Finally. Buyers are gaining power. And sellers are losing it. I have some new visuals to show what the market is doing right now. These are for Sacramento, but I suspect many areas look similar.

UPCOMING (PUBLIC) SPEAKING GIGS:

7/20/22 Beer & Stats at Out of Bounds (sign up (for real estate agents))

7/26/22 Navigating the Shift (sign up here (for real estate community))

8/11/22 Realtist meeting (details TBD)

8/15/22 YouTube Live with Matt Gouge (details TBD)

8/25/22 State of Housing Brunch & Learn (sign up (for real estate community))

Three ways we are seeing a power exchange:

1) MORE BUYERS ARE GETTING INTO CONTRACT BELOW LIST

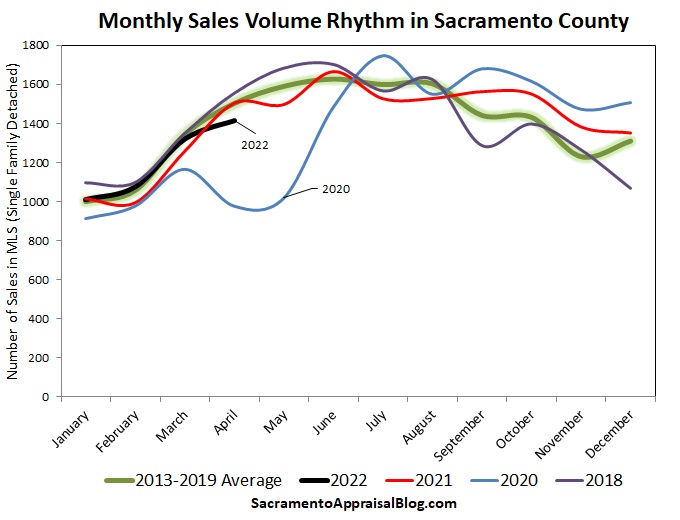

It’s been rare to get into contract below the asking price, but we’re finally starting to see that change. Buyers can now actually get an offer accepted and take more time to shop too. Sellers would be wise to recognize buyers are pickier about getting into contract (and staying in contract). The black line represents 2022, and there has been a sharp shift away from the insanity of last year. These stats are technically looking normal at the moment, but let’s not ignore abnormal things (dropping volume).

Figuring out normal: The red line in visuals below is the pre-pandemic average so we can compare today with then. The goal is to create a benchmark to show what “normal” looked like before things got crazy.

2) BIDDING WARS ARE LESS COMMON

There are fewer bidding wars. You don’t have to offer your firstborn child to the seller. And you probably don’t need to waive all your contingencies. These visuals show a sharp transition downward where we are seeing fewer properties sell above the original list price.

Big Point: It’s important to recognize nearly 40% of sales in July (so far) have sold above the original list price. The narrative is that “everything is selling for a discount way below the asking price.” I get it. And I’m not sugarcoating here. I’m just saying every escrow is NOT experiencing the same exact trend.

3) HOMES DON’T SELL AT THE LIST PRICE VERY OFTEN

We’re seeing more homes sell at their original asking price. I mean, the number is only around 12% of sales, but it’s on the rise. Here’s the massive takeaway though. Nearly 85% of homes regularly do NOT sell at the exact list price. This tells us it is normal in real estate to negotiate up or down, or even reduce the price if needed. In other words, the list price is NOT holy and irreversible. Sellers, did you hear that? Don’t get stuck on the list price.

IF YOU HATED THE GRAPHS, YOU MIGHT LIKE THIS INSTEAD

If you’re offended over line graphs, here’s a table instead. I find some people love line graphs and others resonate with tables. Pick your poison.

ON THE NEWS: I shared some thoughts with four news stations this week on the state of the market. Busy week. Here are two of the pieces. 1) Real estate reality check: ‘The honeymoon is over’ says California housing analyst 2) Red-hot Sacramento housing market shows signs of slowing

SPEAKING: I have lots of speaking gigs coming up. Most of them are private events in offices or bigger venues for real estate professionals. Hopefully something will happen soon where I can invite the public. Here’s an image from last Friday’s event. Anyway, if you’re looking for a speaker, hit me up. I do charge for market updates because of the time involved, and I love interacting with groups of all sizes on Zoom and in person. No pressure at all.

MARKET STATS: I’ll have lots of market stats out this week on my social channels, so watch Twitter, Instagram, LinkedIn, and Facebook.

Thanks for being here. I truly appreciate it.

Questions: What are you seeing happen with properties right now? Selling above or below list price? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

Skim or digest slowly.

Skim or digest slowly.