The housing market has been changing these past couple of months. As I’ve been saying, it isn’t cold, but the temperature is surely different. Anyway, let’s talk about two things to watch in months ahead – price deceleration and days on market. Any thoughts?

This post feels a bit nerdy or heady, but this stuff is so important. I hope you pick up a few nuggets – even if you aren’t local.

1) PRICE DECELERATION:

When this year began, lots of people predicted and hoped for price deceleration. The idea is price growth would slow, so instead of being 20% higher compared to last year, the percentage would start to be lower over time.

- It’s possible we’re starting to see deceleration in the stats, but we still need a few months to be sure. See image.

- We’ve been growing at a freakish pace, and we need to see slower growth for the sake of health.

- This doesn’t mean prices are declining, though some sellers have priced lower than recent sales to generate interest (or multiple offers).

- Last year was really aggressive and this year the market crested a month early. In short, let’s be aware of what we are comparing.

- Not every local county is showing deceleration like the regional image. This is why I’m saying we need a few more months of stats. This is simply a preview of some trends on my desk. Frankly, it could take a bit to see price deceleration in the stats, but let’s be on the lookout.

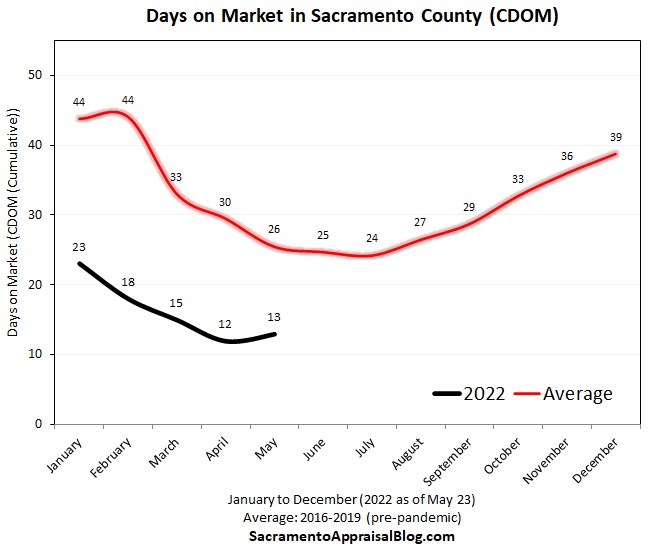

2) DAYS ON MARKET:

I have some brand new visuals to help us watch how long it is taking to sell so we can gauge a change in temperature. Do you like these?

- We’ve had the fastest market ever over the past two years.

- It’s starting to take slightly longer to sell.

- We are still quite far from a normal trend (the red line).

- Pendings are moving quickly, but let’s not forget to look at what isn’t selling too (properties with price reductions).

- I expect to see the black line (2022) tick up in coming months.

- For the sake of market health, we want to get closer to the red line where it’s taking 30 or so days on average to sell.

TOP GUN REAL ESTATE MEMES:

Lately I’ve been making more real estate memes. It’s just how my brain works. Anyway, Top Gun 2 is coming out in a few days, so I give you the following. The second meme alludes to buyer “love letters.”

MARKET STATS: I’ll have lots of market stats out this week on my social channels, so watch Twitter, Instagram, LinkedIn, and Facebook.

Thanks for being here.

Questions: What are you seeing out there in the market? What do you think of the new visuals?

If you liked this post, subscribe by email (or RSS). Thanks for being here.

The visuals are awesome! My listings in Elk Grove have been staying on the market at least seven days longer than earlier this year.

Thank you Johnny. I bet. I am seeing most properties with price reductions this past week had reductions between 3-5 weeks of being on the market. This black line will likely stay low for a couple of months, but assuming some of these properties start closing more regularly, we should see the line shoot up higher than a normal seasonal line that last year would suggest.

Yep Here it comes

Great stuff. Not sure if it’s the data or analysis, but I’m always left wanting more. LOL

Thanks Gary. I’ll take it as a compliment. 🙂

Excellent as always, thank you Ryan!

Thank you so much. I know this post is a bit nerdy, but it is so important to digest this stuff. I appreciate you, Neil.

Ryan, I’m a new subscriber to the blog. I appreciate these detailed reports and look forward to following along.

Thanks so much Jonathan. I appreciate it. And now that you have an approved comment, you can pitch in your two cents any time if you wish. I only moderate comments when people post the first one or share links. No pressure at all. Stay cool. It’s a hot one today!!

I’m an appraiser, and my wife and I have been trying to buy a house in Folsom (it’s nice having access to the MLS!). Have definitely noticed the “change in temp” and deceleration. Our agent told us a week ago that in the previous week 22% of Folsom listings had a price reduction. Good properties still get quick action, but the competition is much lighter. There have been increasing instances of recent closings in which buyers paid WAY over asking, and it turns out there were no other offers. Our agent told about one: a 1.3M listing that sold for 1.5M, and just today I saw a closing of a property listed at 739,000 which just closed for 800,000 with no other offers. These cases of “unicorns” competing against nobody shouldn’t continue much longer, as agents and buyers become more informed. In Metrolist they’ve changed the fields to Yes or No for multiple offers, and a separate field for number of offers.

John, this is excellent commentary. I especially like your “unicorns competing against nobody” line. It’s tough because buyers don’t always know the competition. I talked with an agent who had really busy traffic (close to 100 people through the house), but there was only one offer way above asking price. So this is a thing. Just as you say. But then there are examples of ten offers at lower price points too. And sometimes a few offers come with very limited showings. I even heard of one property in Folsom above $1M with ten offers (right property with all the bells and whistles – and a pool). Anyway, please keep the perspective from the trenches coming. Regarding MLS, I don’t think anything has changed in the fields. It’s always been like that as far as I’ve observed.

Hmmm I would say keep an eye also on the # of listings, along with the price reductions as you mentioned. But I would also suggest watching the Canceled and Withdrawn to see if same property being listed and pulled a few times with price reductions. And any other Mean and Mediation pricing on a monthly basis. For me I am also watching the monthly Avg and Median price to see if any changes. Good job Ryan, great stuff as usual. Opps just had a small earthquake roll thru. Or was Ryan running around in true form assisting all broker…..

Agreed. Let’s watch all of the above. I do think DOM (CDOM) will be a reaction to other things you mentioned. More listings + fewer pending contracts = Longer days on market. Technically we haven’t really seen much of a rise in new listings, but if we see a dip in the number of pending contracts by 10-15% each week, then the number of listings can rise pretty fast. I gave a presentation this morning and said this very thing. Watch the market temperature by the week. More listings available can help soften the temperature. And if we happen to see rates go down, that can also make a difference. It seems like rates shot up so quickly, but they’ve sort of been hovering around 5.5% or lower these past few weeks. Let’s stay tuned. And be careful about those earthquakes…