Buckle up and let’s take a drive through the past 20 years. Where has the market been over these two decades? Since MLS recently made it much easier to extract older data, I had to do this post. I hope you find it useful or interesting – even if you aren’t in the Sacramento market.

SOME THINGS TO KEEP IN MIND:

1) Data: We are only as good as our data and our ability to understand. Some graphs below are very clear in their trends, but others probably aren’t meaningful because of massive data or an enormous price range.

2) Not back: Many lower-priced areas are not back to their price peak in 2005.

3) Back: Some well-established areas have exceeded previous peaks.

4) Different trends: Not all price ranges, locations, and property types have moved the same way, so let’s be cautious about sweeping generalizations about the entire market. After all, the condo market might be far different from the 2-4 unit market or vacant land.

5) Inflation: Prices might be similar today to where they were in 2005, but that doesn’t mean values are the same. I know, that’s so technical, but when we factor in inflation over 13 years, it’s really not the same thing when comparing today’s prices with prices from 13 years ago. Keep in mind the market today has far different dynamics from 2005 also.

6) Bubble: Graphs like this can often lead to conversations about a housing “bubble.” If it’s relevant, please read peak prices and an open letter to buyers worried about another housing bubble.

SIDE NOTE: I’ve been having major website issues over the past 2 months. I’ve switched hosts, and that should solve the problem of down time.

DOWNLOAD ALL GRAPHS: You can download all images as a zip file. I included both a web-friendly size and larger ones. Please use as you see fit (unaltered). If you post somewhere online I always appreciate a link back.

Rosemont:

River Park:

Meadowview:

Vacant Residential Land:

Million Dollar Sales:

Pocket / Greenhaven:

Rancho Cordova:

Sierra Oaks:

Loomis:

East Sacramento:

Duplex Sales:

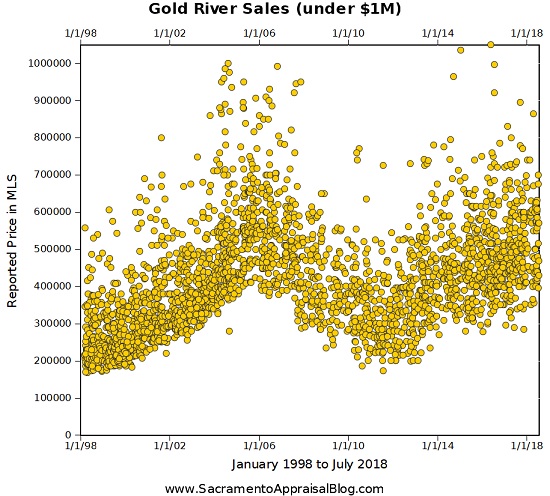

Gold River:

Land Park:

Elk Grove:

Garden of the Gods:

Sales under $50K in Sacramento County:

Del Paso Manor:

Tahoe Park:

Fair Oaks:

Treelake / Ashley Woods (Granite Bay):

Condo Sales in Sacramento County (and Downtown):

Colonial Heights:

College Glen:

Davis:

West Sacramento:

Bella Vista High School Boundaries:

Arden Park:

Folsom:

Arden Manor:

95815 Zip Code:

4-Unit Sales in Sacramento County:

Roseville:

I hope this was interesting or even fascinating. I’m intrigued and excited about having more data at my disposal (thank you Metrolist). Thanks everyone for your graph suggestions too. I reached out on Facebook, Twitter, and LinkedIn and got to most of what people asked for, though I couldn’t do them all.

Questions: What are your thoughts about the market after seeing the graphs above? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

Great post Ryan. It looks like you put a lot of work into it. I love the vacant land graph.

Thank you Gary. Yes, this was a ton of work. Now I’m excited to have these graphs at my disposal to add to them as I see fit (and add other layers and such). I really like that graph too. It’s a good reminder that not all markets are the same. There was rampant speculation on land before the previous bust, and that sort of speculation just isn’t happening at large in today’s market.

Awesome graphs Ryan! I really enjoyed the journey. It’s fascinating to look at. Very cool post!

Thank you Jamie. I wonder what graphs like this would look like throughout the country.

That would be great to see! I would like to put these kinds of graphs together. I just need to set aside the time to do it. I appreciate your hard work that we all benefit from!

Thanks Jamie.

I always find your graphs so intriguing, Ryan. Many have the same distinct look where you can easily see the peak in or around 2006 and then the fall and rebound. The Birmingham area is not like that. I guess every area has its own “fingerprint” of sales characteristics. Keep up the great work.

Thanks Tom. It really is fascinating to see the market like this. I appreciate seeing how different price ranges and property types have trended too. That’s interesting to hear about your market. I guess it’s a good reminder that trends are different everywhere and there is no such thing as “the national market is doing such and such” like we see in so many articles.

Hey Ryan,

Inflation is a fair argument but from searching around a bit, real incomes adjusted for inflation haven’t went up as fast, have they?

Hi Jeremy. Thanks for the comment. All I’m saying is $400,000 today isn’t the same exact thing as $400,000 from 2005 because of inflation. So if I say, values are the same as they were in 2005 in my neighborhood, that technically might not be true. It would be accurate to say prices are the same, but values really aren’t because of the way the dollar has changed in light of inflation. I hate to even talk this way because it sounds super geeky and too technical, but according to an inflation calculator $400,000 in 2005 at the top of the market would have the same purchasing power as $513,000 today.

Let’s be real though. I honestly don’t think the market cares about this technicality because people only see the total price figure of a purchase. Besides, a mortgage is not adjusted for inflation either. Yet when comparing stats today with high stats from the past thirteen years ago, I do think this technicality is at least worth basically understanding (even if the market probably doesn’t even care).

Anyway, I haven’t looked up income stats, so I’m not sure exactly, but our economy has NOT been vibrant by any stretch. It seems like things are picking up a bit, but I don’t think it’s much more glowing that it was just prior to the recession. One of the big troubles in our market is prices have seemed to outpace wage growth, so we are starting to have more struggle with affordability (both rents and purchases). We have lofty real estate stats, but it hasn’t been the economy that’s driven the market unfortunately. I wish it was.

Thanks for your take. If you have any thoughts, feel free to pitch them in. Now that you have an approved comment you can comment freely without moderation.

*drools over all the juicy data

Bravo Ryan, bravo indeed. Extremely informative.

Too cool. Thanks Wes. I appreciate it.

Thanks Ryan!

The market is collapsing under its own weight with rates still historically very low. Wait until the business cycle changes with some joblessness and other recessionary headwinds. This is gonna be a rogering.

Credit card rates at all-time highs and massive consumer debt. We have all seen this movie before. I was a year early in my calls for a crash. But it seems to be coming to fruition.

This isn’t seasonal anymore. The slowdown in demand with supposed low inventory? Ha. Just wait until the inventory picture changes and supply comes online. Oh yes, ‘but but but there hasn’t been new construction and it is a basic supply/demand scenario.’ Negative ghost rider. Supply can change over night when people become sellers. Supply is plastic, it isn’t a fixed number. It will change. It IS changing.

That is my call, they don’t call me Mr. Miyagi because I don’t know what I’m talking about!

Thanks Mr. Myagi. Let’s keep watching the stats closely and listening to the market. There are many sensational headlines out there about the market beginning to crash in other places. People are really paying attention to these too. I can’t tell you how many Facebook threads I’ve seen that say things like, “What’s happening?”, “Is this seasonal or not?”, or “Is this Sacramento or just “national”? Granted, some of the articles seem like they’re not really providing good data though to be fair. Or my sense is the article title is total doom while half the article talks about red flags in the market (duh), and the other half talks about what could happen.

I’ll say this for Sacramento. Sales volume in the region has been down slightly for the past two months and my guess is it will be down slightly again for July based on the number of sales so far. We really have to watch what happens with sales volume in coming time as well as inventory and the sentiment in the market. It’s not down significantly, but seeing subtle changes is something we need to pay very close attention too.

It doesn’t matter that inventory is still low. Having a housing shortage is not the trump card for values continuing to rise. There are many factors that make the market move. Theoretically it’s possible to see softening or declining values despite a housing shortage. Thus supply and demand isn’t always the main force in the market.

Let’s keep watching.

To me it all boils down to whether or not one believes the last RE bull market in 06 was a bubble or not.

If you’re like me and you think 06 was a bubble (regardless of the driver being easy debt–high prices were still the result, the driver doesn’t really matter) then 2018 is also a bubble.

I really think it’s that simple. If it was a bubble then it’s a bubble now. They did not get to where they are because of wage growth, it was from global QE and low rates, period. Now we are back at those same levels from monetary policy and this time it isn’t a bubble?

Same deal in Australia, same deal in Seattle, same deal everywhere. Look at any local newspaper of any town in the US right now and they all say the same thing. Rising real estate prices and no vacancy rate and high rents. BUBBLE.

Prices are again totally disconnected from economic fundamentals and there will be a mean reversion. The only question is what the government and Fed try to do to stem the losses and stop price discovery again. And will it even work this time around? I think the current bubble-status is settled fact though.

I’d love to hear an argument from someone who thinks this thing will just ‘flatten out’ into a healthy market. That makes zero sense to me. There are two sides of the mountain. We have to go down it to normalize. Go ahead, ‘I’m listening…’ (Dr. Frasier Crane voice.)

Thanks Mr. Miyagi. I appreciate your take and I agree with you that prices are disconnected from the economy. I’ve been saying for years that they’re inflated. They are.

Right now we can see the byproduct of years worth of historically low interest rates and heightened investor activity. Six years of insanely low rates has been like a steroid for the market because it’s made prices so affordable. Well, they were affordable at first. Now prices are getting less and less affordable because of how much they’re risen.

Let’s keep watching.