The housing market is a mixed bag. It’s not always easy to understand what the market is doing right now. Today I have some thoughts about prices, Zestimates, and cash buyers. Scroll by topic or digest slowly.

UPCOMING (PUBLIC) SPEAKING GIGS:

3/24/23 How to Think Like an Appraiser (at SAR)

3/28/23 Downtown Regional MLS meeting

4/1/23 NAA Conference in Sacramento

4/13/23 Realtist Meeting

5/4/23 Event with UWL TBA

5/10/23 Empire Home Loans event TBA

5/22/23 Yolo YPN event TBA

THIS MARKET IS A MIXED BAG

This isn’t scientific research, but I did a poll on my Instagram stories two days ago, and there were mixed results when asking what home prices are doing right now (the bulk of these votes are from the real estate community). Moreover, I speak somewhere usually once a week, and I’m finding this same sentiment when talking to groups. I’m hearing everything from, “Prices are dropping” to “Prices are going up.” In short, it’s no longer early 2022 when the trend was so clear. Keep in mind the market could be different all across the country too (not to mention different by price range locally).

THE ZESTIMATE MATCHING THE LIST PRICE

By the way, the top bid so far is $507,000. We’ll see where it ends.

WHAT DO THE STATS SHOW PRICES ARE DOING?

Here’s a look at the weekly median price for closed sales in the Sacramento region. It’s been a bit flat in recent weeks (black line). However, when looking at pendings since March in the entire region, Sacramento County, and Placer County, they’re getting into contract at higher levels in recent weeks (please note the trend could vary by neighborhood). The truth is we never know exactly where pendings will close, but today’s pendings are next month’s closed sales, so they’re important to watch. In short, based on pending prices, it looks possible April stats could show a modest uptick. Only time will tell.

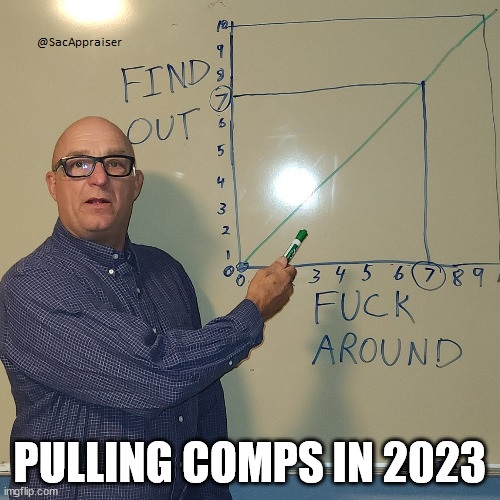

FINDING OUT WHERE THE MARKET IS AT

PENDINGS VS SALES

The goal with real estate value is to understand what’s happening with the current market (pendings and listings) compared to the past (sales). Here are two graphs from recent appraisals to help scrape the surface of what’s happening with pendings in terms of price and volume. Remember, the trendline is based on closed sales, so if we see upward movement ahead, that won’t be reflected until pendings actually close. I find in some neighborhoods right now the trendline is starting to flatten out instead of showing a hardcore decline like we saw in the summer and fall of 2022.

BIG POINT: Ultimately, it takes time for the market trend to show up on graphs, so if we wait for the graphs to tell us what is happening, we’re going to be behind the trend.

A HISTORY OF CASH IN THE SACRAMENTO MARKET

“Bro, 80% of the market is cash and Blackrock is buying everything” Not true. Here’s a look at the percentage of cash sales since 2010 in the Sacramento region. There’s been a slight uptick in 2023, but the year is just getting started. Keep in mind if total volume drops more than the volume of cash buyers too, that will naturally boost cash percentage levels.

UPDATE on Blackrock: A reader sent me a kind email to explain the difference between Blackstone and Blackrock. I was actually intentional here with my use of Blackrock because there has been a fake narrative about Blackrock buying everything on Twitter. I really appreciate the concern though. Truly. Here’s something I wrote in 2021 about this false narrative.

HOPE FOR BUYERS:

The vast bulk of the market is financed in the Sacramento region, which means conventional, FHA, and VA transactions are the overwhelming majority of the market. Buyers, this means it’s highly possible to get a financed offer accepted because it’s happening ALL. THE. TIME. It’s really competitive right now for units that check all the boxes though, so bring an offer that makes sense for the market. My advice? If you are willing to buy right now, get as much as the market will give you, and also be realistic about what it’s going to take today.

50% CASH IN THIS NEIGHBORHOOD

In the Sun City Lincoln Hills neighborhood, it’s normal to see about HALF THE NEIGHBORHOOD as cash transactions. This is REALLY uncommon in other neighborhoods, and I haven’t seen percentages like this elsewhere. Sun City Lincoln is a 55+ community though, and some of these buyers are Bay Area transplants, but it’s also retiring Boomers deploying equity and wealth. By the way, take 2023 with a grain of salt since the year is just getting started.

I hope this was helpful.

MARKET STATS: I’ll have lots of market stats out this week on my social channels, so watch Twitter, Instagram, LinkedIn, and Facebook.

Questions: What are you seeing happen with prices? Up, down, flat? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

I continue to hear about a “Mixed Bag” on the East and West Coasts; however, here in fly over country, there is still a considerable shortage of existing home resale inventory across ALL price and GLA ranges. FYI, my MSA consists of 6 counties and a population of +/- 625,000 and is the second largest MSA in GA. Prices continue to increase but at a slower pace than in 2021 and early 2022. Especially high increases are in the attached one level patio homes and two level townhouses. These are still increasing at 0.5-0.7% per month and some even higher. Some builders have reduced the number of starts over the last 45 days which I believe is a mistake. If and when interest rates come down slightly, there will be a large need for additional new home inventory in July, August, and September. We are still having bidding wars on existing homes with buyers paying as much as 10-20% above full list price on the most desirable properties.

Thank you Pierce. I appreciate your commentary, and I respect that you know your market. I’m really only speaking of Sacramento in this post, so we have to concede the housing market is not going to be the same in every location across the country. No matter what the location though, I do think one of the struggles at this time of year is seeing the market before it shows up in the stats. But most of all, when growth is really modest, it’s not as easy to discern change. Last year we had profound change in early spring, but that’s just not the case right now.

I find a disparity here locally too with homes under $500K compared to the rest of the market. It’s honestly really tight in every price range in terms of monthly supply, but it’s especially tight below the median price. There are also properties being priced too low to stimulate bidding wars, so there is much to consider. Just yesterday I pushed out a stat to show 91% of properties with ten or more offers in the region right now are under $485K. I like to push stuff out like this because it helps show sensational stories aren’t always evenly spread across all price segements. And yes, our MLS does have fields for multiple offers and the number of offers.

I love highlighting the pending sales on the scatter chart. That’s a great visual.

Thanks Gary. I’ll be messing around with this type of visual to see if I like it or not. It could be especially cool with competitive data only. Though one of the struggles is not having as many pendings right now too.

Is this your first NSFW post? LOL!

That was an interesting video, thanks for sharing it. I question whether the ratio of find out to fuck around is 1-1; my experience is at least 2-1.

Now is the time when appraisers can show their expertise. It’s difficult to understand what’s happening but a data-driven approach is crucial.

Haha. I suppose so. This “find out” guy has gone viral. I’m not sure I fully buy into his idea here either, but to find out we do have to… There is something to that.

Totally agree with your statement too on expertise and data. It’s REALLY hard in this market to know what is happening if we’re not on top of the data especially. I find it’s incredibly easy in real estate to let a few trees tell the story of the entire forest if we’re not careful. All real estate professionals need to be cautious about interpreting trends based on what is on the desk. I recall last year an appraiser locally said the market had not changed because everything was getting bid up and such still. Well, the change wasn’t seen yet in the stats on a massive scale. I suspect in this case the deals on this appraiser’s desk were all aggressive still. Until they weren’t of course.

I have a love hate relationship with the Zestimate. I had the reverse of your example when I sold my last home. The Zestimate showed $130K less than what I listed it for (and sold for). The day it went live on the MLS the Zestimate “miraculously” changed to my listing price. That being said it’s a good data point to use both positively and negatively when speaking with buyers/sellers. As agents, we MUST always use the comps for pricing.

Thanks Richard. I think this is a balanced view, and I’m here for it. The Zestimate can be a springboard for conversation, but it’s nothing to get stuck on.

Two years ago I had someone threaten a lawsuit actually because he thought his Zestimate would go down due to me measuring a neighbor’s house smaller than what it said on Tax Records (I was right about the square footage). What a glaring example of someone who took his Zestimate WAY too seriously and really misunderstood how value even worked. I actually did a thread about this last week on Twitter if any onlookers want more details. https://twitter.com/SacAppraiser/status/1636813309801545728

I could be wrong, but I think the percentage spike in cash buying a decade ago was not so much that big investors were jumping on the market, but that all the “normal” buyers couldn’t qualify for financing due to foreclosure, unemployment, and stricter lending standards. There were also more REO/short sales. We’re not really seeing those conditions today (other than strict-ish lending standards).

Hi Joda. I think that’s all part of it. Like most things, it’s not usually just one dynamic. But Blackstone / Invitation Homes went on a buying spree in 2012 and half of 2013, and that did make a difference. I’d chalk it up to all of the above, but there was a heavy emphasis on investment funds too. You are 100% correct about condition. In 2007 through 2010 especially we saw so many foreclosures and short sales. They were still present in 2012 also. But for years these properties really had to go cash due to condition. While investors tend to get a bad wrap, one thing they did help was to improve the housing stock in terms of upgrades. I’m talking about the flippers of course – not the buy and hold types. Of course, there is financing available for properties that are in rough shape, but on the buying side it’s often not easy to get an offer like that accepted.

I was a buy and hold buyer during the 2008 crash. A full rehab was done on the homes I held, and not performed on the on the one I quickly flipped. So the inverse of the assertion that flippers fix and holders don’t. I observed that most of the flips from those days (and before and since) are half – assed or totally assed rehabs ( so glad I can use the most precisely descriptive words now that we’ve gone nsfw) and the ones that weren’t paraded as “like new” were like the one I flipped – not claiming to have done anything.

Edited. I was a buy and hold buyer during the 2008 crash. A full rehab was done on the homes I held, and not performed on the on the one I quickly flipped. So the inverse of the assertion that flippers fix and holders don’t. I observed that most of the flips from those days (and before and since) are half – assed or totally assed rehabs ( so glad I can use the most precisely descriptive words now that we’ve gone nsfw) and the ones that weren’t paraded as “like new” were like the one I flipped – not claiming to have done anything. Oh and though it said cash on the MLS, my purchases were all financed privately via unrecorded trust deeds that did not flow through escrow, so did not show up as financed on either mls or county records. Sorry to mess up the stats.

Thanks Jim. I always appreciate your take. Yes, there has been way too much lipstick on a pig. I recall some flippers that did such a bad job from 2008 through 20013 that it became obvious why I would see their comps consistently selling for less. There were some real prominent flippers too who cut so many corners. I often threw out the comps from one flipper in particular because I knew from personally seeing the properties that it was really bad workmanship. On a geeky note, I wish we had better stats in those days for financing. When I pulled stats this week for cash sales, there was a real difference after 2009 in the numbers. I know it’s really off in MLS when we only saw 5.3% of the sales as cash in 2007. I suspect is categories changed in 2009, which maybe changed the previous stats. Not sure. Maybe when the REO / Short Sale category hit in 2009 it changed some other categories too.