It’s not easy to listen when the market is slowing. This is true for sellers taking in pricing advice, and it’s also true for the average person reading national headlines. Let’s talk about this. Then for those interested I have a big market update. Anything to add?

Sellers not listening: All year it seems sellers have struggled to listen to pricing advice from their real estate agents. I guess I can understand because they’ve had nothing but “hot” headlines for six years. But I think there’s another issue too. Maybe we’re seeing some of the effect of sellers having more real estate data at their disposal than ever because of Zillow, Redfin, Metrolist, blogs… So right or wrong, we have sellers who now they think they know better than anyone. Whatever the case, sellers are making real mistakes out there by not listening to pricing advice and instead pricing for a much hotter market than we actually have. In case it’s useful, I wrote an article in Comstock’s magazine with some practical advice for sellers.

Listening to national headlines: There have been sensational headlines about the market beginning to crash, and it’s difficult at times to think past these headlines and be objective. Let’s remember though that headlines are designed to get clicks, and a headline may or may not mean anything for a local market. My advice? Don’t let any headline cloud your judgement of local trends.

Listening without enough context: This sounds like such a geeky point, but hang in here with me because it matters. Lots of times in real estate we end up comparing the current year with the previous year, and that’s actually a good thing. But my sense is we’re missing something if we pay too much attention to last year only and ignore prior years. In Sacramento at least it’s been a few seasons since we’ve had a dull fall, so it’s easy to forget what that feels like. Moreover, if we look at current inventory levels beginning to push a two-month housing supply, that looks huge compared to the past couple years. But if we look at inventory from 2014 when we had a dull fall season, it was hovering between 2 to 2.75 months at the time. This reminds us it’s possible to have higher inventory at this time of year without the market utterly tanking. I don’t say this to diminish the importance of rising housing supply right now, but only to highlight the need to look to a few more years of data as we interpret what is happening. After all, sometimes pulling stats is like pulling comps. If we only look at the past 90 days of sales, that might not be enough. At times we need a much wider view to really see the market. The same thing happens with real estate data. Know what I’m saying?

I hope that was helpful. Do you “hear” what I’m saying?

—–——– Big local monthly market update (long on purpose) —–——–

The market has been slowing. Duh, we know that. Everyone’s talking about it. Let me unpack what I mean below with some comments on some of the bigger themes right now:

Coffee vs. skimming: This post has lots of information. It’s designed to skim until you find something you want to read, or pour a cup of coffee and really spend some time digesting stuff.

BIG ISSUES IN SACRAMENTO:

Prices softening: Most price metrics in the region softened between 1-2% last month, though the median price in Sacramento County was flat. Around this time of year we normally see prices dip (as graphs show below).

Slowing momentum: We know the market is slowing for the season, but it’s also slowing down in terms of overall momentum. What I mean is in years past we’d look at stats and see price metrics were up a good 8-10% over the year, but these days they’re only up closer to 4-6% instead.

Slowing rent: Rent growth has been flattening lately, which is a good thing since rents sprinted way ahead of actual wage growth. Keep in mind this doesn’t mean rents have declined. It just seems the rent trend is flattening.

Sales volume is not crashing: One of the bigger issues to watch to know if a market is crashing is a change in sales volume. In other words, if properties stop selling, we have a big problem. Last month sales volume was down about 6% in the region and 2.6% in Sacramento County. Uh oh, is that a warning sign? Look, this is important to watch over time to know if we have a trend on our hands, but before making too much of one month of data, let’s look to the bigger picture. The truth is sales volume is actually higher so far this year in the region than last year and it’s up 1% in Sacramento County too. No mater how we look at it, volume has actually been strong. This isn’t spin, but fact. Please see my charts below. So on one hand let’s watch these next months carefully because it could be a problem if monthly sales volume does start to come in lower, but let’s also not give laser focus to a weaker August while ignoring the bigger context either.

Inventory is definitely up: It’s really noticeable to see more inventory right now. Even my non-real estate wife has said she’s seeing more listings when driving around town. Housing supply is actually up 25% compared to the same time last year, and it’s literally the first time in three years since we’ve had more than a two-month supply of homes for sale. Obviously if the rate of increase keeps climbing and the market doesn’t absorb new listings, we could have a problem on our hands. But let’s also remember when the market was very dull in the fall of 2014 we saw inventory hover between 2 to 2.75 months at the time.

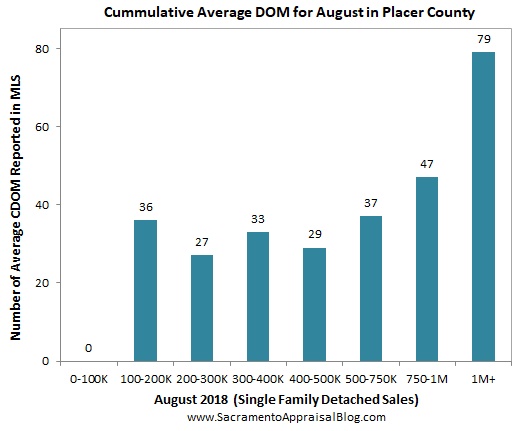

Taking longer to sell: It took five days longer to sell last month compared to the month before. And this year it took 4 day longer than last year at the same time. So the market has slowed down from last year, but it’s definitely slowing from the past few months too. Sellers, did you hear that? You are losing power in this market and buyers are gaining it. My advice? Price according to listings that are actually getting into contract rather than the highest glowing sales from the spring. This week I talked with an agent about the market feeling really soft in a particular area because listings weren’t moving. But sometimes I wonder if it’s the market or just overpriced listings. From my vantage point almost every listing in the neighborhood was priced 5-10%+ too high, so it wasn’t a real shocker they weren’t selling.

I could write more, but let’s get visual instead.

DOWNLOAD 72 graphs HERE: Please download all graphs here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

BIG QUESTIONS:

1) How did the market change from last year?

2) How did the market change from July to August?

3) Is sales volume really crashing right now?

4) How does the current market compare to the previous peak?

2005 vs CURRENT: A few months ago I talked about peak prices because some metrics were showing 2005 levels. But with the market softening right now prices are growing further apart from the “top” so to speak.

SACRAMENTO COUNTY (more graphs here):

SACRAMENTO REGION (more graphs here):

PLACER COUNTY (more graphs here):

I hope that was helpful.

DOWNLOAD 72 graphs HERE: Please download all graphs here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

Questions: Do you think sellers are struggling to listen right now? What are you seeing out there in the market? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

As usual great job. I have been having this conversation down in my area for the last 9 months. Late last year I started seeing some weird things, such as the majority of the buyers were from out of the area, because they were the only ones that could afford to buy based on price run ups in the markets. I have been recommending to the agents both listing and buyer to make sure they point out to the sellers and buyers the inventory (# of active listings) and what % of them have red arrows indicating price reductions. I also suggest they should watch the cancelled and withdrawn and I am seeing a significant increase in that area. One example of why to watch is I was asked to appraise a property that had been listed for 27 days, Yes I know that ain’t to long, but the sellers think it is an eternity. The agent asked me to get involved. What I found was that all of the actives that had been around when they priced the subject were not withdrawn from the market and the subject is about $90,000 above any other asking price and when you are between $500,000 and $630,000 that is a significant gap. Will be interested to see the results of that report once the seller has reviewed. Film at 11 on that one. Ryan as always you have some great thoughts and blogs. Job well done.

Thank you Brad. I really appreciate the deep comments you leave. Way to go on following your market carefully too. That’s interesting to hear about out-of-town buyers. It’s definitely an issue if the market cannot afford homes. In some sense we see this dynamic in Sacramento with Bay Area buyers purchasing here and then telecommuting for work (maybe going in the office once a week or just a couple times a month). But my sense is these buyers don’t make up the bulk of buyers, so it’s different than what you are experiencing. It’s still on my radar though because if the only buyers left are not participating in the local economy, then we begin to have some weird market dynamics.

Let’s keep watching. Thanks again Brad.

As a side note I read an article today on CNN I believe called “3 reasons to be worried about the housing market.” Case-in-point on why it’s important to sift headlines and crunch local data at the same time. Local trends may or may not be tied to what we read on the national level. It’s just so critical to be able to think deeply about data found in articles (if any) and how it may or may not translate to a region or local market.

Great information Ryan. You have a way of delivering the data and providing analysis without all the spin. Thank you.

Thank you so much Gary. You are too kind.

I always appreciate your great blogs and awesome market updates! I appreciate many of the points you made. News headlines are sometimes designed for emotional impact more than accuracy. I was just visiting with a real estate agent who said that their office has been having numerous meetings about a big future slow down. It’s good to pay attention to what’s going on rationally. Sadly, I think the way news is presented these days, on many topics, makes people naturally gravitate to gloom and doom when things may not be bad at all. Thanks for you great post and market update!

Thank you Jamie. I appreciate it. Headlines and hype are a real thing. There are so many messages coming at us right now. Just this morning I saw someone post on Facebook saying values are down 15%. Really? Where? Let’s see the data to back up the claim. Or I saw an email this week from a local brokerage that talked about the market really changing directions because the median price softened. But the median price normally softens at this time of year, so that’s not real proof. Thus I’m reminded there are messages to filter that are both national and even local. Thanks again for the kind words. Let’s keep watching.

For any onlookers, if you are pulling stats from Trendgraphix each month you may notice a difference between what I show and what they show. There is a reason for that, and this is a technical data issue (that matters). For instance, I report that sales volume was down in the region by 7% in August, but Trendgraphix currently shows 12%. The figure of 7% really is more accurate for a number of reasons. Trendgraphix is getting 12% because they’re essentially comparing their updated data from August 2017 compared to very fresh data in August 2018. I wrote about this issue in a comment last month and wanted to mention it here in case there was any confusion. This is where pulling data in equal chunks really begins to matter. https://sacramentoappraisalblog.com/2018/08/14/how-would-you-know-if-the-market-was-starting-to-tank/#comment-152378