I have three things on my mind today. Let’s look at the accused Golden State Killer’s house, a new visual I’m testing out, and some fresh stats.

Huge thanks: First off, thank you for reading my blog this year. This will be my last post of 2019, so I wanted to say I’m truly honored to have you here and I hope you’ll continue to journey with me into the new year. As always, I’m open to your ideas too, so hit me up if you have topics in mind.

GOLDEN STATE KILLER: There’s no holiday cheer with this topic, but we’ve been wondering what would happen if the accused Golden State Killer’s house came to the market. Well, now we know. Sort of. This property sold as a private sale to an FHA buyer a few weeks ago. The SacBee did a piece on it here.

What do you notice about the final price?

Unfortunately the home wasn’t sold on MLS, so we don’t really know the details of how the price was established, but it clearly sold at the lower end of the market. Was the low price due to stigma? Could it be due to condition or lack of upgrades? Or maybe it was the owner selling at a discount? We may never know the details, but it’s interesting nonetheless to see.

House History: It’s sobering to think Joseph James DeAngelo, the accused killer (aka East Area Rapist), was pursuing the “American dream” of home ownership while destroying people’s lives. Here’s a history of the house:

- 1980: Bought the house for $77,000

- 1993: Refinance

- 2003: Refinance

- 2012: Refinance

- 2019: Private transfer to family member

- 2019: Private sale for $320,000

SELLING LOWER (NEW GRAPH): I’m testing out a new graph and I wanted to see what you think. Here’s a look at Roseville and East Sacramento. Would you like to see other neighborhoods? The goal is to see how close a property sells to the original list price vs how long it’s on the market. Thanks Braden Gustafson, MAI for the graph inspiration on Twitter.

The takeaway? The longer a property sits on the market, the further it sells from its list price. I know this is what we’d expect to see, but it’s still cool to visualize. By the way, I used the original list price instead of the most recent list price because it’s a more complete picture of the market.

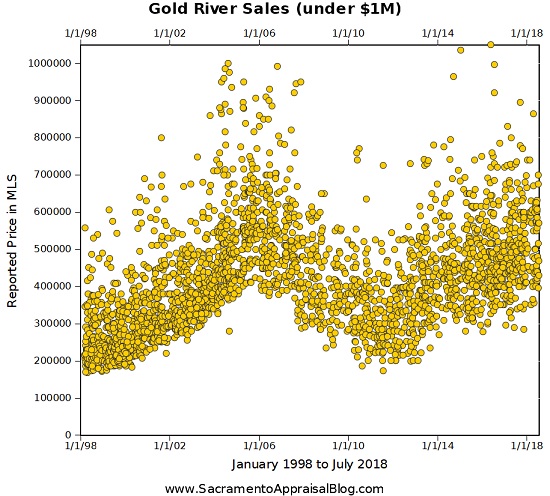

PRICE CHANGE IN NEIGHBORHOODS: Last week I pulled some stats to prepare for an interview with Channel 10 about price dynamics in Oak Park. So I crunched numbers in about a dozen neighborhoods to help get a wide view of both higher and lower-priced areas.

The Sacramento Bee actually did a piece on my stats too.

I looked at both the dollar change and percentage change on purpose as this helps give a well-rounded view of the market. I also looked at huge chunks of data too as this compared almost an entire year in 2012 vs the same time in 2019. The problem with neighborhood data is if we look at one month only, the numbers can end up being all over the place.

NOTE: If you want this data in a PDF, just send me an email.

Again, thank you for being here. From my family to yours, Merry Christmas and Happy Holidays. In coming weeks I hope you get a little time off to connect and reflect. Blessings to you.

Questions: Would you feel comfortable buying this house? Would you expect a discount? Any thoughts on the new graphs or price stats? Anything to add?

If you liked this post, subscribe by email (or RSS). Thanks for being here.