FHA loans have dominated the local market in the Sacramento area lately, haven’t they? This is why many buyers and sellers are paying careful attention to FHA guidelines. I get calls all the time from concerned sellers, prospective buyers, and real estate agents about FHA compliance issues. The question is usually, “will _________ be an issue for an FHA loan?”

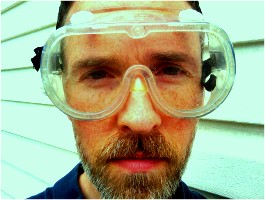

FHA has a very specific set of minimum requirements. If you are planning to sell your house and you think the most likely buyer is going to be using an FHA loan, then strap on your “FHA goggles” to view your property like HUD does. Or if you are purchasing a house, it’s important to be aware of condition issues that may impact qualification for an FHA loan.

FHA has a very specific set of minimum requirements. If you are planning to sell your house and you think the most likely buyer is going to be using an FHA loan, then strap on your “FHA goggles” to view your property like HUD does. Or if you are purchasing a house, it’s important to be aware of condition issues that may impact qualification for an FHA loan.

What does it take for a property to meet FHA minimum guidelines? FHA is primarily concerned that everything in a house functions properly and that there are no health and safety issues. FHA continually says, “Soundness, Safety & Security” as their motto. It’s okay if there is some deferred maintenance, but if there is any issue that may pose a threat to health, safety, soundness or security, then it needs to be solved. Examples might include chipping paint, mold, missing appliances, an inoperable HVAC, a broken water heater, dangling wires, trip hazards, etc… You can see a more detailed list of specific requirements in a previous post.

Quiz Time: Now that you have just a bit of information about FHA compliance, take a look at the image below. What do you see that might pose a safety risk and be unacceptable to FHA? Comment below.

Keep me in the loop if you have any questions or if you need to hire my “FHA goggles” to help you make a decision when selling or buying a house. And don’t worry, I don’t actually wear goggles like this on inspections. 🙂 You can reach me at 916.595.3735, on Facebook, or ryan@LundquistCompany.com.

It’s my youngest son’s birthday tomorrow and it’s also the one-year anniversary of the

It’s my youngest son’s birthday tomorrow and it’s also the one-year anniversary of the  Secondly, the consumer pays more for a real estate appraisal now. Under the direction of HVCC, appraisals geared toward Fannie Mae & Freddie Mac cannot be ordered directly by a lender or broker, but must be ordered from a neutral third-party (often times an AMC – Appraisal Management Company). These companies charge the consumer more than what an appraiser would typically charge, and many times pay the appraiser quite a bit less than what is customary in the market. There are some upstanding AMCs out there that I am thankful to do business with, but on the other hand it’s too bad to see some companies really taking advantage of the situation at hand. For example, I received an email yesterday from an AMC offering appraisers $125 for an appraisal order, while their website shows fees at nearly $500.

Secondly, the consumer pays more for a real estate appraisal now. Under the direction of HVCC, appraisals geared toward Fannie Mae & Freddie Mac cannot be ordered directly by a lender or broker, but must be ordered from a neutral third-party (often times an AMC – Appraisal Management Company). These companies charge the consumer more than what an appraiser would typically charge, and many times pay the appraiser quite a bit less than what is customary in the market. There are some upstanding AMCs out there that I am thankful to do business with, but on the other hand it’s too bad to see some companies really taking advantage of the situation at hand. For example, I received an email yesterday from an AMC offering appraisers $125 for an appraisal order, while their website shows fees at nearly $500. Ultimately, I’m thankful that HVCC only applies to loans geared toward Fannie & Freddie (HUD/FHA has something similar in place now too). I still do many appraisals for investors, Realtors, and home owners, and these types of valuations are NOT affected at all by HVCC. Of course I’m not immune to some of the consequences of HVCC as I mentioned above, and the whole thing upsets me, but I’m choosing to focus on other things. I may be limited in business right now with what I can do for loan appraisals, but I can still chase other avenues of appraisal work such as bankruptcy, divorce, estate settlement, investor valuations, and assignments from local governmental agencies. In fact, just yesterday I had another Sacramento estate settlement retrospective appraisal come my way.

Ultimately, I’m thankful that HVCC only applies to loans geared toward Fannie & Freddie (HUD/FHA has something similar in place now too). I still do many appraisals for investors, Realtors, and home owners, and these types of valuations are NOT affected at all by HVCC. Of course I’m not immune to some of the consequences of HVCC as I mentioned above, and the whole thing upsets me, but I’m choosing to focus on other things. I may be limited in business right now with what I can do for loan appraisals, but I can still chase other avenues of appraisal work such as bankruptcy, divorce, estate settlement, investor valuations, and assignments from local governmental agencies. In fact, just yesterday I had another Sacramento estate settlement retrospective appraisal come my way. I get a lot of questions about FHA / HUD standards and what a property needs to qualify. Here’s the deal: FHA is primarily concerned that everything in a house functions properly and that there are no health and safety issues. FHA continually says, “Soundness, Safety & Security” as their motto. As an FHA certified real estate appraiser, the inspections I do are based upon guidelines from the United States Department of Housing & Urban Development (HUD).

I get a lot of questions about FHA / HUD standards and what a property needs to qualify. Here’s the deal: FHA is primarily concerned that everything in a house functions properly and that there are no health and safety issues. FHA continually says, “Soundness, Safety & Security” as their motto. As an FHA certified real estate appraiser, the inspections I do are based upon guidelines from the United States Department of Housing & Urban Development (HUD).