I have two things on my mind. Street names and super “hot” market stats. Then for those interested I’ve include my big monthly market update below.

Two things:

1) Street Names: Just for fun, could a street name actually affect value? I mean, if it was really off-color, would buyers pay less because of a name? In my mind it seems iffy because I’ve never seen a name that would actually deter buyers. Yet the middle schooler in me can think of some examples that might work… Anyway, after a conversation on Twitter, here are some of the more random street names in Sacramento. What funny or odd street names have you seen?

2) Hot stats with an asterisk: Last year we experienced a REALLY dull market in many places across the country. If you remember mortgage rates ticked up and it was as if a dark cloud was looming over the housing market. I’m bringing this up because stats last year were depressed. Thus when comparing last year to more glowing or normal numbers today it can make recent price figures look really sexy. My advice? Over these next few months be aware of more sensational data due to lackluster stats from last year. Otherwise if we’re not careful we might end up thinking the market is much hotter than it actually is.

Any thoughts?

—–——– Big local market update (long on purpose) —–——–

This post is designed to skim or digest slowly.

Summary: The numbers are “hot” this month. Prices are up to a greater extent than they’ve been most of the year, inventory is down, pendings are strong, and sales volume has been up too. Part of the reason why the numbers are so stellar is because last year’s numbers were dull, but some of the hotness stems from low mortgage rates a few months back too. In other words, strong pendings from the summer finally closed in October.

DOWNLOAD 90+ visuals: Please download all graphs here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

THE SHORT VERSION:

THE SHORT VERSION:

- It’s been a normal fall so far

- FHA buyers have been hungry

- Zillow bought their first house

- Anemic housing supply

- Celebrity flippers are coming

- Rent control doesn’t apply to every property

- Market crash vs recession

- Strong million dollar market

- Slowing price momentum

- Overpricing is still an issue

THE LONGER VERSION:

Here are some of the bigger topics right now:

Normal fall so far: Not all fall seasons are created equal. What I mean is some falls are duller than others, and this year so far has seemed to be a stronger season. Granted, prices are still softening like we’d expect, but it’s nothing like the painfully dull fall we had last year when some thought the market was about to take a big turn.

Hungry first-time buyers: Last month FHA was 21% of the market in Sacramento County. It’s been over two years since we’ve seen a month with 21% of the market go FHA. For years FHA has been declining because there are conventional products that can readily compete, but so far in 2019 FHA is up 5.6% in Sacramento County.

Zillow’s first purchase in Sacramento: About a month ago Zillow entered the Sacramento market and they just closed on their first house. It was a $560,000 private sale in Carmichael. On a related note, a piece came out in Forbes this week about iBuyer models paying close to market value. Look, we need to remember the credits these companies are getting from owners are padded into the purchase price. So instead of reducing the price to account for repairs, iBuyer tech companies are keeping the price higher and getting a credit for repairs within the purchase price. This is a huge advantage because it makes it look like the price is even closer to fair market value.

Anemic housing supply: Last week the big news was sellers are spending an average of 13 years in their homes instead of 8 years. As a result we’re seeing fewer homes hit the market. This is surely in part a consequence of eight years of historically low mortgage rates. We now have millions of owners with less incentive to list because they’re sitting on a low rate with equity.

Celebrity flippers are coming on strong: A few weeks ago I couldn’t sleep and I snapped this image while watching television at 4am. This flipping program aired simultaneously on four major networks. My advice? Be careful. We all want financial freedom, but you can spend thousands of dollars on these seminars to obtain “secret” flipping knowledge you can probably get for free.

Rent control does not apply to single family homes in Sacramento: I have an exhaustive Q&A post on rent control coming soon, but for now I wanted to mention something important. Rent control in the City of Sacramento only applies to properties within city limits with two units or more that were built prior to 1995. It does NOT apply to single family homes. However, if an investor owns ten or more properties under an LLC (and a couple other scenarios), rent control can apply. Keep in mind California has some differences between Sacramento rent control. Here’s an overview of rent control in California with a video link to a lawyer talking through rent control dynamics.

Ready for the market to crash because of a recession: Some prospective buyers are waiting for a recession in hopes of the market crashing, but real estate doesn’t always crumble when a recession happens. In fact, sometimes prices even rise. Here’s a video I made to talk through the past five recessions in Sacramento. This is a huge topic right now.

Strong million dollar market stats: The million dollar market has been growing. We really are in a market of outliers where we’re seeing some of the highest prices ever (Sellers, don’t overprice because of this). For reference, the top three sales ever in East Sacramento have all sold this year.

Slowing price momentum: Overall price growth has slowed down from years ago. This isn’t a shocker because I’ve been beating this point to death for the past couple years at least. What I mean is prices are moving forward still, but it’s not the type of rapid growth we saw in early 2013.

The plague of overpricing: Sellers these days are fixated on glowing stats and they’re often thinking the market is more competitive than it actually is. It’s like sellers are saying, “The market is SO hot and I’m going to get tons of offers,” but then buyers are like, “OK, boomer” (sorry, had to fit that in). Seriously though, overpricing is an enormous problem for sellers among all ages, price ranges, and locations. My advice? Price according to similar homes that are actually getting into contract. Remember, the market in later November and December is usually the slowest time of year. If you’re priced right you’ll likely get one or two offers, but if you’re priced too high you’ll likely get zero.

I could write more, but let’s get visual instead.

FIVE THINGS TO TALK ABOUT:

1) SLOWER GROWTH: Price growth has been slowing. This isn’t my idea or agenda. It’s what stats are telling us. This market is still very competitive when priced correctly, but it’s not a market with hefty price appreciation.

NOTE: Two of the categories above are showing slightly more price growth in 2019 compared to last year. But remember, when looking at data for October or the past 90 days, we have to consider how dull the market was last year.

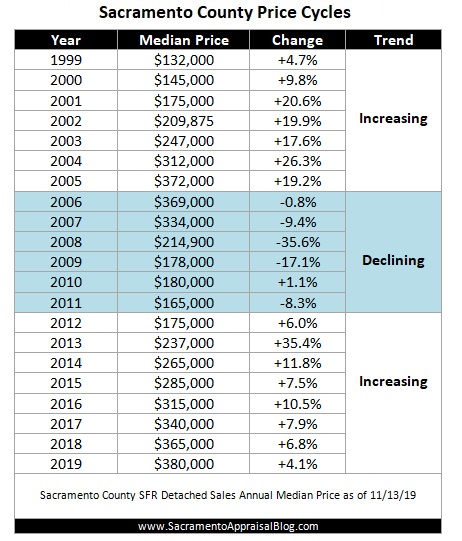

2) PRICE CYCLES: Here’s a look at the past few price cycles in various counties. This is a fascinating way to see the market. What do you notice?

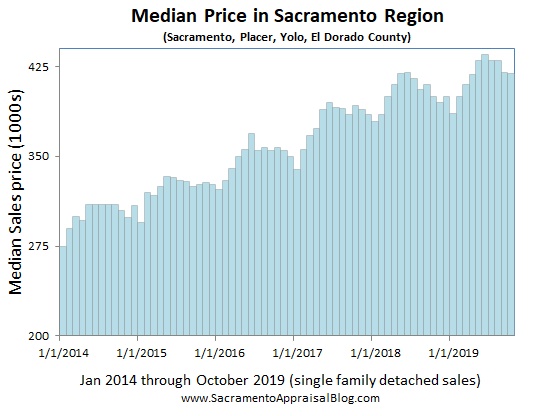

3) LAST YEAR vs THIS YEAR: All year long most price metrics have been up about 2-4% each month compared to last year, but this month they were a little stronger. This is likely due to stats sagging last year during a really dull 2018 fall season. Additionally, mortgage rates went down a few months ago and we’re likely seeing some of the effect of that.

4) VOLUME SLUMP: We’ve been having a definitive sales volume slump since mid-2018, but lately volume has been stronger. In other words, sales volume has been down fifteen out of the past eighteen months. But sales volume has been up for three out of the past four months. This is something to keep on the radar. It’s not a volume meltdown, but it’s definitely been a slower year.

5) PRICES ARE SOFTENING FOR THE FALL: The market generally slowed in October, which is expected for the time of year.

NOTE: Take El Dorado County data with a grain of salt. Stats change significantly month by month. Also, if you’re in Placer, be careful about only looking to Placer data because limited sales can mean numbers jump around quite a bit from month to month.

Thanks for respecting my content: Please don’t copy my post verbatim or alter the images in any way. I will always show respect for your original work and give you full credit, so I ask for that same courtesy. Here are 5 ways to share my content.

Please enjoy more images now.

SACRAMENTO REGION (more graphs here):

SACRAMENTO COUNTY (more graphs here):

PLACER COUNTY (more graphs here):

EL DORADO COUNTY (more graphs here):

DOWNLOAD 90+ visuals: Please download all graphs here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

Questions: What’s the wildest street name you’ve seen before? What market trend above stands out to you the most? Anything to add?

If you liked this post, subscribe by email (or RSS). Thanks for being here.

I loved this post! The street names are great! My favorite is Klingon Ct. Out of this world!

Thanks Jamie. Now I know you’re a Trekkie. 🙂 Well, maybe. The street actually intersects with Romulan Ct too.

I totally am!

I used to watch as a kid. I just never really got into it though. I support you going to conventions though and knowing how to do the Vulcan pinch and salute… 🙂

LOL! Thanks man! In full disclosure, I never went to a Star Trek convention. But I can kind of do the Vulcan salute. ?

Good stuff as always. Speaking of recession, the yield curve is no longer inverted.

https://www.economist.com/united-states/2019/11/13/americas-yield-curve-is-no-longer-inverted

Odds of a recession next year have dropped.

Thanks Joe. It’s like a game of ping pong…. A recession is coming next year. No, it’s not. Seriously, it looks like it could happen.

Well, maybe the next year instead. 🙂

For onlookers, someone asked me why I put together this video the other day. It is only because there is conversation about recessions brewing in real estate circles. I find when consumers hear about a looming recession it tends to bring up questions, so it’s useful to talk through what tends to happen in the housing market when there is a recession. For some this conversation can feel really political, but that’s not the tone here at all. Let’s remember recessions are part of the economic experience and having conversation about them doesn’t need to be politically charged.

Some single-family houses and duplexes will come under the state anti-rent gouging law and just cause eviction protections in January. In Sacramento city, it will be more complicated, as some units will be protected by local law and some by state law.

Also the historical graphs point out the importance of the federal government in subsidizing landlords.

Thanks Alison. Glad to have your take here. I was really careful to only speak to Sacramento rent control as California could be different. I’m still waiting for more details on California before saying too much. There are some differences though. The reality is locals are going to have to be in tune with different sets of rent control laws. This is how it works in the Bay Area, and it’s how we’re going to have to roll in Sacramento.

Everything you need to know is here:

http://www.tenantstogether.org/resources/1482

Thanks Alison. I’ll check it out. I’ve been reading here and there about California, but I’ve been slower to speak before getting up to speed on the details.

One of my favorites around here – Rough and Ready Hwy.

Thanks for all the great info.

That’s great Scott. Thanks so much for sharing.

Two of the funkiest street names in my area are Lickert Harder Rd and Fangboner Rd.

The county now prints L Harder on the street signs because they get stolen when they don’t abbreviate.

Oh wow. Thanks Ken. It’s amazing to hear that they shorten it. I can only imagine how many times the signs have been stolen.

Great Sacramento market update. Always enjoy your take.

Thanks Gary.