It can be a REALLY bad idea to pull comps from the other side of the freeway, but not always. Today I have some thoughts about location, comp selection, and lenders freaking out when schools are mentioned in appraisal reports.

UPCOMING (PUBLIC) SPEAKING GIGS:

11/30/23 Safe CU “Preparing for a Successful New Year”

12/08/23 Free Q&A event for appraisers only (on private work)

11am PST one hour – click link here (see pass code)

Meeting ID: 832 2414 3890 Passcode: 007

01/30/24 Joel Wright & Mike Gobbi Event 9am (on Zoom here)

2/23/24 PCAR WCR Event (details TBA)

3/11/24 Yolo Association of Realtors (details TBA)

I DON’T NORMALLY PULL COMPS ACROSS A HIGHWAY

In so many cases it’s an awful idea to cross a major road or highway to pull comps because a highway sometimes separates markets that are far different in age, square footage, lot size, architecture, price point, school district, etc….

BUT, CROSSING THE HIGHWAY DOES WORK HERE

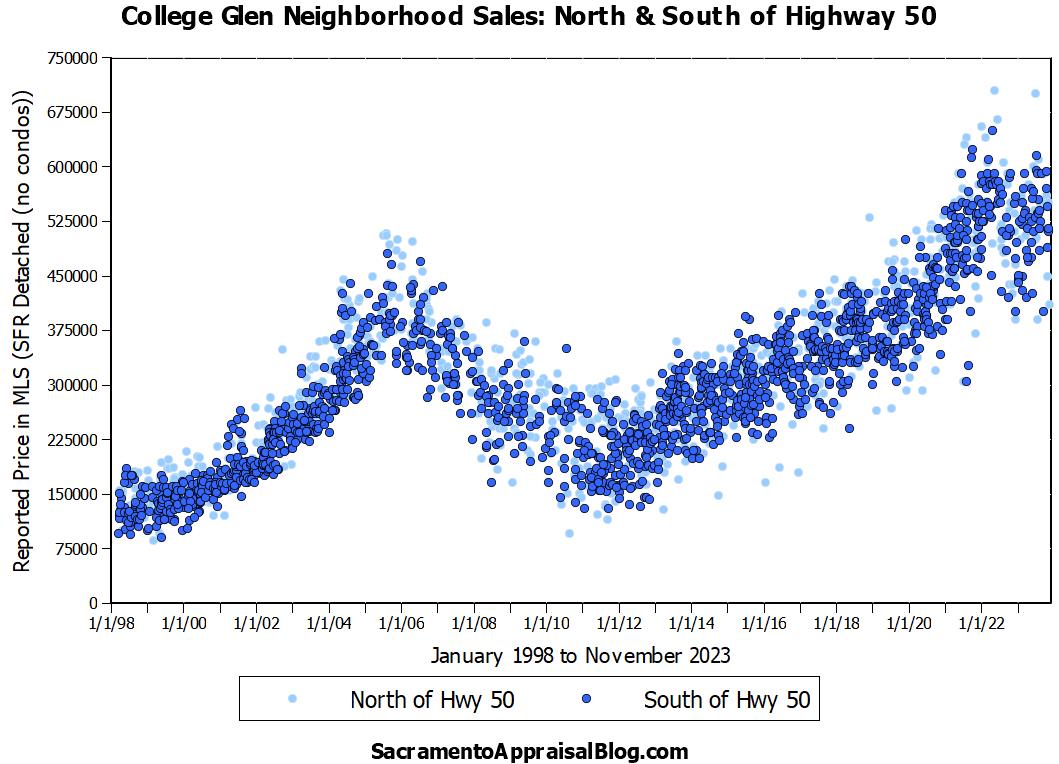

With that said, I want to show you an example of a local neighborhood where I have zero hesitation about pulling comps from both sides of the highway. The areas north and south of Highway 50 below represent the College-Glen area.

WHY IT’S NO BIGGIE TO PULL COMPS LIKE THIS:

A) Prices are similar: Prices are similar on each side of the highway. I’ve found this when pulling comps through the years, and I’ve also shown this when making graphs. I will say the north side tends to have a slightly larger square footage than the south side (same with west vs east), which is something to consider when we compare stats. But it’s still not a major difference.

B) Buyer Behavior: Buyers tend to consider each side of the highway when shopping for a home, but obviously not every buyer thinks exactly the same. That sort of uniform thinking about location doesn’t exist in the real world. I asked local Realtor Doug Reynolds for his take since he lives and works in the neighborhood. Doug said, “From my experience, I would estimate that 50-60% of the buyers are actively looking on both sides of the freeway. And 20-25% are looking only on the north side, and 20-25% are only looking on the south side.” In short, Doug’s words line up well with what I’m saying about a good chunk of the market looking at both sides simultaneously. Thus, in terms of comp selection, my goal is to be choosing comps where buyers would also choose comps.

C) The School System: Both the north and south side of the neighborhood feed into the same schools, and that can be an important factor for buyers when defining a neighborhood. For reference, the only schools in the entire neighborhood are on the south side, which gives further support that the north and south go together.

COMPARING NORTH AND SOUTH:

Here is a view of two decades of sales. The light dots are north of Highway 50 and the dark dots are south. Looks pretty similar, right?

Here’s one more way to look at it. Keep in mind there are not many sales for just one year, so don’t be dogmatic about differences. This is where size matters though since an extra 150 sq ft can affect prices (still nothing major).

BUT LET’S COMPARE WEST AND EAST TOO:

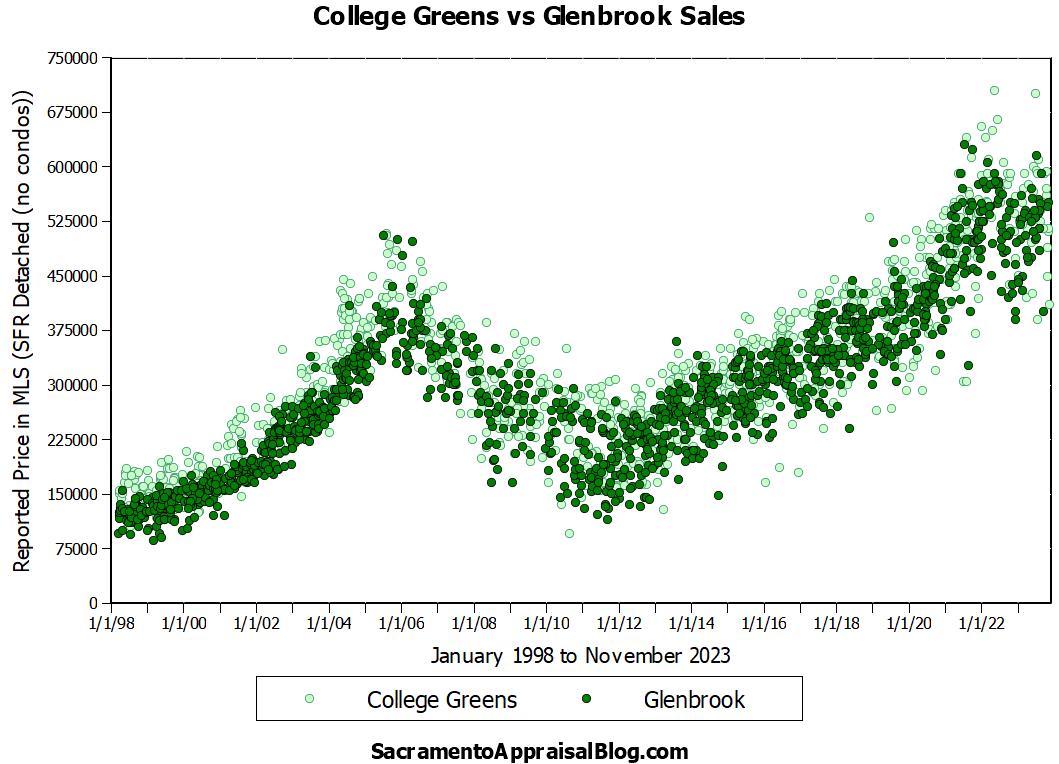

Some would argue College Greens (west of power lines) and Glenbrook (east of power lines) have different values, so let’s look at data that way too.

Here’s a graph split by west and east instead. Personally, I don’t see a huge difference, but the west side does have a larger square footage. This is still not a major difference, but let’s be aware, right?

Do you see how there is slightly more of a spread in prices when looking at west vs east instead of north vs south? And the square footage difference is slightly larger too. Ultimately, this is still minor, so it doesn’t deter me from choosing comps on either side of the highway.

WHAT I’M NOT SAYING:

I’m not saying to blindly cherry-pick a higher sale across the freeway to justify a higher value. I would NOT pass up three relevant sales on the same street either for something across the highway. Ultimately, it’s dangerous in real estate when we start glossing over the most similar stuff nearby for the sake of choosing “comps” elsewhere that don’t really compete.

WHAT I AM SAYING

While it’s generally wise to NOT cross major boundaries, this example is a situation where we need to consider both sides of the highway since it’s the same neighborhood. This is a good reminder to be careful about imposing rules regarding comps. If I say, “It’s not okay to ever cross the highway,” that can end up being a very limiting lens for the way I view value. And to reiterate, I rarely cross highways, but in College-Glen, I have zero hesitation about doing so.

ADDITIONAL THOUGHTS ABOUT BIAS & SCHOOLS:

Since I mentioned schools above, I wanted to share something that’s happening to appraisers right now. These days lenders sometimes flag appraisal reports for mentioning schools or school districts because of potential bias or fair housing violations. So, what happens is an appraiser will turn in a report, and the lender goes back to the appraiser to say, “The mention of ‘school district’ could be a violation of fair lending practices.” The appraiser might have said something like, “XYZ Elementary school is two blocks away,” or “The subject property is located in the Sacramento City school district,” and the system flags for potential bias. I suspect these warnings are automated from computer programs, but I still have concerns about appraisers having to walk on egg shells when it comes to language.

Here’s the thing. School boundaries are a fact, and they can be an extremely important consideration for buyers, so knowing school boundaries as an appraiser can display geographic competence and market expertise rather than bias. Does an appraiser need to mention a school in an appraisal? Probably not. But at the same time, it feels off when the mention of a school is pegged as bias instead of factual or a display of competence. There could be an extremely relevant reason a school is mentioned too, such as, “The subject property is located directly across the street from XYZ High School.”

Look, I want to be the first to eliminate any form of bias in appraisal reports, and I take fair housing laws very seriously. I’ve written about the importance of objective language too because words matter. All I’m saying is I’m concerned about the scrutiny of language going too far. And this is being said from a guy who really takes objective language seriously.

When mentioning a school district or name of a school in an appraisal report, we’re not talking about school ratings, residents, skin color, economic background, gender, jobs, redlining, gentrification, or any other fair housing category. We certainly should not be assigning any subjective quality to the district either such as, “This is a good district” or “The schools are bad.” It’s just off-limits to say a district is “highly-sought after” too because that’s a subjective declaration. In instances like that, there should 100% be correction because the reader shouldn’t be wondering if the appraiser is inserting subjective bias in the report. In my opinion though, it becomes problematic when appraisers are being flagged for potential bias by simply mentioning a school. Moreover, my real concern is in the future if lending institutions tally up red flag instances like this where they “busted appraisers” for potential bias. Ultimately, I’d hate to see a damning report on appraisal bias for stuff that really wasn’t bias. Does that make sense? Can we have some common sense here in the midst of a commitment to objectivity and upholding fair housing laws?

Anyway, I’d love to hear your take. I’m not looking for arguments, so please direct your anger somewhere else if you can’t keep it cordial here. There are many other places to rant online.

Questions: Do you ever cross a freeway for comps? What do you think about my points above? Anything to add about schools? I’d love to hear.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

Great example of defining a competitive market area. It’s a very interesting example and fairly rare in my experience.

I’m right there with you regarding language in appraisals. “Student” is on the Freddie Mac do not use list but how do you describe housing demand in a university town without using “student?” I guess it’s good most of my work is non-lender.

Looking forward to the discussion next week.

Thanks Joe. I’m excited about this one. It was fun to dig in a bit more, and I wrote it after finishing an appraisal in the neighborhood.

Yeah, that’s a weird one. On one hand I can’t think of any reason why I would ever use the word student, but if I was in Davis, talking about the university market is so important. What if student housing was next door too? I cringe to think about not being able to discuss relevant market factors that are drivers for value. I’m not a guy who needs freedom to say whatever I want either.

I do wonder what happens when an appraiser doesn’t mention a school across the street due to so-called compliance, and then a lender comes back later during foreclosure to say, “Why didn’t you mention this relevant factor?”

A student must be referred to as a matriculant. a school is a “place of matriculation”. And I got that from the writings of Jeremy Baggott.

I understand the Golden Rule. Lenders have the “gold”, so they make the rules. However, this bias issue is getting a bit out of hand. The focus should be on accurate valuations-not perceived offensive words. If and when we end up in another mortgage mess, lets make sure that the reports dont mention school districts, or describe a property as better than another. Apparently lending too much money on an overvalued home is less important than offending somebody that went to the other school. I see a LOT of appraisal reports as a reviewer, and I do not see a lot of bias. What I do see is a lot of incompetence. The AMC criteria of awarding appraisal assignments to the fastest and lowest fee appraisers is the problem. Sorry lenders, your transactions are going to the quick and the cheap, not necessarily the most qualified appraisers.

Thanks Mark. I always appreciate your commentary. I agree about a bit out of hand. We need to be here for the conversation, and the profession ought to embrace change where it is needed, but there are some weird examples lately of the system triggering potential bias.

Well said!!!

Thanks Truett.

Always love the your discussions of different neighborhoods and using multiple scatter charts to show it. We certainly have some areas near Portland where it doesn’t matter what side of the highway you’re on, but its the exception. This is where the local expert is so important.

Thanks Gary. Love your last line. Totally agree.

Hey Ryan, My neighborhood, College-Glen, in Sacramento which you highlighted here is definitely a rare scenario where you should be “considering” comps on either side of the freeway. The neighborhood was actually built before the freeway even existed. The developer just left a large strip of land open where they knew the freeway was going in for the future. Not many neighborhoods have had that occurring. But beyond that, you really need to know all the ins and outs of each individual street (what it backs up to, proximity to the schools/parks, amount of traffic on the street, etc.) I always find it funny when i meet with an appraiser for a property i’m selling in College-Glen and i provide them comps from both sides of the freeway. they look at me like i have no idea what i’m talking about, although it’s the first time they have ever driven into the neighborhood in their career and 3 of the 6 comps are listings i personally sold :-). it definitely is a rare scenario but a pretty cool one when you know what’s going on. Thanks for the link/mention. happy to answer any questions people might have specifically about College-Glen.

Thanks Doug. I appreciate the depth of your knowledge. I really liked the percentages you used here too. I find we talk about real estate concepts sometimes in black and white terms, but not every buyer is going to see things exactly the same. It’s funny to hear you talk about meeting appraisers. This is exactly the point. We have to be careful about the rules we impose on comp selection. Let’s step back and understand the market.

Regarding Highway 50, it also split the White Rock neighborhood in Rancho Cordova from the other side of the south side too. While I wouldn’t necessarily choose comps from the other side, I do at least look to see what’s happening. These days we have so few comps, so I’m finding it’s key to look to several surrounding areas to get a better sense of the trend. Maybe I won’t use the comps, but I can use the trend…

I agree it’s quite rare. And there are many neighborhoods that were built before freeways, and the freeways actually became the dividing line between neighborhoods (often with racial-segregation policies). Oak Park vs. Curtis Park? Land Park vs. downtown? West Sac state streets vs. those streets with tree names north of 80?

I like the scatterplots, but there’s so much visual overlap (that’s the point, after all), I’d like to see some actual statistical correlations.

Thanks Joda. Yeah, I hear you. I would definitely not be looking at East Sac vs Tahoe Park or Curtis Park vs Oak Park. Sometimes a highway is a definitive line that separates markets. Agreed on something more specific. Comps would be cool. Or even a scatter plot with a narrow square footage range.

I always mention if there is a school in the immediate neighborhood. Instead of mentioning “highly sought after” or anything subjective I just try to keep all the comparables from within the same school district. I haven’t received any push back as long as the subjective language has been kept out.

Thanks Shelley. It almost seems controversial to even mention a school, but it seems like something important on a few levels. Maybe there’s no difference with the comps. What if there is though? Kudos on objective language. I’m a fan.

Interesting post Ryan. Down here in the Bay Area, it’s common to see a 10% price increase for a property in the same city but within the non-subjectively “better” school district of Acalanes versus Mt Diablo. Much of the reason people buy expensive homes in expensive areas is due to the network effect of going to top schools and rubbing elbows with other “well-to-do” people. Class perception (tribalism) is a huge force on human behavior. I’ll have to leave out all that nuance for a lender though.

Thank you Kyle. Fascinating to hear. I appreciate you chiming in. And yeah, this can start to get incredibly subjective-sounding. This thread underscores the importance of communication, and how much work it takes. I find some people get bent out of shape when language is policed so to speak or when language changes in some way (that’s inevitable though). I get it because the rebel in me doesn’t want anyone to tell me what to do. Yet, language sure does matter, nothing stays the same, and communicating effectively is such incredible work. For the record, we moved to our current house years ago to be closer to the school my kids were going to, and the location was a huge factor.

Thanks for this info, Ryan. I have often times looked at both sides of the freeway when trying to evaluate price for College Glen/Greens.

Another area I think is similar and was once all one area until the freeway went in, is Elmhurst (S & T Streets & 39th St – 59th Streets) & the part of East Sac south of Folsom Blvd. Is that a fair assessment, since that part of Elmhurst is 95819 and the local school is on the other side of the freeway?

The scatter charts are so telling. It would be interesting to see for the above example.

Thank you,

Shawna Friesen

Thank you Shawna. I appreciate hearing. You know, it could be interesting to compare Elmhurst with East Sac. I think part of the struggle would be East Sac being so incredibly patchy in terms of price, so we could get a much different reading depending on the comparison. I’ve been very hesitant to cross the freeway, but next time I appraise there I’ll have to do some analysis for comparison to see if I find anything interesting. The struggle with Elmhurst though is prices in other bordering areas can be so different. Elmhurst does go to David Lubin Elementary in East Sac, though I wouldn’t always say school district is a reason to cross the freeway. It’s probably something to know though. MedCenter also goes to that elementary school.

I’ll be listing something at the beginning of the year on T St and I think it will be a challenge to price. It’s a larger home and in the 95819 zip code, so most of the homes on the Elmhurst side of the freeway are smaller and then once you get south of T you are in 95817 zip code. I’ve been keeping an eye on comps, but I’m seeing more “like for like” properties on the opposite side of the freeway (East Sac side between the I-50 and Folsom Blvd). I’d love to know how an appraiser approaches obtaining value of this little strip.

It’s always about context. How does this property fit into the market? I think one of the best ways to understand context is to compare and contrast many properties over time. I would recommend using the MLS map search and drawing some particular boundaries around areas and then comparing and contrasting. There is nothing wrong with looking at many years of sales too to understand prices in various areas. We might not use really old sales as comps, but we can use them for research. I would maybe start with 2023 and just find similar properties in both areas and see what prices are like. Then look at stuff from 2022. Then 2021. Then… The key is to put a parameter on the data though. Maybe search with a square footage range so you aren’t looking at 200 sales on your screen every year. Does that make sense? That’s where I would start because it would maybe help over time to understand things. And for what it’s worth, there isn’t one way to do this. I suspect other appraisers would not like my advice because they have their own way going about things. The key is that we get to a credible value no matter how we search.

Also, if the subject property has sold in the past, maybe look up comps at the time so you can get clues. What did it compare to? How did it fit into the market? The issue here is we have to take the past sale with a grain of salt. What if it sold for too much or too little? I actually just finished an appraisal though where the subject sold in both 2020 and 2022 in the same condition, and it was REALLY helpful for me because it competed at the top of the market both times due to being remodeled. So today, I’m going to look up comps, but I’m also going to ask where the top of the market is since this property has seemed to sit at that position. Nothing trumps the comps, but two strong previous sales were really helpful for me to establish where this property fit into the context of the market. In contrast, sometimes I throw out previous sales altogether because they sold for too much or too little.

I really like making graphs too, but that may not be in your wheelhouse. I find having visual context is super helpful. I have some tutorials at this link, but I realize that’s not for everyone. sacramentoappraisalblog.com/graphs

Thank you for the feedback. I’ll look at the link.

I always find so much value in your content and this blog/thread is no exception. Thanks Ryan!

That’s so cool. Thank you so much Amy. And you know, I so appreciate people pitching in on the thread. The comments are where it’s at when I read articles. I guess it’s the same with Instagram too after watching a reel. Now let me see what people are saying…

Great post! This is why it is so important that the appraiser is local and familiar with the area. Thanks, Ryan!

Thanks so much Joanie. Appreciate you. Yes, local appraisers for the win!!!

Great post, Ryan. I guess it all goes back to the two most important words when considering things like this: “it depends”. In some areas, I would not cross a major roadway for the exact reasons you mention. Other times I don’t have a problem because they are considered the same competitive market area. Part of what makes a competitive market area is the school system. I have not heard of appraisers getting flagged for mentioning school systems, but I would also find that problematic. As an appraiser, we are supposed to study and analyze what factors influence value, and school systems are one of the biggest influencers in most places. In addition, people buy into some neighborhoods due to the close proximity of the school because it contributes to the walkability of the neighborhood. First, we are told to be subject and to note factual items rather than be subjective and for this reason, I have no problem with mentioning the school and its distance because these are statements of fact. I truly don’t like where the profession is headed with things like this and hope that people will come to their senses.

Thank you Tom. I always appreciate your thoughtful commentary. I am all for objectivity, but there is such a thing as too far if language starts to sound unnatural. If a reader reads something, and thinks, “What the heck is this person even saying?,” then that’s probably a clue. In other words, props to appraisers for saying stuff like this in terms of compliance, but man this really doesn’t tell the reader anything… “The subject shares a lot line with a non-residential, non commercial land use. Comparables 3 and 5 also share lot lines with similar non-residential, non-commercial land uses.”