Who are the players in the market? Who is buying and selling? Who is coming? Who is going? These are questions we have to ask to grasp a local market. And for real estate professionals, knowing who the players are helps us serve clients well and sometimes even make future business plans.

Well, let’s talk about a new player in town called Opendoor. This company is trying to gain a foothold in about 20 markets across the country right now. If you’re not local, are they in your area?

Opendoor posted up in Sacramento last year and they’ve begun to make a splash. They’re not dominating the market by any stretch, but in the region over the past few months they bought over 90 homes. I don’t fully understand the fine print of their business model yet, but in a nutshell they buy from owners privately and then put these homes back on the market to sell to the public. In fact, mostly all of their private purchases are currently re-listed on our local MLS. Opendoor also has an affiliation with Lennar – a local builder.

My real estate antennas: Any time I see a group buying a larger amount of homes, I pay attention. In the past I talked heavily about Blackstone, and in the future I’ll discuss other players whether they’re making a splash or shaping the market (like Blackstone did). Any stories or thoughts?

Now for those interested, let’s talk about the market – especially pendings.

I hope this was interesting or helpful.

—–——– Big local monthly market update (long on purpose) —–——–

The market slumped during the second half of 2018, and now it’s an interesting spot. Let’s talk about it.

THE SHORT VERSION:

- Pendings were normal for January

- Sales volume has slumped for 8 months in a row

- Prices are barely up from last year

- Most metrics softened as expected for January

- The market is starting to wake up for the spring

- This post is long on purpose. Skim or pour a cup of coffee.

DOWNLOAD 70+ graphs: Please download all graphs here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

THE LONGER VERSION:

Here’s some of the bigger topics to consider right now.

We need time: We don’t have a totally clear picture for where the market is going yet in 2019. We still need more time. Here is what I am specifically looking for in the stats over these next few months.

Normal pendings: It’s big news that pending sales were normal this past month compared to last January. We’ve had a slump in sales volume for eight months, so what does this mean? Well, it could be the market trying to find some normalcy after two quarters of sluggishness. Though the real cause very likely stems from mortgage rates recently declining. It’s amazing how that can affect buyers and even sales volume. Remember, pendings in January will likely close in February and especially March. So if we start to see a normal level of pendings in January and February, we may see sales volume show normalcy for the time being.

Yeah, most metrics softened: We saw the typical signs we’d expect to see at this time of year with most metrics. It look longer to sell last month, prices dipped, inventory increased, and sales volume sloughed. Though overall the softening in most metrics felt way more pronounced.

Low rates are steroids: Mortgage rates declined and that’s seeming to draw some buyers back into the market. Low rates are like steroids for demand – at least temporarily.

More listings this year: There’s more listings this year compared to last year at the same time. In fact, it’s been about five years since we’ve started the year with this much housing supply.

Waking up: I’m hearing from many agents about more buyer attention on their listings lately. More traffic at open houses. More offers. It’s still to be determined what this spring market will look like exactly, but for now the spring season is starting to move.

Not seeing aggressive price gains: The rate of price change has slowed. What I mean is in years past we’d see 7-10% price increases when running stats, but now we’re seeing modest 2-3% year-over-year price gains.

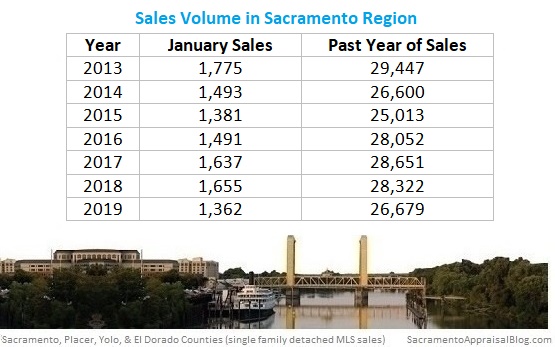

In case you need slumping trivia to impress friends: Last month we saw the worst sales volume in 11 years for a January. We’ve had eight months in a row of year-over-year sales volume declines. That’s a dismal stat and there’s no sugar-coating it. If this trend doesn’t change we’re going to have a much different market. Yet this is why seeing normal pendings for January is a big deal because today’s level of pendings could presumably show a normal number of sales in a couple of months when these properties close.

The Tallest Graph in Sacramento: Here’s a look at over 60,000 single family detached sales in Sacramento County. This graph is inspired by Jonathan Miller.

Less offers: Here’s an interesting way to see the market has slowed. Multiple offers are down about 11% this year.

More concessions in new construction: Lots of builders are offering credits and concessions to help get their deals done lately. This is a symptom of a slower market. It seems more sellers are also offering concessions and credits too. Buyers, don’t be afraid to negotiate with sellers since the market has slowed, but at the same time don’t think you are driving the market either. Keep your perception of power in check. And sellers, talk with your agent about whether credits or concessions might need to be an option on the table.

Final thought before the graphs: In closing, the market is in an interesting spot. It feels like it’s juggling uncertainty from last year with a striving for normalcy today. We only have one month of data and we need to keep watching to see how this market is going to emerge.

I could write more, but let’s get visual instead.

BIG ISSUES TO WATCH:

1) SLOWING MOMENTUM: The stats show the market is slowing down when we look at the rate of change by year. Looking at monthly, quarterly, and annual numbers helps give a balanced view of things.

2) SALES VOLUME SLUMP: It’s important to look at sales volume in a few ways to get the bigger picture. Here it is by month and year.

SACRAMENTO COUNTY:

Key Stats:

- January volume down 21.5%

- Volume is down 4.7% over the past 12 months

SACRAMENTO REGION:

Key Stats:

- January volume down 17.7%

- Volume is down 5.8% over the past 12 months

PLACER COUNTY:

Key Stats:

- January volume down 10.9%

- Volume is down 7.7% over the past 12 months

3) LAST YEAR VS THIS YEAR: Here’s a comparison of last year compared to the same time this year. What do you see?

NOTE: Placer County had very few sales this January, so I wouldn’t put much weight on the price figures for this month.

SACRAMENTO COUNTY (more graphs here):

SACRAMENTO REGION (more graphs here):

PLACER COUNTY (more graphs here):

I hope that was helpful.

DOWNLOAD 70+ graphs: Please download all graphs here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

BLOG BASH: Just a reminder I’m hosting a blog party on March 2nd from 3-7pm. You’re invited to celebrate my blog’s 10th birthday. I know, that sounds a little cheesy. But I’ll be buying the first 100 beers… Details here.

Questions: Any stories to share about who is playing the market right now? What are you experiencing right now in the trenches with buyers and sellers?

If you liked this post, subscribe by email (or RSS). Thanks for being here.

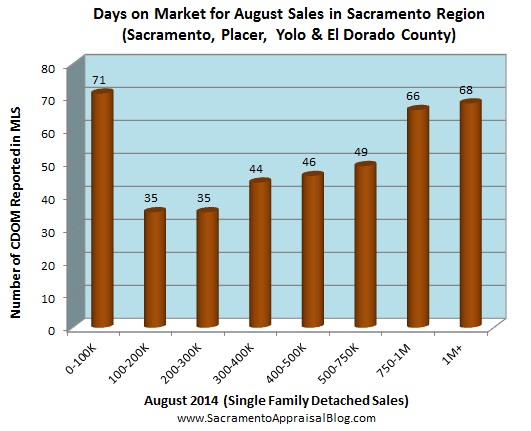

The market is slowing. I’m not saying it’s cold or declining. And this doesn’t mean it’s not competitive either. It is. But there are clear signs the market is shifting for the season. Housing inventory is increasing. It’s starting to take longer to sell. Many prices metrics softened slightly or flattened in June. We’re seeing more price reductions. The sales to list price ratio declined 1%, and even the number of multiple offers declined last month from the previous month in Sacramento County. No matter how we look at it, the market is slowing.

The market is slowing. I’m not saying it’s cold or declining. And this doesn’t mean it’s not competitive either. It is. But there are clear signs the market is shifting for the season. Housing inventory is increasing. It’s starting to take longer to sell. Many prices metrics softened slightly or flattened in June. We’re seeing more price reductions. The sales to list price ratio declined 1%, and even the number of multiple offers declined last month from the previous month in Sacramento County. No matter how we look at it, the market is slowing.

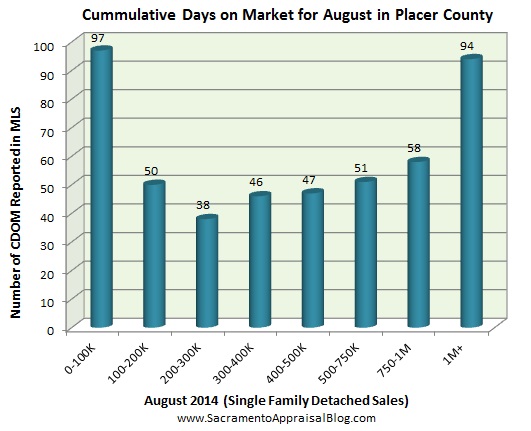

It’s taking two days longer to sell compared to last month: On average it is taking 47 days to sell a home in Placer County compared with 45 days last month. For context it is taking 40 days in Sacramento County and 42 days in the entire region. There were only 2 sales under $100,000, so disregard the 97 days listed above.

It’s taking two days longer to sell compared to last month: On average it is taking 47 days to sell a home in Placer County compared with 45 days last month. For context it is taking 40 days in Sacramento County and 42 days in the entire region. There were only 2 sales under $100,000, so disregard the 97 days listed above.