I’m starting to hear so much more chatter about the “R” word, so let’s talk about it. What happens to the housing market during a recession? What happens to homes prices and jobs? I have some new visuals to help us talk through this. Also, let’s look at some spicy issues to keep an eye on.

NOTE: There are many places to rant about politics, but not here. I won’t approve comments that are only political and don’t add to the conversation.

UPCOMING SPEAKING GIGS:

3/6/25 Yolo Association YPN Event

3/12/25 Windemere Sierra Oaks

3/20/25 HomeSmart iCare Realty (private I think)

4/2/25 SAFE Credit Union (details TBA)

4/10/25 Yuba-Sutter Association (details TBA)

4/15/25 Culbertson and Gray (private I think)

4/24/25 KW EDH (private I think)

5/8/25 Private event (details TBA)

5/13/25 PCAR

6/5/25 Auburn Marketing Meeting

9/26/25 PCAR

11/4/25 SAR Main Meeting

DEEP THOUGHTS ABOUT THE “R” WORD:

Are you hearing more people talk about a potential recession? I’m seeing lots of chatter on social media, so let’s dig in. What happens to the housing market during and after a recession? Let’s have some conversation.

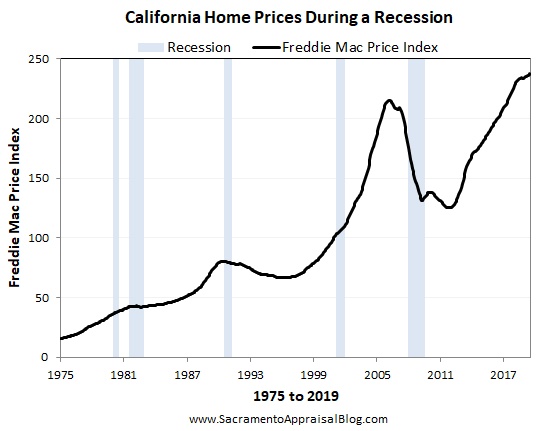

1) PRICES DON’T ALWAYS GO DOWN DURING A RECESSION

Lots of people say prices go down during a recession, but what do the stats show? Well, sometimes prices do drop or flatten. But other times they don’t. If the images below were all white in the background, and I asked you to guess where the recessions were, it would be really challenging to be right about all of them. Stats: Quarterly median sales price and Freddie Mac Price Index.

2) LOCAL MARKETS COULD BE DIFFERENT

National stats are cool, but let’s always try to digest local trends. So, here’s what Sacramento looks like. It’s hit and miss, right? Sometimes prices dip after a recession, but sometimes the market goes up. It’s not just one thing.

And in case you’re longing for an inflation-adjusted image…

3) UNEMPLOYMENT RISES DURING A RECESSION

Like clockwork, the unemployment rate shoots up during a recession (or it could start to increase before one happens). This is true in the United States and locally. If you want to see an image that really drives this point home, check out the United States from 1948 onward.

4) THE GREAT RECESSION ISN’T THE NEW TEMPLATE

What happened in 2008 isn’t the new template or formula for every future recession and housing market correction. I don’t say this to sugarcoat since there is nothing wrong with home prices going down. Let’s just recognize not every recession is the same in severity or length, so it makes sense to not impose what happened during the Great Recession onto every future market. All that said, there is no mistaking we’re seeing consumer debt and delinquencies growing. Real estate friends, check on your people.

Some closing hot issues:

5) POLITICS COLLIDING WITH REAL ESTATE:

Here are three quick topics I’m watching. This is NOT a partisan post, and this is not controversial, but sometimes housing and politics collide, so we need to digest this stuff together.

HIGHWAY TO THE TARIFF ZONE

We want to watch the economy closely as we’ve entered a tariff era under President Trump. Only time will tell how this affects prices for consumers, and so much of it depends on how long these tariffs last. In terms of real estate, there are definitely a few things we want to fixate on. Let’s look at consumer confidence, purchasing power, mortgage rates, and the price of new construction.

GAVIN NEWSOM CALLS STATE WORKERS BACK

This week Governor Newsom called state workers back to the office. This is going to be a massive lifestyle change for so many residents. In terms of the housing market, my inclination is to think this isn’t going to mean much for the residential market since many people will simply start commuting to work again without selling or buying a different home. There are some workers though who moved out of state or area, and now they have a decision to make about whether to come back or stay put. There could be others who use this as a catalyst to make a lifestyle change though – downsize, retire, move elsewhere, find a different job, etc…

ELON MUSK CUTTING FEDERAL JOBS

Let’s pay attention to federal jobs being cut across the country from Elon Musk’s DOGE (Department of Government Efficiency). This could matter for locals since we have over 14,000 federal jobs in Sacramento according to FRED data. It’s not clear yet how many jobs will be cut, but let’s keep this on the radar. On a personable note (and not a partisan statement), I want to encourage those speaking out in favor of the cuts to be aware there could be locals losing jobs who are reading your posts.

Thanks for being here.

LEAVING COMMENTS: There are many places to rant about politics, but not here. I won’t approve comments that are only political and don’t add to the conversation. The captcha is not working perfectly. If you open up a new browser, that should solve the issue. It’s been a problem for some when clicking over from my weekly email and trying to comment. My apologies. I hope to have this solved eventually.

Questions: What stands out to you the most above? Have you been having more “R” word conversations? Anything else you are watching in the market right now?

If you liked this post, subscribe by email (or RSS). Thanks for being here.

The inverted yield curve (and hesitancy): Lots of people are talking about the

The inverted yield curve (and hesitancy): Lots of people are talking about the