The housing market feels like leftovers right now. It’s that time of year where we see less new listings due to sellers hibernating for the holidays, and some of the existing inventory just feels as stale as Aunt Tina’s green bean casserole that nobody wants to see during Thanksgiving. Wait, did I say that out loud? Anyway, today let’s talk about credit card debt, the current market, and some NEW COUNTIES I’m starting to cover for stats.

UPCOMING (PUBLIC) SPEAKING GIGS:

11/16/23 Mega Agent Panel (register here)

11/30/23 Safe CU “Preparing for a Successful New Year”

12/08/23 Free Appraiser Q&A on Private Work (one hour here)

(Meeting ID: 832 2414 3890 Passcode: 007)

01/30/24 Joel Wright & Mike Gobbi Event 9am (on Zoom here)

3/11/24 Yolo Association of Realtors (details TBA)

FEELING THE STING OF INFLATION

I don’t know about you, but everything has felt so expensive lately in my household. Can you relate? Consumers are definitely feeling the sting of inflation, but they’re still buying stuff (just not real estate so much).

GETTING INTO CREDIT CARD TROUBLE

Credit card debt has been rising lately. It’s nowhere near 2007 levels, but let’s not ignore that people are starting to get into trouble (especially younger people). Source: NY Fed (PDF).

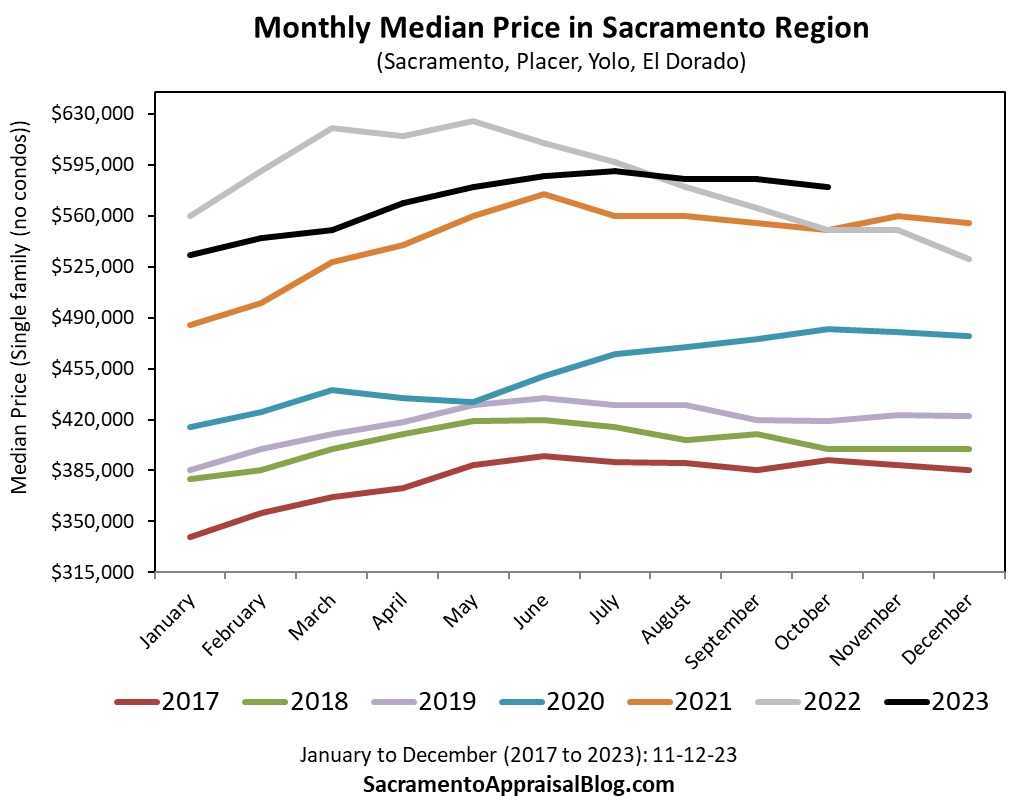

HOW I’M DESCRIBING THE MARKET

We’ve had a pretty normal fall dynamic in many ways, and it’s been very different from the sharp change last year. Prices have softened, it’s taking longer to sell, and we’re seeing less sales, which is all typical. But one thing that isn’t normal is active listings have increased over the past couple of months. At this time of year, we almost always see actives shrink, but not this year. What’s the cause? There have been fewer pending contracts lately, and that’s made the pile of active listings grow larger since properties are staying on the market (not caused by sellers rushing to list more). We’re only talking about a few hundred extra listings in the region, so let’s not sensationalize this, but obviously more listings can affect the real estate temperature. Oh, and let me clarify. We are nowhere close to a normal number of sales. It’s still been such a strange market with low volume and still low supply. By the way, here’s a thread I wrote about actives on Twitter in case there is interest.

THE RATE NARRATIVE CHANGED QUICKLY

Rates have dropped in the past two weeks, and the narrative has shifted. Many were preaching, “Rates at 8% for longer,” but now it’s, “Bro, 6% rates soon.” I get the logic of rates dropping ahead, but we also need to see what actually happens. I think it’s important to talk through all potential scenarios while remaining objective since there is still so much uncertainty.

NEW COUNTIES COVERED:

I’m taking some new counties for a test drive. If you want to see these on a consistent basis, please let me know. Also, smaller areas are in 60-day chunks since stats can be erratic with only 30 days (is that a good idea or not?).

NEW COLORS FOR THESE COUNTIES

I’m going through many visuals to update colors so there is consistency in branding. So, the colors below correspond to the colors in the stats above.

AND NOW DAYS ON MARKET WITH COLORS:

OTHER VISUALS:

I have many other visuals, but that’s it for now (besides these). Catch me on my socials every day for lots of perspective and stats that never make it here.

Thanks for being here.

Questions: How would you describe the market right now? What do you think about the new visuals? What would you like to see more of? I’d love to hear.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

HI 60Day chunks for stats is good. I welcome the newly added counties. Thx Ryan

Thanks Johnny. I really appreciate it. I’m just trying to figure out how to best tell the story of value.

Thanks, Ryan! I like added counties! (Any chance of adding Butte?)

Also, for an extremely detailed look at credit card debt (and why it is not yet a problem) see https://wolfstreet.com/2023/11/09/credit-cards-the-big-payment-method-balances-burden-delinquencies-available-credit-how-are-our-drunken-sailors-holding-up/

Thanks Monica. I’ll think about that. At the least, I do have Butte median price stats from 1990 onward. Happy to share a graph with you on that if you send me an email.

Glad you put up those delinquency charts– I saw those recently elsewhere and find them fascinating (though student loans are their own story and a bit of a distraction). I think I read someone else say it’s pretty difficult to foreclose on a home nowadays– the owner almost has to want it; otherwise, banks are encouraged to work with them to find manageable terms. Auto repos may be a thing though– I’m curious if there will be enough to create a downturn in the crazy resale market.

As for fed rate, my valueless opinion is that there is way too much exuberance still, delusional excitement over the thought of rates going down soon. I’m thinking flat or higher for YEARS. But who knows…

In my corner of the real estate market, I’m seeing volume up considerably, especially in the higher prices and higher square footage. If my Nov-Dec 2020 volume was 100%, then my 2021 was 50% and 2022 was 25%. Nov-Dec 2023 is shaping up to be near 2020 levels.

Thanks Joda. I always appreciate hearing your take. Let’s keep watching the market. And student loans are something to watch too. There is a really cool student loan delinquency chart at the NY Fed link I shared above the delinquency images. There basically isn’t anything to show right now since payments just resumed. I’m eager to see how that shows up again. Lots of people stopped paying their loans during the pandemic because they had space to not pay.

Thanks Ryan, as always great information. Thanks for all you do.

Thank you so much Rick.

Interesting look at debt. We spend so much time as appraisers looking at our neighborhood and local trends, we can forget to look at other factors that might influence trends. Thank you for always bringing us little insights.

Thanks Gary. Yeah, this stuff can matter. It’s also easy to get sensational about. I’m definitely paying attention.

Love the addition of San Joaquin County, if you feel the need 😉 to add Stanislaus County too I wouldn’t complain!

Thanks so much Marvin. I will keep that in mind. Appreciate it.

Great charts, Ryan. I agree, things do feel like they are getting more expensive (probably because they are). I never go to the grocery store, however, recently I went with my wife. It wasn’t a visit to get groceries for the week but just to get us by for the weekend. At checkout, I was blown away at the total bill. For what we paid we COULD have gotten a whole week’s worth of shopping in past years. Then later on the news the president remarked that the economy was doing the best in years and people had more money than in the past. Not to get political but I’m not buying that narrative. I can understand why credit card debt is starting to rise. That is the only way that some people have to pay for the necessities. Hopefully, we will see an improvement in the economy and affordability soon. Keep up the great work, Ryan.

Thanks Tom. I feel similar. Sometimes my wife will start talking about something, and I say, “I don’t even want to know how much it cost. Don’t tell me.” Haha. It does feel like there is a disconnect between inflation data improving and the feel on the street. I’ve heard some economists echo this sentiment, and I suspect many people can relate to that. The economy has low unemployment, and on paper things look great. It’s just expensive right now for consumers. Hope you are well, Tom.

The delinquencies don’t really seem like a big deal, they are working from low levels thanks to 2020-2022 and are really only back to where we were before 2019.

Thanks Paul. We definitely need to watch this closely since it’s rising, but you’re right that we have to keep it in perspective too. We are not at 2007 delinquency levels.