What is the real estate market doing? That’s not always a quick 10-second answer you can give someone while standing in line at Starbucks. Yet here’s the scoop: Demand is very high, values are up, and inventory is down. We are seeing exactly what we would expect to see in a Spring market, and I’d like to invite you to unpack the market with me in this post so you can share specific trends with your clients.

One Paragraph to Explain the Market: The market is having a normal Spring so far. Prices are up, sales volume is increasing, and housing inventory is down. Buyers are hungry out there, which is seen with pendings being 25% higher in the regional market in March 2015 compared to March 2014. Cash sales continue to decline in volume, while FHA buyers are gaining a greater share of the market. Short sales and bank-owned sales are still hovering at very low levels, though there was a slight uptick in volume this past quarter (nothing to sound the alarm about). It took an average of 51 days to sell a house in the region last month, which is 4 days longer than it took last year (thus while the market feels hot, we can also see the market is slowing down too). Well-priced listings are going quickly and experiencing multiple offers, but properties with adverse locations and/or a lack of upgrades are tending to sit on the market. There is a huge demand for quality inventory, yet at the same time the market is price sensitive since buyers are showing discretion. Many neighborhoods over these past few months experienced a seasonal increase in value (not all areas though). Remember in coming time that inventory historically sees a huge increase from April onward, and that can very easily change the tone of the market.

NOTE: This post is longer since it is my big monthly market update. I am experimenting with more graphs and less text. Do you miss the numbers and bullet points? I’d love some feedback.

Two ways to read this post:

- Scan the talking points and graphs quickly.

- Grab a cup of coffee and spend a few minutes digesting what is here

DOWNLOAD 62 graphs HERE for free (zip file): Please download all 62 graphs here as a zip file (or send me an email). Use them for study, for your newsletter, or even some on your blog. See my sharing policy for 5 ways to share.

SACRAMENTO REGION (Sac, Placer, Yolo, El Dorado):

SACRAMENTO COUNTY:

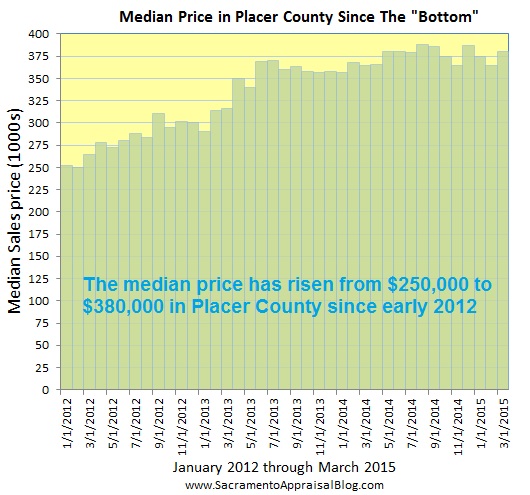

PLACER COUNTY:

Questions: How do you think sellers and buyers are feeling about the market right now? What are you seeing out there?

If you liked this post, subscribe by email (or RSS). Thanks for being here.

Great analysis Ryan. It sounds like you could be describing the market where I work as well. It is very similar to Sacramento trends. I like the chart showing interest rates and inventory trending similarly. I’ve never placed those two things on one chart before. I should try that in my market.

Thanks Gary. If you ever make that graph, I’d love to see it. Interest rates and inventory are two of the big factors that can sway the direction of values, so it’s fascinating to see them plotted together. I remember when rates increased around June 2013, it really made a difference in the market (but that’s about the time when investors began to leave, and that was probably a bigger deal).

Smart move focusing on the charts. Picture is worth a thousand words… or so they say. Speaking of which … seems like that first picture is a more of a button than a ‘trigger’? Wazzup wid dat? (grin)

Ha ha. You caught me red-handed. I am guilty. I mixed a metaphor. Nothing else to say. 🙂

Gagggh, why are property prices (EDH/Rescue) now above the 2007 peak??

Hi Gagggh. Historically low interest rates and outside cash investors really helped boost values in recent years since 2012. Low rates and low inventory are the two big culprits in driving today’s market too. Where do you think values should be? The peak was actually before 2007 in 2005/2006. I’d love to hear your take on the market. I’m open ears. Thanks.