The coming recession is a huge topic right now and lots of people are wondering about the effect on home prices. What’s going to happen to the housing market? Will we see another crash? Here are a few thoughts on my mind right now. Anything to add? Please comment below.

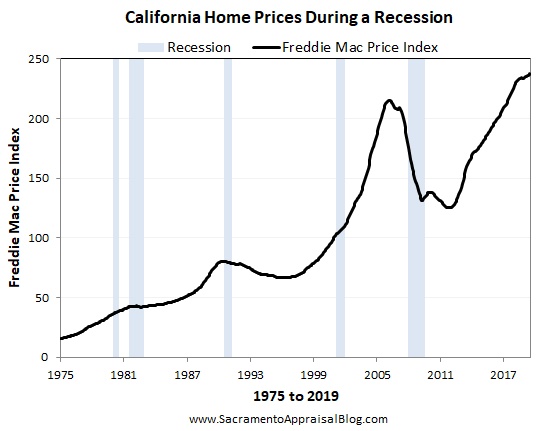

Last time isn’t the new template: The collapse of the economy during the last recession isn’t the new template for how every future recession and housing market will unfold. I’ve heard things like, “I’m so ready for this recession because I’m going to buy low after values tank.” But prices don’t always crash during a recession as you can see in the images below.

Severity matters: It’s hard to think the housing market is going to be swayed much if it’s a quick recession. But if buyers and sellers end up struggling financially and losing jobs, we can expect a greater effect on home prices (thanks Captain Obvious). The thing is we don’t know right now how severe of a recession we’re going to have, so that’s why we can’t say exactly what the housing market will do.

Consumer behavior: One thing we need to watch is consumer behavior. How will consumers think and act differently in coming time about their purchasing decisions? As I talked about last week, during a recession builders actually tend to build smaller homes since consumers tighten up their finances. This reminds us the way consumers think and act can certainly shape real estate.

Locations aren’t the same: It’s nice to see what national price metrics have done during various recessions, but national numbers can show a different trend than local data.

What do prices do during a recession? Sometimes prices have gone down and other times they’ve gone up during (or after) a recession. There’s not a one-size-fits-all answer. In Sacramento at least most of the time there’s been a price dip during or after a recession. If you’re looking for some historical data in your market, I suggest you check out the Freddie Mac Price Index.

During & After: I’ve seen some images that show home prices have appreciated during three of the past 5 recessions. That may be technically true on the national level, but we have to be sure to look at local stats. Moreover, let’s not narrow our focus to only ask what happens during a recession. What about afterward? What do you see in the images below?

UPDATE (OCTOBER 2019): I put together a quick presentation to download to help zoom in on various local recessions since these images show a more panoramic view. Enjoy if you wish.

UNITED STATES:

CALIFORNIA:

SACRAMENTO:

Don’t get too stuck on prices: When we think about a recession, let’s of course watch prices, but the bigger story will likely be found in what happens to the number of sales. Are buyers playing the market or are they backing off? In short, let’s not forget to watch sales volume because we’re so obsessed with prices.

The inverted yield curve (and hesitancy): Lots of people are talking about the inverted yield curve as an indicator of a coming change in the economy. For now I don’t hear buyers saying things like, “Maybe I shouldn’t buy because of the inverted yield curve…” Okay, I’m joking in part because most buyers aren’t going to be making a decision based on this metric. But to be fair there’s been a sincere hesitancy among some buyers because they feel uncertain about what the future market is going to do. By the way, thanks to Alex on Twitter for the “inverted” Top Gun reference. This is golden.

The inverted yield curve (and hesitancy): Lots of people are talking about the inverted yield curve as an indicator of a coming change in the economy. For now I don’t hear buyers saying things like, “Maybe I shouldn’t buy because of the inverted yield curve…” Okay, I’m joking in part because most buyers aren’t going to be making a decision based on this metric. But to be fair there’s been a sincere hesitancy among some buyers because they feel uncertain about what the future market is going to do. By the way, thanks to Alex on Twitter for the “inverted” Top Gun reference. This is golden.

Hype: Everyone has a take right now and there is lots of hype about what the market will or won’t do when a recession hits. Some preach doom and gloom and others are doing their best to paint a rosy view of housing. My advice? Let’s do our best to let the actual market influence what we are saying about the market instead of getting caught up in someone’s talking points or agenda.

Making predictions: There are many predictions about a coming recession, and at some point one will happen. But predicting recession specifics is a bit like predicting housing market specifics. At the end of the day we might have ideas, but we don’t know the exact future until it happens.

I hope this was interesting or helpful.

BIG MARKET UPDATE I’M GIVING: I’ll be giving a deep market update at SAR on September 24th from 10:30-12:00pm. My goal is for everyone to walk away with an understanding of how the market is moving, ways to describe it, and some ideas for business in 2020. Sign up here.

Questions: What has been your experience with real estate and recessions? What are you hearing from buyers and sellers right now? Any stories to share?

If you liked this post, subscribe by email (or RSS). Thanks for being here.

Hi Ryan! You made some great points. I agree with you that it doesn’t make sense trying to predict the future because we have no idea what will happen. The next recession could be very bad, or it could be a nothing-burger. We just have to wait and see. Keep

Up the great blogging!

Thanks Jamie. I appreciate your take. You get extra points for your phrase “nothing burger” also.

It’s good to keep in mind not all recessions are created equally. Three of the past five were only 6-8 months while the Great Recession was 1.5 years (but the turmoil lased way longer). On that note, my sense is when talking about price trends the focus is often only on what happens during an actual recession. Some of the stats I’ve seen published have focused on that too. But being that a recession is fairly short, I think I find myself more interested in what happens after a recession. That’s where we could see a bigger trend.

I think we not only need to focus on recession but in the bigger picture it will be a depression. There are tools, such as the interest rates, that can be utilized to help reduce recessions that won’t be available at the next downturn. Add to the fact we have record consumer loans, record, student loans, record home and auto loans, manufacturing is down, GDP down, and the gov’t inflating job numbers and we are headed to a financial crisis, think depression on steroids.

Thanks for your take. I sure hope that’s not the case James. The market has been slowing in terms of price growth and sales volume, but there are ways to juice the market to help it continue to grow. Artificially low mortgage rates, appraisal waivers, looser lending, etc… These are all factors we can introduce to the market to inflate prices.

I sure hope you’re wrong. But, I do see the potential for that. We just won’t know until we are there. The global economy is of great concern as it impacts our economy. However, things may not be as ominous as they appear. All we can do is watch, wait and not panic.

When one bumper hits another, some people call it a crash while others just call it a fender bender. Moderation in the market is not what I would call a crash, but we still may see a little whiplash. I think the job market is a key factor for those making predictions (and I don’t make them). Great, timely blog, as usual!

Thanks so much Barb. I like how you wove a car analogy through your comment. Nice!!

I totally agree. What’s going to happen with jobs and wages? That’s the big factor.

On a side note, one thing to consider is we are on the cusp of the first recession with social media. I wonder if that will magnify the intensity or at least people’s perception in any way.

I don’t make predictions either. You’re smart.

There won’t be any more price crashes. You need sellers who are willing to give their house away!

But since they changed the rules and banks don’t have to sell their REOs right away – heck, they don’t even have to foreclose any more – there won’t be any wholesale dumping of homes to crash the market.

If banks aren’t selling for whatever the market will bear, then who will? Anyone who loses their job and can’t make their payments has to be offered a loan modification in California, thanks to the Homeowners Bill of Rights.

How about the seniors? Could there be a boomer liquidation in our future? Probably not – if they need money, they can get a reverse mortgage and have no payments!

The flippers and ibuyers are creating the market floor, and will prop up the pricing artificially – and if they have to, they’ll just wait until they can get their price. The high rents are providing another great option too.

There might be slight price fluctuations over time, but no crashes. Who would give their house away?

Try to get a seller to take just 5% less than his (inflated) asking price today, and he’ll shoo you off his lawn!

Thank you Jim. I always welcome your take. We are in a much different market today. That’s for sure.

Another layer to consider for the current market is we have many owners who don’t have any incentive to sell. They’re sitting on a 3.5% interest rate and unless they have a big lifestyle change, it probably makes sense to stay put more than anything. This helps keep inventory lower for everyone.

One thing I’m watching is buyer sentiment. Buyers are very picky right now, but a recession can put their pickiness on steroids. Thus if sellers are prone to overprice now, it’ll be all the more important in coming time for sellers to get in touch with how price sensitive buyers are (and how that may grow if buyers end up pulling back financially during a recession).

For any onlookers, here’s a great Wikipedia page on recessions if you want to see previous recessions, how long they lasted, and the unemployment rate during each one. https://en.wikipedia.org/wiki/List_of_recessions_in_the_United_States

>Thus if sellers are prone to overprice now…..

The thing that sellers never consider is by how much they are over-priced.

They think they are close, and all they have to do is wait longer for some young couple with 2.2 kids to come along and love the gold-lame wallpaper like they do!

If the house isn’t selling, all we know is that the price is wrong – but who knows how wrong?

This is especially true in the high-end areas, where prices might be wrong by a million or two.

Well said Jim. It seems like the high-end homes just sit. I have a whole cart of properties I’m watching in MLS right now and the high-end ones can tend to sit for hundreds of days without any price changes. The seller maybe doesn’t have to sell, but a big part of it is the seller waiting for that one buyer to come along. Does a buyer exist at that price level? That’s the real question. Of course there are unicorn properties where unicorn buyers will simply take a while to find. But most of the time it seems like a price issue. It’s like that $250M “record-breaking” listing in Bel-Air last year that’s now priced at $150M because it didn’t sell…

Hi Ryan…all good stuff here! I have helped several 1st time buyers move from their rentals in past couple of years. They are tired of increasing rents and/or forced to move. Rental demand will also come into play when the recession comes. If rents soften or incentives are offered that will reduce housing demand.

I agree that we often focus on prices but there are other factors that the next “slow down” could see. Such as longer DOM, (days on market), more seller concessions and improvements. Today’s buyers are lot more picky. They expect move-in ready at today’s price. Then of course, I am watching inventory and it remains very low. I suspect if there is a slow down coming Inventory has to rise before prices are even affected. Thanks for a great blog…I read it all the time

Thank you very much John. I appreciate the kind words. That’s encouraging to hear.

Yeah, let’s keep watching rents. Lately rental growth has been slowing down like home price growth. It’s still been moving forward, but not at such an aggressive rate. If the economy struggles, that could be a factor to help soften rents. I sure wish it was easier to build in California though. That’s the real solution. We need more units.

Great post Ryan. Let’s see a graph of appraisal volume during recessions. That might be hard to get, but loan volume during recessions might be one interesting to check out.

Thanks Gary. Yeah, that’s on point and it’s exactly why I said we can’t just focus on prices. What is happening with sales volume? Loan volume? New builds? I may hit on that in the future. No time today (and my post was already getting longer (again)).

I don’t think there is a coming “recession”.. I truly believe it is News Rhetoric repeated over and over again hoping to create negativity in the minds of those who aren’t paying attention.

The economy is great and better than it has been in a while. I’m not buying into it…

Thanks Patricia. I appreciate your sentiment and I know you are not alone in feeling that way either. I hear you on hype and news. We really need to sift carefully what some voices are saying out there.

My take is that at some point it makes sense to see a recession because recessions are part of the rhythm of the economy. One of my favorite graphs is actually this FRED one with mortgage rates from 1970 onward. The gray bars in the background on the graph are recessions. I like this view because when we look at nearly 50 years it’s clear recessions happen regularly over time. They don’t always happen after an exact number of years, but at some point we are due. But what would the severity be like? That’s the big question. https://fred.stlouisfed.org/graph/?g=NUh

I find myself having this conversation almost daily with people, so it’s definitely on people’s minds. My post really just consists of stuff that keeps coming up in conversations.

People who say they’re waiting on a crash to buy are reacting from fear and will always be afraid of the next thing. If a crash happens like last time (unlikely, I agree with your assessment Ryan) that same person won’t buy even at reduced pricing because they’re afraid they’ll lose their jobs or will buy into a declining market or…

Great thought Erik. Thank you. There’s no shortage of fear out there.

On a related note, I just shared a SacBee story on Twitter from 1988 yesterday and it’s fascinating to see common

narratives to today’s market. Despite prices being much lower compared to now, people were still struggling with affordability. On some level we have to realize affordability in California is an ever-present issue. https://twitter.com/SacAppraiser/status/1169360667389784064

Rarely seen a recession in a pending election year…..just after.

Yeah, I hear you. There was a recession in 2008 though (and in early 1980). We’ll see. I’m not one to prophecy specifics. I just know this is on people’s minds, which is why it’s worth talking about. I have been having this conversation constantly lately.

Some people say a recession is most likely to happen over the next three years in light of the inverted yield curve. In my mind a three-year window is a pretty generic prediction.

Part of the heightened conversation lately may relate to the reality of nearly 8 years of price growth since the market bottomed out in 2012. I think the concern of being closer to the top of a price cycle only exacerbates this conversation.

In a place of uncommon economic conditions and regulatory changes. Also changing inter generational buyer patterns.

See? Feds came out today to say economy, jobs etc are good and they are not expecting a recession….

Thanks. Now let’s see who is right and how the message evolves in coming weeks and months. Let’s hear some voices interpret the Fed’s announcement too. I’ve only read some economists briefly on Twitter and I’ll have to read more. The Fed also mentioned today significant risks and the global economy slowing.

Many people talk about a recession coming, but that doesn’t mean it is happening now or that it will happen over the next few months. Some have said 2021 or even 2022. I don’t make predictions, and I don’t have a horse in this race, so I don’t really know. I will continue to watch the market though and engage in these conversation. Thanks Patricia.

You make some great points, Ryan. In the end, as I think you alluded to, we really don’t know what will happen until it happens. There are a lot of prognosticators out there who think they know how it will go down and some who may even look forward to it as a means of effecting political change. It will be interesting to keep an eye on things.

Thanks Tom. I appreciate your take. It’s interesting as I’ve had quite a few conversations about politics since this post went live. I get that some would use recession talk for political purposes, but I’m more interested in housing and I’m aware of the rhythm of recessions we see over time (irrespective of politics).

Let’s keep watching the market and sifting news…

Ryan,

I recall seeing a real estate email come across from a bay area realtor this week that the prices are down 10% YTD and 6% MTD. Volume is down 7% YTD and 3% MTD.

Historically, has there been a leading/lagging correlation between silicon valley prices going up/down and an effect on Sacramento prices? I wonder if Silicon valley goes down first for some time and then maybe it comes here? Any insights from past experience on a leading/lagging correlation?

Hi Samuel. I don’t have exact stats here, and someday I need to make some visuals to more exhaustively study the issue, but there is a connection between the markets. What happens in the Bay Area can certainly affect us here. Of course we have 27,000 Bay Area residents moving to Sacramento each year too per the Greater Sacramento Economic Council.

I know some in Sacramento who say the Bay Area is a leading indicator for the market here, but I’m not willing to go there for now without digging deeply into the numbers. It sounds like it could be true, but I’m anal about saying stuff without the numbers to specifically back it up. So generally I’d just say there is absolutely a connection and it’s hard to imagine a sagging market in the Bay Area and Sacramento not experiencing some of that.

With that said, it’s interesting to compare the Freddie Mac Price Index for SF vs Sacramento vs San Jose vs United States. On one hand when looking over the past 40 years it looks like the Bay Area generally corrects before the Sacramento market, so I understand when people say the market there is a leading indicator for Sacramento. But in 2005 Sacramento looks to have softened first (just barely). Thus in my mind this underscores the reality that there is no one rule where the market in one place will ALWAYS lead or lag. Here’s a link if you want to play with the graphs and see what you can observe when comparing the United States, California, and different metros. http://www.freddiemac.com/research/indices/house-price-index.page

On a related note, if the market begins to struggle in the Bay Area, I would suspect we could see some sellers want to cash out there and target Sacramento. That’s definitely something on my radar. Moreover, we have to remember that while the markets in Silicon Valley and Sacramento are vastly different, if the economy is struggling or there are big factors facing the entire state, it makes sense we’d be seeing some similarities in trends despite big location differences.

One more thing. I’ve been watching some Bay Area stats and the median price was down quite a bit in June, so I’m anxious to see what stats show in coming months. Though I’d also like to see other price metrics such as average sales price and average price per sq ft. I read one article that only focused on the median price and I was left wondering what the other price metrics were showing. I’m not sugar-coating a slowing market, but only saying I’m thirsty for more context in some of what I’m reading.

Ryan, I posted an article on the National Appraisers Forum on Yahoo Groups yesterday.

It gave comparisons for major metro market areas for the last 12 months compared to the prior year.

The Sacramento Metro area showed a -3% change in the last year, compared to +9% the prior year.

While the numbers are not huge, not double digit, the trend is there. Not as bad as say, Las Vegas that went from +17% to -8%, or worse yet, Boise that went from +16% to -12%.

Lowered interest rates, the lowest since the Eisenhour Years of the 1950’s has not been enough to spur sales. Sales volumes have been declining since the beginning of last year.

When sales volume declines, prices tend to follow, especially when the sales volume declines have occurred for more than a year.

Our industry is reticent to say the market is going down. Some will not say it until clients demand it be measured.

Personally, I do not care if the market is going up rapidly or down. I have measured outlying markets that went up more than 50% in one year, only to see them decline as rapidly when the market segment that was driving them pulled out.

Is -3% enough for appraisers to start making negative Time Adjustments, perhaps not, but worthy of note. Well, worthy if one were to use the number to add context to what is happening in the neighoohood or market segment the appraiser is working in.

Example, if the Metro market went down -3% in the last year, but, say Rocklin went up 6%, it is worth nothing that the local market is performing better than the Metro market area.

As appraisers, we should be aware of what the clients, and those up-line from them can retrieve on point. Meaning, many can see what the Metro area is doing but not the local market.

Knowing this, causes me to report both to forestall questions after the appraisal is delivered.

Thanks so much Steve. I always appreciate your take and how much you give to appraisers also. I’m curious what sort of metric you are looking at to show 3% because I’m not seeing that in the stats by county or region in Sacramento. We’re actually up right now, which I just wrote about this morning. I’m with you though in that I don’t have a horse in this race, and when the market turn it’ll be my duty then to tell the story of value just as I do now. It’s just there are different talking points when a market is going down. We’re still measuring it though.