Have you been feeling the market change lately? We all know real estate has been slowing down, but the big theme last month seemed to be the change in the psychology of the buyer’s mind. A year and-a-half ago buyers were getting beat down by cash investors, but now buyers feel like they are sitting in the driver’s seat of the market because they have more power, selection, and even the perceived luxury of time being on their side. Let’s talk about this below as well as hit on some other trends. Remember, the goal of my big monthly post is to help better understand and explain what the market is doing. I hope this helps.

Two ways to read this post:

- Scan the talking points and graphs quickly.

- Grab a cup of coffee and spend a few minutes digesting what is here.

1) The median price INCREASED, but the market is NOT increasing:

The median price increased from $270,000 to $275,000 last month. Does that surprise you? I think many of us were expecting the median price to show a decline this past month in light of rising inventory and a general malaise in the marketplace. However, remember that sales stats for September strongly reflect what the market actually did in August rather than September. Being that properties are taking 41 days to sell right now in Sacramento, this means most escrows in August actually ended up closing in September. Thus the slowness felt in the market in September will theoretically be better reflected in sales stats in October. This is a good reminder too to not take one month of data and draw a big conclusion from it. We also must ask what the surrounding market is doing (hint: The median price has been the same for 5 months in a row).

One last thought on Trendgraphix: I mentioned previously how Trendgraphix in MLS showed the median price was increasing over the past few months in Sacramento County despite the trend really being flat. This has now been corrected. Just be aware that Trendvision adjusts publishes stats at the beginning of the month, but then they adjust their graphs at the end of the month. This means the data might look different depending on when you look at it.

2) Distressed sales represent only 6% of the market

There were less REO sales and less short sales over the past quarter compared to the previous quarter. I hear rumors of increasing REO sales, but that hasn’t shown up in the stats yet since both bank-owned sales and short sales showed a decline from the previous quarter. Keep in mind REOs and short sales each only represented about 6% of all sales over the past three months. Remember too that “Boomerang Buyers” are entering the market right now after having gone through a foreclosure or short sales, and they are hungry to buy again.

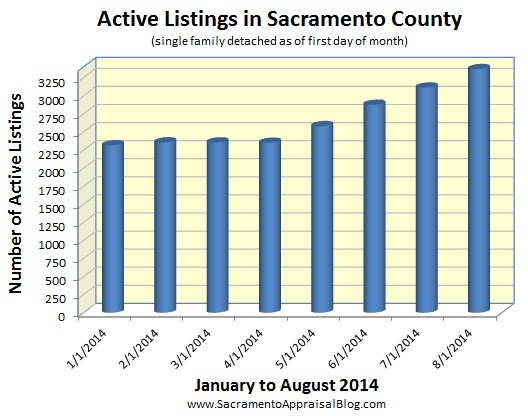

3) Inventory increased again last month and is now at 2.5 months:

Inventory is now at 2.5 months of housing supply (up from 2.41 month last month). This means there are 2.5 months worth of houses for sale right now in Sacramento County. Inventory also increased in the regional market, but we’ll dissect that in two days. Inventory right now at the beginning of Fall is at the peak of what it was at the end of Fall last year.

What happens with inventory over the next 3 to 5 months will set the stage for the housing market in 2015. Increasing housing inventory is definitely one of the X-factors for how values are going to move in coming time. A larger housing supply is also indicative of having a more “normal” level of demand now that cash investors are no longer driving the market. Investors acted like a steroid for the housing market, and their rampant purchases made it seem like demand was much stronger than it really was. But lately we are getting a taste of what demand is really like now that regular non-cash buyers have to support the market. As you can see above, inventory is not the same in every price range, and that is a key marketing point for buyers and sellers to embrace. Anything below $300K is still a bit of a fight to get into contract.

4) Sales volume is down 10% from last year:

Sacramento County has seen about 10% less sales volume so far in 2014 compared to 2013, but sales volume is only down 2% when looking at September 2013 and September 2014. The more sluggish volume of course is due to less purchases by cash investors.

5) Sellers are lagging behind the changing market

The market has changed and really softened over these past five months, but many sellers are stuck in Q1 2013 when the market was very aggressive, or the first quarter of 2014 when the market experienced a normal seasonal uptick. Throughout September there were about 400 price reductions every day in MLS, and that tells us the market has been overpriced. This means it’s all the more important to price according to the most recent listings that are actually getting into contract (instead of the most recent sales from six months ago). If you haven’t seen my “Open Letter to Sellers in Sacramento“, it may be worth a look or share.

6) Cash sales are down 42.5% from last year:

There have been more non-cash purchases in 2014 so far compared to 2013, but the big news is cash sales volume is down by 42.5% from last year. Furthermore, cash sales used to represent almost 36% of the entire market in Sacramento County, but now cash sales are just under 18%. At the same time, it’s important to realize cash sales below $200,000 still represent almost 34% of the market, which tells us cash purchases are more aggressive at the lower end of the price spectrum than the rest of the market (that’s normal). Remember, taking cash out of the market has led to buyers gaining more power.

7) Buyers are gaining an obvious edge in the market

FHA sales have taken back about 7% more of the entire market since cash investors began exiting the scene 15 months ago. This is important for several reasons: 1) It shows us many first-time buyers are getting FHA offers accepted; 2) Sellers are more accepting of FHA offers lately (and conventional & VA); and 3) As buyers gain more power in the market, they are gaining the power to negotiate for lower prices and seller credits. If you are rusty when it comes to FHA appraisal standards, be sure you get in tune with FHA minimum property requirements.

8) It took 1 day longer on average to sell a house last month:

On average it took 41 days to sell a home in Sacramento County last month, which is up 1 day from the previous month (and up 68% from September 2013). All things considered, properties that are well-priced and in good condition are tending to sell quickly, but anything that is overpriced is simply sitting on the market. Buyers have become much more picky about location and upgrades also, so any detrimental property characteristic is standing out like a sore thumb right now. Remember, when the market is very competitive and inventory is low, outdated homes and adverse characteristics are less of a big deal for buyers, but now that buyers have more choice and feel that time is on their side, they are tending to ignore certain listings because they believe they can find something better or wait out the market to see what happens. On the positive side, if your home is upgraded already, you have a marketing edge.

9) Interest rates are hovering in the 4% range:

Interest rates have been hovering in the lower 4s lately. It seems week by week the tone of real estate articles change from saying rates are likely to increase or they’ll likely to decrease. Ultimately only The Fed knows what will be done, so we’ll see how this pans out. This will be an important factor to watch since a change in rates can impact affordability and competition. Personally, I’m hoping interest rates don’t creep down too low because that will only ramp up prices again. Our market needs some space to figure out how to be normal rather than more outside forces to help inflate values beyond where the local economy would naturally take housing prices.

10) Values when the “bubble” burst and when we hit bottom

The median price is currently about 30% lower than it was when the previous real estate “bubble” burst in the summer of 2005. This may be helpful to consider for context for some buyers and sellers. I’ve heard a number of friends say, “I know values increased rapidly recently, but they are still so much lower than they used to be.” What do you think of that?

The median price is currently about 30% lower than it was when the previous real estate “bubble” burst in the summer of 2005. This may be helpful to consider for context for some buyers and sellers. I’ve heard a number of friends say, “I know values increased rapidly recently, but they are still so much lower than they used to be.” What do you think of that?

The market hit bottom in early 2012 and has since seen exponential appreciation.

Current values in Sacramento County are similar to where they were during Dec 2007/Jan 2008 and Dec 2003/Jan 2004. Keep in mind different neighborhoods or property types might not be experiencing this same trend.

Summary: Despite the median price showing an uptick this month, the market is NOT increasing. The market can best be described as flat, price-sensitive, and less competitive than it was in recent months. At the same time inventory is still relatively low, interest rates are near historically low levels, and there is still stiff competition to get into contract in various price ranges. We can look at housing market metrics until we’re blue in the face, but one of the biggest changes not shown on a graph above per se is the mind of the buyer. Real estate and Psychology definitely mix, and we’re seeing the mixture with buyers beginning to feel much more confident and in control of their housing destiny.

Two speaking engagements: By the way, I’m speaking at Sacramento Association of Realtors at the end of the month on the 24th. This is a free event, and I’ll be sharing about market trends and how to talk about them with clients when the market slows down. Secondly, I’ll be teaching a class on how to work with appraisers on the 27th. The cost is $25 for this class, and you have to sign up with SAR. Full disclosure, as the instructor I get a portion of the $25 fee.

Sharing Trends with your Clients? If you want to share graphs online or in your newsletter, please see my sharing policy. Thank you for sharing.

Questions: How else would you describe the market? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.