Real estate has been slowing, but it’s still completely nuts. I’ll explain below. But first let me unpack the NAR conference in San Diego and share some exciting personal news. Oh, and let’s talk about smaller homes selling. Then stats and perspective for those interested.

NAR Conference & my new BFF: I had the honor of sitting on an appraiser panel last weekend at the National Association of Realtor’s annual conference. I appreciated being asked to share my two cents and I’m so grateful to have met and mingled with colleagues too. Also, I met former quarterback Drew Brees since he spoke at the conference and he’s pretty much my new BFF.

500 days of no beer: In personal news it’s now been 500 days since I gave up alcohol. I said goodbye to alcohol for health reasons and I’m feeling really good. This was a personal milestone and now I’m targeting two years. At some point in the future I might re-introduce beer back into my life, but for now I’m taking some time to focus on health. This has been good. And my pants fit better too.

Slowing but not slow: The housing market has been experiencing definitive seasonal slowing and I’ve been talking about that for months, but at the same time the market is still so much more competitive than it usually is for the time of year. In other words, the stats are slower than spring, but they’re elevated way beyond normal for the fall season. On that note, when some say the housing market is crashing, I wonder if they’re in touch with how aggressive some of the statistics are right now.

Smaller homes: During the beginning of the pandemic there was a notable uptick in the size of homes selling. Initially I thought it was maybe due to buyers targeting larger homes to sort of quarantine in style, but now with the benefit of hindsight I think the real culprit was a spiked emphasis on more expensive (and larger) homes due to an influx of buyers at higher prices.

Here are a few visuals to show this spike in size in 2020 and now a slightly smaller size in 2021. I wanted to mention this because part of me wonders if we are starting to see a bit of the pandemic home size sizzle begin to fade slightly.

This visual shows a dip from 2020 to 2021 in home size. It almost looks like 2020 was an elevated year and now the trend is getting back to normal.

Sharp size drop lately: There has been a definitive drop in home size since May. It’s normal to see larger homes sell for about half the year and then smaller homes for the second half of the year. The drop this time around though has been sharp and that’s something I’ll be watching. This could speak to a normalizing of the higher end market (fewer higher-end sales after a pandemic spike), but we need some time to understand. Stay tuned.

No blog post next week: I won’t have a blog post next week because I’ll be thinking about family, woodworking, and eating pie. I am doing Run to Feed the Hungry, so I hope to see some local friends there. Happy Thanksgiving!!

Thanks for being here.

—–——– BIG MARKET UPDATE FOR THOSE INTERESTED ———––

Skim or digest slowly.

Skim or digest slowly.

QUICK SUMMARY:

The market is so obviously not as hot as it was during the height of spring. Yet the slower speed today is still so much faster than a normal fall season. This is why I keep saying the market is like a car speeding on the freeway that recently let up on the gas. The car is clearly slowing, but it’s still going really fast. Both things are happening at once. Ultimately buyers have been gaining more power and it’s been a bit easier to get into contract, but there is a difference between easier and easy.

Some visuals eh…

YEAR OVER YEAR:

Year over year stats are important to digest, but don’t forget to look at month to month stats to understand what the market is doing right now.

MONTH TO MONTH:

Stats from September to October basically show more seasonal slowing, but not every category is slowing. Remember, stats around this time of year tend to bounce around a bit. One month prices might be up slightly and the next month they could be down slightly. And remember, part of prices dropping has to do with smaller homes selling. Technically the median price in the region has dropped 4% from June, but this does NOT mean prices are 4% lower in every area. Simply put, some of this price drop really has to do with size.

STILL SELLING ABOVE THE LIST PRICE:

Here are some visuals to show how properties have sold in relation to the original list price. In short, we are seeing more properties sell at or below the list price, but last month on average properties still sold almost 0.50% above the original list price. For context, 43% of the market sold at or below the list price last month (most of that is not below). In 2019 more than 70% of all sales sold at or below the list price though, so despite seasonal slowing the market is still moving really fast. It is actually highly unusual to see homes selling above the list price in October. On average homes sold about $2,800 above the original list price whereas in October 2019 homes sold about $15,800 below the list price.

We really don’t have an overpriced market, but some sellers need to adjust to the reality of a slower pace compared to April. Buyers, there is a little more hope for you, but you still have to bring a strong offer. Only 13% of homes sold below the original list price last month. In a normal market his number should easily be 20% or more. Hang in there.

UPDATED VISUAL:

This is a cool visual I’ve been making for a few months. It shows how prices are distributed throughout the market. I actually corrected this visual since I made an error in Excel that pushed the columns over one bin (and that changed everything). Sorry about that.

TWO BRAND NEW VISUALS:

Here are a few new visuals to show how much buyers paid above asking price. I like this format because it compares multiple years at once. But I’m not totally sold on this either because 2020 was such an odd year and 2021 is so far removed from the trend. It just feels a bit awkward maybe. No matter what though, do you see how normal it is at this time of year to see cooling? It’s like the market goes up for about half the year and then things descend.

A BUNCH OF VISUALS:

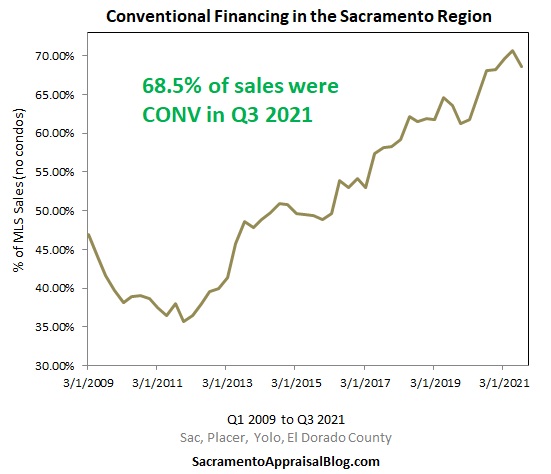

In case you’re still reading, here are a bunch of visuals to digest. I’m playing catch-up after being out of town, so I don’t have any more time to organize these. Let me know if anything stands out to you.

MARKET STATS: I’ll have lots of market stats out this week on my social channels, so watch Twitter, Instagram, LinkedIn, and Facebook.

Thanks for being here.

SHARING POLICY: I welcome you to share some of these images on your social channels or in a newsletter. In case it helps, here are 6 ways to share my content (not copy verbatim). Thanks.

Questions: What are you seeing out there in the market?

If you liked this post, subscribe by email (or RSS). Thanks for being here.

Great info as always. You do a spectacular job of keeping up on your Sacramento trends. SoCal still seems to be full steam ahead with the irrational market continuing to amaze me. Congrats on the 500 day milestone…beer wanted me to let you know that it misses you, but understands. And in my best Napolean Dynamite voice….”LUCKY” meeting Drew Brees. Loop me in on your next text chain with him and maybe I can develop a bromance with him also. Great to see you in person last week!

It was great to see you at the conference Mark. I’m so glad we ran into each other. I miss beer too. I just need to focus on health right now. But for the record let me state I am still a beer snob as I still have strong opinions about beverages. Drew and I should be doing some woodworking soon. I’ll keep you posted.

Regarding the market, it’s mind-blowing here too to see how aggressive stats are. I gave a presentation both yesterday and today and the stats are just bananas. Yes, there is definitive slowing, but this market is still so juiced beyond normal. Properties should be selling about 3% below their list price on average right now, but they’re about 0.50% above. Just an example. It’s wild to see this and we have a ways to go before achieving any real balance.

By the way, I spent two days in Carlsbad with my brother after the conference and I loved it. I’d never been before. What a great spot.

Love all the stats and congratulations on the conference and your health.

Thanks so much Gary.

Ok. So the headline here is “No Beer for 500 Days!”. Wow, don’t think I could do it. Congratulations….I think.

Hey, thanks Brad. I appreciate it. I had some pressing encouragement to make big changes because of some health stuff that popped up, so I think that helped. It’s been good though. I love beer and I do miss it here and there, but being healthy has been the bigger focus. Enjoy one for me though.

Well that’s a different story. Congratulations for sure! I will have one with a toast to your health! From a fellow numbers geek, thanks for all that you do!

Thanks Brad.

I’ve been alcohol free for more than two decades. I never had health or any other issues with it but I just wanted to see if would I miss it. Nope. And my pants fit better too! Also, I get in at least an hour a day of vigorous exercise. Mostly CrossFit type stuff. At you move towards your retirement years (I’m ready to pull the trigger any day now…) health (both mental and physical) becomes more important than work. At least for me. Keep it up!

Mike, I love hearing this. Thanks for sharing. I need to get a little more vigorous with exercise, but I love walking and I put in lots of miles every day. That keeps me sane and fit. I need more cardio though. Anyway, I’m so happy for you that retirement is almost here. Congrats on two decades too. That’s wonderful!!

I wonder if the greatly increased prices have resulted in more demand for the smaller homes as people get priced out of affording the larger homes. I have clients that want a three bedroom home in East Sac for under $600,000. Having missed that opportunity by being outbid many times, they now have to choose, give up on East Sac or settle for a smaller, two bedroom home here…

Thanks for your thoughts Nathan. That could be a part of it. I think we need some time to understand more. I will say the top of the market is still really strong, so it’s not like there has been a huge drop. I checked in with Jonathan Miller about this yesterday as he reports on quite a few markets across the country and he tells me he is starting to see something like this in areas he covers. Over time things will evolve and we’ll get a sense of what is happening and how to describe it. For today I just wanted to start giving more focus to this because it’s been on my desk for a while and we’re starting to see some stats change. So it’s a good time to kick around thoughts. I think your story echoes what many are experiencing though. Buyers have to weigh different locations and it’s amazing how much you need to access some of the more expensive areas like East Sac.

Congrats on your milestone! That’s awesome!

Interesting about the “crashing market”…one of our agents was called by a past client. She was in a panic for selling her home prior to next month’s “crash”. No amount of sharing of knowledge would convince her otherwise. Our agent was stunned.

Thank you Paula. I appreciate it. That’s really interesting to hear, though not surprising. I just wonder what has convinced this person. Is there a data point, economist, YouTube guru, or maybe a spidey sense? I gave a talk yesterday on Zoom to a local brokerage and I actually told them to be ready to list with some people who are looking to sell at the top so to speak. This is a real thing. I get people thinking like this, but it’s also disheartening because there are so many voices preaching a crash because it gets clicks. In contrast I think what needs to be done is to let stats form the perception of the market and then our narrative. And stats are not showing a crashing market right now. If anything they suggest we are poised to start 2022 at an aggressive point. Of course nobody knows the future. If 2020 taught us anything it’s that we cannot predict with certainty. I think of the YouTube videos though that said the top is here because Zillow failed as a flipper. There is just no integrity in making predictions like that and then punting predictions when they don’t come true. People of course are responsible for what they choose to embrace, but anyone talking about real estate publicly needs to be careful of spinning sensational narratives also. Maybe I’m a purist, but I think there is a responsibility here for those who talk about trends.

Wow, big time congrats on 500-days with no beer!! Your publicly announcing that emboldens others to make the same pro-health choice. Kudos. As someone who loves craft beer yet has high cholesterol and wants to live a long healthy life, I may follow your lead one day soon…

And as a Purdue Boilermaker alumnus, I have been a big Drew Brees fan since he played there in the late 1990s. He’s an even better person than he is/was an athlete. Cool that you got to meet him.

Thank you so much CBern. I really appreciate the kind words. Agreed on Drew Brees also. I recall him doing a giveaway to the SuperBowl and he even included an extra $400 on top of the whole prize package so the winner could pay taxes on the winning (if it was claimed of course). I appreciated the thoughtfulness and to me that spoke volumes.

Spot on as usual Ryan and great slides! Most importantly, congrats on your personal accomplishments! Life is good and happy holidays!

Pat, it’s great to hear from you. Thank you so much. Yes, life is very good. I hope you and the family are well. Happy Thanksgiving!!

Great market recap, Ryan, and congrats on your 500 days of being Beer free.

Thanks Tom. Appreciate it.