I see fidget spinners everywhere. It’s incredible how popular they’ve become over the past few months, right? Though like any fad, the market is about to change. Well, that’s what my 11-year old son thinks anyway. He sensed a “bubble” brewing, so he unloaded some of his spinner inventory on the last day of school and ended up raking in $37 (little stud).

Slower “spin” in real estate: About this time of year the real estate market begins to cool or “spin” more slowly so to speak. Though at times it feels controversial or blasphemous to say that because it goes against the grain of an ultra-positive real estate shtick. Yet no matter what, it’s normal for values to soften every year, and right now we seem to be in the beginning stages of that. This doesn’t mean the market is not incredibly competitive still or values have stopped increasing. It just means high altitude values in spring tend to subtly begin a downward descent right about now.

Pregnancy analogy: The problem is when the market slows we don’t see it in the stats yet for a couple months. It’s like taking a pregnancy test. You can be pregnant, but an over-the-counter test won’t tell you that for two weeks even though your body has 100% changed. Similarly, the real estate market may have begun to shift, but we might not see any difference in the stats yet. For example, almost every year July sales take longer to sell than June sales. It’s easy to then say, “The market changed in July.” But the truth is things actually began to change in May and June. After all, let’s remember the sales that closed in July got into contract in May and June. Thus when July sales stats show a slowing, it really tells us the market began to slow a couple months prior.

The Point: Whether spinners or real estate, let’s watch for signs of change so we can speak definitively about trends and give solid advice. Let’s be cautious to not talk about markets like they always stay the same either.

I hope that was helpful or interesting. Any thoughts?

–——-——- Big monthly market update (it’s long on purpose) ———–——-

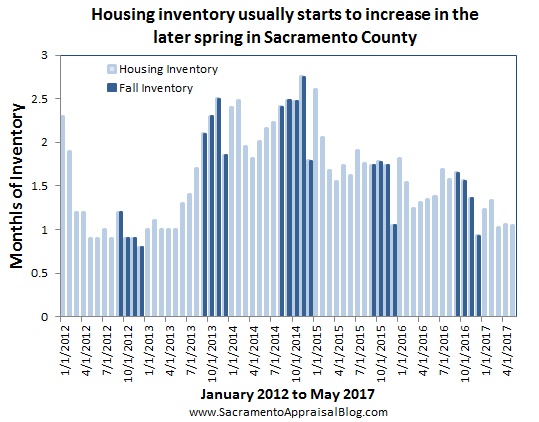

If you didn’t know, sales volume last month was the strongest May we’ve seen over the past 4 years. But don’t get too excited because sales volume for the entire year is about the same as last year. No matter how we look at it, price metrics are up 7-9% from 2016 and they increased by 2-4% last month. One of the themes that won’t go away is we have a shortage of housing. In fact, housing supply is 22% lower right now compared to last year, and it’s been putting pressure on values to increase – particularly at entry-level price ranges. The tricky part lately is many contracts are getting bid up due to multiple offers (even beyond a reasonable appraised value). This can favor sellers accepting offers from buyers who have more cash to make up the difference between the appraised value and the contract price, though FHA sales stats show first-time buyers are still finding ways to close deals. In higher price ranges the market feels much softer, though we are still seeing multiple offers when properties are priced correctly. This is a good reminder that it’s possible for the market to feel more aggressive than actual value increases. In other words, having multiple offers doesn’t mean values are increasing rapidly or at all. Lastly, we are starting to hear more about lenders rolling out 100% financing to help buyers artificially afford higher prices (sounds healthy, right?). I could go on and on with words, but let me share some graphs to show the market visually.

If you didn’t know, sales volume last month was the strongest May we’ve seen over the past 4 years. But don’t get too excited because sales volume for the entire year is about the same as last year. No matter how we look at it, price metrics are up 7-9% from 2016 and they increased by 2-4% last month. One of the themes that won’t go away is we have a shortage of housing. In fact, housing supply is 22% lower right now compared to last year, and it’s been putting pressure on values to increase – particularly at entry-level price ranges. The tricky part lately is many contracts are getting bid up due to multiple offers (even beyond a reasonable appraised value). This can favor sellers accepting offers from buyers who have more cash to make up the difference between the appraised value and the contract price, though FHA sales stats show first-time buyers are still finding ways to close deals. In higher price ranges the market feels much softer, though we are still seeing multiple offers when properties are priced correctly. This is a good reminder that it’s possible for the market to feel more aggressive than actual value increases. In other words, having multiple offers doesn’t mean values are increasing rapidly or at all. Lastly, we are starting to hear more about lenders rolling out 100% financing to help buyers artificially afford higher prices (sounds healthy, right?). I could go on and on with words, but let me share some graphs to show the market visually.

DOWNLOAD 55 graphs (and a stat sheet) HERE: Please download all graphs in this post (and more) here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

Sacramento County graphs this month (more here):

Sacramento regional graphs (more here):

DOWNLOAD 55 graphs (and a stat sheet) HERE: Please download all graphs in this post (and more) here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

Questions: Do you think we’re in a fidget spinner “bubble”? What else are you seeing in the real estate market? Did I miss anything? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

Great stuff! I have been having some interesting conversations on some forums about contract prices. I get the sense some appraisers feel it is our duty to “hit” the value. However, if a person is putting little to nothing down and can’t come up with additional funds to cover a difference in appraised value, isn’t that a sign to the lender (and the buyer) that maybe they are looking for “too much home”? Whatever happened to the 20% down principle? Heck, even the 10% down. How is putting 0-3% down even remotely healthy for the mortgage industry? I wonder if we will see a replay of the ’08 crash or some facsimile thereof…

Thanks Abdur. Our job is definitely NOT to “hit the number.” If the contract falls within a reasonable range of value, I have no issue at all reconciling the value right at the contract price. It’s really a recognition that the market, buyer, and seller nailed the value when the property was vetted. It’s easy for some to see the appraised value at the contract price as “hitting the number”, but in many cases it’s simply the appraised value lining up well with the market. The tricky part though is properties can get bid up to “no man’s land” so to speak. Thus a contract price doesn’t always represent the market. I did a purchase appraisal last month and there was one offer on the property. The seller immediately accepted an FHA offer that went $10,000 over asking. As I lined up similar sales, there just wasn’t any support for a value that high. I can see why the buyer offered that amount in order to secure a contract, but value wasn’t there.

Let’s keep watching things Abdur. It seems every other day I have a loan officer friend on Facebook telling about their new 100% financing product…..

Ryan, we are in complete agreement. I have no problem reconciling to the contract price if there is reasonable support for it.

I feel that with these little-to-no-down-payment schemes the appraiser becomes the “bad guy” if the opinion of value falls short. Lenders are using every trick they have to get people into loans, but is that healthy for the industry? If matters are that tight with the borrower now, what happens when the borrower has a financial setback? Likely they have little to no savings and guess what happens to the mortgage payment.

The appraisal is an important part of the lending process, but the appraiser is being put in an increasingly uncomfortable position. We will see how this all pans out.

And for the record I only mentioned that for the benefit of others who might be reading. Sometimes I talk with other real estate professionals who think it’s fishy to see the value at the contract price. It could be, but sometimes it’s just good appraisal methodology and respect for the open market.

Lenders have so much power right now. What they do in coming time can really impact values. We’ve seen massive value increases over the past 5 years. In Sacramento there is simply less room to see prices increases without more economic and wage growth. Yet the steroid of “creative” financing can help compensate for higher prices. Again, I’m not a doom and gloom guy. This is just one of the realities of the market right now that we need to watch. It’s never just about supply and demand. It’s about availability of financing, the economy, job market, Trump’s Twitter account (joking on that one), investors, etc…. This is why real estate is so interesting in my mind. 🙂

Very important points! Also, what is it with the FHA buyers? I have been finding that most of the contracts out in “no mans land” are from FHA buyers. Is it because so little money is coming directly out of their pockets?

My observation is that some buyers make offers based on the amount they are qualified to borrow rather than what the property is worth. On that note some buyers are less sensitive to paying a little more as long as the payment is affordable. This does seem more common for loan programs with less money down. I get it because it feels easier to spend money when it is not disappearing from a bank account. That’s just the nature of things. FHA buyers have represented about 25% of the market lately, so they are a strong force. However, FHA is down almost 7% from last year. As more and more conventional products are able to compete with FHA, we’ve seen a clear downward trend. Though FHA has still been a large force this year. I suspect in 2018 we will see the FHA percentage of the market decline. We’ll see though.

LOVE the anecdote about the fidget spinner bubble. Perhaps your son has a future in hedge funds or the stock market hahah.

I noticed a slow down in traffic for the open houses I was doing for one of my listings. Every week we were getting 5-7 parties in a 2 hour time frame, then as soon as my son got out of school we got like 1-2 and that’s it.

It starts to get hot, kids get out and now parents have to drag them to open houses, and families go on vacation around this time of year, and I think those are some of the main reasons for the slow down. But overall, still a hot market if you ask me. Great article!

Thank you Wes. I appreciate it. I hope you give away all your Realtor branded spinners soon before that “bubble” pops… 🙂

I agree with you that we can still call the market “hot”. It’s just we have to recognize when the market begins to shift. We begin to see it in subtle ways around this time of year. I love the example you gave of traffic. Case-in-point.

NOTE: To any onlookers, I am not saying the market has entered a season of decline or a “bubble” has burst. Every year we see the market slow, just like the graphs show below. If the market were to take a turn downward I think we would be watching for some more significant changes such as sales volume declining, listings no longer selling, buyer sentiment really changing, prices softening…. As an FYI, here is a video to talk through seasonal dynamics and even look at the crash in 2005. https://www.youtube.com/watch?v=k8nlTU2viQE

We had this discussion around the dinner table earlier this week. When will the ‘bubble’ burst? Our CPA friend predicted no more than two years. We’ll gear up to sell and retire then.

That’s the dream of everyone in real estate. Buy low and exit at the top. I think you’re not alone in your thinking. I know there are many locals who are not listing on purpose. The idea is to hold out until values have maximized. Very few people time real estate perfectly.

Thanks, Ryan for another great article! I miss the Placer County stats and hope you will include those again once your knee heals!

Thanks Judy. I appreciate you saying that. I’ve been asking for some feedback. if people want those stats, I’ll provide them. My knee is doing profoundly better. At first I could only bend it to 35 degrees, but now I’m at 5 degrees as of physical therapy last week. I’ve been off my cane these past two weeks also. I am blessed. Regarding the stats I suspect I’ll be back to normal next month as I should be nearly 100% by then.

For any onlookers, I am open to feedback any time regarding the way I put together this post. Keep in mind there is a one-page stats sheet in the download too. I stopped putting those stats in the actual post as it seemed clunky. I do have some ideas for better formatting in the future. I just need to find time… 🙂

Thanks again Judy.

Glad to hear you’re feeling better! Thank you, too for helping out a friend of mine recently on a trust appraisal – bad knee and all. They were very grateful for your help 🙂

Thank you Judy. I really appreciate the referral. You are the best. I will say it’s nice to now show up to houses now and not give a brief explanation why I”m using a cane. I found people were very understanding though.

You’re the Analogy King Ryan. You have more analogies about the real estate market than Gene Simmons has inches of tongue. :-),

Funny stuff Gary. Thanks. 🙂