If you torture the stats long enough, they’ll confess to anything. Have you heard that before? Well, it’s true in real estate. If we’re not careful, we can make numbers say anything, whether for a glowing or doom narrative. Today, I want to talk about the danger of annual stats right now, and then I have a massive market update to share. This post is designed to skim by topic or digest slowly. I hope you get some value here, whether you’re local or not.

UPCOMING (PUBLIC) SPEAKING GIGS:

1/12/23 McKissock / Appraisal Buzz Webinar (register here)

1/18/23 WCR Market Update in Cameron Park (register here)

1/19/23 Big market update at SAR on Zoom (register here)

1/20/23 NARPM Luncheon

1/23/23 Residential RoundUP on Zoom (register here (free))

1/27/23 Q&A Appraiser Marketing (free Zoom webinar) (sign up here)

2/8/23 SAFE Credit Union “Snacks & Facts” (for RE) (register here)

3/10/23 PCAR Market Update Lunch & Learn (detailed TBD)

3/28/23 Downtown Regional MLS meeting

4/1/23 NAA Conference in Sacramento

IT’S EASY TO ABUSE ANNUAL NUMBERS RIGHT NOW

Last year had two parts. It was super-hot at first, and then it got really dull, and this makes for a weird combination when putting these parts together.

A) HIDING THE TREND WITH ANNUAL STATS

Check out this visual. When comparing all sales from 2021 with 2022, the median price technically went up 7%. This is statistically true because there was so much growth during the first part of the year, BUT focusing on annual stats hides the huge shift in recent months.

CLARIFYING ANNUAL STATS: Annual means we’re comparing ALL of 2021 with ALL of 2022. So this is where we’re comparing the median price of 28,000 sales in 2021 with 22,000 in 2022. So we are literally looking at the entire year and comparing it to another year. It’s actually a cool way to see the market and gauge appreciation over time. In a normal year, I would be a fan of sharing annual appreciation rates, but this year I think it hides the real trend happening in the market. So if I were to only focus on the annual difference this year and say, “The median went up 7%,” it’s just not telling the full story of what is happening. I think looking at year-over-year stats (December 2021 vs December 2022) and month-to-month stats (May to December) really helps us see the market trend. I think it’s fine to share annual stats, but it can quickly become misleading or stink of greasy salesperson vibes.

If annual vs current stats were a meme…

B) FALSE NARRATIVES FROM ANNUAL STATS

The danger of focusing on annual stats right now is annual numbers look far sexier than the current market, so it’s easy to hide the real trend by looking to older figures. It would be like looking at the average price of bitcoin over the past two years instead of the price right now.

ANNUAL VS. THE REAL TREND:

Annual volume was down about 20%.

Volume lately has been down over 40%.

It took an average of 25 days to sell last year.

Last month it took an average of 49 days to sell.

The median price rose 7% annually last year.

The median price declined 15% since May.

C) GAINING & LOSING CREDIBILITY WITH ANNUAL STATS

Some real estate professionals are going to gain credibility this year and others will lose it. My advice? Be transparent with the stats and DO NOT create a narrative that obscures the real trend. Likewise, don’t impose a doom narrative on the market either. I wrote more about this last week. Look, we all have ideas about the future, but let’s be real about the market that actually exists.

Thanks for being here.

—–——– DEEP LOCAL MARKET UPDATE ———––

We are in a market of change, and change continued last month.

We are in a market of change, and change continued last month.

Scroll quickly or digest slowly.

SHARING POLICY: I welcome you to share some of these images on your social channels or in a newsletter. In case it helps, here are 6 ways to share my content (not copy verbatim). Thanks.

VOLUME WILL IMPROVE AS AFFORDABILITY GETS BETTER:

We are in a valley right now where we’re missing about 40% of the market. There is no sugarcoating this. The reality is lots of prospective buyers are on the sidelines due to the struggle to afford current prices. With that said, more than half of buyers are present and shopping, so the market is still moving.

This week I talked with someone who is actively hunting for homes with an agent, but he is still hesitant. He said it’s nice to maybe get tens of thousands off the list price, but he is still concerned about the lofty monthly mortgage payment. Look, sharp price declines have been helpful for affordability, but rates above 6% are still making it tough to make things work. Anyway, the market will figure this out, and more buyers will come back as affordability improves. That’s the truth.

DECEMBER VOLUME WAS NOT PRETTY:

December had the lowest volume in Sacramento County over the past 20 years, and the region is basically tied with 2007. There are two stats here. There are over 800 missing sales from the pre-pandemic normal, but there were nearly 1,300 sales that happened. I recommend for real estate friends to know all the numbers, but in terms of business, focus on the part of the market that is happening rather than the part that isn’t.

NOTE: Placer County has experienced massive growth this past decade, so a comparison to the previous decade looks different than Sacramento County. Still, it was a really dull month of closed sales.

PRICE STATS ARE DOWN ABOUT 4-5% FROM ONE YEAR AGO:

Here’s a look at stats compared to last year. Remember, closed sales in December really tell us what the market used to be like in November when the bulk of these properties got into contract. In a normal year we tend to see price metrics dip from December to January, so let’s see what happens ahead.

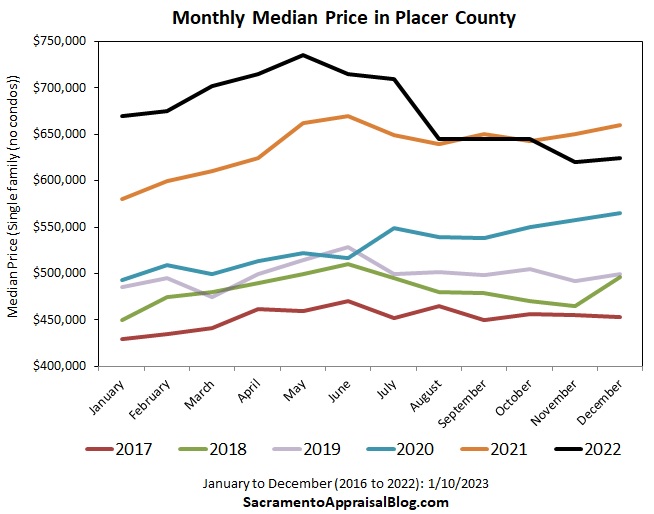

PRICE STATS ARE DOWN CLOSER TO 15% FROM MAY:

We’ve seen significant change since May, but the market still doesn’t feel affordable to lots of people. I’m not trying to be negative. This is just how it is, and we’ll see more buyers come back to the market as affordability improves. Keep in mind median price change doesn’t necessarily mean value is actually down by that amount. This is why I advise looking to neighborhood comps rather than imposing a county or ZIP code price metric on a neighborhood.

PRICES WENT DOWN FROM NOVEMBER TO DECEMBER:

Looking at sequential months is key so we don’t just get stuck or hyper-focused on last year (the past). Like I said above, it’s easy to hide behind older stats if we’re not careful.

OTHER PRICE VISUALS:

These visuals help show that prices are a bit lower than last year, but check out the sharp change in order to get here.

TAKING ABOUT A WEEK LONGER TO SELL:

It took about a week longer to sell last month in Sacramento County compared to the pre-pandemic normal (red line). I’ll push out other county visuals soon too (especially during my presentations coming up). However, this is over twice the time it took last year, so it feels dramatic to see 45 days lately. Historically this isn’t all that high, but it’s been a real adjustment to get used to a market where not everything is selling in the first weekend. However, keep in mind these figures only represent properties that closed escrow, and there are lots of listings that didn’t close (key point).

NEW LISTINGS ARE COMING:

We’re seeing more listings hit the market, but it’s very normal for new listings to not hit their stride until March or so. Buyers are waking up for the year though and they’re hungry for quality listings after a stale fall season of overpriced leftovers. And yes, serious buyers are shopping – even in the rain. I’ll push out some inventory images soon, but on paper things are pretty normal in terms of the months of housing supply. We technically really don’t have many listings on the market, but like I keep saying, it doesn’t matter about technicalities right now. The market has been declining despite low supply since affordability is the bigger issue. Now let’s see what 2023 brings. As I said last week, we can expect more attention on the market during the spring.

ANNUAL RECAP:

Okay, here are some annual recap images organized by county. These visuals include every single sale for the entire year, so it’s a weird combination of a blazing hot market and a dull market. I deliberately didn’t include price stats on most recap visuals because I honestly think it would lead to confusion (and some might even think it was misleading).

2021 comparison: 2021 did have slightly higher volume, so the ideal is to compare the pre-pandemic average to 2022, and I’ll roll out some stats soon to show you what I mean. But it’s still a legit comparison to compare the past two years. For instance, volume was down 22% from last year, but it was down 19% from the pre-pandemic average. Yes, there is a clear difference, but we’re not talking about twice as many sales last year. Granted, new construction numbers were truly sensational in 2021, so it’s honestly a mistake to only focus on 2021 vs 2022 numbers for that niche. More on that eventually.

SACRAMENTO REGION:

SACRAMENTO COUNTY:

PLACER COUNTY:

EL DORADO COUNTY:

YOLO COUNTY:

MARKET STATS: I’ll have lots of market stats out this week on my social channels, so watch Twitter, Instagram, LinkedIn, and Facebook.

Thanks for being here.

SHARING POLICY: I welcome you to share some of these images on your social channels or in a newsletter. In case it helps, here are 6 ways to share my content (not copy verbatim). Thanks.

Questions: What stands out to you above? What are you seeing happen in the market right now? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

Live in the now. This is my mantra when speaking to real estate professionals. Many of the fundamental drivers of the real estate market have changed dramatically, as you point out with each blogpost. My real estate agent, Winston Churchill, gave me some sage advice. When you are going through hell, keep going. Chin up people, good times are coming.

Yes, very well stated. This is exactly what I say too. Focus on what you can control, and be a part of the market that is happening.

Lowest sale volume in 20 years is the headline. Yikes.

For sure. I didn’t lead with that because I didn’t want to be sensational, but that’s the big trend. In my market update below I actually started with talking about volume on purpose because that’s the most important thing right now. Price trends are secondary in my opinion. What’s happening with volume is far more interesting and relevant to real estate professionals who are earning a living based on volume.

So is everyone going to panic in April/May when they see year-over-year?

I guess it depends on what we’re comparing this year to last year when the time comes. I think YoY stats are part of the story. What do you think would cause panic? I’d love to hear. I suspect we’re still going to have to consider that April / May 2022 had much more volume presumably and prices were barely starting to change too. This is always fascinating because we have to consider what the dynamic was last year. Was it a pandemic year? Extra migration? A freakish fall or spring season due to heightened demand? A dull market? Lots of factors.

Lots of factors, but I see an interest rate phenomenon more than anything. Affordability has tanked and cash buying is going up.

“Panic” is probably too strong a word for people who don’t have options. But I think there will be a media frenzy when they pick up on double-digit Y-o-Y declines. There is some reporting on the six-month, but I think it’s going to be dramatic when we get to the “magic” 12-month. Buyers may think we’re in freefall and decide to wait a couple more years.

I’m starting to get concerned about the “buying down” of mortgages by sellers for buyers. It keeps prices “artificially” high, and in a couple years when payments go up for these folks, without the promise of a fed pivot and the corresponding opportunity to refinance, I think we may see quite a bit of selloff.

Thanks for the great content. I look forward to it every week.

Thank you Joda. Now I get what you are saying. We really haven’t seen panic hit the market as of yet. I think part of the struggle with that is the high cost of a replacement home. There simply isn’t much room for panic. But to your point, we haven’t seen an avalanche of declines yet either nationally, and this is something to watch. I wonder how having so much access to data could change things too. Some housing analysts think the market can move faster in light of having so much data. To be determined. Let’s keep watching and comparing notes. I hope you stay busy with your photograph business too. I always appreciate your thoughtful commentary. Thanks.

Joda, just had a Realtor tell me in a class that this is for sure happening, where POINTS (words I have no heard in awhile) are being paid by sellers. They jack up the sales price to cover points paid so for sure that is artificially inflated price that may soon become a new “comp” It is very tricky and must be carefully reviewed and adjusted for. I think lenders will have to have more skin in the game with higher down payments especially in a declining market. It used to be that way and I think buyers should have more skin in the game. One of the local Mortgage lenders is offering a deal to current clients that if the interest rates go down, they will Refi that loan with ZERO costs to them to that lower rate! I guess they make their money on the long term over the course of that loan, plus it makes their refi number look better. We shall see!

The annual stats do look more rosy now. Last spring was so incredible that it will be hard to see much in the way of a positive monthly stat the next few months if we compare our monthly to the prior year. Hopefully we will see some positive month to month stats though this spring. I know that spring upticks are normal, even in a down year, and we are seeing a lot of pre-listing actives in my office.

Thanks Gary. We’ll see ahead. The way I think about annual price growth too is we saw way more sales at heightened prices, and we’ve seen volume taper as prices have gone down. So that really influences the price metrics. Hope you’re well and enjoying life.

Thanks ryan, your stats and graphs are amazing. Im seeing similar trends here in modesto. its always best to short the trend time. like you said, depends on the time of the year. lol. thanks for all your information. much appreciated!

Thanks so much Eddie. Please keep me posted on your market too. I’m always open to any insight. It’s actually fascinating to see so many markets in California that are doing the same thing right now. Many years ago I used to do some appraisals in Modesto (when the housing market crashed). I would never do that today, but in those days we all boldly went where nobody else would go…

Thank You Ryan; In Southern Oregon our statistics follow your area and thus this is a good leading economic indicator. If all the Local Realtors in this area knew that, they would be more well informed.

(When in-migration from your area dwindles it affects our values and trends,despite not all in-migration coming from your area.

Fascinating to hear. Thank you Mark. Please keep me posted with any changes in your area. It’s hard to speak too much about migration since by the time stats come out, they’re really dated. My sense is the pandemic rush to the market subsided about 1.5 years ago. I noticed a return to a smaller home size for closed sales in the summer of 2021 after a big spike during 2020 and 2021 when buyers were rushing the market (low rates, extra migration, and extra focus on larger luxury homes). I mention this because it seems reasonable to think the big inbound migration wave has changed. Granted, people are still coming to Sacramento for sure, but I’m not hearing as much in the trenches about outsiders. I guess I’ve found less frequency with the narrative that Bay Area buyers are driving the market too. Though to be fair, I think that narrative is more popular when the market is hot because it places blame on the Bay. But I am starting to hear things like, “Tech jobs are crumbling in the Bay Area, so just wait for more migration…” We’ll see.

Long story short, let’s trade any stories. I’d love to hear any time what you’re seeing.

You have inspired me so much to think outside the box and dig deeper into the trends for my area. Thank you. What you said about being careful with annual stats is interesting. When I compare our numbers, I realize how rural my area really is. You show about 22,000 sales for last year in your region and I’m looking at only 800 in mine. Which is why I tend to focus on quarterly numbers because when I only have about 70 sales in a month the number tend to jump up and down so much. Only takes a few outlier sales to sway the numbers. I am in process of pulling the numbers for last year as well. How would you handle looking at trends with so few sales?

Thanks Mark. That’s so kind of you to say.

First, I would defer to people in smaller markets who have been doing this successfully. I have access to lots of data, so the following are just ideas. It’s tough to say exactly, but 800 is not many. I would start with quarterly and see if it leads to a credible trend that seems to be reflecting the market (even though numbers could bounce around some). There are two local counties I cover that don’t have much data, and I do quarterly stats for each (though both still have far more than just 800). What I’ve tried through the years is basically to analyze the past 90 days this year with the same time period last year. So instead of a rigid traditional calendar quarter, I’ve experimented with something like September through November 2022 compared to the same time last year. And each month I can report on trends for a three-month period basically no matter what time of year it is. I personally like this because then I can take a monthly dive into the numbers without having to wait for a quarter to officially end. In one county I’ve been fairly pleased with the results, but I’m not too crazy about the stats in the other to be honest. 800 sales really isn’t much, but if this was a conforming tract neighborhood, then that could be enough to be meaningful. Even month to month MIGHT work in a conforming area (maybe). But if you are rural with lots of variety, it’s going to water down the data and be all over the place. This is where I would probably experiment with quarterly, and maybe experiment with pushing out some scatter graphs and different types of visuals. I do an image like this for a smaller local county, and it works out alright. I wonder what it would show in your area. The thing is price stats can be all over the place, so you might have to focus on other things like DOM, average square footage, volume, % cash sales, % FHA, how much acreage people are buying, and whatever you think is relevant. You get to decide who your target audience is and what they might want to hear. Ultimately, if you have a template of a few pet images and stats, it can be very easy to add one extra month of data each month.

Example of volume image:

https://i0.wp.com/sacramentoappraisalblog.com/wp-content/uploads/2023/01/Sac-Volume-Line.jpg?w=645&ssl=1

One last thing. In December 2020 I pushed out a spreadsheet that was really just a quick way to export stats. I don’t think it’s an end-all spreadsheet, and I actually need to update it since MLS change some of their categories. But if you make something like this for yourself where you can quickly push out visuals, that could be cool. I do think you can do better than this scatter graph style, but just an idea… https://sacramentoappraisalblog.com/2020/12/22/you-carried-me-a-spreadsheet-for-christmas/

Mark,

I’m one county west of Ryan but have a lot of small acreage residential work with few sales. I use scatter graphs and trendlines for most of my market analysis decisions. I include a 12 month graph in the vast majority of my reports. I also consider whether the homes sold have changed significantly and graph home size over time and lot size over time to make sure price trends are not being influenced by changes in these factors.

I do include a summary table of sales, usually by month, just to give the reader a sense of the market.

One market I cover has maybe 10 sales per year. In that case, I use the Freddie Mac House Price Index for the closest MSAs for market trends. There are not enough sales to come to a reasonable conclusion if I don’t look at nearby markets.

Hope this helps. If you want to talk more about this, email me at joemlynch2112@gmail.com.

You are the man, Joe. Thanks. And Mark, Joe is really smart. I know him really well.

Ryan, great information and shows how markets can vary greatly. I just had a Realtor class yesterday disussing this very same thing, however we cannot ignore year over year as opposed to just the last quarter. In my market there was such a high Bell Curve upward that in the past quarter or 2 those values have come more in line with true market value. Many Reatlors agree buyers paid well over market during that high bell curve period. So the year over year stats puts into perspective at least in our market, that we are almost exactly where we were last year. Only a slight 2% decline Year over Year. Yes, the last quarter or 2 shows a larger decline, higher days on market, though still under 90 days, list to sales price ratios wider, but still pretty tight in our market 98% vs. over 100%. Volume down but number of listing is up last quarter so of course prices dip natually with higher supply. But like one of your other commentors here, I am In a relatively small county with wide style and variety of homes, so I cannot really define a declining trend until I see closer to 2 quarters of definitive decline. This past 3 months also takes us into the typically slower period heading into holidays in our market. Last year we were in what I define as a corrective market, not declining year over year. But we are now at the point of consistent decline in all price points in the past quarter, though still small in most price brackets. We also have lakefront property here that I seperate from the other off lakes sales in reviewing data because of course that would skew numbers considerably on all counts. Really diving deep into the numbers is an absolute must for every market as it is eye opening and it places you in a strongest position to justify your adjustments. Thank you for your time in doing this, it takes alot, but keeps you in the drivers seat when it comes to extensive knowledge of your own market.

Thank you Mary. I really appreciate hearing the commentary. It must be challenging to work in a market without much data. I completely get why you would need longer to feel comfortable solidifying the trend too. I respect the critical thinking through a normal seasonal trend also. What you’re saying makes perfect sense to me, and I’d very likely feel similar in your area.

On a somewhat related note (but different), an appraiser in a tract market told me he needs about six months to say if it is declining, but I asked if he would need six months to say a market is rising in the spring. That was a challenging question that brought pause because if he didn’t say the market was rising until June, he would have basically missed the entire spring trend. In this case, then appraisers are a rear view mirror instead of on the cutting edge. I bring this up to say this market keeps us on our toes, and somehow we have to be able to see the trend and justify the trend we say exists. In your case, it’s totally different of course, and I want to be clear that I concur with your thoughts. You simply need more time. But I’d say with tract subdivisions and ample data, we have to be able to see the market and call it like it is sooner if possible. It takes skill for sure. And even in tract markets, it takes time to see and understand the trend.

For any onlookers, one of the things that makes me say we’re in a declining trend is we’ve had a departure from normal seasonal change in a big way. Knowing the normal seasonal trend and seeing something different in many ways (volume, rate of price change, sharp change in most stats) has caused me to be able to say it’s declining and NOT just seasonal. This is why I think it’s so important to understand what normal looks like so we can spot abnormal. In a few cases people have alluded to the idea of seasonality, but I reject that because the stats don’t support that narrative.

Okay, that was a rabbit trail, but I’m inspired. Thanks again for the commentary. And if anyone wants to pitch in how you know a market is declining, please add to the conversation. This is SO important – especially for appraisers.

Hey Ryan,

100% agree in track like markets especially in today’s changing market, you can absolutely see declining or increasing trends relatively quickly and of couse those pending sales become so important for the most up to date trends in any market. Luckily since I am in a smaller market I know many of the Realtors and I can call and ask them what the actual sales price is and most of them will tell me, plus closing costs paid if any, and IF it looks to be a solid deal that will close. This is the most helpful information for me. Thanks again!

Right on. And great job. I think the stories from escrows can be very powerful indicators. I’m just glad we’re no longer in a market where buyers are waiving all contingencies as the norm.

Amen to that!

Ryan, I love the content you put out and have come to trust you very much and hold a lot of weight to what you say. I am always wanting to be better for my clients and I would like a little clarity on “abusing annual stats” I personally am loving the annual stats that show the big picture of prices from 2019-2022 so I am hoping I am not abusing them. I feel like some buyers waiting for the crash to come and are waiting for prices to come down 100k (or offer 50k less on a home) because they are seeing the decline this year Vs. last year and it looks so significant that they perceive it will continue to go down. I am trying to educate them that this might not be the case based on historical trends over more years and not just 2021-2022. I do not want to paint a picture of fear or over enthusiasm. When you say annual, are you just meaning one year over one year? I do not want to be missing the ball here and absolutely do not want to be misinforming my clients. Your feedback would be awesomely appreciated.

Hi Steph. Thanks for the kind words. I respect your quest to be credible here too. That’s awesome. Annual means we’re comparing ALL of 2021 with ALL of 2022. So this is where we’re comparing the median price of close to 28,000 sales in 2021 with 22,000 in 2022. So we are literally looking at the entire year and comparing it to another year. It’s actually a cool way to see the market and gauge appreciation over time. In a normal year I would be a fan of sharing annual appreciation rates, but this year I think it hides the real trend happening in the market. So if I were to focus on the annual difference this year and say, “The median went up 7%,” it’s just not telling the full story of what is happening. I think looking at year-over-year stats (December vs December) and month-to-month stats (May to December) really helps us see the market trend. Granted, I think it’s okay to share an annual stat, but if the intent is to hide the trend, that’s where it start to feel like greasy salesperson vibes.

I’m going to clarify a bit what an annual stat is in my post because I may not have done a good enough job.

Here’s an image with all the stats together. https://i0.wp.com/sacramentoappraisalblog.com/wp-content/uploads/2023/01/Annual-stats.jpg?w=530&ssl=1

Does this make sense?