-30% rates, this time around they may have been increasing at 5-15% rates. This is one more point of discussion, and another point that makes it difficult to say when the next down cycle is coming. Because increasing rates were more subdued this time around, perhaps the increasing cycle can sustain a longer period of growth? Obviously there are many other factors that play into this. What do you think?

Hi Jacob. Thanks so much. I appreciate you thinking about this critically. You are 100% correct that the end-result of posting charts like this is us asking when the market might turn next (I know someone who regularly comments think the turn has already happened).

Despite all the analysis and neat charts, one thing I am constantly aware of is there is no such thing as a market formula or even a certain way the market has to change or “pop”. Thus just because something happened one way in the past doesn’t mean it needs to unfold that way today or in the future. So despite seeing similarities or differences in the stats, it may or may not mean anything. It is good nonetheless to see more subtle price changes lately, though after adding those up for years it results in quite a bit of change. Moreover, if wage growth has not simultaneously increased, that’s where we really have to think about sustainability.

This market is different from 2005 though in that it lacks out-of-control lending and rampant speculation. In that regard we can see healthier elements, and that’s a good thing. Though to be fair we are not without red flags. It’s just we don’t have those red flags from the past.

Yes, that is always a point of my response when people talk about a bust. I am quick to point out that certain lending practices were put into place to prevent that from happening again, the biggest of all is the subprime mortgages. HOWEVER, these red flags that you mention have come back within the last 6 months and I am paying close attention to this news. Subprime mortgages are back in one form or another. I read this story about a gal who got a subprime mortgage during the prior cycle, and subsequently lost her house. The article was painting her as a victim who shouldn’t have lost her house. And it’s ‘victims’ like that who deserve home ownership. And now this new subprime product will allow her to get into a home again, and she was the first to be in line for it. Moral of the story: we didn’t learn our lesson!!! And red flags are increasing. I, like yourself, am quick to point out that I do not own a crystal ball that is in good operating condition 🙂 and I don’t know what the future holds or exactly how it will unfold. But I am pretty good at looking at historical trends and I am starting to see the red flags increase more and more. I have a “wait and see” mentality, but I can’t help but cringe when I see products like this returning to the marketplace.

Thanks Jacob. Yeah, lenders hold lots of power right now. If they’re not careful they can further inflate prices if they end up introducing more creative products into the market to help buyers artificially afford higher prices. This would break from the trend of strict underwriting, and hopefully it won’t happen, but greed is a very powerful thing. As many banks are laying off loan officers right now, there is going to be more pressure to keep volume up.

On a different but somewhat related note, some say FHA is the new subprime, though we have to remember FHA Borrowers have been scrutinized to qualify for these loans, which is unlike what used to happen back in the day when anyone with a pulse could obtain financing. Thus today’s market really is different. That doesn’t mean it is perfectly healthy because it’s not. It is very different in this regard though thankfully.

Happy Thanksgiving to you and yours, Ryan. Thank you for the always insightful information and your always positive attitude. It was a pleasure to meet you at Appraiser Fest.

Hi Teresa. Thank you so much. It was nice to meet you too. Happy Thanksgiving to you and your family!!

This time it’s different, it is a great time to buy before interest rates go up and you’re priced out forever!!! Real estate always goes up!!!!!! It’s a great time to be a buyer right now!! It’s also the best time ever to be a seller!! CALL ME TODAY FOR YOUR FREE ANALYSIS!!! Toll Free at1-800-TheHouseKing!!!

Hey wait, I just called that number and it didn’t work…. 🙂 Happy Thanksgiving Mr. Miyagi.

Hey thanks Ryan, you as well.

Sorry I couldn’t resist because I really do here that sentiment all the time from Realtors. Thanks for being a good sport.

You know how I feel about this market. As you know I am in the camp of 100% certainty that the cyclical bear market in RE has officially begun. Short of the Fed engineering some fiat currency destroying antics to rescue the air coming out of the balloon, this is going to be a transformational 2019.

And to the poster above, real estate is NOT local anymore. Sorry to break it to you. It has been commoditized and is controlled by central bankers, not local incomes. How can you possibly think local factors have driven this macro everywhere bubble that we are in? Do some research and you will see that RE is no longer ‘local’ like it once was.

I’ll save you some research, watch the global central banks if you want to know where RE valuations are heading.

Thanks Mr. Miyagi. I hope you had a nice Thanksgiving. I sure did… Though I built a kitchen island, so it wasn’t necessarily relaxing.

Anyway, I hear you on the local issue, though I wanted to say real estate markets still are local in that trends are not the same everywhere. I know, we are probably on the same page about that, but I wanted to mention it nonetheless. For instance, when looking at the Freddie Mac Price Index and comparing Dallas with Sacramento, it’s astonishing to see the difference. Our market utterly imploded over 10 years ago, but that didn’t happen in Dallas. Overall Dallas was more flat than not before a giant boom in recent years. Again, I hear you on the bankers controlling the game. I’m just saying the game doesn’t end up playing out everywhere the same…. By the way, for any onlookers Freddie Mac has a cool little tool to compare different areas of the country now to make graphs. Check it out. http://www.freddiemac.com/research/indices/house-price-index.html