The appraisal came in low. Those are five very stressful words during a real estate transaction, right? We hear these words every now and then, but when a market begins to change in the spring especially, it seems like we hear them more. So what can be done when this happens? What is the best way to communicate with the appraiser? What are some things to do and not do? Let’s talk about what it can look like to work through this issue. I’ve included a template you can download to your desktop, but I’ve also included some communication tips. The goal here is not only to give a useful rebuttal format, but to spark conversation between agents and appraisers (see tips below).

I’d love to hear your take and insight in the comments.

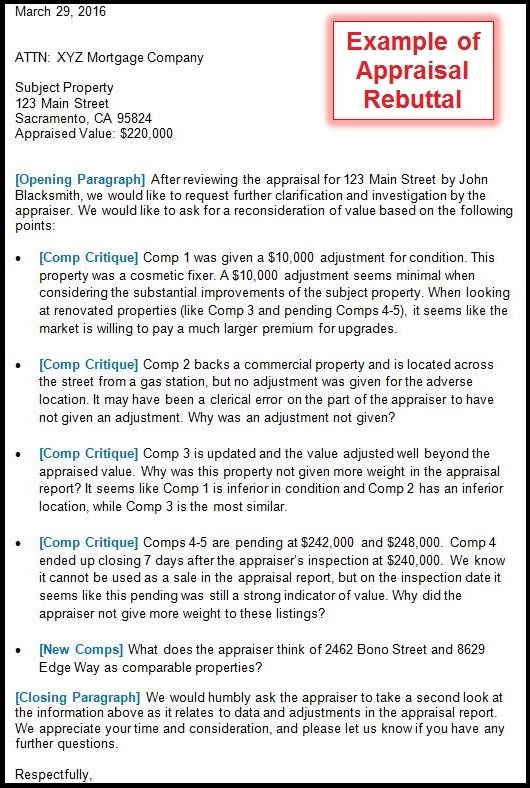

DOWNLOAD this format HERE as a Word document. I created this format to help foster better communication with appraisers and focus on the right issues when challenging an appraisal. You might notice the diplomatic tone and logical flow too. Use this format as a template to fill in the blanks for a specific property.

Example of the template filled out:

DOWNLOAD this format HERE as a Word document. Use it as a template to fill in the blanks for a specific property.

TIPS FOR AGENTS:

- Be Reasonable: Be realistic about what a property is worth. Try to help the owner base the list price on actual similar sales and whatever the current market is doing in the neighborhood for similar properties.

- Communicate First: Sometimes real estate agents have a very hands-off approach about communicating with appraisers (until an appraisal comes in too low of course). When that happens, agents will often start communicating all sorts of things about the property and how the market responded to it. But why was this information not shared in the first place? If you aren’t using my “Appraiser Info Sheet“, please consider doing so because it helps you be intentional about answering questions appraisers tend to ask (before they ask). Remember, it’s easier to be proactive before the appraisal is finished rather than reactive afterward.

- Ask the Lender: Before launching into a rebuttal, first make sure to ask the lender what their process is for challenging an appraisal so you know you are spending your time wisely. They might have their own form. Remember, a reconsideration of value has to come to the appraiser from the lender.

- Wear your Data Hat: It can be emotional when a property appraises too low, so it’s important to remain objective and stick to the facts of the market when talking with appraisers. Focus on critiquing the meat of the appraisal, which is comp selection and adjustments given (or not given). Forget about minor issues or clerical errors that don’t really sway value.

- Price Per Sq Ft: I recommend giving most of your attention to similar sales rather than bringing up price per sq ft. At the end of the day price per sq ft can be a valuable metric, but during an appraisal rebuttal it’s important to focus on sales that are similar since that is probably what is going to be most useful for the appraiser.

- Be Humble: It’s easy to blast the appraiser because you think you’re right, but the appraiser might have nailed the value. Remember, some appraisals come in low because the appraiser did a bad job, but many times properties come in lower than the contract price because that’s really where value is.

- Novel: There is a better chance of being heard if you keep it short. Don’t write a novel (and it helps if you’re diplomatic and nice). This is why the format above is useful because it helps organize thoughts into a logical manner.

- No pressure: Remember to not pressure for a higher value (Dodd-Frank). Stick with the facts and try to help the market speak for itself. That’s the value of the sheet above because it helps focus the conversation on comps and adjustments. You are asking the appraiser to reconsider the value, not meet your contract price. In fact, don’t even suggest a target value for the appraiser to meet. With some focused communication, you can provide support for a higher value without saying, “it’s worth at least X amount”.

TIPS FOR APPRAISERS:

- Seasonal Market: When the market changes, the most recent sales may not yet reflect the change. This means if we use older sales, we might essentially undervalue or overvalue a property unless we give an adjustment for the way the market has changed. The most recent sales probably got into contract 30 to 60 days ago, which means they reflect the market at the time. This means we need to weigh carefully if we ought to be giving a “Date of Sale” adjustment to help sales conform to current trends.

- Correct Mistakes: I know some appraisers never budge on changing the value. I get that. Nobody wants to have different versions of a report out there. I’m not an E&O company, but if the value is wrong due to our mistakes, isn’t our professional duty to get it right? It’s okay to change the value in the report, and if you need to do that, I would recommend writing in the addendum what changes were made and why they were made. This happens to the best of us. Nobody nails value perfectly all the time.

- Professionalism: The market is complex and there is something humbling about putting a value on something. This ought to bring a sense of awe and evoke a deep respect for the way value works in a neighborhood. In other words, since it’s not always easy to interpret value, we ought to be careful to not be arrogant. Let’s rather find ways to reek of humility and professionalism.

- Use the Info Sheet: If you think it would be useful, feel free to use my Appraiser Info Sheet document to help train local agents in your area to give you the type of information that is valuable to you during a transaction (this makes for a great office presentation too). Many times agents are doing their best to give appraisers what they think is useful, but it’s actually not helpful at all. This is why appraisers can help educate agents on what type of information they are really looking for. I have a set of questions I always ask a listing agent, so this is exactly why I created the info sheet. Feel free to download the sheet and use it in your market. In fact, make it better. If you end up posting the document on your blog or online, please give me a link back to honor the original source (I’ll do the same for stuff you create).

- Be Neutral: There is often pressure to “hit the number” or make the deal work, but appraisers aren’t escrow helpers or deal-enablers. This point really could have been placed above for agents, but it’s always a good reminder for us appraisers too. If value isn’t there, it’s not there, and everyone else needs to be okay with that. Recently a file on my desk ended up appraising 4% below the contract price. In this case the seller was asking way too much in hopes of netting more money to buy a larger house. My job wasn’t to meet the contract price, but to be a neutral party to the transaction.

I hope this was helpful.

SacBee Article: By the way, I have some cool news to share. I’ll be writing a bi-monthly column in the weekend real estate section of The Sacramento Bee. My first article was published last weekend. I’m honored and excited for the opportunity. Now I just need to find more time to write. 🙂

Questions: Anything else to add? Did I miss something? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.