If you want to understand real estate, it’s important to see the big picture. It’s one thing to unpack trends for a neighborhood or county, but when we take a panoramic view of the region we can often get a fuller sense of how the market is really moving. Buckle up and let’s go for a quick tour of five trends to watch in Sacramento’s regional market. Remember, I do two big market posts around the second week each month, and there are two ways to read these posts. You can scan the highlighted text quickly or take a few minutes to digest what is here.

THE SACRAMENTO REGION:

1) Prices have been flat for three months in the Sacramento Region:

The median price has been the same for three months in the Sacramento Region, which shows the market has definitely cooled off. There may be some sub-markets that are still hot and showing increases in value, but the overall trend for the region is very telling. When looking at the median price, average price per sq ft, and average sales price in multiple counties, the market as a whole has been clearly flat for the past 90 days.

Quote in SacBiz: By the way, I was quoted in the Sacramento Business Journal yesterday in an article about the slow market. Check it out at Slower real estate market could just be normalizing. It’s always an honor to share my two cents. I’d love to hear your take on the market too.

Quote in SacBiz: By the way, I was quoted in the Sacramento Business Journal yesterday in an article about the slow market. Check it out at Slower real estate market could just be normalizing. It’s always an honor to share my two cents. I’d love to hear your take on the market too.

2) Inventory is steadily increasing in the Sacramento Region:

Housing inventory has been increasing in the Sacramento Region over the past several months, which is creating more opportunity for buyers to get into contract (and be more picky). This has also increased competition for sellers to compete for a smaller pool of buyers. Inventory is still relatively low, which means well-priced properties are generating quick and multiple offers, yet there are also ample price reductions since many properties are simply overpriced. Sellers, pay attention to this trend because you need to price your property correctly in this market or it is going to sit.

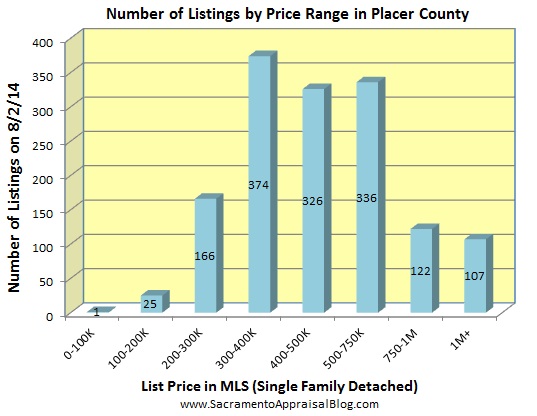

The higher the price, the more inventory there is. This is a normal trend, but it’s always interesting to see, isn’t it? Moreover, when we know how much inventory there is at a certain price range, we can help coach buyers and sellers about what they might expect.

3) It’s taking 40 days on average to sell a house in the Sacramento Region:

Last month it took three days longer to sell a property compared with the previous month, which is one more sign the market is slowing down. Before calling in the troops and sounding the alarm, remember it’s normal for the market to cool off as summer fades away. Generally speaking, the higher the price, the longer it is taking to sell.

Last month it took three days longer to sell a property compared with the previous month, which is one more sign the market is slowing down. Before calling in the troops and sounding the alarm, remember it’s normal for the market to cool off as summer fades away. Generally speaking, the higher the price, the longer it is taking to sell.

4) There are 6% more listings this month compared to last month:

The number of listings jumped by about 6% from last month to this month, while the number of sales rose by just over 2% (pending sales did increase though). Overall since the number of listings outpaced sales and pendings, inventory saw an increase.

5) Sales volume is down by 11% from last year in the Sacramento Region:

Sales volume is down about 11% from where it was last year for the Sacramento region. Why? In large part it’s a reaction to investors stepping away from the market one year ago. Less cash sales in the region created a gap in sales, and the market is simply trying to figure out how to normalize or adjust now that investors have taken their foot off the gas pedal. You can see in the graph above how there has been about the same number of non-cash sales in 2013 and 2014, but the number of cash sales is very noticeably down this year. Keep in mind investors didn’t gut the market in Placer County or El Dorado County like they did in Sacramento County, but what happens in surrounding areas still matters for market trends.

BONUS MATERIAL: PLACER COUNTY

Prices have been flat in Placer County: Just like Sacramento County, Placer County is best described as flat. The median price saw a dip to $379,000 from $380,000 this month, but overall has been hovering around $380,000 for three months in a row after a small seasonal uptick this spring. It seems the peak of summer has hit, so it is likely to see the market soften up over the Fall (which is completely normal to see). Last year the market felt really sluggish though at this time in light of the looming government shutdown. This year we don’t have the same phenomenon, so the market is a bit different.

Inventory saw a very minor decline last month: Monthly inventory saw a very slight decrease, but really it’s still hovering at about the same level. As you can see, inventory above $750,000 is far different from the rest of the market. Generally speaking, the higher the price, the more inventory there is.

It’s taking one week longer to sell compared to last month: On average it is taking 45 days to sell a home in Placer County as opposed to 37 days in Sacramento County (and 40 days in the Sacramento Region). Generally speaking, the higher the price, the longer it is taking to sell (which is normal). There were only 14 sales between 100-200K, so take the days on market with a grain of salt. Overall it took about one week longer to sell a home last month compared to the previous month.

Sales volume is approaching more normal levels: Sales volume saw an increase last month, but volume is still down by 7.5% from July 2013. Overall volume is starting to hit much more normal levels.

There are more listings this month than last month: Listings increased by 5% from last month to this month. At the beginning of July there were 1387 active listings on the market, and at the beginning of August there were 1457 listings. This isn’t news to write home over, but the number of listings is something important to watch because if sales don’t increase at the same rate, the market will inevitably soften. Inventory actually went down slightly though in July in light of sales slightly outpacing listings in Placer County (very slight decline).

It’s a joy to put these graphs together every month. Yes, it takes quite a bit of time, but it’s worth it. As always, I’d love to hear your take on how the market is unfolding too. Moreover, if you have ideas for how to refine or present trends, I’m always game to get some constructive feedback.

Sharing Trends with your Clients? If you want to share graphs online or in your newsletter, please see my sharing policy. Thank you for sharing.

Questions: How else would you describe the market? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

It’s amazing how these trends change form one year to the next. It would be easy for sellers to only remember how hot your area was last year and price their home for sale based on those figures. This is why it is so important to get a current appraisal when selling. Great post Ryan.

It sure is amazing Tom. Markets are living organisms and they are always changing. Thanks.

Ryan-

Fascinating post. Other interesting stats might be the perceptage of owner occupied dwellings and per capita income.

ricardo

Thanks Ricardo. That would be interesting. Income levels are a big deal right now because buyers need to gain some growth in income to keep up with these prices.

Well yes, incomes must increase or house prices decrease for the restoration of a normal market. If not, Sacramento would become a rentier town, perhaps with prpessure for rent control. Is there a way to find out the current cost of building per square foot in Sacramento?

There are surely many cost websites out there. This is one that might work, but it’s really only an estimate at the very best. The cost will obviously vary tremendously based on what is being built and even where it is being built. For instance, the Sacramento Business Journal reported a few months ago on permit fees. In Folsom it costs about $35K per house for permits and all fees associated with building, yet in Elk Grove it’s $68K, and in El Dorado Count it’s almost $86K. Interesting, huh. For what it’s worth, here’s a cost-to-build website: http://www.building-cost.net/CornersType.asp

I am surprised that the permit costs are so varied.

We had an interesting discussion in our office recently about the inventory of two story homes increasing more quickly than single story homes. Do you see the same trend? Thanks

It is surprising Ray. Check out the article I was quoting, though it may be only available for subscribers (not too sure): http://www.bizjournals.com/sacramento/print-edition/2014/03/28/where-to-build-homes-permit-fees-can-make-all-the.html?page=all

That’s interesting, Ray. Thank you. I haven’t noticed anything in particular. I’ll have to keep my eye out. Is this in Elk Grove? I would think that was true for new construction since it is cheaper to build 2-story homes, and builders can therefore make more profit. But it’s peculiar for existing inventory.

Thanks for the info on cost to build. It is so valuable for us laypersons to get unspun information and analysis from professionals in the field.

I would have never guessed that the market would remain as high and tight as it has over the past two years.

In time changes will have to come, if not in the very near future, certainly in time from young folks, the Millenials who don’t have huge salaries but do have 1 trillion in student debt.

And speaking of the cost of living, has anyone else noticed that the cost of food is going up, as mcu as 25% for some staple items?

I think you have a great point about Millenials. The job market has been soft, and younger people simply need to find careers / jobs that pay well. It’s not easy out there for many people, so the economy needs to see improvement in coming years to help support higher prices.

I hear you on the cost of food. My wife does most of the grocery shopping in our household, and I make it a point in many cases simply not to even ask how much it was. I feel better about it that way.