The appraisal came in low. Those are five very stressful words during a real estate transaction, right? We hear these words every now and then, but when a market begins to change in the spring especially, it seems like we hear them more. So what can be done when this happens? What is the best way to communicate with the appraiser? What are some things to do and not do? Let’s talk about what it can look like to work through this issue. I’ve included a template you can download to your desktop, but I’ve also included some communication tips. The goal here is not only to give a useful rebuttal format, but to spark conversation between agents and appraisers (see tips below).

I’d love to hear your take and insight in the comments.

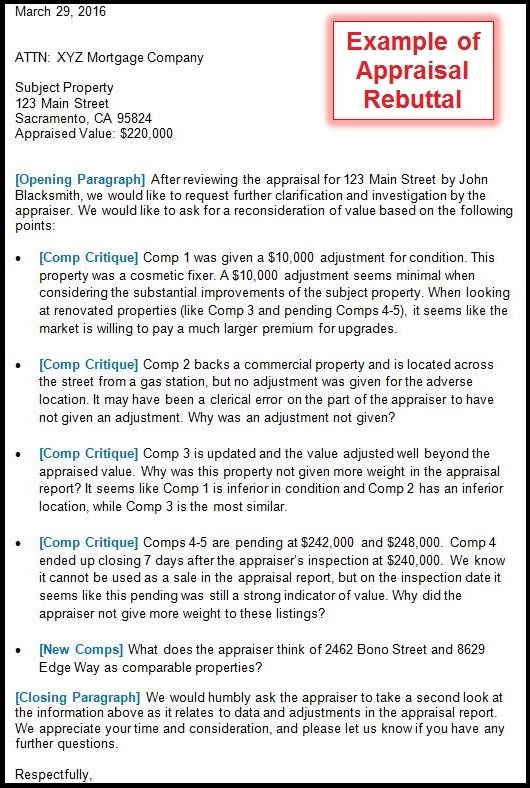

DOWNLOAD this format HERE as a Word document. I created this format to help foster better communication with appraisers and focus on the right issues when challenging an appraisal. You might notice the diplomatic tone and logical flow too. Use this format as a template to fill in the blanks for a specific property.

Example of the template filled out:

DOWNLOAD this format HERE as a Word document. Use it as a template to fill in the blanks for a specific property.

TIPS FOR AGENTS:

- Be Reasonable: Be realistic about what a property is worth. Try to help the owner base the list price on actual similar sales and whatever the current market is doing in the neighborhood for similar properties.

- Communicate First: Sometimes real estate agents have a very hands-off approach about communicating with appraisers (until an appraisal comes in too low of course). When that happens, agents will often start communicating all sorts of things about the property and how the market responded to it. But why was this information not shared in the first place? If you aren’t using my “Appraiser Info Sheet“, please consider doing so because it helps you be intentional about answering questions appraisers tend to ask (before they ask). Remember, it’s easier to be proactive before the appraisal is finished rather than reactive afterward.

- Ask the Lender: Before launching into a rebuttal, first make sure to ask the lender what their process is for challenging an appraisal so you know you are spending your time wisely. They might have their own form. Remember, a reconsideration of value has to come to the appraiser from the lender.

- Wear your Data Hat: It can be emotional when a property appraises too low, so it’s important to remain objective and stick to the facts of the market when talking with appraisers. Focus on critiquing the meat of the appraisal, which is comp selection and adjustments given (or not given). Forget about minor issues or clerical errors that don’t really sway value.

- Price Per Sq Ft: I recommend giving most of your attention to similar sales rather than bringing up price per sq ft. At the end of the day price per sq ft can be a valuable metric, but during an appraisal rebuttal it’s important to focus on sales that are similar since that is probably what is going to be most useful for the appraiser.

- Be Humble: It’s easy to blast the appraiser because you think you’re right, but the appraiser might have nailed the value. Remember, some appraisals come in low because the appraiser did a bad job, but many times properties come in lower than the contract price because that’s really where value is.

- Novel: There is a better chance of being heard if you keep it short. Don’t write a novel (and it helps if you’re diplomatic and nice). This is why the format above is useful because it helps organize thoughts into a logical manner.

- No pressure: Remember to not pressure for a higher value (Dodd-Frank). Stick with the facts and try to help the market speak for itself. That’s the value of the sheet above because it helps focus the conversation on comps and adjustments. You are asking the appraiser to reconsider the value, not meet your contract price. In fact, don’t even suggest a target value for the appraiser to meet. With some focused communication, you can provide support for a higher value without saying, “it’s worth at least X amount”.

TIPS FOR APPRAISERS:

- Seasonal Market: When the market changes, the most recent sales may not yet reflect the change. This means if we use older sales, we might essentially undervalue or overvalue a property unless we give an adjustment for the way the market has changed. The most recent sales probably got into contract 30 to 60 days ago, which means they reflect the market at the time. This means we need to weigh carefully if we ought to be giving a “Date of Sale” adjustment to help sales conform to current trends.

- Correct Mistakes: I know some appraisers never budge on changing the value. I get that. Nobody wants to have different versions of a report out there. I’m not an E&O company, but if the value is wrong due to our mistakes, isn’t our professional duty to get it right? It’s okay to change the value in the report, and if you need to do that, I would recommend writing in the addendum what changes were made and why they were made. This happens to the best of us. Nobody nails value perfectly all the time.

- Professionalism: The market is complex and there is something humbling about putting a value on something. This ought to bring a sense of awe and evoke a deep respect for the way value works in a neighborhood. In other words, since it’s not always easy to interpret value, we ought to be careful to not be arrogant. Let’s rather find ways to reek of humility and professionalism.

- Use the Info Sheet: If you think it would be useful, feel free to use my Appraiser Info Sheet document to help train local agents in your area to give you the type of information that is valuable to you during a transaction (this makes for a great office presentation too). Many times agents are doing their best to give appraisers what they think is useful, but it’s actually not helpful at all. This is why appraisers can help educate agents on what type of information they are really looking for. I have a set of questions I always ask a listing agent, so this is exactly why I created the info sheet. Feel free to download the sheet and use it in your market. In fact, make it better. If you end up posting the document on your blog or online, please give me a link back to honor the original source (I’ll do the same for stuff you create).

- Be Neutral: There is often pressure to “hit the number” or make the deal work, but appraisers aren’t escrow helpers or deal-enablers. This point really could have been placed above for agents, but it’s always a good reminder for us appraisers too. If value isn’t there, it’s not there, and everyone else needs to be okay with that. Recently a file on my desk ended up appraising 4% below the contract price. In this case the seller was asking way too much in hopes of netting more money to buy a larger house. My job wasn’t to meet the contract price, but to be a neutral party to the transaction.

I hope this was helpful.

SacBee Article: By the way, I have some cool news to share. I’ll be writing a bi-monthly column in the weekend real estate section of The Sacramento Bee. My first article was published last weekend. I’m honored and excited for the opportunity. Now I just need to find more time to write. 🙂

Questions: Anything else to add? Did I miss something? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

Great post Ryan and very thorough. I like that you even included an example appraisal rebuttal and tips for appraisers. I’ve swallowed my pride on several occasions over the years and changed my opinion of value after having a dispute. It is no fun for either party.

Thanks sincerely Gary. I appreciate your example too. Been there. Done that. This is not something the industry discusses much because it’s easy to act like a spotlessly perfect Jedi who never gets it wrong. But that’s just not reality (even Luke Skywalker got his arm chopped off, right?). 🙂

Another great post Ryan! Good advice for both agents and appraisers! I would like to share your post with the local agents and of course giving proper credit to you!

Thank you so much Erika. I really appreciate it. Please share away. I do have a sharing policy that has 5 ways to share my content (https://sacramentoappraisalblog.com/share/). I always appreciate when people share within the confines of that. I hope many appraisers will do presentations on the Info Sheet I mentioned in this post. As an FYI for any onlookers, the last page of the download has some excellent tips to share in terms of rebuttal tips. Thanks again.

The reader of the report needs to understand bracketing, the principal of substitution and many other appraisal concepts that are very important to the process. The appraiser is already required to explain their adjustments so that should already be in the report. Asking them to explain them again just because you do not like the indicated value is not productive. What is a “low appraisal” – typically (most often we see this term used in lending work) it means the lender or borrower can not do the loan they wanted or borrow as much as they want. I recently had a job where the lender told the borrower on a refi the appraisal came in low – once the borrower got a copy of the appraisal he found it came in just where he had just purchased it at and had told the lender was his estimate of value, however the lender had wanted it to come in well over the just purchased price so he could roll the fees in and had not told the borrower this. Did it come in “low”? Only by the lenders definition which would not fit any unbiased option of value. It is important that whomever is reading the report and looking at value understand – Scope of Work – the lender requirements for comparables – all way too detailed to explain in a blog post or comment as it varies by lender, job etc. If your house is “way better, nicer” than the other sales does this indicate it is over improved – possibly. In my opinion in order to do a request for reconsideration the writer needs to provide closed sales they consider better than are already in the report or information not already considered or noted. The agent “should” have already provided the appraiser with a list of upgrades to the home, not wait until after the appraisal is done. It is fortunate most good lenders have a process to weed out the reconsiderations that not well substantiated.

Thank you Cynthia. I appreciate your comment. As with many blog posts, there is so much value found in the comments, so I am thankful for your addition.

One of the reasons why I don’t write often about “low appraisals” is because it’s not a very fun topic for me. In fact, the last time I did this was four years ago I think. Yet I felt it was time to take a stab at the subject again because there is room for empowering the real estate community when the need arises, but also there is room to foster better conversation between agents and appraisers.

A few points:

1) I would never advocate for someone to challenge every comp or adjustment without reason. What I am saying is the meat of an appraisal is the comps and adjustments. If something is wrong with the value (high or low), it’s probably a result of either comp selection or adjustments (or lack of). Therefore in an intelligent conversation about value, it’s critical to focus on both instead of getting caught up in minor stuff that doesn’t sway value.

2) If there is nothing to argue, I definitely hope lenders weed out ridiculous “rebuttals” that have no support whatsoever and are maybe more based on emotion than anything. The other day I saw an email chain from an agent who thought the appraiser was an idiot because of the value. Yet the agent averaged two recent sales to come up with the list price. What is the “average” didn’t make sense for the subject property’s condition? Buyers don’t think in terms of averages. What have buyers paid for similar properties? What are similar properties selling for currently? That’s a much better approach than trying to use an average of two sales.

What is powerful about this post in my mind is it hopefully brings the conversation around to wanting to have an intelligent conversation and sticking to the facts rather than spewing out “rebuttals” void of any support. If an agent fills out this form, there simply has to be substance there. Let’s talk about that substance too because maybe the appraiser really did miss the market so to speak.

3) I agree with you about “low”. That is a relative term, and properties should appraise “low” in many cases if they are in contract at ridiculous price levels. The value has to be supported by comps, listings, and data in the market. When the real estate community or owners pick a price and then hope it will “appraise”, that’s a recipe for disaster. Or when an owner accepts that one absurdly high offer, it’s no surprise if it appraises for less.

4) Bad appraisals tend to not describe where adjustments came from, so that is why it’s important for someone to ask about that if the adjustment really should have been different. Again, this is for a legitimate situation where maybe an adjustments was $5000 for an adverse location when it should have been maybe $30,000 to $40,000.

I hope that provides clarity. If not, let’s keep kicking around ideas. I appreciate your input Cynthia, and I have a high level of respect for you.

Great info. Ryan and congrats on your newspaper column!

Thanks so much Tom. I appreciate it very much.

Thanks Ryan, I have downloaded the template and pray that I won’t have to use it too much! Great resource!

Thanks so much Ron. I appreciate it. I hope you don’t have to use it much either. I find when agents price well and communicate well with the appraiser, it can make a big difference. Here’s to a very successful year ahead!!

Thank you for this post. I’m a listing agent on a property which didn’t appraise for the sales price. This gave me a better structure of how to approach the reconsideration of value.

You are very welcome Eric. Thank you for the comment. Let me know if you have any additional questions.