The housing market has shifted over the past month. That’s what the stats are showing, and it’s what we’re hearing from the trenches. Today I want to highlight what’s been happening in Sacramento, and unpack what I mean by “shift” too since this word can be sensationalized. If you’re not local, what are you seeing in your area? I’d love to hear your take.

WEBINAR I’M DOING NEXT WEEK: On Thursday May 19th at 10am I’ll be doing a deep market update for SAR to talk about the latest trends. We’ll have an hour to talk through lots of stuff. SIGN UP HERE.

Skim quickly or digest slowly.

Listen to Uncle Rico: The housing market temperature has changed from early 2022, so it’s a different market today. My advice? Don’t get stuck in the past. And sorry if you don’t get the meme (Uncle Rico was stuck in ’82).

How I’m describing the market: Overall, the market still feels elevated in that we are seeing a higher-than-normal amount of competition. And frankly, sellers are still in the driver’s seat. Yet, there is no mistaking a blatant temperature change or shift about a month ago. It seems an inflection point occurred where we really noticed the effect of higher mortgage rates on buyers. Some buyers have backed off due to declining affordability, and others have become much more sensitive to price. In other words, buyers are hyper aware of lofty monthly mortgage payments, so they have higher expectations about what they’re buying. It would be an error to call this market cold, but there is no mistaking a cooler temperature from the scalding temperature of January through March.

Fewer pending contracts (big news): We’ve seen a dip in pending contracts over the past few weeks, which speaks to shifting demand. The number of pendings was down 12% this April compared to last year. Where will this black line go in coming time? That’s the big question. Will buyers adapt to a new environment of higher rates or will we continue to see fewer buyers playing the market? Let’s keep watching. Visual made using data from Trendgraphix.

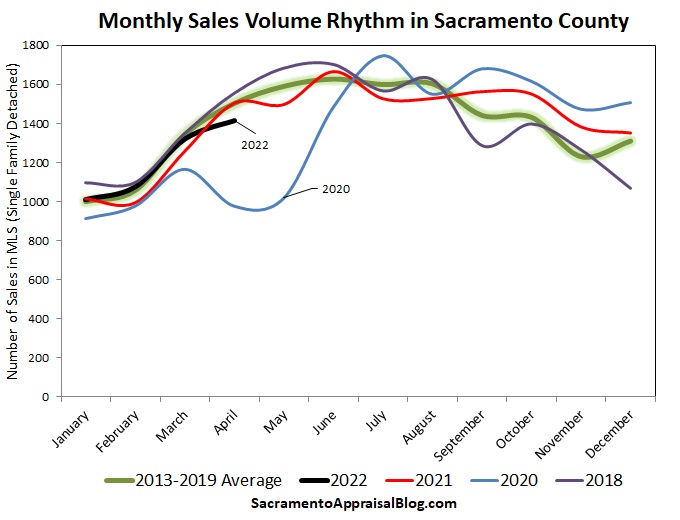

Lower volume in April (but not super low):

The number of sales in April was clearly lower than last year, but still on the lower end of normal when considering many years. Granted, with pending volume down in April, this will likely mean May sales volume will be down. As I said last week, I think it’s key to focus on what is happening with volume.

The word on the street:

The stories of today become the stats of tomorrow. A few days ago, I asked Instagram how many offers properties are getting. Not too long ago this poll would’ve showed far fewer homes getting “1-2” and especially “0”. I know, this isn’t scientific, but this lines up with other stats right now.

Fewer Multiple Offers

In April we saw fewer multiple offers compared to March. It’s atypical to see the peak of multiple offers in March (only happened during the pandemic in 2020). This supports the idea that the market seems to have shifted early for the spring. Keep in mind this visual is based on sales. When looking at pending contracts since May, 55% have had multiple offers. Granted, 55% is still slightly higher than normal, but there is a huge difference with 72% of sales getting multiple offers two months ago and 55% lately.

Price reductions are starting to increase:

We’re starting to see price reductions tick up according to Altos Research. The number of reductions is much higher than last year, but closer to levels seen in May 2019. In short, we are not at dangerous levels, so it’s important to remember what normal feels like and not sensationalize the number of reductions at the moment. It’s important to note that every single price range is experiencing reductions, which tells us you can overprice in any neighborhood. Let’s keep watching this by the week and change our narrative accordingly.

Added: I just ran some stats, and Opendoor represented 13% of all price reductions this week in the region. The iBuyer model doesn’t account for the growth in reductions overall, but I’m just saying, this is something to watch as we crunch stats and decipher trends.

More listings are hitting the market (not many though):

The number of listings has been increasing, but inventory is still sparse. On one hand, we are on the cusp of finally breaking out of a one-month supply of listings, but on any given day we still have at least one thousand fewer listings available compared to normal. I’ve heard some stories of sellers looking to list and “sell at the top”, but sellers have not rushed the market by any stretch. Keep in mind if we start to see fewer pendings, this will help inventory increase since there will essentially be more available listings that didn’t sell.

Price growth looks to have slowed, but…

The median price in the region dipped from March to April, which is uncommon for the time of year. I’m not ready to say prices have peaked for the year since we need a couple more months of stats. What I am saying is April sales have clearly started to show a reaction to higher mortgage rates, so it’s not a surprise to see the unhealthy growth between January and March begin to fade. Yet, I watch prices by the week (third image below), and the most recent two weeks have shown an uptick, so let’s wait to see how the entire month of May looks. Keep in mind most local counties saw a modest price uptick in April instead of a dip like the region saw (see stats below).

It does look like we are starting to see price deceleration. Instead of being up 20% from last year, prices are up closer to 15%. This is a good thing and what we want to see happen. We’ve needed the crazy pace to slow.

Buyers are starting to pay less above list price:

This visual shows a flattening trend for buyers paying above the list price. I suspect in another month we will see this line decline since demand has begun to shift. But here’s the thing. In a normal year, we should be seeing buyers on average pay about 1% BELOW the list price, but this past month buyers still paid about 3% ABOVE the list price. Granted, these figures represent sales, so this tells us more about what the market was like one month ago when these properties got into contract. But like I’ve been saying, the market is still not back to a normal level yet. This is exactly why it’s important to unpack what a shift in demand looks like. And if people aren’t willing to read more than just the title… Well, I can’t help that.

I better stop before this becomes a dissertation. Do you see what I mean by a market shift though? I hope this was helpful.

Thanks for being here.

—–——– BIG MARKET UPDATE FOR THOSE INTERESTED ———––

Skim or digest slowly.

Skim or digest slowly.

QUICK SUMMARY:

After some very rapid (unhealthy) price growth in the beginning of the year, it looks like we are starting to see the return of more sanity to the housing market lately. Granted, we are in the midst of the beginning of a temperature change, so we’ll have to continue to watch to understand how it all unfolds. For now, it’s best to describe the market as being elevated, but softening. In short, when priced right, properties are poised to get multiple offers, but when priced too high, properties are going to sit and not sell.

A QUICK RECAP:

SHARING POLICY: I welcome you to share some of these images on your social channels or in a newsletter. In case it helps, here are 6 ways to share my content (not copy verbatim). Thanks.

Some visuals…

YEAR OVER YEAR:

Year over year stats are important to digest, but don’t forget to look at month to month stats to understand what the market is doing right now. Also, not every location and price range have the same trend.

MONTH TO MONTH:

Looking at sequential months is key too so we don’t just get stuck or hyper-focused on last year (the past).

OTHER VISUALS:

As if anyone really wanted more…

MARKET STATS: I’ll have lots of market stats out this week on my social channels, so watch Twitter, Instagram, LinkedIn, and Facebook.

Thanks for being here.

Questions: What are you seeing out there in the market? What did I miss? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

Great commentary. As an out of area Realtor, the Maui market is seeing the Hot Pocket phenomenon. We aren’t seeing the growth of inventory in new listings although as a second home market, we don’t typically see the spring influx of listings like most markets. I’m wondering the impact of deep plunges in tech stocks, crypto etc. impacts discretionary second home purchases moving forward. Would not be surprised to see demand slacken further especially with mortgage rates on second homes that much higher.

Thank you Pete. I really appreciate hearing about your market. I am definitely not in an area where second homes are a massive factor. Tahoe isn’t far from me, but that’s not a market I serve or cover. I don’t know if you’ve seen this Redfin piece, but it’s right in line with what you are saying about the second home market. And spot on about stocks, crypto, rates, etc… All factors that can affect what people are willing to buy. I wonder too if we’ve moved past some of that initial pandemic fever to have more space and such. I know in my area we’ve seen a notable difference in the size of homes being purchased after a big spike for the first year or so. That’s something a bit different maybe as it relates to luxury homes, but there is a sense where I think the sizzle of pandemic fever has maybe subsided somewhat. https://www.redfin.com/news/second-home-demand-drop-march-2022/

You work so hard on these market updates. Thank you. Portland is looking very similar, but wish we had your analysis up here as well.

Thank you Gary. I am actually sick this week, so it’s a miracle to get this out. I caught a gnarly cold over the weekend. It’s been brutal (I tested negative). Can’t wait to be back up and running. For now I’m grateful to scratch out some thoughts and get some perspective out there while I ride the couch…

I particularly enjoy your thoroughness with the statistics, thanks

Thanks Besley.

Get well soon. I am starting to see more inventory in the Austin area as well. I think we are a little behind your market, but it also appears to be shifting. Thanks for the great information.

Thank you Slad. I appreciate it. I’m thankful to be typing an appraisal right now. Hopefully I’ll get one report out today and then have another office day tomorrow. Deadlines are piling up. Keep me posted with Austin.

Keep me posted with Austin.

It’s definitely an interesting time, and as usual, appreciate all the stats and analysis!

One personal example of a recent situation:

I closed a listing in a PUD two weeks ago. It was a halfplex and we had 9 offers. Just listed another halfplex in that PUD; same size, similar condition, one street over. Had 6 offers this time, but accepted an offer at approximately 4% higher than what the first halfplex closed at. Really getting mixed signals with the shifts in the market….

Thank you for the example. It’s still lopsided out there. I would say this is still a sellers’ market also. It’s not cold. But the temperature has changed. All of that is true. It’s wild to see price growth like this. Someone critiqued my stats a couple of weeks ago when I talked about a temperature change at a local brokerage. The thought was, “Hey Man, in all my appraisals I’m seeing properties that are going over list price, so I’m not sure where you are getting your stats from….” My response was that aggressive examples can coexist with what I’m saying about the overall temperature of the market. The key here is to look at the entire forest (big picture) as well as the trees. What we don’t want to do is just the forest by looking at the trees. And to be fair, we don’t want to look at the forest only and completely neglect there are aggressive examples out there (like the ones you mentioned). To be fair, I did mention to my appraiser colleague that it’s possible he is appraising properties that are getting into contract too – not the ones with price reductions…

@Ryan, get well. I’m in the Cape Coral and Fort Myers area and see more listings.

Thanks, and appreciate all the stats and analysis!!

Thank you Jorge. I appreciate it. I’ve been staying away from my family all week to be safe. And keep me posted if you see anything interesting in your market. While there is no such thing as a national market, it’s fascinating to see how many locations across the country are experiencing a very similar trend. So it’s really worth comparing notes in my opinion.

And keep me posted if you see anything interesting in your market. While there is no such thing as a national market, it’s fascinating to see how many locations across the country are experiencing a very similar trend. So it’s really worth comparing notes in my opinion.

Great job Ryan. You as saying exactly what I am seeing. However, being both a Real Estate Agent and Mortgage Broker, the mortgage side has died.

Thank you so much Rick. Yeah, refinances especially have taken such a beating lately. It’s mind-blowing to look at graphs of refinances. That is one massive downward trend.

Great post, Ryan. I think the important thing for agents and sellers to keep in mind is they need to price for what is happening now as opposed to what was occurring several months ago. It’s easy to live in the past like Rico did but if we’re not aware of what is happening right now we can get our pricing wrong.

Thank you Tom. And well stated. Agreed.

I’m an Atlanta buyer and have Redfin notifications turned on for everything in my price range (2 bedroom condos and townhomes). The gentrifying areas are seeing significant price reductions, decent places in developed areas are staying on the market longer, and the most desirable of all are still going strong under contract/over asking in mere days.

Thanks KJ. I appreciate hearing. This sounds similar to here in that the trend isn’t even throughout every price range and area. In other words, on one hand we here about price reductions, but this in some places it’s complete chaos.

Well done Ryan – an incredibly detailed real-time analysis about what is happening in the local Sacramento real estate market. Is too obvious to state that interest rates are only going to go up and therefore house values have topped and we will move to a buyers market – as that is what the Federal Reserve needs to see happen as a by-product of getting inflation down?

Thank you Andrew. I really appreciate it. I think we need time to know for sure. Nobody gets it right with their rate predictions. They seem poised to go up, but who really knows for sure? The biggest real estate data companies out there were all wrong in their predictions for 2022. I have images to show predictions around 4% or so from the biggest names around. None of the big dogs said 5.5% by May. With that said, we have a big issue on our hand with affordability due to inflation and mortgage rates. We are in an interesting place for certain. Since this post, we’ve seen a bit of moderation with pending contracts, so the line hasn’t dropped at the same rate. So we’ll see if buyers get a bit more used to the trend. The struggle is if rates were to continue to climb, that keeps adding uncertainty.