The housing market is a mixed bag. It’s not always easy to understand what the market is doing right now. Today I have some thoughts about prices, Zestimates, and cash buyers. Scroll by topic or digest slowly.

UPCOMING (PUBLIC) SPEAKING GIGS:

3/24/23 How to Think Like an Appraiser (at SAR)

3/28/23 Downtown Regional MLS meeting

4/1/23 NAA Conference in Sacramento

4/13/23 Realtist Meeting

5/4/23 Event with UWL TBA

5/10/23 Empire Home Loans event TBA

5/22/23 Yolo YPN event TBA

THIS MARKET IS A MIXED BAG

This isn’t scientific research, but I did a poll on my Instagram stories two days ago, and there were mixed results when asking what home prices are doing right now (the bulk of these votes are from the real estate community). Moreover, I speak somewhere usually once a week, and I’m finding this same sentiment when talking to groups. I’m hearing everything from, “Prices are dropping” to “Prices are going up.” In short, it’s no longer early 2022 when the trend was so clear. Keep in mind the market could be different all across the country too (not to mention different by price range locally).

THE ZESTIMATE MATCHING THE LIST PRICE

By the way, the top bid so far is $507,000. We’ll see where it ends.

WHAT DO THE STATS SHOW PRICES ARE DOING?

Here’s a look at the weekly median price for closed sales in the Sacramento region. It’s been a bit flat in recent weeks (black line). However, when looking at pendings since March in the entire region, Sacramento County, and Placer County, they’re getting into contract at higher levels in recent weeks (please note the trend could vary by neighborhood). The truth is we never know exactly where pendings will close, but today’s pendings are next month’s closed sales, so they’re important to watch. In short, based on pending prices, it looks possible April stats could show a modest uptick. Only time will tell.

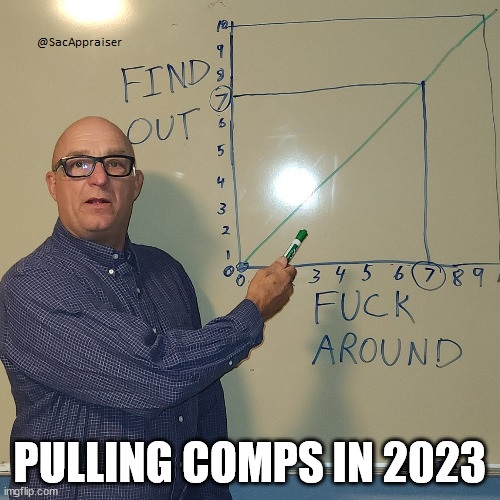

FINDING OUT WHERE THE MARKET IS AT

PENDINGS VS SALES

The goal with real estate value is to understand what’s happening with the current market (pendings and listings) compared to the past (sales). Here are two graphs from recent appraisals to help scrape the surface of what’s happening with pendings in terms of price and volume. Remember, the trendline is based on closed sales, so if we see upward movement ahead, that won’t be reflected until pendings actually close. I find in some neighborhoods right now the trendline is starting to flatten out instead of showing a hardcore decline like we saw in the summer and fall of 2022.

BIG POINT: Ultimately, it takes time for the market trend to show up on graphs, so if we wait for the graphs to tell us what is happening, we’re going to be behind the trend.

A HISTORY OF CASH IN THE SACRAMENTO MARKET

“Bro, 80% of the market is cash and Blackrock is buying everything” Not true. Here’s a look at the percentage of cash sales since 2010 in the Sacramento region. There’s been a slight uptick in 2023, but the year is just getting started. Keep in mind if total volume drops more than the volume of cash buyers too, that will naturally boost cash percentage levels.

UPDATE on Blackrock: A reader sent me a kind email to explain the difference between Blackstone and Blackrock. I was actually intentional here with my use of Blackrock because there has been a fake narrative about Blackrock buying everything on Twitter. I really appreciate the concern though. Truly. Here’s something I wrote in 2021 about this false narrative.

HOPE FOR BUYERS:

The vast bulk of the market is financed in the Sacramento region, which means conventional, FHA, and VA transactions are the overwhelming majority of the market. Buyers, this means it’s highly possible to get a financed offer accepted because it’s happening ALL. THE. TIME. It’s really competitive right now for units that check all the boxes though, so bring an offer that makes sense for the market. My advice? If you are willing to buy right now, get as much as the market will give you, and also be realistic about what it’s going to take today.

50% CASH IN THIS NEIGHBORHOOD

In the Sun City Lincoln Hills neighborhood, it’s normal to see about HALF THE NEIGHBORHOOD as cash transactions. This is REALLY uncommon in other neighborhoods, and I haven’t seen percentages like this elsewhere. Sun City Lincoln is a 55+ community though, and some of these buyers are Bay Area transplants, but it’s also retiring Boomers deploying equity and wealth. By the way, take 2023 with a grain of salt since the year is just getting started.

I hope this was helpful.

MARKET STATS: I’ll have lots of market stats out this week on my social channels, so watch Twitter, Instagram, LinkedIn, and Facebook.

Questions: What are you seeing happen with prices? Up, down, flat? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

Neighborhood Mini-Case Study: Let’s look at a particular neighborhood to get a closer view of distressed vs traditional sales. The data below represents the “Bridgegate” model in

Neighborhood Mini-Case Study: Let’s look at a particular neighborhood to get a closer view of distressed vs traditional sales. The data below represents the “Bridgegate” model in  Avoid REOs in appraisal reports: REO sales should be avoided in appraisal reports where possible. However, many areas in Sacramento have a percentage of distressed sales (bank-owned + short sales) near 70%, so it’s not always possible to use only traditional sales. I just appraised a condo recently and 35 of 36 sales over the past year were distressed.

Avoid REOs in appraisal reports: REO sales should be avoided in appraisal reports where possible. However, many areas in Sacramento have a percentage of distressed sales (bank-owned + short sales) near 70%, so it’s not always possible to use only traditional sales. I just appraised a condo recently and 35 of 36 sales over the past year were distressed.