Sellers haven’t had to negotiate much with buyers over the past two years, but that’s changing. As of today, a whopping 35% of active listings in the Sacramento region have had a price reduction (more here). This is a big change from the market we had just a few months back, so let’s talk about one aspect of a power exchange – seller concessions.

THE HONEYMOON IS OVER: It’s like the market was on a honeymoon for nearly two years. Nothing but glowing stats, mimosas, and tropical paradise. Now it’s trying to figure out what normal looks like as the honeymoon stage is over. Of course, the doom perspective would say divorce is coming…

EXPECT MORE CONCESSIONS: We’re poised to see sellers have to negotiate more often with buyers, so expect to see more credits for repairs and closing costs (or price reductions instead). We’ve seen a quick rise in the number of active listings, so sellers have so much more competition right now. We still technically only have five weeks of housing supply, but this feels way different than two weeks of supply about six months ago. We’ve become really used to anemic supply, so having about 3,000 actives feels like a massive amount (even though closer to 4,000 would be normal). In short, we’re poised to see supply continue to rise since we’re seeing fewer pending contracts – and therefore more listings that are staying on the market. Anyway, back to the topic. Seller concessions won’t happen in every transaction, but this will hands-down be one thing we see more frequently due to buyers gaining power lately. By the way, here’s a post about why appraisers ask about concessions.

FIVE THINGS TO KNOW ABOUT CONCESSIONS

1) Concessions to buyers have fallen for two years

Ever since rates dipped below 3% in the summer of 2020, we’ve seen fewer concessions being given to buyers. This means sellers haven’t been offering credits for repairs or helping to cover closing costs as much as they were doing previously. About 42% of transactions had concessions in July 2020, and that number has been closer to 25% over the past couple of months.

Action Step: Be ready to see this percentage increase in months ahead as we move beyond the hottest market ever.

Here’s a different way to look at it. Numbers instead of percentages.

2) There are more concessions at lower prices (duh, thanks)

Not a shocker. The lower the price, the greater the chance there will be concessions given to the buyer from the seller. For instance, between $400,000 to $500,000 so far in 2022, about 30.3% of all transactions have had concessions. And above $1.2M, only 16.2% of sales have had concessions. Don’t make too much of under $400K since there aren’t many sales.

Action Step: Recognize the market temperature isn’t the same in every price range and neighborhood. Also, expect for these percentages to start ticking up. This is basically what a really aggressive market looks like, and it’s time to see the stats move beyond that.

3) Most credits have been under $10,000

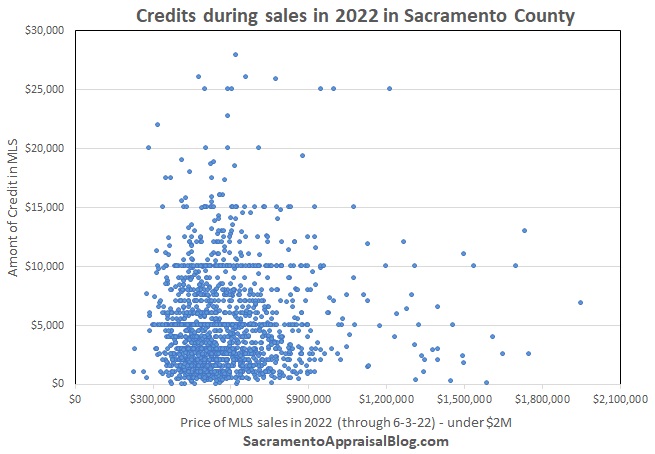

In Sacramento County so far in 2022, over 26% of all sales in MLS have been listed with concessions to the buyer. Among these sales, 91.6% gave a credit under $10,000, which means we’ve overall seen a modest dollar amount given to the buyer (when considering higher home prices).

Action Step: Sellers, don’t be afraid to give a credit if that is the thing that helps get your deal done. Gone are the days of not negotiating.

4) The average concession amount has been $4,987 in 2022

The average concession amount in Sacramento County this year has been about five thousand dollars. It’s rare to see concessions above $20,000, and only one sale was above $30,000. It does happen, but the bulk of the blue dots are below $10,000 (with the average at $4,987).

Action Step: Buyers, you’ve gained power, but be careful about asking for too much. You still need to bring a strong offer – especially at lower price points where there is more competition. Back in 2009 sellers often gave a credit at 3% for closing costs (when prices were lower), but that hasn’t been common today. If it becomes common, so be it, but for now it’s not what I’m seeing when looking through concession descriptions and figures in MLS.

5) The most common concessions are…

Here is a word cloud to show the most common concessions in Sacramento County in 2022. The larger the word, the more common the word was in MLS. I made this by exporting concession descriptions to wordclouds.com.

And here is a list with the top concession descriptions shown in MLS. The number one word was “closing” due to “closing costs” being a massive reason for concessions.

Action Step: Sellers, many buyers are going to want help with closing costs or repairs in coming time since affordability has taken such a hit lately. It would be wise to recognize this and negotiate as needed.

DATA SOURCE: These visuals represent concessions data found in MLS. This is not a perfect dataset since the concessions field is not required for every listing. This means sometimes agents simply do not fill it out. However, I wanted to take these stats for a test drive, and I think there is likely enough information to be meaningful for two reasons: 1) We can see a definitive trend through the years as the market changes; and 2) When agents select “yes” for concessions, it becomes required to enter a specific dollar amount. I suspect a few people might say “Call Listing Agent” is written instead of a dollar amount for concessions, but that’s not how it works. There is another field called “Concessions Description” where further details about the dollar amount can be provided. This is where we see things like, “Repairs for roof,” “Closing costs,” or “Call Listing Agent.” Anyway, I’m leaning toward liking these stats, but I’m also aware this isn’t perfect. In short, I won’t be basing my entire perception of the market on concessions data, but I do think there is something here to watch. Anyway, I’d love to hear your take. Yes or no?

MARKET STATS: I’ll have lots of market stats out this week on my social channels, so watch Twitter, Instagram, LinkedIn, and Facebook.

Thanks for being here.

Questions: What stands out to you the most about concessions? What did I miss? Anything else to add?

If you liked this post, subscribe by email (or RSS). Thanks for being here.

As always, great job Ryan! Good info. One of the things that often gets overlooked is that a seller credit, is dollar for dollar less money out of pocket for the buyer, rather than a price reduction that only lowers the monthly payment a few bucks. With a lot of people being strapped for cash, this can make a huge difference. The saved money can then be used to do improvements or repairs or whatever they want.

Thank you Rick. Love it. I agree. This can be a massive help for buyers who don’t have as much cash too. It’s time for sellers to get on board with the market. 1,026 current listings have had a price reduction. These levels are still on par with about 2019 figures, so it’s not outlandish, but it’s been a quick spike, so it’s really a shock to the market – especially since this is dramatically different than last year.

All I can say is I wish our MLS had data on concessions. The best we get is sometimes the agent will note them in the private comments. There is no field for concession data. Appraisers simply have to call and ask questions. I also love knowing if the concession is for a repair because that’s treated different than just paid closing costs.

Bummer that you don’t have a field for this. We do, though sometimes it’s really misunderstood too. I see concessions comments at times that aren’t really concessions. So we still have to sift through perspective and make those calls to understand. I am definitely hearing confirmation from lots of agents about more credits and concessions being offered. I think we’ll see that in the stats more. Not in every transaction, but this should become more common.

Wonderful !! You tell the whole story with a few graphs. Now I have to see what my market is doing. I am seeing an up tick in concessions within the past few months. I always think its an indicator of a lack of readily available money. Nobody seems to have a savings account anymore.

Thank you Mark. That makes sense. Buyers are feeling the pain of such a quick rise in rates. I suspect many buyers, especially at lower prices, are going to greatly benefit from sellers negotiating to help pay closing costs and such. On a related note, I do hear some people talking about keeping the price high while simply offering a credit. As if a seller concession is magic. I think this is where sellers need to be realistic about the price and not look at concessions as some sort of silver bullet to boost a price.

The meltdown was simply delated a few years from massive government intervention in the form of fiscal and monetary stimulus on steroids. The Can-Kicking didn’t mean your ‘doomsday prophets’ or whatever you call them were wrong, just that the problem was delayed and concealed to people that can’t understand macroeconomics. The incoming real estate meltdown is simply part of the Everything Asset Bubble mean reverting. It isn’t ending it is simply starting.

Thanks Mr. Miyagi. There is so much to watch right now. I get what you are saying, but Twitter right now is full of people saying, “This is what I predicted.” I’m just not a fan of the flex. Let’s keep watching though. What a dramatic change over the past few months.

HI Ryan,

Great info as always! Do you have the concessions granted as a percentage of sales price? As you said, it used to be common for a 3% concession, but with the elevated market it would be interesting to see what actual percentages are currently. Thanks, Tim

Hi Timothy. Sorry for the delay. I took the entire week off. What a week!! Anyway, I don’t have that metric. For now concessions have been pretty rare, but we are poised to see that change. I may experiment in the future with something like you mentioned. We’ll see what’s relevant. Though realistically I could simply convert one of my graphs to a percentage maybe instead of dollar amount. The struggle is results are going to be all over the place though.