Sometimes crossing the street can make all the difference for value. In short, if we don’t understand where a neighborhood starts and ends, we might choose the wrong comps. Let’s talk about that today. I welcome your constructive and thoughtful comments.

Photo used with permission (thanks Vicky).

1) BOUNDARIES MATTER:

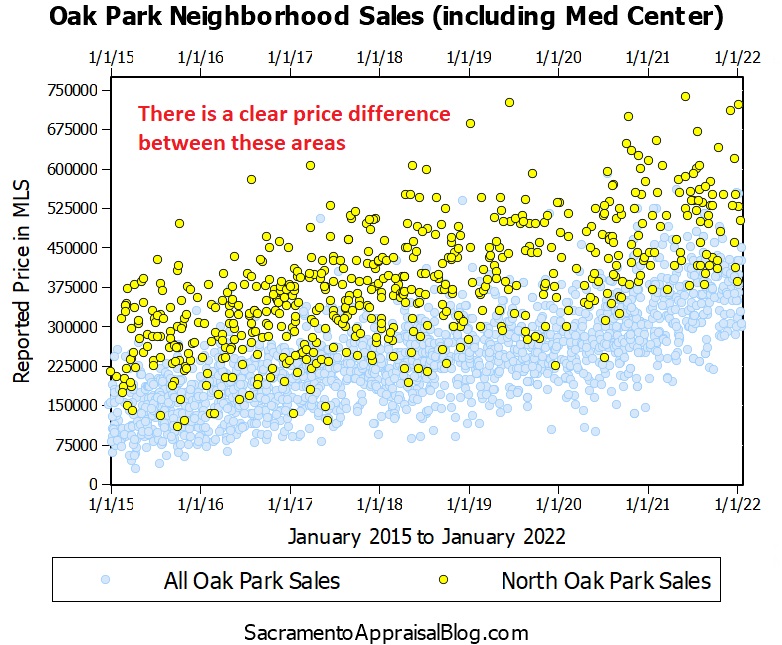

Here is a real example of how important neighborhood boundaries can be. This is the Oak Park neighborhood of Sacramento, and the entire neighborhood is outlined in black whereas North Oak Park is yellow. In short, the northern portion of the larger neighborhood has much different prices.

Different prices: When looking at North Oak Park in yellow and the rest of Oak Park in blue, there is a clear price difference. So as an appraiser I need to be careful about crossing boundaries when choosing comps because prices might be different on the other side of a street.

NOTE on Med Center (for locals): I included Med Center within North Oak Park since these two areas have started to meld together. I think Med Center still generally has a price edge, but these areas are closer together lately.

2) NEIGHBORHOODS CAN CHANGE:

When we look at Oak Park over twenty years it’s obvious the neighborhood has seen a big change. This is clear when looking at development on Broadway, but it’s also apparent on this graph. The yellow dots represent North Oak Park and prices in this section have essentially broken away from the rest of the neighborhood over the past decade. In other words, we see way more blue dots at the bottom these days.

Gentrification: This is where the conversation can get intense because Oak Park (especially North Oak Park) is the poster child for gentrification in Sacramento. In fact, Capital Public Radio reported that Oak Park’s black population dropped by 24% since 2010. That is a sobering stat, which is why this conversation matters. And to me this isn’t some sort of academic exercise where we’re only focused on parsing trends and pretty graphs. This is affecting real people.

Comps in 2004 vs 2022: In terms of real estate, when it comes to comp selection, we might have pulled comps differently in 2004 compared with 2022 because the market is different now. What I mean is the boundary line in North Oak Park is a bigger deal for value in today’s market. This has nothing to do with the racial make-up of the neighborhood of course, but everything to do with recognizing prices have changed over time.

3) HOW DO WE KNOW NEIGHBORHOOD BOUNDARIES?

Okay, this is a big question and it could easily be a dissertation. For starters let’s consider what Fannie Mae says about neighborhoods:

Fannie Mae: “The appraiser should provide an outline of the neighborhood boundaries, which should be clearly delineated using ‘North’, ‘South’, ‘East’, and ‘West’. These boundaries may include, but are not limited to streets, legally recognized neighborhood boundaries, waterways, or other natural boundaries that define the separation of one neighborhood from another. Appraisers should not reference a map or other addendum as the only example of the neighborhood boundaries.”

Other thoughts (mine): I think sometimes we focus only on major streets, but let’s also consider school boundaries and even how neighborhood associations or city websites define areas. But also, where would residents themselves draw the lines? And where would buyers be hunting for a home before shopping somewhere else? All these things could be clues.

If you have something to add, please do so in the comments. And if you think everyone is getting it wrong, please share your solution.

4) BOUNDARIES AND BIAS:

There has been lots of conversation about appraisers and racial bias. In terms of neighborhood boundaries, some of the narrative has seemed to suggest appraisers are perpetuating devaluation by selecting boundaries. The idea is appraisers are choosing comps from an area with lower prices while not considering higher-priced homes outside of the boundaries. I understand this sentiment, especially since there has been a history of systemic racism in real estate through redlining and restrictive racial covenants. But on a practical level, buyers are not willing to pay the same amount in every area, so it’s important to recognize boundaries and choose the most representative comps. In other words, how much would buyers pay for a specific house in a specific location? This is the question to ask whether we’re looking at the lowest prices in town or the highest. Moreover, residents actually define boundaries. What I mean is if we ask people who live in a neighborhood what boundaries define their area, they’re going to be able to tell us. I don’t say this to gloss over accusations of bias (seriously). All I’m saying is appraisers reflecting real world boundaries isn’t automatically a symptom of bias. And if anyone has ideas for how to value without boundaries, I’m open ears.

CLOSING THOUGHTS:

Neighborhood boundaries are a real thing, but they aren’t set in stone either. The truth is sometimes boundaries start to change and the market begins to pay higher or lower prices in some areas. This is where it’s really important to study neighborhoods, check any biases, be thoughtful in our selection of boundaries, and ultimately be sure we’re choosing comps that truly reflect what buyers are willing to pay for the location. Bottom line.

Thanks for being here.

NOTE: I will only approve comments that add to the conversation. It’s okay if you disagree or have questions because I welcome all perspectives. But you have to play nice. That’s my rule. Life is way too short.

Questions: What do you think of the points above? Anything to add?

If you liked this post, subscribe by email (or RSS). Thanks for being here.

I believe the Yellow area is the Subject Neighborhood, and the black outlined area is the Market Area. There are discernable differences in market reaction between the highlighted area and the other neighborhoods, such that if a sale located outside the highlighted area were used, a locational adjustment appears to be needed by the data provided. Having to make a locational adjustment is another indicator of boundaries of the Subject Neighborhood. IMHO

Thanks Richard. I like your last sentence especially. Totally agree. It’s not that we cannot use comps from a different area, but we have to consider if there is a difference in value (higher or lower).

Such a timely topic. With all the news lately about appraiser bias, we should remember that, as you say, the residents are the ones who define the neighborhood. Buyers also define the neighborhoods where they choose to purchase homes. The Principle of Substitution dictates where buyers will buy. When the bias issue comes to trial, it won’t be appraisers who are being judged, it will be the appraisal process as a whole that will be on trial.

Thanks Bill. This is definitely a timely topic and I’m hopeful to be able to have some conversations publicly about it. And if there are better methodologies for valuing, I’m open ears.

Until agents in the MLS start inputting race as a defining characteristic of a house’s features, its not something we can search for to use as a data point.

A little sarcastic but thats what this comes down to.

Not one of your data points can have a racial factor since there isnt that data point available.(and shouldnt be-duh!)

It is only after the fact(MAYBE) that someone who is trying to skew things can look at who owns what house to try to make a false claim of bias.

BTW-in this hot of a market-what used to matter such as ISD or major roads or other factors seems to have dried up.

In a local HIGHLY coveted ISD with over 10,000 students over a 20 mile radius, yesterday had only 15 active homes for sale at any price point(semi-rural)

This ISD has a boundary easily defined in MLS and utilized and clear data points to locationally adjust for a quality comp outside the ISD.

But since covid, other ISD areas have slowly become less defining as more and more people start working remotely, lower inventory makes people “settle” for whatever’s for sale, and tech allows neighborhood, state, and international borders to disappear.

Thats now the interesting point. In your example-its clearly a stationary, mandatory in person employment. Hospitals usually have a clear market boundary driver for residents/workers(less for doctors).A major manufacturer might have a similar but less defined boundary but any number of tech or non-goods companies who deal in intellectual or CS oriented jobs-their boundaries might just be the limits of the internet and why satellite and fiber in so many places.. that may not have a limit on the planet.

Thank you Mark. And I hope it was clear that race is not a factor in choosing comps. I didn’t explicitly say that, but I hope nobody is picking up the idea that I am. If that’s the case I very much want to hear what I said that would lead someone to that conclusion.

For any onlookers, I am simply sharing price trends in the market and discussing how boundaries have changed. This is something real that is happening. Everyone in the local market knows there is money coming into this neighborhood, homes are being rehabbed, and there has been quite a bit of economic development that is causing the neighborhood to look different from a commercial property standpoint. These are all facts. And when we back up we can see black residents have been displaced too as I shared from a media report that was recently published.

Yet it’s really important to clarify that this dynamic of race changing plays no role in how I am appraising properties and what I am writing about in my reports too. I 100% never mention race in my appraisals and I would never even share the Cap Public Radio facts in a report because it’s not relevant for value. In other words, having the racial makeup of the neighborhood change is nowhere on my list of things I talk about in appraisal reports or ever consider even one bit for value. It’s the house I’m appraising – not the person.

Nobody could ever truthfully state you have ever exhibited race bias in all the years I have been hearing you. Just to be super clear.

Its almost not the point of this conversation… dont want to talk about race-this is a boundary issue. It again proves the entire basis of appraisal practice.

KNOW

YOUR

MARKET

and then report it accurately with data to prove your conclusion. In the falling 2008-2014ish years-micro markets might have mattered. *maybe*

but in an area holding 26,000 people with only 15 properties for sale maybe the boundaries are the limits of willingness to drive to amenities or school. Or how long you can stand living in your inlaws attic/basement/couch…

Thanks Mark. And I didn’t think you were saying that either. Your comment definitely helped me clarify though (as did a few others).

Absolutely on point, as usual Ryan, and this statement says it all, ” I understand this sentiment, especially since there has been a history of systemic racism in real estate through redlining and restrictive racial covenants. But on a practical level, buyers are not willing to pay the same amount in every area, so it’s important to recognize boundaries and choose the most representative comps.” The public needs to know this and how appraisers go about calculating the differences. For this reason, and due to the lack of sales within the subject’s specific neighborhood in the last few years, the number of appraisals I could do in a day was typically .3 – .5/day. A LOT of research was necessary on ALL value factors to arrive at a supportable value conclusion.

Thanks Pia. I appreciate the kind words. I know this conversation isn’t always welcome, but there is no reason not to have it. I think the public deserves to ask questions too and get into the mind of appraisers to understand. What are appraisers considering when valuing properties? That’s a good question. And in terms of this blog post, is it off limits for appraisers to choose boundaries? Stuff like this matters and I’m hoping for good conversation. Keep up the research on your end too. Good for you.

Nice educational piece about the realities of neighborhoods and how they change. I find it interesting that “gentrification” has become nearly a bad word in some circles when it generally means progress and improvement. I can recall working with a young couple in 2011 that qualified for short sales and REO homes in the Fruitridge area and they would not tour homes on certain streets. Having grown up in the neighborhood and still lived and rented there, they were sensitive to the conditions in the “micro neighborhood” which made these streets undesirable for them. I have not generally in recent years heard this same kind of feed back. So much has happened economically in the last 25 years that have lead to changes in neighborhoods throughout the region that we as real estate professionals are constantly challenged to keep up.

Thank you Bill. That’s really interesting to hear how sensitive your buyer was on the micro level. And yes, gentrification is a double-edged sword. Objectively there are benefits and threats. There are benefits if properties are improved, the ownership rate increases, and crime is reduced (I don’t have stats regarding Oak Park with this stuff). But there is also the reality of higher incomes squeezing out long-time residents. And that’s the crummy part and quite painful.

Unfortunately I only tend to hear people complain about gentrification rather than promote a model that would actually work to help long-time residents become stakeholders in the community (owning the block with homes and businesses). I’d love to hear from anyone who is concerned about the negative side of gentrification and what ideas might work to help. My inbox is open also. Thanks.

Great post Ryan! You covered some important ground here! In my area, there are some cities in which part of the city is in one school district and other parts are in a different school district. In some of these situations, it makes a significant difference in value. One street away, can sometimes make a big difference. Thanks for your excellent blogging as always!

Thanks Jamie. That’s a great example. Imagine not knowing that and choosing comps without that knowledge. That could end badly.

That’s for sure! I’m sure it happens.

For those of you that have not read the 84-page document that NFHA put out on their interpretation for racial bias and how bad appraisers are then all this discussion is great, but meaningless. Because according to NFHA we as appraisers are biasing our value by determining boundaries of the neighborhood. In a very recent note that I sent to one of the participants I asked if that means that if I appraise a property in Compton can I now use a sale from Beverly Hills. Still haven’t heard back. Folks we have not seen the aftermath of this racial bias claim. If one of the five pending cases is lost, then appraisers and maybe RE agents lives as we know it will change. If you think mass confusion existed before, wait till this mess comes on board. Just finished reading the report two days ago and my teeth are still gnashing. Last comment. There is no room for racial bias in an appraisal, but I still haven’t seen proof that appraisers are purposely lowering values because of someone’s race.

Show me the facts and if found guilty that appraiser should have their license revoked. But what is going on now seems less about market values but something entirely different. Ryan in the next 3 years boundaries and the world we have known may not be that way at all.

Amen Brad. Amen

Thanks Brad. We absolutely need to see facts here in these cases and my hope and prayer is the truth rises to the top – whatever that is. I firmly agree with you too regarding having a license revoked.

This is why this conversation is so relevant. I find the sentiment is that defining boundaries is an egregious act when I think it’s actually a very practical act that reflects:

1) Value isn’t the same in every location (even within the same area). This is true at higher prices and it’s true at lower prices. There are pockets of value in every location. I think of East Sacramento, which is one of the most expensive neighborhoods around (and just north of the highway from Oak Park). Even in that neighborhood there are pockets where prices are WAY higher than other pockets. The houses in the 40s are simply selling for more than the 50s. It’s of course about lot size, square footage, and architecture. But it’s also about location. You could put an identical house on 45th Street and pay a way different price than something ten streets to the east. Thus within this neighborhood it’s so important to reflect what the market will pay for the location of the actual parcel – not just being located within the wider East Sac area.

2) Even residents define boundaries. There is such a thing as boundaries that exist and we have to find them and reflect them. It seems nebulous to me to say boundaries are egregious. Though on the valuation side of things I do think there is room for improvement when considering boundaries. Are appraisers being thoughtful about boundaries? Do appraisers ever get the boundaries wrong? And do appraisers get too laser-focused on one or two streets that they sometimes misinterpret the market? Of course. So on the positive side this is where the appraisal profession gets to listen to these conversations and get better. But the profession also needs to speak up and help educate about how things work. I don’t think the public understands what appraisers are doing, so they’re left to thinking we are using racial boundaries to decipher value when that’s not something on our radar at all.

1000% agree, or I agree as how as much as housing pricing has gone sine April 2020. Almost 1000% LOL

Brad, I read the report and had the same reaction as you. The very basic theory of appraisal and what creates value is being questioned. I came away feeling that the only way to not be accused of being a racist appraiser is to use and emphasize the cost approach since there is too much room for subjectivity in the sales comparison approach. I don’t know what the answer is but I believe the road that the entities putting together the report you mentioned are going down is the wrong one.

Hmm, I’m going to have to read that. The irony here is buyers pretty much use the sales comparison approach as their primary tool for establishing value. The problem with the cost approach is land isn’t worth the same amount in every location. I wonder if that is the assumption here? I just don’t get how this approach is going to be a cure. It seems amateurish to hope for better results by focusing on the cost to build. Objectively speaking we could pull land sales in various price ranges and there will be a huge difference in value based on location, size, zoning, etc…

I’m troubled though if someone ends up coming up with an inflated value based on the cost of construction because cost is sometimes way different than what buyers are willing to pay. This isn’t just an issue at lower prices either. Case-in-point. The highest sale ever in Sacramento County was for $5M a few years back and the Sacramento Bee reported that this property was said to have cost $10M to build. So even at top prices we see a disconnect at times between the cost to build and actual value. This isn’t an isolated incident either.

Nice provocative discussion Ryan!

I suggest that the buying market sets the boundaries — physical and otherwise.

Physical boundaries are confusing – If you look at different sources some show different boundaries for established subdivisions.

Interviewing the BUYERS should determine what the important buying criteria are to THAT buyer. Get enough of these together you have Market Buying criteria. What interests buyers the most in each? Is it a street an area – is it inside a well-defined Sub, close by schools, employment, walking distance to hospitals, parks, close shopping, or highway access? Appraisers have to be inquisitive and researchers.

Keep up the good work Ryan!!

Fantastic commentary Ed. I like how you said that. Thank you.

I completely agree too on various sources. This is why we have to maybe piece together different ideas and ultimately ask, what do buyers say? I find we can look at Nextdoor, Google Maps, or City-Data, but those boundaries might only reflect whoever input them. I will say sometimes it’s helpful to hear what Realtors think too (ones that really know an area).

On a related note, I find subdivision names in Tax Records mean little because how the market defines itself today might not reflect Tax Records at all. Case-in-point. I recall a conversation in recent years where I said publicly the Fab 40s boundaries in East Sac were 38th through 47th. A few people were like, “Wow, I had no idea 38th and 39th were include in the FORTIES.” I get that because it’s actually shocking. But this is the way the market defines this “Fabulous 40s” niche. But to my point, someone argued that it was only in the forties because of the legal descriptions found in tax records. I think specifically the person was arguing about some language in the legal description being the definitive source for what was and was not “40s”.

Look, maybe in the past the legal description set the pace and mattered, but for the market today it wasn’t any sort of trump card any longer. In other words, it doesn’t matter if 38th and 39th had a different description according to this person because the market has defined this area.

My point here is this makes us really have to understand what owners and buyers would think. In other words, it’s not just about a neighborhood tract name or even legal description we might see in Tax Records.

Excellent post Ed. The problem is some of the appraisers (my peers) don’t even take the time to speak with the listing agents about what is going on in the market and what the agents are seeing in general.

Ryan, Thank you for the many facets you have touched on in this blog. Two points,

1)Being in real estate 45yrs we often have to set aside our pre determined neighborhood boundaries as they ARE fluid. We never identified Oak Park as North or not. Be careful all us long timers!

2) There is no technology which will substitute for physically working and knowing a neighborhood. Desk top appraisals, come on. Agents, Brokers and appraisers need to know the neighborhoods and communities.

Thanks for great discussions.

Haha. Point taken. You know, I talked with someone who grew up in Oak Park this morning and he indicated the same thing that the northern portion wasn’t something he knew about growing up. So what you just said reflects that perfectly. But it’s definitely a thing now as so many people clearly say North. Or buyers do at least. We see the language in listings also. This is a thing.

Part of me wonders if the advent of the internet has helped categorize or define neighborhood boundaries a bit more too. I mean, every time we go to Google there is often a neighborhood name or even boundaries sometimes. Just a thought. I’d love to see someone do a research paper on this….

Agreed too on doing the work to know neighborhoods. Nothing replaces effort and sweat to really understand areas. Frankly there is always learning to be had and there isn’t a manual for knowing the idiosyncrasies of a neighborhood. These are things we have to absorb over time and intentionally study as professionals.

Great conversation on all levels. Oak Park looks like the neighborhood to have purchased into ten years ago. It makes me sad that race needs to be part of this conversation. Appraising over the past 17 years, I’ve looked at data like this countless times and it was only recently when it occurred to me (due to recent press and studies of appraisers) that my defining a market area because of certain prices can look to the outside as if I’m defining the area due to racial factors that I’m not even aware of.

Thanks Gary. Yeah, I don’t think this was even on the radar of our profession before, but it certainly is now. I guess the good part is we are now aware of how this looks to the outside world and we get to clarify what we are doing when selecting boundaries and why we are doing it. I know this is only one blog post in a large internet ocean, but I hope stuff like this will maybe help move conversation forward.

Hi Gary, in your defense the market was defining by demographics not you. I have sat in on several calls for racial bias and I can tell that every time I ask a pointed question about market area and how the buyers and sellers defined it not me. I am told either I don’t understand, or they move on to the next question without answering mine. So that says a bunch. Now granted I do wear a Stetson so maybe they figured they could work around me. I may have been raised on a ranch in Kansas, but I realize the world isn’t perfect, but I sincerely doubt that a significant number of appraisers are moving prices around because of race. What I also find fascinating is how those making the point about race seem to leave out the point about quality and condition of the property.

Ryan, great blog with great thoughtful responses. as always YOU THE MAN>

Great post, Ryan.

Analyzing the markets and the neighborhood is what you have demonstrated here. The fact that they change is one of the reasons it is important to analyze it. To me, the most fundamental part of being an appraiser and the service we provide is the fact that we are to be unbiased in our approach to opinion of value. We are not making a deal work, or making the market. We are analyzing the market and reporting what market participants are doing. The market participants are the ones that make the market not appraisers. The principle of substitution is the basis of the sales comparison approach and a fundamental principle of real estate appraisal.

I absolutely think that all of the redlining that occurred in certain neighborhoods was atrocious. I can also understand why many think that because appraisers choose comps from those historical neighborhoods then the system perpetuates the discrimination. Without understanding the principle of substitution it would seem that way, however I believe it may have more to do with income gaps and income disparity. A factor in real estate is purchasing power. We all buy where we can afford. We are reporting what is happening in a neighborhood rather than making it happen. I am 100% for helping with the income gaps and for increasing appraiser diversity and I will do all I can to help in that regard. If an appraiser is truly being biased towards people then that is 100% wrong.

I take the part about providing an unbiased appraisal very seriously. I will not appraise a property that involves my relatives or friends because I want to remain neutral and unbiased.

Thank you Shannon. I am all for seeing more diversity in the appraisal space too. I think this will make us stronger. The struggle is it is SO difficult to become an appraiser. I’m getting 2-3 calls a week on how to become one, so demand is there. Something has to give because the current mentor model is broken and it’s not going to be enough in my opinion to get more appraisers into the field.

Market value is determined by market participants. As long as the market participants money is green, real estate professionals should not care what color their skin is. In my opinion, market areas are driven more by socioeconomic forces than anything else.

Thanks Mark. Yes, buyers set value and appraisers need to reflect it.

On a tangent, there is so much attention on the real estate community right now and it’s a good opportunity to listen and make changes where needed. I find sometimes people judge topics like this as wokeism so to speak (whatever that means), but I think there are things to learn here. And there has been damage inflicted by the real estate community in the past through redlining and other practices, so it’s good to listen and learn. That’s my intent anyway.

I appreciate your willingness to talk about the G-word, neighborhood boundaries (remember the days before NextDoor?) and bias (so brave!) and create space for all in the industry to learn and consider our role and what we can do to create change.

Here are my thoughts on solutions to ensure people living in Oak Park (and Del Paso and all other rapidly changing neighborhoods) can actually stay in their homes. I would love to see the real estate industry incorporate them as a way to take meaningful and transparent action against systemic racism.

Community Land Trusts (CLTs) have been successful in other cities (Oakland, San Francisco, Los Angeles) . A CLT is a non-profit community centered organization designed to strengthen historically disenfranchised neighborhoods through community stewardship of the land. The land trust takes homes (and multi-family/vacant lots/commercial building) out of the speculative market and ensures that they remain affordable forever.

Housing policies including Tenant Opportunity to Purchase Act (TOPA) and Community Opportunity to Purchase Act (COPA). These policies can ensure tenants have first right to purchase a home (or apartment building) if the landlord decides to sell.

Another tool is to ensure that neighbors who are renting can afford to stay in their rentals (dare I mention the words rent and control in this forum…). From 2012-2019 rents increased by 45% displacing many from the neighborhood. Unexpected rent increases make it difficult for many to save for a down payment (or even an emergency fund).

A real estate transfer tax is another tool (currently used in Roseville to support the Placer Land Trust). Each time a home is resold a half percent transfer tax is given to the land trust. A tax (I’m really not going to be popular for this) could be imposed on North Oak Park to support current residents and housing affordability in the rest of Oak Park.

These options are some of the ways we can help our neighbors stay in their homes and stabilize our communities. By reducing the number of neighbors who are displaced we will also reduce the number of neighbors who are living outside.

Some will read these options and see how they can benefit our society as a whole, others will read them and see missed opportunities to make even more $$$.

Thank you Rose. I really appreciate your thoughtfulness and ideas. I’d love to see some of these things implemented locally. I know on Instagram you just posted about those vacant lots in Oak Park (if I remember right) and that smells like a perfect opportunity here….

My sense is there is often finger-pointing at gentrification without tangible solutions. It’s as if there is so much talk, but so little remedy. We do have rent control in Sacramento, so over time I wonder if we will have stats to show the effect on tenants and even gentrification. Unfortunately rental data isn’t always easy to get, but this would be quite valuable to gauge if this tool is helping or not.

Please pitch in any time. If you have ideas for how real estate professionals can keep biases in check too, I welcome your take. I appreciate your diplomatic tone too because that’s what helps conversation flow IMO. I know as an appraiser it’s been brutal over the past year in the media and I’m listening. I’m also hoping to educate and maybe speak to some of the narrative that isn’t really accurate about appraisers. Ultimately my posture is one to listen. I’m not on defense. But I’m definitely wanting to have conversations that help truth rise to the top.

One quick thing. For any onlookers, last year I wrote about subjective language and I think it’s really important to focus on objective language in appraisal reports especially. But I would also say objective language is critical for all real estate professionals in order to uphold respect for all and refrain from Fair Housing Law violations. This has nothing at all with being “woke” either because it’s all about being professional. Objective language helps avoid confusion and can help avoid accusations of bias too. https://sacramentoappraisalblog.com/2021/08/03/just-say-no-to-subjective-language-in-real-estate/

Wow, Ryan. This post is really timely. I’m not sure I can add much more than a lot of your other readers have. I did read the NFHA report that Brad Bassi mentioned and came away feeling that the whole appraisal process was being put on trial and the very basic appraisal principles are based on racism. In their mind, the sales comparison approach has built-in racism and prejudice, especially because appraisers have the discretion of choosing where the comps come from and in their mind appraisers have been carrying on the racist behaviors of the past. It seems that the only solution would be to use the cost approach, however, we all know that cost does not always equal value. Thanks for writing about this very important issue. I think it is one that needs to be addressed and solved immediately so we can all get back to our jobs.

Thanks Tom. I’m going to read that report. In the webinars I’ve seen this idea has been floated where the sales comparison approach is questioned. The irony to me is the people making the suggestions are very likely personally using this approach when buying a home. What they are very likely doing is looking at comps in a certain area and offering according to what they perceive based on the location of the property. So it’s like they are saying, “you guys are full of bias and the process is broken,” but then they are personally using the same exact methodology in their own lives.

Look, in my mind the big issue here is the quality problem we have in the appraisal space. That needs to be addressed. We need to be real about that. But throwing out the sales comparison approach seems iffy because it’s actually a very useful approach that the market uses.

I’m okay if there is a better way to value properties, but it’s a concern if people outside of the valuation space are making suggestions for how this needs to work (and then those suggestions become laws). I don’t know if that’s the case here, but I find sometimes people who talk about real estate who aren’t actually in real estate don’t always have success because they’re not really entrenched in the market. This has actually been a problem for many years with appraisers too because everyone speaks on behalf of appraisers while rarely actually talking to appraisers.

Anyway, regarding being disconnected, I’ve seen this play out with some tech start-ups who have ideas for how to make real estate more efficient. On paper their ideas sound awesome, but then they fail in the real world because they underestimate how complex the human element is within real estate. I think some companies get into the market and learn that it’s difficult. There are so many new companies saying, “We’ll buy the house with cash for you”, which sounds so promising. But here’s the issue. Only 15% of all sales in my market were cash last year, so cash isn’t actually the dominant mechanism to get an accepted offer right now. On paper it sounds like a winning combination, but in the real market the stats don’t say the same thing.

And you know what else is difficult? Value. It is very tricky. I think many discussions about bias are not coming to the table with an honest assessment of how value works. Value is being talked about as it’s something scientific in a test tube that should produce one very specific result. The truth is there is always a reasonable range of value. That’s how real estate works. It would be silly to say the market is only willing to pay $301,564 for this property. Nah, the market is probably willing to pay $290,000 to $305,000 (or whatever a reasonable range would look like based on comps).

If anyone from the National Fair Housing Alliance happens to be looking on, please talk to appraisers (if you haven’t been doing so). You are certainly welcome to reach out to me. My inbox is open.

Ryan, I highly recommend reading the report, as negative as it is. They quote some appraisers who have made racist comments and try to infer that we are all racist. I’m with you, that many who are discussing this are not in the trenches. I would bet that if you offered to sell these people a house in a specific area for $50,000 (random number) more than what others in the neighborhood are selling for just because a similar house (physically: ie GLA, BR/BA, etc) in a totally different neighborhood sold for that they would not go for that, and they should not because there are value-related, market-driven differences that need to be accounted for. I do not believe we have any representatives in the larger appraisal organizations that are speaking on our behalf. They are not willing to explain to the general public how value works and that appraisers are not racist and we are not carrying on redlining because we use the sales comparison approach.

Thanks Tom. I’ll check it out. I suspect there are terribly racist examples in any group of people – even clergy. But how representative is the activity? That’s the real question.

Hi Tom, glad someone I consider to be a whole lot smarter than me, got the same impression from this mess that is coming down the pike. YIKES

I highly recommend reading Dr. Korver-Glenn’s 2021 monograph, Race Brokers, if you have not already. I think you would find her research and suggestions/advice to be helpful

Great article!

Thanks for the suggestion. What does the book say about comp selection and neighborhood boundaries? I would be curious to here what sort of methodology is discussed. In other words, what would be an equitable way to value properties? Not that you need to answer, but any onlookers can pitch in thoughts because that’s what this is about. Let’s have conversation and kick around ideas.

I had a listing in South Land Park (95822) a few years back, the assigned appraiser came from out of the area. The value came in substantially under the contract price, every comp the appraiser used was from south of Florin Road in the Meadowview area. Comps were still in 95822, but there was a definite difference in values from neighborhood to neighborhood within 95822. It seemed obvious to me that in that particular area Florin Road was a neighborhood boundary, but appraiser stood by the fact that he had pulled all the comps from the same zip code.

That’s a bummer to hear Michael. I appreciate you pitching in somet thoughts. This is a good example too because value really does change once you go outside of South Land Park. This doesn’t mean people or homes are better in one area compared to the other. But prices are not the same, which is statistically true.

I think sometimes appraisers decide to choose the most recent sales rather than the most similar sales. Often lenders request sales over the past 90 days, but just because something has sold doesn’t mean it’s really a comp. And regardless of what a lender might want, the appraiser needs to be the one in charge of comp selection. In some cases it might be okay to use an entire zip code, but that’s often a mistake because buyers aren’t simultaneously shopping in South Land Park and Meadowview at the same time because these are two different markets.

Thanks Ryan, you made some excellent points! There were some factual differences in neighborhoods- you could walk to iconic William Land Park and the Zoo from my listing, it was a shorter trip to downtown and the river, etc. It’s not that one neighborhood was inherently “better” than the other, but these factors could have an impact on desirability and value of a location to a buyer.

Thanks. And let’s consider house size too. If homes are a different size or type of architecture, that makes a difference too. There are many layers here. This example is exactly what I’m talking about. Choosing comps that are truly representative of value for the location is the key.

Here’s one of my favorite sayings about comps. It’s never about how far we can go. Where should we go? That’s the big question.

Thanks for the convo.

This is a really important topic and I’m glad to see you talking openly about it while also adding context from an appraiser’s perspective. Our role as appraisers is to objectively develop an opinion of a property’s market value which, in most cases, is intended to reflect the most probable price a typical buyer of that property is willing to pay and a seller is willing to accept. By carefully defining the neighborhood boundaries and fully understanding location factors which influence value in that specific neighborhood, we can provide our client with a credible opinion of value. While acknowledging that there are likely some appraisers who have bias, we must also acknowledge that it’s just as likely that most appraisers are objective and fair, and adhere to the state and federal regulations on which our professional licenses are issued. I really hope the public knows that most honest and fair appraisers want to root out the bad apples at least as much as others do. You’re one of the very good guys in our profession Ryan and I hope we can all have honest discussions with open minds.

Thank you Michael. I really appreciate your kinds words and commentary. Yes, this is a very important conversation. It’s not easy to have.

Good post Michael. Every profession has their entertaining individuals. I agree with you most don’t care about skin color but care about deferred maintenance, crack slab, peeling paint on an older house and located next to a landfill.

Great topic. As an appraiser my role is to act as a reporter for my client. That is, I report value, I do not create it.

In this role I am to look at the actions of sellers and buyers as it relates to a specific property. I need to determine the various market segments, which includes price influences such as school districts, neighborhood boundaries, construction era, even the condition of the roads.

Pricing action also helps define a market area. Prices could be increasing on one side of the street, but not the other. Why? Could be related to city provided services. Even something as simple as availability of high-speed internet service.

Good appraisers try to understand this. Fast appraisers most often do not take the time, and their clients get what they pay for.

As an appraiser, past transactions are like a history book, for the most part projecting into the near future. And current listings provide a view into seller expectations. Are the two in alignment? Pending transactions may help, but RE agents will not/can not disclose pending information.

What if a school is closing? How does this influence future valuations? As an appraiser, I do not have, nor am I expected to foretell the future.

My role is to report, not create value.

Great stuff, Mike. I appreciate your thoughtful commentary and your objectivity. I think you hit the nail on the head with the need to identify various factors that influence prices. 100% agree. If the influences are different, value just might be different too…

Ryan

I should mention that the use of Appraisal Management Companies hiring the cheapest and often out of area appraisers only makes this problem worst.

And I am sorry, but people have bias. Just driving into a poor neighborhood can taint a valuation.

~mike

Thanks. Yeah, bias is real. As appraisers we have to deal with any bias that comes up. And right now the world is pointing its finger regarding racial bias, which makes this conversation so important. On that note I find it’s critical to take steps to remain objective and dig up any bias that does show up (bias of any kind).

Great article! The Appraiser does not set the neighborhood boundaries. We just report the boundaries set by the market. Thanks for writing the article.

Mary Cummins, Appraiser in SoCal

Thanks so much Mary. That’s the goal. We are not a brake pedal or gas pedal for the market. And we don’t create value or destroy it. The goal is to report and reflect the market that exists.

Ryan … I was a review analyst for 14 years. I have argued the neighborhood argument for longer than I can remember. I finally reconciled a basis for the market where I work and it can work for many areas of the country. For metropolitan areas, a neighborhood starts at the subdivision level. Even subdivisions that have several phases phase 7 may be built by a different builder than phase 3 or 4. So as per the Fannie Mae Selling guide (failure to use comparable sales that are the most locationally and physically similar to the subject property), that is the place to start. From there you can define in commentary what is extended neighborhood and what is market area. If you work in a rural area it changes and becomes difficult. So appraisers must make extensive commentary as to how they determined “neighborhood”.

Thank you John. I really appreciate your take. You are welcome to pitch in thoughts any time now since you have an approved comment (first one gets moderated). I love your last sentence because we really do need to think critically about neighborhoods and how we define them. I don’t recall if I said above, but a neighbor showed me an appraisal on her house recently, and the boundaries were silly. It just didn’t make any sense from my perspective as an owner or even when I was a buyer – not to mention my knowledge as an appraiser. I think if the appraiser was more familiar with the area, there would have maybe been more thoughtfulness in defining and describing the neighborhood. And to be fair, I don’t think there is only one right way to do this.