The housing market went from an ice bath to a bloodbath. That’s a good way to describe the contrast between the dull fall season and the spring. In today’s post I want to highlight national vs local stats, a dead cat bounce, and dive deeply into local trends. I hope this is helpful.

Scroll by topic or digest slowly.

UPCOMING (PUBLIC) SPEAKING GIGS:

5/10/23 Empire Home Loans event TBA

5/22/23 Yolo YPN event (only for YAR members)

5/25/23 TBD

6/1/23 DJ Lenth Event TBA

6/07/23 SAFE Credit Union event for agents (register here)

6/08/23 Made 4 More event TBA

7/20/23 SAR Market Update (in-person & livestream)

HOT NATIONAL STATS & CAPPUCCINOS PER CAPITA

Before getting into the blazing spring, here’s something on my mind… I like to hear what’s happening with national real estate stats, but numbers on the bigger level might not mean anything at all for the local market. It’s sort of like national stats for cappuccinos per capita. That could be interesting, but also totally meaningless locally.

A NATIONAL PREDICTION I’M SEEING SOME TALK ABOUT

Over the past month I’ve kept hearing about 117 housing experts who say prices are going to climb in 2024. After seeing this a few times on social media, I wanted to find the source of the information, which ended up being a poll by Zillow. Here’s the gist. A poll from December 2022 interviewed 117 housing market experts and economists, and they basically predicted a lackluster 2023 and a rebound in 2024 for the national market.

I LIKE POLLS, BUT WHAT WOULD 117 BARISTAS SAY?

I’m intrigued with polls, and I use them in my own practice, but I’m also aware that 117 people looking into the future may not have it right either. I am not diminishing the expertise of anyone polled, but the future hasn’t happened either. I always wonder what these same people predicted last year and what they’ll say one year from now. Moreover, what type of results would we get if we polled 117 surfers, baristas, or teachers? Somebody please do this.

THE NATIONAL MARKET COULD BE DIFFERENT

Okay, back to the national vs local issue. This Zillow poll focuses on the national market, which is not always the same as the local trend. For instance, the Sacramento market had definitive price declines in the early 1990s, but Zillow’s press release described the national trend as “relatively stable from 1987 to 1999.”

THE BIG TAKEAWAY

I’m not trying to be a killjoy, but let’s be careful about forming a local housing outlook from national stats or what experts think might happen nationally. I’m not trying to throw shade on this poll either. It’s interesting. But it might not be meaningful at all for the local market.

——————— big market update below ———————

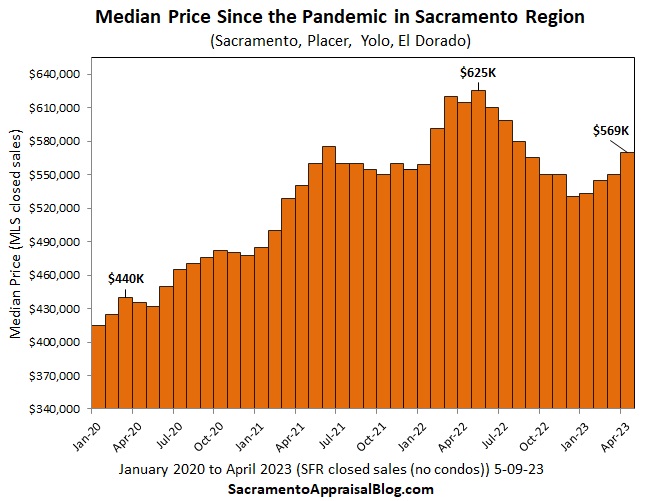

7% MEDIAN PRICE GROWTH THROUGH APRIL

The spring started out more subdued, but it’s really become competitive. When looking at median price change from January to April, we’ve seen about 7% growth so far in the region. This is pretty decent for the time of year (slightly lower than normal). Based on what I’m seeing in the pendings, we should see some standard if not strong growth ahead in May closed sales. Keep in mind this does NOT mean prices are up 7% for every property. Please look to the comps. The median price does NOT translate rigidly to every parcel or area.

The spring started out more subdued, but it’s really become competitive. When looking at median price change from January to April, we’ve seen about 7% growth so far in the region. This is pretty decent for the time of year (slightly lower than normal). Based on what I’m seeing in the pendings, we should see some standard if not strong growth ahead in May closed sales. Keep in mind this does NOT mean prices are up 7% for every property. Please look to the comps. The median price does NOT translate rigidly to every parcel or area.

NOTE: Prices rise in the spring almost every year (even in a declining cycle).

And here’s Sacramento County, which is more subdued. Keep in mind the median price was a little higher than usual in January, which is maybe causing the trend to look minimal. I know it sounds like I’m trying to be ultra-positive about prices, but I’m not. I’m only trying to explain why this stat is a bit more subdued.

SHARING POLICY

I welcome you to share some of these images on your social channels or in a newsletter. In case it helps, here are 6 ways to share my content (not copy verbatim). Thanks.

IS THIS A DEAD CAT BOUNCE?

A dead cat bounce is a temporary or short-lived recovery in the price of a declining stock (Wikipedia). The idea is even a dead cat would bounce if you thew it off a building. Sorry, I know that’s graphic. Please send your hate mail to whoever invented the phrase. In real estate we had a dead cat bounce in 2009 when the federal tax credit was introduced. The housing market was declining at the time, but then it got really hot while the tax credit was here. Yet, as soon as the credit ended, we saw prices continue to decline in Sacramento. Well, in today’s market, some onlookers are wondering if the spring season is a dead cat bounce. In other words, the idea is we’re in a declining cycle, and this spring is simply an expected seasonal uptick, and we’ll see declines persist after the hot season subsides. On the positive narrative side of things, some would say this is NOT a dead cat bounce at all. The idea is we’ve bottomed out and we’re going to increase from here on out. Look, I wish I could tell you what will happen, but here’s what I know. The market is not affordable in Sacramento for many people. During a declining cycle we normally see prices drop for 5 to 6 years. Keep in mind what happened in the past isn’t automatically the new template for the future though. Moreover, we’re in a weird spot with sellers sitting, and what happens with inflation, mortgage rates, the economy, and Fed policy can change the feel of things. On a practical note, I’m way more interested in the second half of 2023 after we get through the glowing spring. I do want to say I’m not a fan of saying the market has recovered in Sacramento. That’s the wrong sentiment in my opinion. I think it’s best to say we are seeing a decent to strong spring seasonal market in 2023, and we need to keep watching to understand how the market is going to unfold.

Okay, here’s an awkward analogy. Honestly though, I think it’s perfect.

STILL SEEING FREAKISHLY LOW LISTINGS

We still have more pendings than listings in the region and Sacramento County. This is a lopsided dynamic as a normal market should have a much higher selection of actives. It’s been so tight out there lately, and I feel for buyers. It’s basically a situation where we’ve seen low demand meet low supply. It’s not that we’ve returned to normal.

WATCH FOR THE SEASONAL PEAK

Normally prices peak in June, which really means there was a peak in late April or May (and those pendings close in June). In short, be on the lookout for a seasonal peak because that’s typically what happens around this time of year. Leading indicators will be the percentage of multiple offers, the number of pending contracts, open house traffic, and the word on the street from real estate professionals. Of course, one thing to watch is whether the peak changes this year in light of sellers sitting out of the market.

HOUSINGWIRE PODCAST:

If you need some background noise, here’s a podcast I did with HousingWire last week to talk about the spring market.

HALF THE PRICE GROWTH CAME IN APRIL

Prices felt a bit flat for the first couple months of the year, but March to April was strong. I like this visual because it helps show change over the past two decades. It’s striking to see a higher percentage this year, but it makes sense since the market hit an inflection point in mid-March. This isn’t just about the Dream For All program, but that’s part of it. My sense is we hit a point where supply was so anemic that it changed the feel of the market. Imagine how different the housing market would feel if we weren’t missing 4,400+ new listings over the past few months.

LIFESTYLE IS WHAT MATTERS

Lifestyle. That’s what today’s market is about. Lots of people are sitting and cannot move, but who has incentive to buy and sell regardless of what prices and rates are doing? That’s the question that matters for real estate professionals. My advice? Buckle up, cut expenses, put people first, diversify the types of business you focus on, get in front of people every week, increase the size of your network, add new skills through education, put out helpful content, and focus heavily on people who have incentive to buy and sell due to lifestyle changes. Moving up, moving down, inheriting a property, having a change in family status, letting go of a second home, financial hardship, selling an investment, buying from a landlord, looking for acreage, buying a first home, etc… I know this market has been brutal. Stay focused. Expect to hear NO more than YES. And don’t lose hope. Keep moving forward. One step at a time.

GAINING BACK SOME OF THE LOST GROUND

We are NOT back to peak levels from 2022, but prices in some counties are flirting with late 2021 or very early January 2022 generally. Remember, the trend could be different in each neighborhood, so look to the comps.

IT’S NOT JUST ABOUT PRICES

If we obsess too heavily about prices, we’re going to miss a significant issue in real estate. Volume. Like I keep saying, volume is what pays the bills for real estate professionals – not prices. How many transactions are happening? Typically, we see the number of sales rise between March and April, but that didn’t happen this year. Other than 2020, lower volume in April happened a few times during the prior decade, but it hasn’t happened since 2012 locally. Before calling this a trend, let’s watch the next couple of months.

EXPLAINING WHY VOLUME IS LOW:

The market has felt like a bloodbath in terms of competition, but it’s been really weak in terms of volume. One thing on my radar is whether we start to see more subdued volume because of a lack of listings (or maybe we’re already there). The main culprit with lower volume for so many months has been buyers stepping back due to affordability struggles (rates rising), but if we start to see even more subdued volume ahead, we’ll have to ask if it’s also about a lack of listings. The temptation for some is to blame it all on a lack of listings, but that glosses over the affordability issue. But we may not be able to blame it all on affordability either. Time will tell.

WE’RE MISSING 3,000 SALES THIS YEAR

I keep saying the market feels like 2020 in terms of competition, but it’s 2007 vibes in terms of the number of sales happening. We’re missing about 3,000 sales from the pre-pandemic normal in the region so far in 2023. In Sacramento County, monthly levels have actually been worse than 2007 levels for six months in a row. On the positive side, there have been over 4,900 closed sales in 2023. My advice for real estate friends? Know the stats better than anyone, and focus on the part of the market that is happening.

THE TREND ISN’T THE SAME EVERYWHERE

The market isn’t the same in every price range and neighborhood. Case-in-point. Check out volume by county in March and April. These images compare 2023 with the pre-pandemic average.

Okay, this post is getting long. Some recap visuals.

YEAR-OVER-YEAR

MONTH-TO-MONTH

OTHER VISUALS:

I hope this was helpful.

MARKET STATS: I’ll have lots of market stats out this week on my social channels, so watch Twitter, Instagram, LinkedIn, and Facebook.

SHARING POLICY: I welcome you to share some of these images on your social channels or in a newsletter. In case it helps, here are 6 ways to share my content (not copy verbatim). Thanks.

Thanks for being here.

Questions: Do you think this is a dead cat bounce? Or have we bottomed out? What are you seeing right now in the trenches of escrow?

If you liked this post, subscribe by email (or RSS). Thanks for being here.

I asked 17 surfers about the market. They told me that it was on the corner and had some dank beer and tasty grub there. The only thing they could predict was the next south swell. I’ll get back to you with the other 100 responses asap. Shaka brah

This is exactly the type of research I need to hear about. Haha. LOL. Thanks Mark. Honestly though, I’d love to do some polls of people in various professions and backgrounds against experts in housing. And let’s see who gets it right.

I like the King Charles mention.

I think we’re seeing reduced supply because of sellers on the sidelines plus reduced demand because of affordability issues. The two ate combining to reduce volume. What will happen if rates come down? I’d expect volume to increase because of both factors. If rates go up, say because of our leaders unable to raise the debt limit, I wonder how much lower volume will go.

Thanks Joe. It’s a weird market right now. Volume and listings has been shrinking since last year as buyers stepped back from the market, but 2023 has been such an interesting dynamic with 40%+ fewer listings coming to the market. It’s stunning to watch, and it’s been a game-changer. And yeah, it feels like a mess out there still with our leaders. Inflation numbers are out today. It seems inflation is down, but still not back to normal.

I learned dead cat bounce. I will work this into a conversation tomorrow. Thank you for that nugget!

Right on. Hope you’re well Gary.

Dead Cat Bounce. Yup. Historic low unemployment = low housing inventory, leading to higher Spring home prices. My crystal ball says we’re heading into a prolonged debt-fueled recession, leading to higher unemployment (think 6-8%), leading to higher inventories, leading to continued housing price declines. Crystal ball says 2018-19 home prices at the 2024-5 trough.

Thanks Josh. It would be really healthy to see prices go down. I don’t get to make the rules, of course. I think seeing more buyers able to participate is a symptom of health. What happens with the economy ahead is critical.

Hi Ryan,

Where would be the best place for me to find Sales Volume Data for other counties in the country? You show helpful Sales Volume figures over the last 20 years, for Sacramento, El Dorado and Placer County. I would like to check on several other counties in the country where I conduct business.

Thanks!

JIM

Hi Jim. Thanks so much. I’m not aware of any public database where you can extract decades of data. There are state real estate associations that tend to put out robust data, and I would maybe check there first. CAR puts out fantastic data for a few decades in California, but they actually don’t push out data for volume unfortunately for whatever reason. I find some data sources provide really good context, but it’s only for a few years (such as Redfin’s weekly data). In short, I don’t know where you could get data for free for that long without being an MLS subscriber. When it comes to stats, I find very few people push stuff out with such a long context. I wish there was more context with volume at least. Anyway, you might be able to at least see a few years though with a tool like Redfin. https://www.redfin.com/news/data-center/

Here is data from the CA Association of Realtors too in case any onlookers are interested. https://www.car.org/marketdata/data/countysalesactivity

The Freddie Mac House Price Index goes back to 1975 and has data down to the MSA level. However, it only has price data, not sales volume.

I love that index. I really wish someone had historic volume. I need to track that down at some point. I wonder if the real estate associations locally might have something. One would think, but then again, such old data may not have been important in the moment to keep.

Is there a way to see trends in volume for sales vs. rentals? By looking at zillow for my zipcode, I see a much (!) larger number of rental listings over selling listings this spring. However, I lack the historical data to put this into context. My hypothesis is: sellers want to make a lifestyle change AND keep their low-interest mortgages, thus, a significantly larger amount of sellers decide to put their property out for rent instead of selling this season (while buying a new home for them selves in- or out of state). Do you have the data and tools to validate or reject this hypothesis?

My *hope* would be that a large amount of these rental listings will be converted in selling listings later this year.

BTW: This is by far the most data-rich, intellectual, neutral and humorous real estate blog there is. Thanks for that and it’s a pity that there is no qualitatively equivalent blog for my zip code!

Hi Lukas. That’s a huge compliment, and I’m really thankful for the encouragement. I’m having fun over here, and we should be able to laugh, make jokes, and share some stats. Look, if we can’t talk about mullets and sales volume in the same sentence, then what are we doing?

That’s an interesting insight. I’ve noted more rental listings in Sacramento too. The culprit is likely sellers who couldn’t get what they wanted, so they are renting instead of selling (for now at least). This perspective comes from talking to property managers. The problem with rental data is there isn’t any one major source. I’ve literally never seen rental volume data for Sacramento, for instance. I would love to be able to see more context over time, but that’s just not available publicly to me. I actually wrote about the rent trend a few months ago, and that helps explain it. There are still sources I watch for rents (linked in post), but it’s just not so robust or easy to grasp unfortunately. It’s possible there is a paid service that property managers use, but there is nothing for the general public that I’ve seen. https://sacramentoappraisalblog.com/2023/01/24/its-not-just-home-prices-rents-are-dropping-too/

And it would be great for some of these new landlords to maybe try to sell again. The market got really dark during the summer and fall, and some sellers might feel a little better about the market and their position today after a price bump in the spring. Time will tell. All that said, I don’t think these sellers have been coming to the market in Sacramento at least, but it’s something to watch.

Always look forward to your blog. I appreciate your comments about “Lifestyle and to buckle up” you do really get our situation. I have been full time agent for 22 years. I navigated throught he 2008 disaster but I have to say… this market is really tricky!! When you have so few seller’s we are practically out of business. I am managing buy cutting expenses and the few deals I am working are Lifestyle changes..ie divorce, financial situation, first time buyer with 4 kids in a 2 bed house..(that’s motivation !!). Anyway, that’s for the works of encouragement.

Thanks John. I appreciate the kind words, and I really appreciate your transparency. It is a really tough market. Low supply and low demand. It’s a weird dynamic from a stats perspective, but from a real estate occupation standpoint it’s just difficult because there aren’t many deals going around. Hang in there. Keep doing what you are doing. I appreciate your mindset here too.

In 2005 my phone stopped ringing when the market changed, and for a couple of years I basically sold anything I could around the house to help make ends meet. This is why I no longer have a prized baseball card collection. I had to let it go because paying my mortgage and feeding the family was more important. I learned a ton about diversifying business from that time, and it was really formative for me moving forward. I remember most of all just cutting back as much as I could and trying to figure out ways to make it happen. I share because I know many real estate professionals today are in that exact same situation. I just talked with someone this week who hadn’t closed any deals all year, but finally there are a few listings that went live. So many people talk big on their social channels, but it’s in the DMs where people are really honest about the struggle.

I hope that’s not awkward to share. I just wanted to say I really value your perspective here. Hang in there friend.

Finally, it’s just a numbers game until there’s a sale. Last week a local realtor sent me an email showing that my house value has declined just over 10% from December – and yet you show a (regional) price appreciation of 7% in the same period (I suspect it’s somewhere in between). I live in a desirable and stable neighborhood that still gets some sale prices over list.

Down 10% from December though today? Interesting. I’d love to see the comps and statistical substantiation. Granted, county stats don’t translate to every price range and neighborhood perfectly, but it seems like prices have been flat to showing a spring uptick in so many areas. Maybe prices are down in others. This is where the comps matter most. I can definitely see being down 10% in some areas between May 2022 and December 2022. We had an extremely sharp price decline. The thing to remember is 7% doesn’t translate rigidly. I’m talking to lots of agents right now, and about 1/3 of them are saying the market feels more stable at the moment. I’m not hearing anyone say we are experiencing rapid appreciation. It’s a mixed bag. But about 1/3 also say prices are going up. And a smaller portion at the moment are saying they’re going down. Ultimately, I’m looking to the stats to form my perception, but I’m also listening to the stories from escrows. Down 10% from December is new to me. I haven’t heard anyone say that yet.

On a side note, I’m not a fan of the Zestimate for so many reasons, but I think the Zestimate in many cases is actually showing seasonality pretty well. I tell people to take the Zestimate with an extreme grain of salt. I would never rely on the Zestimate for making a real estate decision. All I’m saying is when clicking on neighborhood graphs on Zillow, they mostly all show an uptick at the moment after intense decline through 2022. By no means am I saying the Zestimate is trustworthy, but I do think the algorithm is reflecting market conditions here in that we’ve seen a spring bump. Bottom line.

Agree all the way around. (can’t find the email I received, unfortunately). But – just checked on Redfin – value 916K, but on the same page, I’m seeing an estimated offer from opendoor for 665K. Zillow? 1.1M . But Zillor bounces around all over the place. Sounds like a fools game to me (I’m not fooled, however). The unnamed realtor’s site has me down for 1070K now, down from 1252K in December (I’ve watched it trend down with her the last few months). Wish I hadn’t lost the email.

Thanks. It’s amazing how different the sites can be. And the humans too. Value is tricky. I wonder if your area has sparse data. Sometimes places like that can jump around all over the place.

To clarify for any onlookers, the only thing I like about the Zestimate right now is seeing a seasonal uptick when clicking on “Zestimate history & details.” I think in many cases they’re getting the trend right in terms of showing a seasonal uptick. No idea about the value. I wouldn’t put ANY weight on that.