Half the homes in the country lost value since last year. This is a big headline from Zillow, and I want to unpack that today before the holiday officially comes. I think it’s important in real estate to understand what people are saying about the market.

UPCOMING SPEAKING GIGS:

12/9/25 Downtown Regional MLS Meeting

12/10/25 SAFE Credit Union (TBA)

1/13/26 Residential RoundUp via Zoom (register here)

1/14/26 Windermere EDH / Placerville

1/20/26 Carlile Group (private event)

2/11/26 San Joaquin County presentation (TBA)

2/20/26 PCAR

3/25/26 Coldwell Banker EDH

4/14/26 Culbertson & Gray

10/2/26 PCAR

HOUSING CONVERSATION AT THE DINNER TABLE

I don’t recommend it, but if conversation isn’t spicy enough on Thursday while you’re with your people, here are some housing topics to bring up. Which one would rile up grandpa the most? Haha.

In all seriousness, I hope you deepen relationships this week. May you be filled with deep joy regardless of your circumstances.

ZILLOW’S SENSATIONAL HEADLINE

Zillow published a piece last week stating 53% of homes in the United States lost value over the past year, and it’s gone viral online. What really caught my eye was the locations with the most losses. Check out Sacramento ranking third on the list with 88% of homes said to have lost value – only behind Denver and Austin. I’m not surprised to see Sacramento make the cut since I’ve been talking about softer prices for many months now. But it’s also easy to get sensational with this headline because it sounds worse than actual market change.

If you’re in one of these top markets, what do you think of these stats?

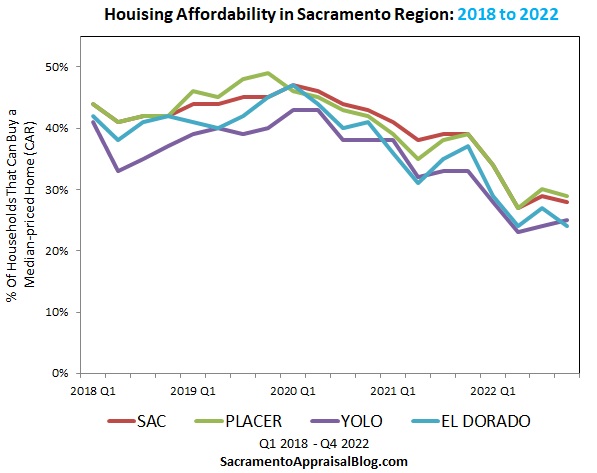

ACTUAL VALUE DECLINES AREN’T SENSATIONAL

In short, 88% of homes losing value sounds really big, but how much did prices actually go down? Well, Zillow’s price index for Sacramento is down 2.3% from one year ago, and traditional metrics are hovering somewhere around that level depending on the month (they’re bouncing around). I like to say it’s been a slow burn for price change despite glaring affordability issues. Supply just hasn’t built enough to create quick change. I’m not sugarcoating here. I’m only pointing out the 88% headline sounds way more sensational than actual market change. All that said, a positive here is affordability has improved slightly for buyers. This isn’t a major change, but a little relief is welcome.

By the way, I’m not saying Zillow’s numbers are perfect for Sacramento either, though their numbers have been pretty reasonable so far compared to other metrics I’m watching. I’ll keep reporting on many different metrics to help us have a wide view of the trend. I’m also not a Zestimate fanboy, but it’s interesting to consider what percentage of Zestimates have dropped below last year as shown above.

A BIG THANK YOU

Thank you so much for this year. I am beyond grateful for the relationship we’ve built and the business we’ve done together. Thank you for your continual support. I know this has been a tough time in real estate for so many over the past few years, so I don’t take it for granted that I’m surrounded by amazing people who have blessed my life and business.

Thanks for being here. I hope this was helpful.

LEAVING COMMENTS: The captcha is not working perfectly. If you open up a new browser, that should solve the issue. It’s been a problem to comment when clicking from my weekly email. My apologies.

Questions: Which housing topic are you bringing up at Thanksgiving? And does anyone else feel like turkey is overrated?

If you liked this post, subscribe by email (or RSS). Thanks for being here.