The market looks really dull on paper, but it’s not. Well, the latest sales stats from January are sluggish, but one of the worst things we can do this time of year is get stuck on sales. The problem is the market is actually heating up right now, but we just won’t see it for a couple months until current hot pendings start closing escrow. Here are a few fresh analogies to help explain this dynamic. Then for those interested, let’s take a deep dive into the market.

Examples to explain the market at this time of year:

Pregnancy test: You can technically be pregnant but an over-the-counter test won’t tell you that for a couple of weeks. Similarly, the market is heating up, but we won’t see the results of the market changing for a couple months until current pendings start closing escrow.

Getting a pay raise: You got a pay raise, but you won’t see it reflected until your next paycheck in a few weeks or months. The market is exactly like that. Something good is happening, but we don’t quite see it in the sales stats yet (but we do see it in the pendings).

Election results: The polls jut closed and there’s definitely a winner, but we don’t know who it is until the votes are actually counted. This reminds us of today. We don’t always know exactly what the stats are going to be in a couple months, but we do sense the market getting hot.

Planting a seed: The market is like planting a seed. You know something is growing, but you cannot see it yet until it pokes above ground in a month or two.

Thank you Twitter friends for helping me crowdsource some of these examples.

CLASS I’M TEACHING: By the way, I’m doing my favorite class at SAR on Feb 18th from 9am-12pm called “How to Think Like an Appraiser.” Sign up here.

THE BIG POINT: In a normal January and February the market is in a weird spot. It’s out of hibernation from the holidays, but we might not see any upward value movement in sales stats until March (even though the market started heating up in January and February). The truth? Data lags the trend. I remind myself of this every year. Anyway, here are some things to watch right now:

I hope that was helpful or interesting.

—–——– Big local market update (long on purpose) —–——–

This post is designed to skim or digest slowly.

THE SHORT VERSION:

THE SHORT VERSION:

- January stats were down

- Hot stats have an asterisk

- Strong pendings so far

- The market feels like 2017

- Competitive feel vs increases

- Pretty weak January volume

- No “full” priced offers yet

- Multiple offers growing

- Sales volume feels normal (sort of)

- Why volume slumped

- Low rates are like steroids

- Listings are coming

- Ain’t nothing wrong with a slower pace

- More visuals for surrounding counties

DOWNLOAD 82 visuals: Please download all graphs here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

THE LONGER VERSION:

January stats were down: Usually January real estate numbers are sluggish, which is why we shouldn’t look to them to boost our self-esteem. This makes sense though because closed sales reflect what the market was doing during November and December when these properties got into contract. Here’s a good picture of the market where you can see clear softening from December to January in every category (this is normal for the time of year).

Hot stats have an asterisk: Most price metrics right now are up 5-7% compared to last year and this makes the market sound super hot. But one thing we have to realize is we’re comparing today with a very dull season last year. So for the past few months we’ve seen sexy stats that make it seem like the market is going insane, but we need to be aware of how easily numbers can get inflated if we don’t recognize how dull the market was then compared to now.

Strong pendings so far: The sales numbers for January are dull, but the seasonal market is definitely heating up. We just don’t quite see it in the stats yet. Last week 500 properties got into contract in the Sacramento Region. There were 600 new listings also. Overall pendings look to be up slightly compared to the past couple years at this time.

The market feels like 2017: It’s important to recognize the temperature of the market is definitely changing for the season as it’s getting “hot” around here, but it’s not also the type of hyper-aggressive market we saw in 2013 either. I think a good way to describe today is it’s a price-sensitive sellers’ market that feels much more like 2016 or 2017 rather than 2013.

Competitive feel vs aggressive increases: The market is definitely competitive out there, but it’s also important to realize it’s possible to have a really competitive market without crazy value increases either. In other words, we can have lots of competition without enormous price gains. This is sort of what much of last year felt like actually where the market was competitive but price increases were more subdued. Of course the verdict is still out on this spring season, and it’s frankly going to be interesting to see how the numbers evolve in light of how low mortgage rates are.

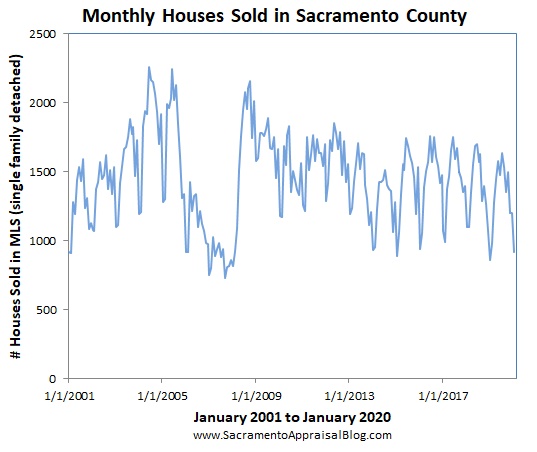

Pretty weak January volume: The positive news is this January sales volume was up about 6% compared to last year, but it was actually the second lowest January in terms of sales volume in over a decade in Sacramento County.

No “full” priced offers yet: Did you watch “Full House” from the 80s and 90s? I sure did. But I’ll admit I haven’t jumped on the “Fuller House” reboot on Netflix. I’m just not interested. Anyway, the “Full House” home in San Francisco has been on the market and it’s not selling. It’s almost like buyers aren’t willing to overpay just because the house was on TV… Seriously though, this is a great lesson. Buyers won’t pay any price, but they will pay the right price. Did you hear that sellers?

Multiple offers growing: An interesting way to gauge the market is to consider multiple offers beause it’s a clue into the current market. We don’t have sales stats yet to show a “hot” spring, but we do have pendings, and this says something. Last month 44.5% of sales had more than one offer. This is actually higher than it was last year or any year for that matter since our MLS began tracking the number of offers.

Sales volume is normalizing (sort of): For over a year we saw sales volume drop, but over the past six months we’ve been coming out of the slump. Well, technically. Stats have been up these past six months, but we have to take this news in context because we’re comparing today’s numbers with really dull stats from the previous year. In short, on one hand we’ve seen volume sort of normalize so to speak over the past two quarters, but on the other hand we’re still down from previous years as you can see in the second image below. In fact, this past year saw about 1,500 to 2,000 fewer sales compared with the clear trend from 2016 through 2018. But here’s the thing to remember. Sales volume was lower these past two years, but it’s also on the lower side of normal. So if we look at 2014 and 2015, for instance, we can see this clearly. But the bigger truth is we’ve seemed to break away from the higher trend from 2016 through 2018. So in this regard sales volume is still down. Are we now entering a new normal with lower volume? We’ll see.

Why volume slumped: When giving market updates the conversation about slumping volume almost always leads into talking about anemic listings. The idea is volume has slumped because there are fewer listings available. It sounds logical because if you have fewer listings, you’re going to have fewer sales. The truth is over time if sellers don’t list this could absolutely affect sales volume. But here’s the thing to remember. When volume started to really slump in 2018 it wasn’t because of a lack of listings. It was because mortgage rates shot up and it shocked buyers out of the market. Buyers definitively put their foot on the brakes and we saw the effect of that for over a year. So while anemic listings can certainly influence sales volumes figures over time I think we have to recognize that what started this was a reaction against increasing rates (which is really about affordability).

Low rates are like steroids: Mortgage rates have almost never been as low as they are right now, and we have a market that is very sensitive to rate changes. So when rates move up, we really feel it and the market gets dull. Likewise, when rates drop, buyers jump into the game and the market feels much more competitive. Buyers at the moment need to get into contract quickly to lock in a low rate, so that only compounds a competitive feel.

Expect more listings: Buyers have been patiently waiting for good product to hit the market and that’s finally beginning to happen. There are hundreds more listings going live every week and we can expect to see this continue through probably mid-Summer (which is the normal trend).

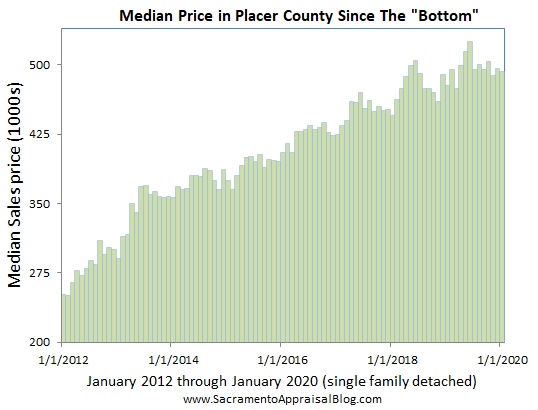

Ain’t nothing wrong with a slower pace: There is no mistaking a slower pace of price growth lately. As you can see when looking at the annual median price in the Sacramento region, the market has clearly decelerated. This doesn’t mean it’s declining. It just means growth has been slower compared with the beginning of this real estate cycle. My observation is sometimes the real estate community struggles to admit this because people buy into the idea that you can only say good things about the market. But markets don’t always increase and they aren’t always aggressive either.

Okay, I need to mention one thing. When we look at the past quarter of sales for each respective year we actually see a more robust quarter this past year. Does this mean the market is starting to accelerate? Well, that could be, and mortgage rates could certainly be an x-factor here. But one thing we do need to consider is last year the market was REALLY dull, so I wouldn’t put too much stock for now in comparing today’s numbers with last year. My advice? Let’s get a few more months of data before drawing conclusions.

I could write more, but let’s get visual instead.

Thanks for respecting my content: Please don’t copy my post verbatim or alter the images in any way. I will always show respect for your original work and give you full credit, so I ask for that same courtesy. Here are 5 ways to share my content.

Please enjoy more images now.

SACRAMENTO REGION (more graphs here):

SACRAMENTO COUNTY (more graphs here):

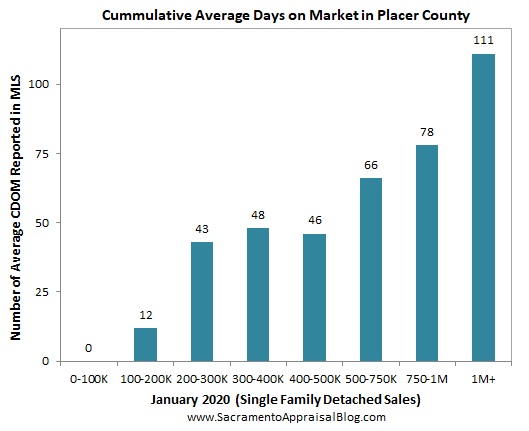

PLACER COUNTY (more graphs here):

EL DORADO COUNTY (more graphs here):

DOWNLOAD 82 visuals: Please download all graphs here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

Questions: Do you have any analogies to add to my list above? What stands out to you about the market right now? What are you seeing out there? Anything to add?

If you liked this post, subscribe by email (or RSS). Thanks for being here.

Love your examples, for the “Signs of an Increasing Market”…Pregnancy test, getting a pay raise, election results and planting a seed.. and your “big point” is that results are delayed. Here’s where pending sales help with pricing. I love the fact we can see on our MLS, how many offers were put on a home, the days on market and finally who purchased it with conventional cash or FHA loans. I heard that there was a 30.2% increase in loan applications in January that is the biggest increase in applications since Oct. 2009. .. But I’m not pregnant

If your Sacramento market follows the Bay Area, just to let you know that the East Bay is trending up already. Listings are being snapped up in a few days and inventory continues to be low. There is high turnout for open houses & we are seeing buyers from San Francisco continuing to recognize value in our area. It may only be early February but all indicators are stronger than Q4.

Thank you Alison. I appreciate the commentary. I’m hearing the same exact thing. It’s hard to say how much appreciation is out there right now. We’ll know more in coming time. Low rates really are a steroid.

Thank you Nancy. Wow, I hadn’t heard a stat like that yet on loan applications, but it’s not surprising to hear of an increase. Loan officers are incredibly busy because buyers are busy trying to get into contract. Low rates are a blessing for buyers, but they sure do help diminish inventory over time in a few ways too. Let’s keep watching…

Always good to hear your take on things and it is always surprising how similar the Sac market is to Portland on a lot of trends.

Thanks Gary. I’m going to have to check out some Portland stats soon. Heck, I need to get to Portland at some point too. Hope you’re well.

Great analogies! The seeds growing is my favorite. Nice points about things happening that take a while to see on the market. That is the case most of the time. Sometimes it’s hard to remember that. Great post my friend!

Thanks Jamie. I appreciate it. I’m guessing you might have a green thumb then. Though can you grow stuff in the freezing cold in your area? (kidding) Hope you’re well.

Haha! Actually, it’s my wife that really has the green thumb. But, I guess gardening is growing on me.?