People ask all the time. Is the market good or bad? I have some quick thoughts and then a huge market update for those interested.

The truth: The market isn’t always good or always bad. What I mean is it’s either good or bad depending on whether you can move, sell, buy, or invest. At times we get so focused on what prices are going to do that we forget to think this way. Remember, no matter what prices do in the future, the market will still be bad or good for various people.

College Admissions Analogy: Real estate is sort of like getting into college. It’s good if you have the grades and financing, but bad without a high GPA (or rich parents who can bribe school officials). Too soon? 🙂

The big point: I don’t say this to gloss over prices seeming to be closer to the top of a real estate cycle. I’m just saying sometimes we label a market good or bad without digging deeper. Who is it good or bad for? Who are the players in the market? Who will become the players if the market changes?

Any thoughts?

—–——– Big local monthly market update (long on purpose) —–——–

The market slumped during the second half of 2018, and now it’s an interesting spot. Let’s talk about it.

THE SHORT VERSION:

- Pendings were fairly normal for February

- Sales volume has slumped for 9 months

- We’re starting to see prices tick up

- I’m now publishing El Dorado County stats

- Most metrics are doing what we’d expect for the spring

- This post is long on purpose. Skim or pour a cup of coffee.

DOWNLOAD 70+ graphs: Please download all graphs here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

THE LONGER VERSION:

Here’s some of the bigger topics to consider right now.

That weird place of spring: We’re in a place in the market where a hotter seasonal trend is happening, but we don’t quite see it in the sales stats yet. Let’s remember sales from February tell us more about what the market used to be like in December and early January when these homes got into contract. So we have to look to the listings and pendings right now to understand the market.

It feels kinda normal-ish: It’s felt like a somewhat normal spring lately. We’ve seen prices tick up, multiple offers on many listings (if they’re priced well), it’s taking less time to get into contract, inventory is going down, etc… We’ve basically been seeing all the stuff we’d expect to see in the spring. Of course the real test is whether sales volume will be normal in March, April, and May, but we just don’t know that yet.

Dude, call the market already: Some people want to know definitively what the market is going to do in 2019, but we don’t have enough information yet. Besides, interest rates went down, and that’s like injecting a steroid into the market. So in some senses we have to wait until this steroid wears off.

Flattening rents: We’ve seen rents flatten lately. They’re still up, but the rate of increase is not as aggressive as it used to be.

The market isn’t slow, but it’s slowing: I get a little pushback when I say the market is slowing because the spring has felt more competitive. Here’s the thing. We’re having a hotter spring, but in the bigger picture of the market it’s just not as aggressive as it used to be. I think Barry Habib’s analogy says it perfectly. It’s like the market was driving 80 mph and now it’s driving 30 mph. In other words, we’re still seeing forward price progress, but it’s not 2013 anymore. If the stats over these next few months say differently of course, then I’ll change my tune based on new information.

Less offers (but actually more): Multiple offers are down about 13% in the region this year compared to last year, but the number of multiple offers actually increased from January to February. But that’s normal for spring, so I wouldn’t write home over it. The takeaway? Buyers, you need to bring a strong offer. Don’t think you are running the show. You’ve gained power from last year, but you’re not in charge.

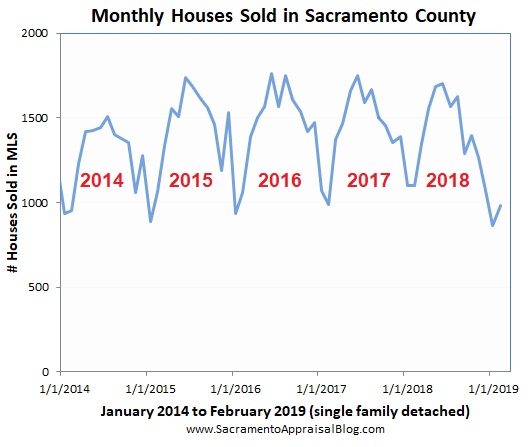

Nine months of slump: Sales volume has slumped for the past nine months in the region. This means the number of sales was lower compared to the same exact month the previous year. In short, if this doesn’t change over time and get back on track, then we could be talking about the market starting to embark on a different trend. This past month volume was down about 7% in the region, which is much better than over 20% in December.

Normal pendings & steroids: Last month pending sales looked fairly normal, which suggests the market is trying to flirt with normalcy for the spring compared to the slump of volume we had over the past 9 months. What’s making the change? It’s most likely due to interest rates declining. Low rates are like a steroid for the market. Remember, if pendings were fairly normal in January and February, that could lead to fairly normal sales volume in March & April. But let’s see how it shakes out. We don’t have those stats yet.

Not many listings yet: There’s not much on the market yet, but that’s fairly normal for the time of year. Historically listings hit their stride between April and the end of summer, so we can expect lots more in coming time. For now inventory is declining, and that’s normal for the time of year.

Final thought before the graphs: In closing, the market is in an interesting spot. It feels like it’s juggling uncertainty from last year with a striving for normalcy today. We only have two months of data and we need to keep watching to see how this market is going to emerge.

I could write more, but let’s get visual instead.

BIG ISSUES TO WATCH:

1) SPRING GETTING HOT: The market is heating up for 2019 and here’s proof. We’re seeing price changes, lower inventory, and increased sales volume.

2) SLOWING MOMENTUM: Despite the heating, stats show the market is slowing down when we look at the rate of change by year. Looking at monthly, quarterly, and annual numbers helps give a balanced view of things. As a side note it’s going to be interesting to see price metrics these next few months.

3) SALES VOLUME SLUMP: It’s important to look at sales volume in a few ways to get the bigger picture. Here it is by month and year.

SACRAMENTO COUNTY:

Key Stats:

- February volume down 10.5%

- Volume is down 5.2% over the past 12 months

SACRAMENTO REGION:

Key Stats:

- February volume down 6.7%

- Volume is down 6.6% over the past 12 months

PLACER COUNTY:

Key Stats:

- February volume was up 13.3%

- Volume is down 6.8% over the past 12 months

EL DORADO COUNTY:

Key Stats:

- February volume was up 23%

- Volume is down 7% over the past 12 months

NOTE: El Dorado County monthly stats vary significantly. I wouldn’t put much weight on volume being down 23%.

4) LAST YEAR VS THIS YEAR: Here’s a comparison of last year compared to the same time this year. What do you see?

Quick note on how NOT to use my content: Please use these images in blog posts or on social media, but don’t copy my post verbatim or alter the images in any way. I recently saw someone remove my blog link on an image. Look, I will always show respect for your original work and give you full credit, so I ask for that same courtesy. Here are 5 ways to share my content.

Now here are a bunch of images. Please enjoy.

SACRAMENTO COUNTY (more graphs here):

SACRAMENTO REGION (more graphs here):

PLACER COUNTY (more graphs here):

EL DORADO COUNTY (more graphs here):

NOTE: This is the beginning of sharing more for El Dorado County (as long as people want it). What type of graphs would you like to see?

DOWNLOAD 70+ graphs: Please download all graphs here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

Questions: What are you seeing out there? Which metrics above stand out to you the most? What are you hearing from buyers and sellers lately?

If you liked this post, subscribe by email (or RSS). Thanks for being here.

After completing two appraisals in the past 10 days for buyers for all cash transactions, I wanted to throw down some thought about getting an appraisal when paying all cash in the Sacramento area. I think there is a time to do that and also a time to not do an appraisal. This isn’t legal advice, but here is my opinion:

After completing two appraisals in the past 10 days for buyers for all cash transactions, I wanted to throw down some thought about getting an appraisal when paying all cash in the Sacramento area. I think there is a time to do that and also a time to not do an appraisal. This isn’t legal advice, but here is my opinion: