Sometimes crossing the street can make all the difference for value. In short, if we don’t understand where a neighborhood starts and ends, we might choose the wrong comps. Let’s talk about that today. I welcome your constructive and thoughtful comments.

Photo used with permission (thanks Vicky).

1) BOUNDARIES MATTER:

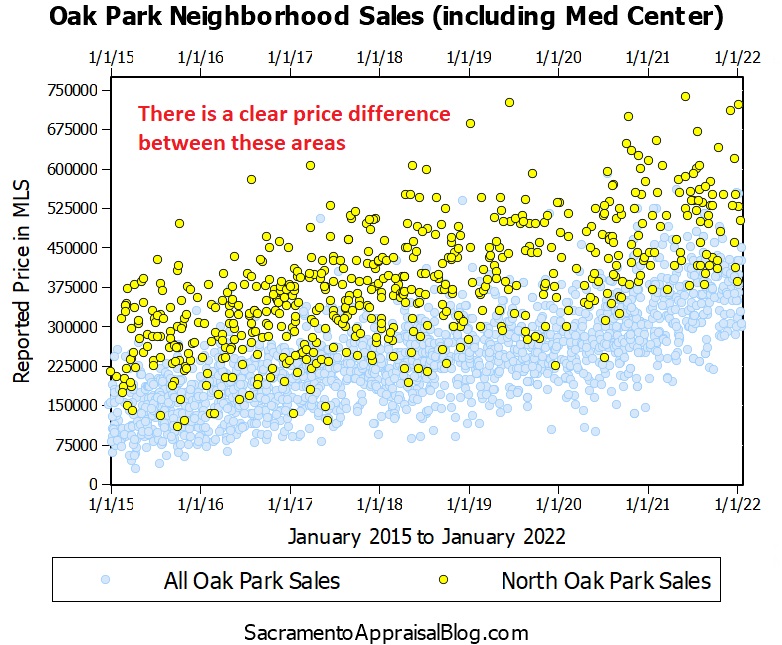

Here is a real example of how important neighborhood boundaries can be. This is the Oak Park neighborhood of Sacramento, and the entire neighborhood is outlined in black whereas North Oak Park is yellow. In short, the northern portion of the larger neighborhood has much different prices.

Different prices: When looking at North Oak Park in yellow and the rest of Oak Park in blue, there is a clear price difference. So as an appraiser I need to be careful about crossing boundaries when choosing comps because prices might be different on the other side of a street.

NOTE on Med Center (for locals): I included Med Center within North Oak Park since these two areas have started to meld together. I think Med Center still generally has a price edge, but these areas are closer together lately.

2) NEIGHBORHOODS CAN CHANGE:

When we look at Oak Park over twenty years it’s obvious the neighborhood has seen a big change. This is clear when looking at development on Broadway, but it’s also apparent on this graph. The yellow dots represent North Oak Park and prices in this section have essentially broken away from the rest of the neighborhood over the past decade. In other words, we see way more blue dots at the bottom these days.

Gentrification: This is where the conversation can get intense because Oak Park (especially North Oak Park) is the poster child for gentrification in Sacramento. In fact, Capital Public Radio reported that Oak Park’s black population dropped by 24% since 2010. That is a sobering stat, which is why this conversation matters. And to me this isn’t some sort of academic exercise where we’re only focused on parsing trends and pretty graphs. This is affecting real people.

Comps in 2004 vs 2022: In terms of real estate, when it comes to comp selection, we might have pulled comps differently in 2004 compared with 2022 because the market is different now. What I mean is the boundary line in North Oak Park is a bigger deal for value in today’s market. This has nothing to do with the racial make-up of the neighborhood of course, but everything to do with recognizing prices have changed over time.

3) HOW DO WE KNOW NEIGHBORHOOD BOUNDARIES?

Okay, this is a big question and it could easily be a dissertation. For starters let’s consider what Fannie Mae says about neighborhoods:

Fannie Mae: “The appraiser should provide an outline of the neighborhood boundaries, which should be clearly delineated using ‘North’, ‘South’, ‘East’, and ‘West’. These boundaries may include, but are not limited to streets, legally recognized neighborhood boundaries, waterways, or other natural boundaries that define the separation of one neighborhood from another. Appraisers should not reference a map or other addendum as the only example of the neighborhood boundaries.”

Other thoughts (mine): I think sometimes we focus only on major streets, but let’s also consider school boundaries and even how neighborhood associations or city websites define areas. But also, where would residents themselves draw the lines? And where would buyers be hunting for a home before shopping somewhere else? All these things could be clues.

If you have something to add, please do so in the comments. And if you think everyone is getting it wrong, please share your solution.

4) BOUNDARIES AND BIAS:

There has been lots of conversation about appraisers and racial bias. In terms of neighborhood boundaries, some of the narrative has seemed to suggest appraisers are perpetuating devaluation by selecting boundaries. The idea is appraisers are choosing comps from an area with lower prices while not considering higher-priced homes outside of the boundaries. I understand this sentiment, especially since there has been a history of systemic racism in real estate through redlining and restrictive racial covenants. But on a practical level, buyers are not willing to pay the same amount in every area, so it’s important to recognize boundaries and choose the most representative comps. In other words, how much would buyers pay for a specific house in a specific location? This is the question to ask whether we’re looking at the lowest prices in town or the highest. Moreover, residents actually define boundaries. What I mean is if we ask people who live in a neighborhood what boundaries define their area, they’re going to be able to tell us. I don’t say this to gloss over accusations of bias (seriously). All I’m saying is appraisers reflecting real world boundaries isn’t automatically a symptom of bias. And if anyone has ideas for how to value without boundaries, I’m open ears.

CLOSING THOUGHTS:

Neighborhood boundaries are a real thing, but they aren’t set in stone either. The truth is sometimes boundaries start to change and the market begins to pay higher or lower prices in some areas. This is where it’s really important to study neighborhoods, check any biases, be thoughtful in our selection of boundaries, and ultimately be sure we’re choosing comps that truly reflect what buyers are willing to pay for the location. Bottom line.

Thanks for being here.

NOTE: I will only approve comments that add to the conversation. It’s okay if you disagree or have questions because I welcome all perspectives. But you have to play nice. That’s my rule. Life is way too short.

Questions: What do you think of the points above? Anything to add?

If you liked this post, subscribe by email (or RSS). Thanks for being here.