Cash stats showed a decline last quarter and properties are taking slightly longer to sell. What do you make of that?

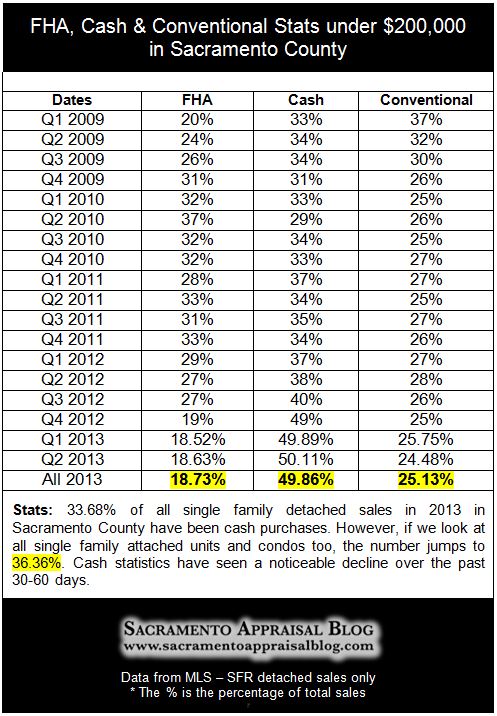

I mentioned in early June that cash sales in Sacramento County were down slightly from the previous quarter. Since the data at the time was based on sales in only April and May though, I wanted to see how the last month of the quarter would steer the stats. Let’s take a look below to see what the numbers tell us now that the month of June has closed.

As you can see, there were definitely less cash purchases in Sacramento County from April to June 2013 (Q2) since cash sales decreased from 36.3% to 31.8% of the market. Stats in both Placer and Yolo County were also down.

The market under $200,000 still continues to be a cash feast though and has not changed much as 50% of all sales continue to be cash for the third quarter in a row. In light of the median price skyrocketing over the course of the year, the market under $200,000 has become far more competitive for first-time buyers and investors. I don’t see this letting up any time soon so long as rates remain relatively low and inventory continues to hover around one month of housing supply. The vast bulk of cash purchases are still under $200,000 in Sacramento County, though keep in mind about 25% of all sales between $200,000 to $300,000 were cash in Q2. That’s a strong market segment.

What does this mean for the market? Ultimately less cash has seemed to create SLIGHTLY more opportunity for owner occupants. Take that with a grain of salt of course because the market is still HEAVILY in favor of sellers since there is only a one-month supply of inventory available. I don’t know about you, but I’ve been noticing in my appraisals over the past few weeks that the Days of Market (DOM) for current listings has been slightly higher than the DOM for closed sales over the past quarter. This means properties are taking a bit longer to sell than they were during previous months. I’ve been hearing a similar thread from some Realtor and investor contacts also. Yes, there are still properties being sold in days of being listed and there are multiple offers too. There is just a very subtle dynamic going on right now as explained above, and we’ll see where it leads.

By the way, I appreciate Realtor Doug Reynold’s take on the market in one of his recent YouTube videos as it compliments some of what I’m seeing. Give it a watch or listen above (or here) and let me know what you think.

UPDATED ON 07/05/2013: I wanted to clarify that these stats do not apply to every single neighborhood and every single niche market in Sacramento County. When determining trends for a neighborhood, it is very important to look at hyper-local neighborhood data.

Any thoughts?

If you liked this post, subscribe by email (or RSS). Thanks for being here.