The coming recession is a huge topic right now and lots of people are wondering about the effect on home prices. What’s going to happen to the housing market? Will we see another crash? Here are a few thoughts on my mind right now. Anything to add? Please comment below.

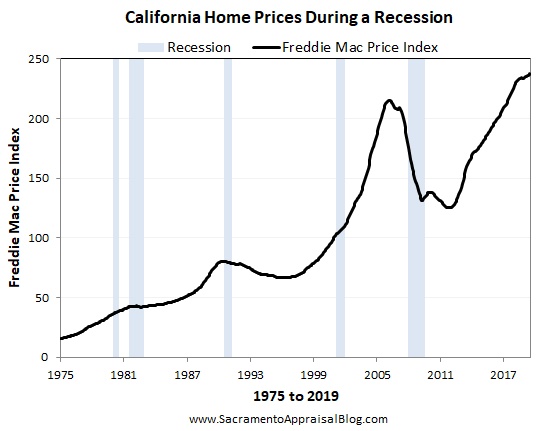

Last time isn’t the new template: The collapse of the economy during the last recession isn’t the new template for how every future recession and housing market will unfold. I’ve heard things like, “I’m so ready for this recession because I’m going to buy low after values tank.” But prices don’t always crash during a recession as you can see in the images below.

Severity matters: It’s hard to think the housing market is going to be swayed much if it’s a quick recession. But if buyers and sellers end up struggling financially and losing jobs, we can expect a greater effect on home prices (thanks Captain Obvious). The thing is we don’t know right now how severe of a recession we’re going to have, so that’s why we can’t say exactly what the housing market will do.

Consumer behavior: One thing we need to watch is consumer behavior. How will consumers think and act differently in coming time about their purchasing decisions? As I talked about last week, during a recession builders actually tend to build smaller homes since consumers tighten up their finances. This reminds us the way consumers think and act can certainly shape real estate.

Locations aren’t the same: It’s nice to see what national price metrics have done during various recessions, but national numbers can show a different trend than local data.

What do prices do during a recession? Sometimes prices have gone down and other times they’ve gone up during (or after) a recession. There’s not a one-size-fits-all answer. In Sacramento at least most of the time there’s been a price dip during or after a recession. If you’re looking for some historical data in your market, I suggest you check out the Freddie Mac Price Index.

During & After: I’ve seen some images that show home prices have appreciated during three of the past 5 recessions. That may be technically true on the national level, but we have to be sure to look at local stats. Moreover, let’s not narrow our focus to only ask what happens during a recession. What about afterward? What do you see in the images below?

UPDATE (OCTOBER 2019): I put together a quick presentation to download to help zoom in on various local recessions since these images show a more panoramic view. Enjoy if you wish.

UNITED STATES:

CALIFORNIA:

SACRAMENTO:

Don’t get too stuck on prices: When we think about a recession, let’s of course watch prices, but the bigger story will likely be found in what happens to the number of sales. Are buyers playing the market or are they backing off? In short, let’s not forget to watch sales volume because we’re so obsessed with prices.

The inverted yield curve (and hesitancy): Lots of people are talking about the inverted yield curve as an indicator of a coming change in the economy. For now I don’t hear buyers saying things like, “Maybe I shouldn’t buy because of the inverted yield curve…” Okay, I’m joking in part because most buyers aren’t going to be making a decision based on this metric. But to be fair there’s been a sincere hesitancy among some buyers because they feel uncertain about what the future market is going to do. By the way, thanks to Alex on Twitter for the “inverted” Top Gun reference. This is golden.

The inverted yield curve (and hesitancy): Lots of people are talking about the inverted yield curve as an indicator of a coming change in the economy. For now I don’t hear buyers saying things like, “Maybe I shouldn’t buy because of the inverted yield curve…” Okay, I’m joking in part because most buyers aren’t going to be making a decision based on this metric. But to be fair there’s been a sincere hesitancy among some buyers because they feel uncertain about what the future market is going to do. By the way, thanks to Alex on Twitter for the “inverted” Top Gun reference. This is golden.

Hype: Everyone has a take right now and there is lots of hype about what the market will or won’t do when a recession hits. Some preach doom and gloom and others are doing their best to paint a rosy view of housing. My advice? Let’s do our best to let the actual market influence what we are saying about the market instead of getting caught up in someone’s talking points or agenda.

Making predictions: There are many predictions about a coming recession, and at some point one will happen. But predicting recession specifics is a bit like predicting housing market specifics. At the end of the day we might have ideas, but we don’t know the exact future until it happens.

I hope this was interesting or helpful.

BIG MARKET UPDATE I’M GIVING: I’ll be giving a deep market update at SAR on September 24th from 10:30-12:00pm. My goal is for everyone to walk away with an understanding of how the market is moving, ways to describe it, and some ideas for business in 2020. Sign up here.

Questions: What has been your experience with real estate and recessions? What are you hearing from buyers and sellers right now? Any stories to share?

If you liked this post, subscribe by email (or RSS). Thanks for being here.