It’ll get worse before it gets better. That’s pretty much true in lots of ways in life. Going through the teenage years, recovering from injury, remodeling a kitchen… and enduring a housing downturn. Today I have a few things to share, and I hope this will be helpful (especially #3 as you look to 2023).

UPCOMING (PUBLIC) SPEAKING GIGS:

12/5/22 SAFE Credit Union market update on Zoom (register here (free))

1/18/23 WCR Market Update in Cameron Park (register here)

1/19/23 Big market update at SAR on Zoom (details TBD)

1/23/23 Residential RoundUP on Zoom (register here (free))

5/22/23 Yolo YPN (details TBD)

Three quick things:

1) THE MARKET ISN’T THE SAME EVERYWHERE

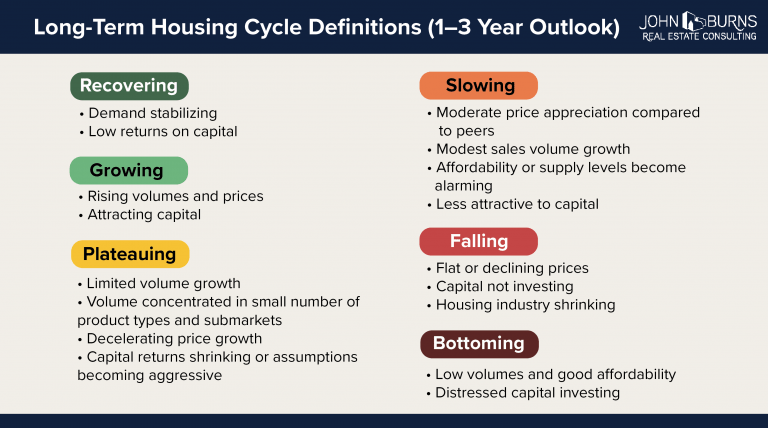

The housing market is NOT the same in every part of the country, or even every sliver of the local market. Here are two images from John Burns Real Estate Consulting to show what I mean. Read their original post here.

Does anything surprise you on the list? It’s not a shocker that Sacramento made the falling list along with some of the usual suspects we’ve been reading about in media stories.

DIPPING PRICES IN SACRAMENTO

Here’s a look at the preliminary median price for November in the Sacramento region. I’ll solidify this visual in a week when we have more November stats collected. But do you see how the median price this year (black line) is officially below last year (orange line)? As I mentioned a few weeks back, 40% of pandemic price gains have been wiped away over the past six months. That’s not always easy to digest, but it is exactly what sellers need to hear right now. And again, the median is not a perfect metric as it doesn’t rigidly translate to every price range and location.

2) GETTING WORSE BEFORE IT GETS BETTER

Back to my blog title. It’ll get worse before it gets better. Someone saw this visual during a presentation last month and had an epiphany that closed sales volume got really ugly for a couple of years during the previous housing crash, but volume eventually returned to the market. I think the takeaway for this person was to hold on tightly right now, and hope for eventual recovery too. Of course, there isn’t any template for how a housing market needs to correct, so we don’t want to think of 2007 as the formula. But it does make sense to see some volume vanish for a season until the housing market starts to heal by becoming more affordable. It’s impossible to say how long volume will be subdued ahead, but we’ll get more buyers back as affordability increases and market confidence grows.

Worst November in Two Decades: I know this sounds super sensational, but it’s what the stats show. As of now it looks like we’re going to have the worst November in over two decades in the Sacramento region. It’s possible we could slightly surpass 2007 if an unexpected number of sales close over the next week, but November volume looks like it’ll be down about 43% from the pre-pandemic average, and down 49% from last year (Sacramento County is 46% and 50%). No matter how we look at it, nearly half the market is missing. Or we could say half the market is happening. Both trends are accurate.

November Rain: On a side note, all this talk of change reminds me of a classic Guns ‘N Roses song, November Rain.

3) EXPECT A SPRING VOLUME UPTICK IN 2023

This might be helpful as you plan ahead for the spring market. It’s important to note that seasonal volume changes can still exist even in a downward market. Check out the visual below where the dark bars represent sales from January to June each year. Even in 2007, one of the worst years on record, we still saw a spring seasonal uptick in volume. This shows it’s really difficult to erase the seasonal trend in real estate – even when prices are plummeting. Granted, we don’t technically know what is ahead for the market, so if rates spike unexpectedly, all bets are off. For now, I would expect to see some seasonality ahead. This makes sense in light of stories from the trenches too where I’m hearing buyers waiting for better inventory in the spring, and some sellers will wait to list in the new year instead of December.

I hope this was helpful.

MARKET STATS: I’ll have lots of market stats out this week on my social channels, so watch Twitter, Instagram, LinkedIn, and Facebook.

FREE WEBINAR ON DECEMBER 5TH:

I’m doing a deep dive into the Sacramento market on December 5th at 12pm. There is so much to talk about, and I’ll have about an hour. Thanks to SAFE Credit Union for making this FREE EVENT happen. Register here.

Thanks for being here.

Questions: What stands out to you above? What did I miss?

If you liked this post, subscribe by email (or RSS). Thanks for being here.

I find this very helpful. It provides a useful template as to what could happen based on what has happened in the past.

Thanks Rex. That’s part of the goal. I think it’s helpful if we can understand previous cycles. Hope you’re well.

Ryan as always YOU THE MAN. Great stuff. As to Guns and Rose’s song, you caught me off guard, but you never cease to surprise me.. On predicting “what might happen” looking back ain’t a bad thing. Hmmmm so don’t worry about going back to 2007. I just worked on very large custom home on acreage and discovered in the market where it is located there have been 0 sales over 5,000 sf homes in the last 5 months and that wasn’t normal. So as an appraiser I went back to 2006 – 2012 (don’t ask me why I did that not sure what directed my brain) and found a gap from November 2008 to February 2010 where in this particular market there were 0 sales over 5,000 sf. during that time. Curious what the client thought after seeing that chart. Ain’t predicting the future but that stat gave me pause. And YES it did impact the estimated market value as I didn’t go to the upper end of that adjusted value range. And YES there were negative time adjustments based market stats. So stats and data are always good. Wish I could accurately predict next spring, if could I wouldn’t worry about it as I would have selected the right super lotto numbers and won a bunch of money.

As you hinted, History can and does repeat itself. Ryan happy holidays to you and your family, as well as all those that follow your blog.

Sorry to throw you off about the song. Next time I’ll try to use something country (assuming that’s what you listen to as a cowboy). If there ain’t a mullet, it doesn’t get air time. I’m pretty sure that’s how the saying goes. Haha.

That’s fascinating to hear. Thank you for sharing, Brad. Part of me wonders if this is an example of buyers with more wealth being able to weather the storm. My observation is markets in Sacramento with higher prices definitely declined during the previous cycle, but not to the extent of entry-level price points that were decimated with foreclosures. So there is a sense of being able to hold on a bit more in certain price ranges. And on that note, I reject the idea that some neighborhoods didn’t decline. I sometimes hear that, and it’s fanciful (not statistically accurate). Please keep me posted if you end up having any further insight. Thank you for sharing. I’ll keep my eyes open here too.

Happy Holidays, friend!!

Good post as usual. Prices in Davis were declining year over year in the fall of 2019 and then the pandemic hit. Prices have a lot of room to drop.

Thanks Joe. I appreciating hearing that. And you have a solid point. I think sometimes it’s easy to look at pandemic price gains as the only point of reference, but we were already struggling with affordability before the pandemic happened in light of prices having risen for eight years already prior to 2020.

Yes, Joe highlights the fact that momentum was heading toward zero in late 2019. Then Wuhan happened. https://jayemerson.com/averages/

And for more context, CAR states 45% of households in Q4 2019 could afford the median price in Sacramento County. Now they have that at 27%, and it used to be 74% in Q1 2012. Just to give some statistical context to a growing issue at the time for affordability issues.

My predictions have always been way off and too pessimistic. I thought the market was doomed when the first pandemic lockdown happened. Now I’ve moved from predictions to hope. I hope next year interest rate hikes slow and the market gains traction to find it’s new balance.

It’s hard to predict a future that hasn’t happened. And it can be challenging to stay grounded in the stats too. Objectivity is a superpower for appraisers (and all real estate professionals I think).

Of the 4 neighborhoods I am looking at, I am now seeing more than half of the houses continue to sit. With minimal or no price reductions. Granted we’re in the dead slow season. I imagine there might be some last minute movement after the next fed meeting in December and again in January before their March meeting and then we’ll see the spring uptick. So curious what will happen between now and March. That’s another 90+ days of sitting if buyers don’t enter the market or sellers don’t lower their prices. And in that time we could see two rate hikes (even if they’re small) and houses drop another 5-10%. So so curious…..

Thank you Kayla. Keep that insight coming. I really love to hear what you’re seeing from the trenches. I think some sellers right now are only technically listed for sale without any real effort into the listing. They’ll just let listings expire and withdraw. If they are intent to sell, then they’ll re-list during the spring. This is sort of a normal trend for the time of year, and it’s why the market often feels like leftovers at this time of year. I’m anxious too to see how sellers respond. For now we’ve still been in a situation where we’re not seeing a normal level of listings hit the market. It’s a market of quicksand where some would-be sellers are stuck due to enjoying such a low rate and/or not being able to afford replacement cost. That could change ahead if sellers feel economic hardship, but right now it still feels pretty subdued.

In my South Florida zip code, most of the properties for sale are lowering list prices. Guess they were overpriced to begin with. Currently, all homes are listed above the mid $500,000’s. Keeping my fingers crossed to more inventory will hit the market so something may become available under $500k

Thanks Joel. Good luck with that. I think lots of buyers are hoping for lower prices to help increase affordability.