It’s been a stunning first half of the year for the housing market. Let’s talk about some of the bigger issues right now. Here are some things on my mind including weird stats, the anniversary of the market peak, Matt Rife tickets, and being ready for the second half of the year. I hope you get something out of this, whether you’re local or not. Skim by topic or digest slowly.

UPCOMING (PUBLIC) SPEAKING GIGS:

6/30/23 Halftime report with Ben Johnston 10am (Zoom)

7/20/23 SAR Market Update (in-person & livestream)

7/26/23 Fair Mortgage (details TBD)

8/18/23 Details TBD

10/23 SAR Think Like an Appraiser (TBD)

SELLERS ARE STILL SITTING BACK

New listings have been down about 40% compared to last year, and this has changed the market in Sacramento. We’re missing about 5,400 new listings from last year and 7,500 from the pre-pandemic average. Yikes!!

THE SIX-MONTH STREAK WAS SNAPPED

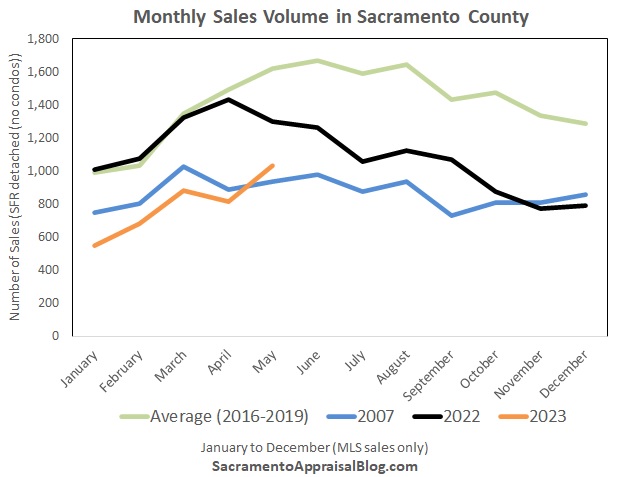

We had the worst volume ever for six months in a row, but May was finally better than 2007 levels. Should we throw a party? Haha. Technically the streak has been snapped, but let’s give it some time before hyping this as a trend.

ONE YEAR ANNIVERSARY OF THE MARKET PEAK

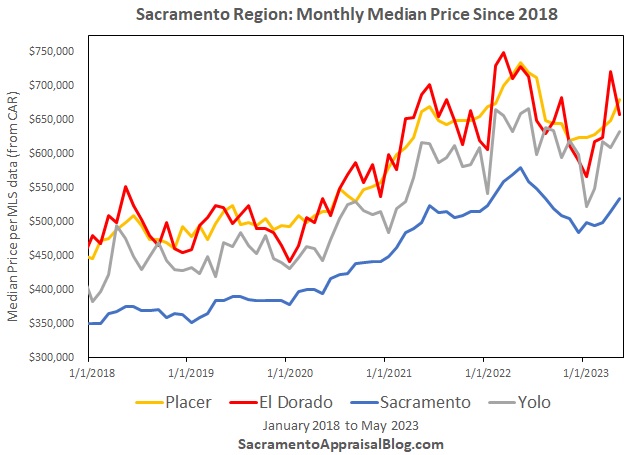

Prices peaked one year ago, and it’s been a wild ride since. Someone told me prices are back to peak levels, but I’m not seeing that in county or neighborhoods stats. If you are, let me know which areas.

NOTE: Some stats are starting to get weird when comparing to last year.

RATES ARE THE X-FACTOR FOR THIS MARKET

Low mortgage rates are keeping many sellers in their homes, and higher rates have been keeping many buyers from purchasing. That’s what’s so weird about today’s market. We have a situation where lower supply has met lower demand. Some people are saying things like, “Bro, this market is resilient, and nothing can hold it back.” Yeah, but if sellers were listing like normal, the market wouldn’t be competitive like this. Anyway, when thinking of the future, if rates go up, it takes demand out of the market. If rates go down, it’ll create more demand. Sorry, I know that’s obvious. But backing up, it’s likely easier to unlock demand than supply. I heard Michael Zuber put it this way first, and I agree with him. In other words, it will likely take more to move owners sitting on sub-3% rates than bringing buyers back into the market.

DECENT PRICE GROWTH THIS SPRING

Here are some different ways to visualize price growth. Which one do you like best? The median price grew 8.82% from January through May this year, which is a decent amount, but slightly lower than normal. Frankly, it feels astonishing though after an ice bath market for the second half of last year. Keep in mind this doesn’t mean every property grew in value by 8.82%. My advice? Don’t be rigid about the median (look to the comps).

STATS ARE GOING TO GET WEIRD (PLEASE READ)

Some stats are going to get weird as we compare this year to last year. For instance, sales volume for May 2023 was down about 20% from last year, which is SO much better than numbers from previous months. The issue is we’re now comparing today’s market with a depressed year in 2022. A better way to look at the numbers is going to be a comparison to the pre-pandemic normal, which shows volume is still down about 37%. Look, this is nerdy stuff, but there are going to be false narratives spun based on awkward comparisons. And some people will flex hard about how bad it is to compare to last year, but that gets problematic because we need to know these numbers. Moreover, there is tremendous value in comparing prices, days on market, and inventory, so a blanket statement about not comparing to last year seems off.

GOING BEYOND NORMAL

Many stats lately have crossed beyond a normal level, which means the market has become more competitive than usual. It’s stunning to see this since we had such an ice bath market in the fall of 2022. For instance, the percentage of multiple offers this past month is higher than the peak of every other year between 2017 and 2020. That’s stunning, right?

We also see crossing over when looking at properties selling above and below the original list price (see the black line crossing the red line). The market isn’t as competitive as 2021 (orange), but we’re now beyond normal.

Also, days on market is starting to be more competitive than usual lately.

LOOSENED A LITTLE, BUT STILL TIGHT

The market has loosened up a bit, but it’s still really tight out there. What I mean is we have more active listings lately compared to the number of pendings, but there still isn’t much selection for buyers.

MATT RIFE TICKETS & HOUSING SUPPLY

Comedian Matt Rife is the latest example of shows selling out and people being outraged with Ticketmaster issues. Matt Rife is coming to Sacramento, and his show sold out here soon after tickets went live. Anyway, I can’t help but think of the housing market and the challenge to find a home today (especially something affordable). Last year the market experienced a sharp change up with inventory, but this year it’s been a sharp change down.

PLANNING FOR THE SECOND HALF

Here’s a visual I’ve been using in some of my presentations to list some of the things we tend to see during the second half of the year. This isn’t an exhaustive list, but it hits most of the main stuff. Keep in mind we are about to begin the second half of the year with more competition than usual, so there’s more room to soften before we feel “normal” so to speak. I’ve been noticing fewer multiple offers in the pendings and a slight increase in active listings, so it does seem like some of the typical seasonal slowing is starting to show up. This doesn’t mean the market is slow either, so save your hate mail. The dynamic is also way different than one year ago too, so be careful about imposing what happened in the second half of 2022 on today. Ultimately, it’s key to know what normal looks like so we can anticipate the market ahead (whether it’s a regular pattern or we see an extended spring season since conditions are so lopsided). Let’s keep watching.

RECAPPING THE STATS

Look, recap stats are getting a little weird right now with sales volume since May 2022 had lower volume, but many annual recap stats are incredibly valuable. Let’s not throw out stats like prices, inventory, and days on market just because volume stats are wonky.

YEAR-OVER-YEAR

MONTH-TO-MONTH

And let’s not forget month-to-month visuals.

I hope this was helpful.

SHARING POLICY: I welcome you to share some of these images on your social channels or in a newsletter. In case it helps, here are 6 ways to share my content (not copy verbatim). Thanks.

Thanks for being here.

Questions: What has stood out to you most about 2023 so far? What are you seeing right now in the trenches of escrow? Did you get Matt Rife tickets?

If you liked this post, subscribe by email (or RSS). Thanks for being here.