The housing market has ’80s vibes. The ’90s are back for clothing, but it’s the early 1980s when it comes to housing narratives. Today, I want to show some headlines from over forty years ago, and I’d love to hear your take.

UPCOMING (PUBLIC) SPEAKING GIGS:

01/31/24 Joel Wright & Mike Gobbi Event 9am (on Zoom here)

02/01/24 Gateway Event (private)

2/09/24 PCAR WCR Event (11:30am-1pm (more details))

2/13/24 Downtown Regional MLS Meeting 9am

2/21/24 Matt the Mortgage Guy YouTube Live

3/11/24 Yolo Association of Realtors (YAR only)

3/21/24 2024 Market Update for Brent Gove Team (big event free)

3/26/24 Orangevale MLS meeting 9am

3/27/24 SAFE Credit Union Lunch & Learn (TBA)

4/11/24 Lindsay Carlisle Event (private)

4/25/24 HomeSmart iCare Realty (details TBA)

5/9/24 Empire Home Loans (details TBA)

6/13/24 Sacramento Realtist Association (details TBA)

NEW MEME:

A Jason Kelce meme that I shared during the game on Sunday.

THANK YOU TO THE SACRAMENTO BEE

I got permission from The Sacramento Bee to use these images. I found the headlines through the Sac Library archives. I am a digital subscriber to The Sacramento Bee, and I appreciate what they do (please subscribe).

YO MAMA’S HOUSING SHORTAGE:

Did you think the housing shortage narrative was new? Nope. I can’t say exactly when this began, but it’s been around for many decades. In other words, it’s not just my shortage, but it’s my mom’s too. Check out this headline from November 1980 in The Sacramento Bee.

Source: SacBee today / archives

OOPS, THE FED DID IT AGAIN:

This headline from May 1980 could be written about today’s market. Here’s the formula. The Fed increases rates sharply, that changes affordability, and we see sales volume slump. However, new construction back then really struggled, but today in light of so many sellers sitting in the existing market, builders have been thriving. And yes, the “oops” mention is a Britney Spears reference. Sorry.

Source: SacBee today / archives

BUYING A HOUSE FOR 11 RASPBERRIES:

This is a viral bit from a few years ago that fits perfectly today. There are deep emotions when it comes to affordability because we’re talking about people’s lives. This isn’t just an academic conversation with stats. This is very personal, and that’s why different generations need to work to understand each other.

LIKE, TOTALLY INSERT MILLENNIALS OR GEN Z:

Look, Baby Boomers ended up winning big-time, but isn’t it interesting to see how it wasn’t a walk in the park for Boomers at the time? Check out the highlighted portion below. Frankly, this piece could be repackaged today, but instead of “Boom Babies,” we could insert “Millennials” or “Gen Z.” By the way, I’m Gen X. Not that I need to say this, but I imagine some are wondering. Technically, I’m a younger Gen X as I missed being a Millennial by five years. But forget about me because that’s what people do about Gen X.

Source: SacBee today / archives

RECYCLING HOUSING NARRATIVES:

This article from December 1981 mentions inflation, dropping sales volume, younger adults having to live at home longer possibly, and so many of the things we’re talking about today. All too familiar. Isn’t it wild how these narratives from yesteryear have been recycled? Like I said, ’80s vibes.

Source: SacBee today / archives

LOWER, BUT NOT A PIECE OF CAKE

Back in 1981, the median price finally went above $100,000 in California, and it’s mind-blowing to even think about that since the median home price in California was $819,740 last month (CAR). However, it wasn’t easy to buy a house back then due to high rates, and I think that gets lost in translation sometimes as we talk about housing dynamics. By the way, I’m not trying to diminish the problem of affordability today (see more on that below). I just wonder sometimes if we only look back to the “good old days” thinking it was a cinch for buyers. With that said, if you brag, “I paid $56,000 for my house in 1982, and I’m so glad I did,” that’s a tough thing to hear today for many young people who feel hopeless. Not cool to do. But young people aren’t off the hook either because too many Boomers are unfairly labeled as just one thing. Anyway, I’m getting off topic, but it’s good to evaluate how we’re showing up.

NOTE: Adjusting these prices for inflation doesn’t come anywhere close to today’s prices. $100K adjusted for inflation is $346K.

Source: SacBee today / archives

Anyway, I hope this was interesting. I got intrigued poking around old articles, and I hope you enjoyed checking this out too.

A FEW CLOSING THOUGHTS

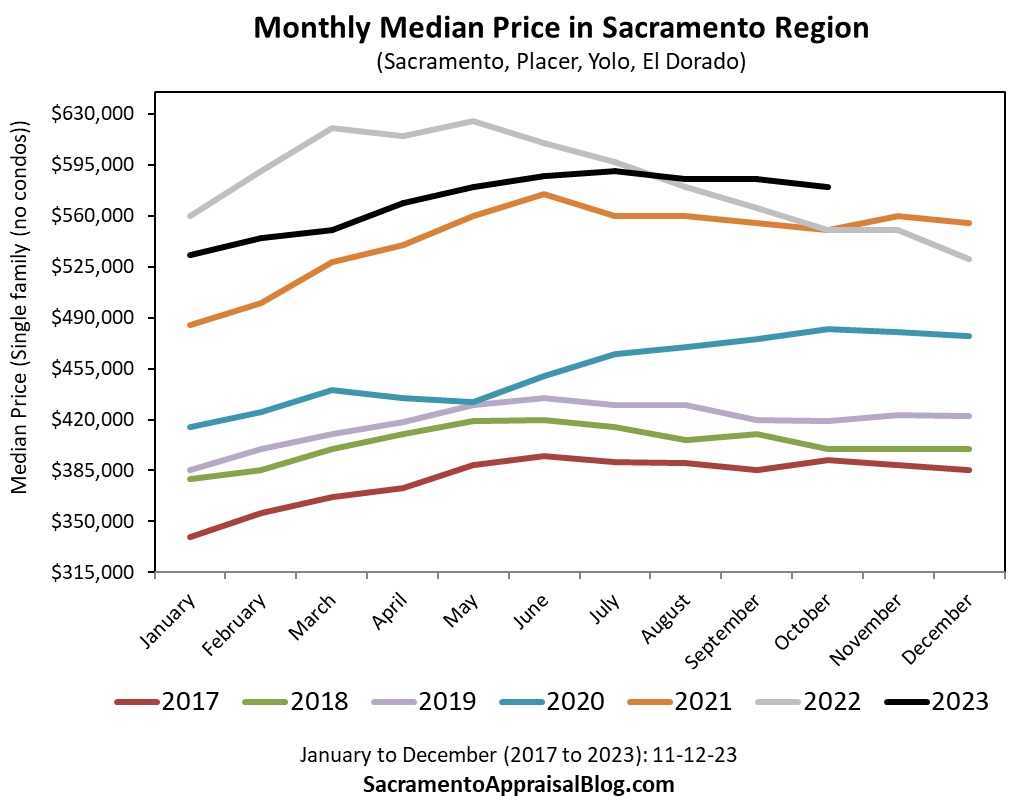

1) Affordability today is no joke: I’m not diminishing the reality of a lack of affordability today, and I hope to not get destroyed in the comments from people who think that is my intent. There is no sugarcoating the cost of buying and renting in 2024. Last year, we were missing about 40% of local buyers from the pre-2020 normal, and a lack of affordability was the big culprit.

2) Every generation struggles: I know it might sound a bit off to say this, but one encouraging layer here is seeing previous generations struggled too. I think it’s easy to feel alone in the struggle to afford, but there is something maybe mildly comforting about seeing that affordability has not always come easily through the decades. In other words, you are not alone. The truth is it’s easy to feel overwhelmed with housing headlines today, but many of these narratives have existed in the past too (I still think it’s more challenging to make it work today though).

3) There is hope: History tends to rhyme, and one thing about housing markets is they are always changing. As a broker friend told me last year, “the good markets don’t last, and neither do the bad ones” (Nick Brooks). I think that’s spot on for real estate professionals, and it’s true for buyers and sellers. In short, right now we’re in a tough part of the housing cycle because the market feels very broken with sellers sitting back, but it won’t always be like this. I can’t promise the future, but I can look to the past and say there is an ebb and flow to affordability, sales volume, and homes prices. And sometimes things end up working out even when it seems there is not a pathway to financial progress or homeownership.

Thanks for being here. And thank you again SacBee for the permission.

Questions: What stands out to you most about the headlines above? Do you think we’re going to be recycling headlines today for future generations also? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.