I saw a massive garage while on vacation that I just have to share. I also have some quick thoughts on focusing too much on prices. Those are the two things on my mind. Then for those interested let’s dive deep into the market.

I took almost two weeks off and part of my vacation was to drive to Boise to visit family. Of course my real estate mind doesn’t shut off when out of town, so I was blown away to see a brand new neighborhood with nearly every other house having a massive RV space in the garage. This one actually has two separate RV spaces. I’ve never seen two spaces like this in my market. Have you?

I’ll admit the neighborhood looked a little odd from the street because of the amount of space dedicated to garage doors. It didn’t look bad per se, but it was definitely different. And for the record, I would use both spaces for a massive woodworking shop. Forget the RVs.

Migration garage marketing plan: This is actually brilliant marketing because the builder is clearly appealing to the retiree crowd. In fact, when talking with a few neighborhood residents, they tell me there are lots of ex-Californians as well as people from Texas and North Carolina. This reminds us of the reality of migration. Who is coming to the market? And who is leaving? Those are two vital questions to ask to know a market.

And a quick thought on prices…

Focusing too much on price? Price is THE obsession in real estate, but focusing too much on price can actually cause us to miss the real story of the market. It’s common to hear stuff like, “Prices are up, so the market is doing great.” I get that, but what if we had a market where there are fewer buyers, but those who are buying are still paying higher prices? This is where fixating too much on prices would cause us to miss what’s really happening. After all, if sales volume is sliding, it could be a sign of buyers stepping away from the market, which is a much bigger issue (that will eventually show up in prices if the trend continues). My advice? Pay attention to prices, but give equal or more focus to what is happening with current listings and sales volume. Are buyers absorbing the listings? What are they saying about the market? How is volume changing? Is the number of sales normal or not right now? These are some of the questions to keep asking.

Any thoughts?

—–——– Big local monthly market update (long on purpose) —–——–

Now for those interested, let’s talk about Sacramento trends. Prices have been a bit flat, but the bigger story here is the sales volume slump streak of fourteen months has ended. If I had to pick a few phrases to describe the market it would be competitive if priced right, modest price growth, lower volume, and fairly normal stats for the spring / summer so far.

DOWNLOAD 70+ visuals: Please download all graphs here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

DOWNLOAD 70+ visuals: Please download all graphs here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

THE SHORT VERSION:

- Prices feel a bit flat

- The volume slump streak ended

- July looks fairly normal stat-wise

- Pendings are strong right now

- Sales volume is still down this year

- The market is slowing for the season

- Mortgage rates are like a steroid

- Inventory is sparse (but not in El Dorado County).

THE LONGER VERSION:

Here are some of the bigger topics right now:

The volume slump streak has ended: We had a fourteen month streak going, but it’s now done. For fourteen months in a row we’ve seen sales volume down compared to the same month last year until this month where sales volume was up about 4% in the region. It was a strong month for most local counties, though El Dorado County was down 15% from last year.

Modest price growth: Price metrics in the region are up about 2-5% or so this year compared to last year depending on which price metric we’re looking at. In short, this is pretty modest price growth overall, which has been the narrative all year (did you hear that sellers?).

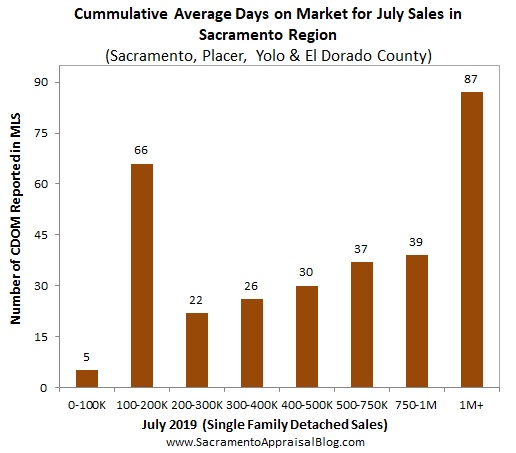

Not surprised by slowing: At this time of year we tend to see prices begin to cool and it takes longer to sell. This is exactly what the stats are showing us below too. This comes as a shock to some, but if you follow real estate closely there’s a rhythm to the market, which means we can expect this slowing EVERY. SINGLE. YEAR. In short, in a normal seasonal slowing we tend to see most of these things below happening to greater degrees as we inch closer to the holidays. This is a good reminder that low mortgage rates and sparse inventory aren’t a trump card to buck a traditional seasonal slowing. And if you want proof, it took three days longer to sell last month in the region compared to the previous month.

Rent control: The City of Sacramento approved a rent control measure today. This is huge news and it’s absolutely something to watch. I’ll be talking lots about this in coming time as the trend unfolds. I actually ran a Twitter poll the other day about rent control.

Inventory is down overall (mostly): In the region we have less than two months of housing supply. This is actually down from last year. In short, inventory is sparse on one hand, though on the other hand the new normal is low inventory. It’s tempting to say stuff like, “It’s normal to have a 5-month supply of homes for sale,” but that’s simply not true for today. Maybe it used to be the norm, but for now our new normal looks to be somewhere between 2 to 2.5 months of housing supply.

Multiple offers: When I talk about the market slowing it can sound confusing because the market feels really competitive when properties are priced right. In fact, you’ll probably get a few offers if you price it correctly. But if you overprice you can very easily get zero offers (really). Here’s a stat I’ve been tracking each month. As you can see nearly half of all sales had more than one offer last month. But then again, nearly half of sales didn’t too.

Inventory is GROWING in El Dorado County: Inventory has been shrinking in the market, but not in El Dorado County. This is a new graph I made and I hope you like it. I know it’s busy, but can you see recently how inventory has been shrinking everywhere besides El Dorado County? I may unpack this in a deeper blog post at some point, but this is definitely something to watch. Part of it could be due to the struggle of obtaining affordable fire insurance also.

Just kidding about rates never going below 4% again: It’s unreal to hear about mortgage rates at 3.5%. Remember just a couple years ago when everyone and their Mom were saying, “Rates have bottomed out.” Just kidding. They didn’t. On a serious note, low rates can act as a steroid to help get buyers off the fence and play the market. It helps buyers also artificially afford higher prices too, which isn’t the healthiest sounding thing in the world.

Property tax appeal season: If you didn’t know, it’s now property tax appeal season in the region. Most counties allow residents to dispute their property taxes between July and late November or early December (Placer County is mid-September). Here’s how the process works. Not many people honestly pay attention to their property taxes in an up market. It’s just true. But I advise for all property owners to stay in tune to be sure they are paying a fair share and no more.

I could write more, but let’s get visual instead.

FOUR BIG ISSUES TO WATCH:

1) SLOWER GROWTH: The market continues to show price growth, but the rate of change is slowing. This almost sounds offensive to some because the narrative in real estate is often that the market is always blazing hot. But let’s remember “slow” is not a dirty word in real estate. Moreover, do you know what sellers need more than anything right now? They need to price for the real market today rather than the ultra “hot” market of yesteryear.

2) A QUICK RECAP: All year prices have shown a modest uptick. What I mean is prices are up from last year, but not by much. Keep in mind the lowest price ranges are likely the “hottest” market in town too.

3) VOLUME SLUMP: Up until this past month the number of sales slumped in the region for 14 months in a row (and 13 months in Sacramento County). Sales volume was strong in July though and actually up. This year volume is still down about 9% in the region though. Overall despite a lower year of volume, it’s still not outside of normal low ranges (see 2014 and 2015).

4) PRICES SOFTENED IN JULY: The market generally slowed in July in terms of price growth. This is why I’m saying prices feel a bit flat. This is fairly normal for the time of year, and sometimes we see prices bounce up and down as summer comes to a close. Stay tuned. Let’s keep watching.

NOTE: Take El Dorado County data with a grain of salt. Stats change significantly month by month.

Thanks for respecting my content: Please don’t copy my post verbatim or alter the images in any way. I will always show respect for your original work and give you full credit, so I ask for that same courtesy. Here are 5 ways to share my content.

Please enjoy more images now.

SACRAMENTO REGION (more graphs here):

SACRAMENTO COUNTY (more graphs here):

PLACER COUNTY (more graphs here):

EL DORADO COUNTY (more graphs here):

DOWNLOAD 70+ visuals: Please download all graphs here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

Questions: What are you seeing out there? What do you think prices are doing? What are you hearing from buyers and sellers lately?

If you liked this post, subscribe by email (or RSS). Thanks for being here.