The other day a client asked me to include a statement in my appraisal that horses are allowed on the property. It was a huge lot, so it seemed like that might be okay… But I said NO for a very specific reason. Let’s talk about this and then for those interested let’s take a deep look at the local market.

A conversation with the city:

Me: Are horses allowed in the Tahoe Park neighborhood?

City: No. You need agricultural zoning for that to work. City of Sacramento code says: “It’s unlawful to keep, harbor, or maintain any bovine animal, horse, etc… on any parcel located in the city.” There are some locations that will work in the northern part of the city due to agricultural zoning, but not this location.

Me: What if it’s a really large lot though?

City: No. You need agricultural zoning.

Me: What if it’s an emotional support horse? (I wish I asked)

The point: On paper it might look like a horse property, but what does zoning allow? That’s the question. This is a good reminder to call the city or county to verify what is legally possible. To be fair owners can sometimes obtain a variance, but otherwise horses weren’t going to fly in this tract subdivision.

Class I’m teaching on Jan 16th: I’m doing a big market update at SAR from 9-10:30am. We’ll talk through the market, tips for talking to clients, and ideas for where to focus business. I’d love to see you there. Sign up here.

Any thoughts?

—–——– Big local market update (long on purpose) —–——–

This post is designed to skim or digest slowly.

A QUICK LOOK AT CONTENT

A QUICK LOOK AT CONTENT

- Recap of 2019

- Loans & cash over the past decade

- The number of sales in 2019 vs 2018

- Distressed sales in Sacramento County

- Sales above $1M over the past eight years

- Sales below $100K over the past eight years

- Sales volume “recovery”

- Not a crash, but on the lower side

- Price growth is slowing down

- Comparing last year vs this year

- Price Cycles

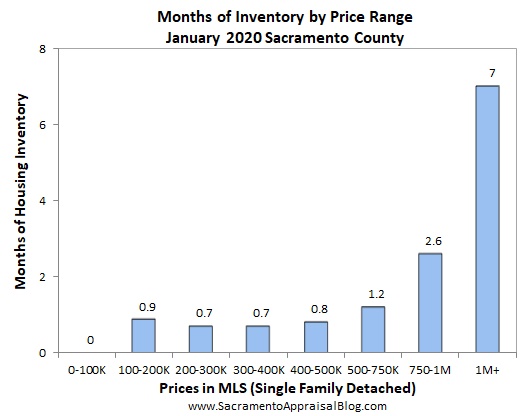

- Housing supply is anemic

- More visuals for surrounding counties

Scroll down to see what captures your interest. There are a number of new visuals too. I used a different format. What do you think?

DOWNLOAD 145 visuals: Please download all graphs here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

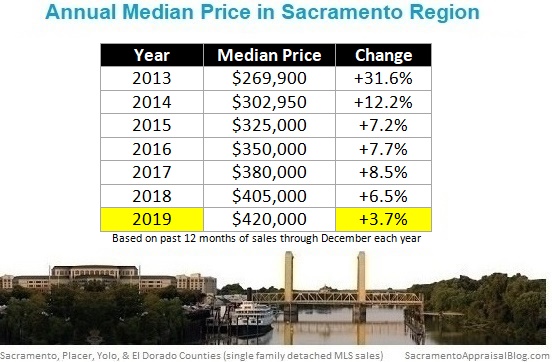

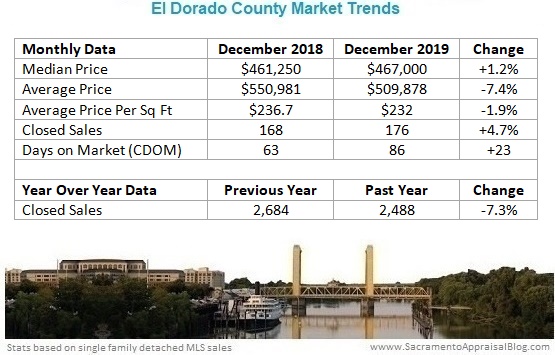

1) Recap of 2019: The year ended up feeling somewhat normal after a painfully dull last half of 2018 that left us wondering what would happen in 2019. Price gains were modest, there were slightly fewer sales compared to the prior year, and it typically took several days longer to sell in most counties (besides El Dorado taking over ten days longer). Here are some trends to watch in 2020.

2) Loans & cash over the past decade: These visuals are brand new and I hope you like them. Conventional financing has taken off this past decade, right? FHA used to be more common until conventional products began offering lower down payments. There was actually an uptick in FHA though this year, so let’s keep watching that. Cash sales are not a big factor in today’s market despite sellers thinking they are.

3) The number of sales in 2019 vs 2018: There were more sales at higher prices and less at lower prices. This makes sense for a market that showed upward price movement.

4) Distressed sales in Sacramento County: It’s astounding to think that 84% of sales in Sacramento County were distressed in early 2009, whereas now we have fewer than 1.5% bank-owned sales and 0.5% short sales. People keep asking me if we’re poised to see these numbers start increasing again. Technically there’s really no place to go but up since distressed sales have bottomed out. But I wouldn’t expect these to increase dramatically because there’s no mechanism in place right now that would trigger mass-distressed sales. There is not the ticking time-bomb of adjustable rate mortgages or an economic collapse. But if we had a devastating economic downturn or some other huge issue, that could change things. There are definitely voices that talk about a coming “wave” of distressed properties, but this wave has not materialized despite prophecies for many years. Granted, bank-owned sales are up very slightly this year, but it’s not statistically significant. I’ll keep you posted with any changes.

5) Sales above $1M over the past eight years: This is a fascinating way to look at the market. I know there are many colors, but here is the number of sales above $1M for each respective year. What’s the trend?

6) Sales below $100K over the past eight years: On the other side of the price spectrum, here are sales below $100K. There aren’t too many these days. I know, everyone wants to go back to 2012. But the problem is financing was hardly available back then to so many people who had a foreclosure or short sale on their record. So even though prices were right so to speak, financing wasn’t.

7) Sales volume “recovery”: We’ve begun to see sales volume come out of a funk as it was down for over a year. However, there’s an asterisk to this news because we’ve seen sexier volume over the past few months, but we’re also comparing these recent months to a REALLY dull season last year. So of course the numbers today look better. My advice? Take this news with a grain of salt and save rejoicing for the spring season if we see this trend continue.

8) Not a crash, but on the lower side: As I said above, we’ve been having a definitive sales volume slump since mid-2018, but lately volume has been stronger. The number of sales this year has basically been down about 3% or so from last year in the region, though when looking at the past five years we can see volume is down closer to 5% or so. But here’s the thing. Sales volume this year was still on the lower side of normal (and even higher than 2014 which was a dull year). This is a good reminder to look at stats in a wider context instead of having tunnel vision stuck on one or two years. For reference, when the market crashed in 2005 we saw a 40% drop in sales volume over one year.

9) Price growth is slowing down: Price growth has been slowing, which basically means prices aren’t rising as quickly as they used to. Though technically the monthly and quarterly data below show higher price growth this year. Does that mean the market has been more aggressive? Has it begun to rebound? Not necessarily. I recommend being hesitant about sharing this positive-sounding news because the market was REALLY dull last year. Thus when we compare monthly and quarterly numbers today with dismal stats from 2018 it can really inflate the figures.

10) Comparing last year vs this year: All year long most price metrics have been up about 2-4% each month compared to last year, but these past three months they’ve been higher. This is likely due to stats sagging last year during a dull 2018 fall season. I know, I keep mentioning that. Additionally, mortgage rates went down a few months ago and we’re likely seeing some of the effect of that.

11) Price Cycles: Markets go up and down. That’s just what they do. Here’s a look at the past few price cycles in various counties. This is a fascinating way to see the market. Do you see the price deceleration in this current cycle? Also, in El Dorado County I pulled my stats just two days ago and the median price was down 0.1% instead of at 0% in my recap image above (that’s why the numbers are slightly different).

12) Housing supply is anemic: There isn’t much on the market right now, so buyers are hungry for good product. Remember, the spring market usually comes alive in the sales stats by March, but this means the market really started to move in January and February when these sales from March got into contract. Anyway, inventory looks to be mirroring what we saw a few years prior to last year’s dull season as you can see in the image directly below. There should be more homes hitting the market in coming months if we have a normal seasonal rhythm. Sellers, there’s nothing wrong with listing in January or February either. If you sense demand is there and especially if rates go down, you’ll have a captive audience.

13) More visuals: I know, there are too many visuals already. But here’s more. I never post them all either, so check out the download if you wish.

SACRAMENTO REGION (more graphs here):

SACRAMENTO COUNTY (more graphs here):

PLACER COUNTY (more graphs here):

EL DORADO COUNTY (more graphs here):

DOWNLOAD 145 visuals: Please download all graphs here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

Thanks for respecting my content: Please don’t copy my post verbatim or alter the images in any way. I will always show respect for your original work and give you full credit, so I ask for that same courtesy. Here are 5 ways to share my content.

Questions: What stands out to you about the market last year? What are you seeing right now? Anything to add?

If you liked this post, subscribe by email (or RSS). Thanks for being here.

What about a goats?

Code actually says goats are not allowed either. I do wonder if this is enforced. I also wonder if an owner on a larger parcel could obtain a variance because goats could help with fire safety. All I know is code is pretty clear, but it also says, “Where such keeping, harboring, or maintaining of such animals would constitute a valid nonconforming use under the applicable provisions of the Planning and Development Code of the city.” In short, this is where I would always tell a client to investigate further. Here is local code: http://www.qcode.us/codes/sacramento/view.php?frames=on&topic=9-9_44-iii-9_44_340#0

Great Information and Data as always! I particularly appreciate your comment on distressed sales. We are wise to always keep an eye on things but the “Imminent and Total Collapse of The Real Estate Market” just isn’t indicated by the current facts. Also interesting is the $1M sales numbers. Consumer confidence continues to increase? At least it is so with wealthier families? Finally: We are wise to acknowledge the trend of SLOWER appreciation. However, slower doesn’t mean a decrease in values . . . YET. I still hear some folks in the business mistakenly stating that values have dropped. Overall, not yet.

Thanks Randy. I love your comment on slower not meaning declining. I have heard that sentiment too a number of times, and it’s important to parse the difference. I’ll say it’s also possible to confuse how the market feels with how much it is changing. So even though a market can feel really competitive, that doesn’t mean prices are going nuts.

Hi Ryan!

I am signed up for your “Market Trends” class this coming Thursday, Jan. 16th from 9:00am to 10:30am!

Your classes are so informative, that I will even postpone appointments so that I can find out what the latest in the market is!

See you there!

Aww, thanks Patricia. I appreciate the kind words. I’m really looking forward to this one because we have 90 minutes to really unpack the market.

Emotional support horse. I love it, but I’m sure it’s actually thing. LOL. Thank you for all the great data.

I don’t know if it’s a thing. And for any onlookers I don’t mean any offense for those who might feel offended.

I was just sitting down to eat a bowl of homemade soup after figuring out my schedule for feeding some horses and I read your blog. What NO HORSES, what the heck is up with that. I just almost lost my first bite of soup. What the heck is going on up there, NO HORSES. You have got be kidding me. I didn’t know you folks up north didn’t like those of us who care for and ride the big ol’ four legged creatures. Okay for those that don’t know me, which is probably your entire blogsphere you can explain to them Ryan, Why I am So Shocked (tongue in cheek for those of you not getting my sarcasm). Ryan and I have met and I think the Stetson threw him off at first. Although I didn’t have spurs with me for our breakfast coffee meeting.

Funny how that damn Zoning and Land Use figures into things. What I really find funny or troubling is that a lender / or incent third party making that request sure enjoys stepping across the line. I guess I really don’t understand their need for a horses allowed appraisal. The world is loosing its mind. Course I am right out in front.

As Always, just like Gary, great stuff and great charts. You the man. And for the person saying they are coming to your seminar, she should not tell any of her friends so that we look like a star. Sorry Ryan I know you want backsides in the chairs. Great job and thanks for all you do. For those of you in Sacramento market area you had better be at his seminar, otherwise you will really be missing out. All my best young man.

Haha. I’m so glad you commented my cowboy friend. Can you imagine if horses were allowed on tiny postage stamp lots? That would be wild. Thanks as always for your support and the kind words. I’m really looking forward to the class. We have over 50 signed up too, so it’ll be a fun crowd.

Great information and stats Ryan! Thank you.

You are so welcome. Thank you Lourdes.

I like you, Ryan, and I appreciate your diligence in presenting statistical info about the Sac and surrounding counties. BUT why do you insist on presenting “Median Price Per Square Foot” as a meaningful number ?? How many OTHER factors influence value that are not addressed in the $/SF figure? I know,REALTORS(R) use it and show it in MLS, because it is a brainless figure, but others may notice this in your stats and be misled.

Thanks for liking me Truett. Right backatcha.

I’ll admit I get grief from appraisers for this and someone gave me beef last week too on Facebook. But here’s why it’s important. This is going to be respectfully direct and it’s really written for colleagues. This is not geared toward you.

1) First of all, I never share this figure alone on purpose because I get that price per sq ft on the neighborhood level is often abused by the real estate community. When I share it is always coupled with other price metrics because I think we need a few ways to see the market. Thus when discussing price change I tend to talk through median, average, and average price per sq ft. You will almost always see these three figures together. The beauty of talking about all three is it tends to give us a balanced view too. In other words we might actually be able to say things like, “Based on multiple price figures we saw a 2-4% increase last year.” At times I find real estate professionals including appraisers gravitate to a certain pet metric rather than looking at a few, and that can frankly be a narrow way to see and talk about the market. I think it’s incredibly dangerous to put all our eggs in one price basket. Thus while I prefer the median over other metrics because it can weed out the outliers, it’s also not the only show in town or the perfect way to see the market. This is why it’s powerful to be able to parse a market in a few different ways so we can talk more definitively about the trends we say exist.

Sometimes the change in price per sq ft over many years can be illuminating too as it may reflect larger or smaller homes being built. Thus like any metric it’s critical to know how to think through the metric, milk it for what it’s worth, and let it serve us.

2) Honest question. Why would we as appraisers limit or narrow our focus when there is a metric like this to watch and interpret? Frankly, I’ve been watching this for many years every single month and it tends to be a little more tame as a price figure. It’s definitely not all over the place either when we’re looking at lots of data points. Of course it could be an utter disaster in a rural market or any area with limited data. But that’s not what we’re talking about here because I often have hundreds if not thousands of data points I’m working with.

Ultimately, why not glean value from this as long as we have enough data points (and there is value to be gleaned)? The average price per sq ft can be quite valuable as a way to interpret market price change also as this metric trends to rise and fall throughout the year. So I truly don’t understand when appraisers give me grief. Are we really actively saying we want one less way to view the market?

Now here’s the straight dope. The reality is some appraisers who offer critique might not actually be pulling these types of stats. Thus some colleagues might not recognize the full value here. I think in some cases appraisers are projecting bad experiences with price per sq ft onto something much bigger like this at the county level.

3) I’m not immune to the real hot button for colleagues. Price per sq ft is often abused on the neighborhood level and nothing is going to stop that. It’s a truly awful way to choose comps and it’s a terrible way to value properties. I’ve written about this many times. https://sacramentoappraisalblog.com/2019/06/04/photoshopping-price-per-sq-ft-in-real-estate/

But what I am doing here is 100% different. In short, looking at price per sq ft on a city, zip code, or county level is not the same thing as the neighborhood level. As a case-in-point, look at some of my graphs I post. There is one that includes all three metrics (https://www.sacramentoappraisalblog.com/wp-content/uploads/2020/01/3-metrics-2.jpg?w=538). The awesome thing with this image is we can see price changes AND a seasonal market in each metric. And like I said, the benefit of price per sq ft is it tends to be a little more tame and not have as many swings as the average sales price (as can be seen in the graph I linked to above).

One more thing. We don’t need to be motivated by fear over what someone might do with a metric. Let’s educate and be the experts in the market who tell the story of value. And there are many ways to tell this story…

Thoughts?

Hello Truett, glad you like Ryan, He is a likeable guy. Full disclosure I am one of those appraisers out here in cyberspace, located south of you. I have very little knowledge over Sacramento but the data is the data. As Ryan has stated below, it is one metric, not the only metric. I too review $/ Median & avg price per SF, Avg Sale price and Median Sale Price. The reason I look at these is to find trends, not to answer a specific question. I also review the prior two years for all this data. Down in my neck of the woods, we had a rather quiet mid to second half of 2018, which leads to some deceptive potential for time adjustments if you just look at one year. I like looking a multiple data points including my favorite of sales volume. Sales volume is the one I watch closely, along with the 10 year treasury to see what can and will happen to the housing market. Again mid 2018, was a great example of these trends. So from my world of appraising it is the price trends of multiple items, the 10 year treasury level, the sales volume charts and interviews with the agents when I call them to confirm sales. All of these items, not just one become the factor in my decision about how I am looking at the market and is it going up, down and sideways. Thought I would chime in just so know that it isn’t just one appraiser (Ryan) but several of us out there looking at this type of data. Hope this helps a little. Really good issue to bring up. Enjoy your weekend coming up.

Appreciate your take Brad. I like the way you worded things here about finding the trend by digging through data (and looking to several years). So good.

Way to say Nay Nay! Great article and update! Always a pleasure to read your post. Have a great run this weekend!

Thanks Jamie. I had lots of thoughts prancing through my mind before saddling up with my response to the owner.

LOL!