Weird. That’s a good way to describe today’s housing market. On one hand prices are still pretty high, but volume has fallen off a cliff. This week I was talking with a broker who has been in business since the 1970s, and he told me he’s never seen a market like today. Exactly. This is new territory. Anyway, below I want to unpack some trends, show a seasonal peak has occurred, and talk about a big stat mistake right now. I know I’m unpacking Sacramento, but many areas across the country are showing a similar dynamic. I’d love to hear your take in the comments.

Scroll quickly by topic or digest slowly.

UPCOMING (PUBLIC) SPEAKING GIGS:

8/18/23 Market & Mimosas (register here)

8/29/23 Elk Grove Regional MLS Meeting

9/26/23 Orangevale MLS Meeting

10/4/23 KW Sac Metro Big Market Update (register here)

10/6/23 SAR Think Like an Appraiser (TBD)

10/27/23 AI Fall Conference (San Francisco)

I GUESS IT’S HARD TO PREDICT RATES…

In the beginning of the year there was so much optimism about mortgage rates going down, but that hasn’t panned out. It’s a good reminder that nobody can predict the future with certainty. Be careful about promising the future.

PRICES AREN’T DOWN ALL THAT MUCH

I’m not sugarcoating to say prices aren’t down that much from May 2022 because that’s what the stats are showing. I’ve been seeing this dynamic when pulling county stats, but I’m also seeing it when pulling comps lately in my appraisal reports. I’ve yet to see a neighborhood where prices are higher than the peak, but some agents swear that’s the case. I just haven’t personally seen it in the stats or in appraisals on my desk.

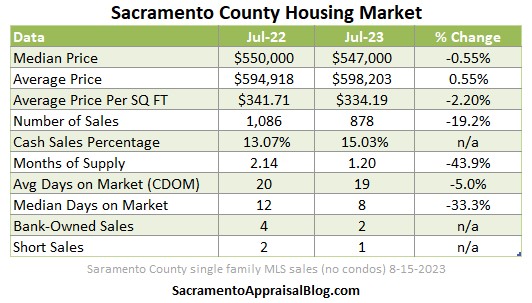

PRICES ARE SIMILAR TO ONE YEAR AGO (BUT STILL DOWN)

Prices are similar to where they were one year ago, but they are still down from the peak in May 2022. I suspect some people will look at year-over-year prices and say, “Bro, we’re back to peak prices,” but that’s going to be a stat mistake.

NOTE: These price metrics don’t translate rigidly to every property, so it would be a mistake to say “prices in the neighborhood are down 5-6%.” Maybe. Maybe not. Look to the comps.

DID PRICES PEAK FOR THE YEAR OR NOT?

Normally the median price peaks in June for the year, but it’s more likely that it will peak in July this year unless a wave of sales close higher in August. It would be weird to see price growth extend another month, so we’ll see. But let’s not get too stuck on the median because it looks like the average sales price and average price per square foot peaked in June as expected.

WEEKLY PRICES SHOW FLATTENING

Okay, it’s a couple of days too early to share this because we need more sales to close, but I want to show you the weekly median and weekly average price in 2023 in black. Do you see how it’s flirting with last year and sort of leveling off too? This most recent week looks to have dipped as it should for the time of year. But time will tell. Like I said, it’s slightly early to share last week’s data.

VOLUME IS STILL REALLY DEPRESSED

Prices are sort of glowing, but volume is depressed. I saw a post this week where someone said sales volume has been normal lately in Sacramento, but that is completely false. I’m not being negative here. I’m simply describing the market that actually exists (which is the market that buyers are sellers need to navigate).

A FEW IMAGES

This visual has over two decades of monthly volume, and it’s sobering. What do you notice about 2023 volume? It’s basically been the worst year ever, and it’s currently flirting with 2007 volume levels.

Here’s a different way to look at the trend. The green line is the pre-2020 normal, and the orange line (2023) is way below the normal trend.

And here’s a cool but chaotic way to see the trend. The percentages below show how much lower 2023 is compared to the pre-2020 normal. Basically, volume in July was down about 37% from the pre-2020 normal in the region.

DON’T MAKE THIS BIG MISTAKE

Let me highlight a big mistake that’s going to be pretty easy to make for the rest of this year. If you work in real estate, my strong advice is to pay attention to stuff like this so you tell a credible story of the market.

When we compare last year with this year, it looks like volume is only down 16%. Is the market back baby? Is volume normal again? I wish I could say it was, but the problem is we’re now comparing today with a slumping year in 2022, and that makes the numbers look much sexier today.

Here’s a better way to look at the trend. When we compare 2023 with the pre-2020 normal, it helps us see that volume is down closer to 38% over the past sixty days instead of just 16%.

Here’s a good way to see what I’m talking about. Placer County in 2023 has a nearly identical level of volume to 2022 (black and gray line). It would be easy to walk away and say, “Bro, we’re back!!!” But the real trend is seen when comparing the black line with the green line (pre-2020 average). I know this is nerdy, but improper comparisons are going to fuel real estate narratives ahead, and this is how people lose credibility.

BIG POINT:

Some of the year-over-year stats are going to get really weird ahead, so be prepared to talk about stuff like this.

DID THE HOUSING MARKET PEAK FOR THE YEAR?

Yes, the market did peak. I want to show you what I mean in the stats. But I’ll say it’s also been more competitive than usual still, and it looks like the spring season has been extended into the summer. As I wrote recently, it’s either a bidding war or crickets, so the dynamic is interesting out there. If you aren’t priced right, you’re going to sit on the market. If you are priced reasonably, it’s go time for buyers. Time will tell what happens ahead, but check out the visuals below to see what I mean about a peak.

It’s starting to take longer to sell:

Fewer homes sold above their original list price:

More properties sold below their original list price:

The percentage of multiple offers has been subsiding since May:

We’re seeing price growth slow (normal for time of year):

New listings likely hit their seasonal peak for the year (Redfin data):

Pendings have been flat lately. Something to watch:

It looks like volume has begun to crest for the year (orange line):

IT’S STILL MORE COMPETITIVE THAN USUAL

Last month properties on average sold about half-a-percent below their original list price, and that’s a more aggressive number for the time of year compared to the pre-2020 average. It’s wild to see stats like this in the midst of a market with low volume and a struggle to afford, but this is the dynamic we have today. In fact, many stats right now are more competitive than normal. Anyway, price stats and the sales price to original list price have been a little stronger than usual for the time of year, which shows we haven’t seen a sharp price change like we did last year. Could rates going higher cool the market? Sure. I’m just saying so far it hasn’t been a sharp seasonal change reminiscent of 2022 vibes. If anything, it seems like the spring market has been a little more extended so far, which makes me eager to see how the stats evolve ahead.

RECAP STATS

And some recap visuals. Please use these on your socials as you see fit (with credit and without alteration). Thanks.

ANNUAL STATS

Remember, some annual stats like volume get a little weird, but this is still a valid comparison we want to know and understand.

MONTH TO MONTH:

I hope this was helpful.

SHARING POLICY: I welcome you to share some of these images on your social channels or in a newsletter. In case it helps, here are 6 ways to share my content (not copy verbatim). Thanks.

Thanks for being here.

Questions: What are you seeing out there in the market? What stands out to you above? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.