Who are the players in the market? Who is buying and selling? Who is coming? Who is going? These are questions we have to ask to grasp a local market. And for real estate professionals, knowing who the players are helps us serve clients well and sometimes even make future business plans.

Well, let’s talk about a new player in town called Opendoor. This company is trying to gain a foothold in about 20 markets across the country right now. If you’re not local, are they in your area?

Opendoor posted up in Sacramento last year and they’ve begun to make a splash. They’re not dominating the market by any stretch, but in the region over the past few months they bought over 90 homes. I don’t fully understand the fine print of their business model yet, but in a nutshell they buy from owners privately and then put these homes back on the market to sell to the public. In fact, mostly all of their private purchases are currently re-listed on our local MLS. Opendoor also has an affiliation with Lennar – a local builder.

My real estate antennas: Any time I see a group buying a larger amount of homes, I pay attention. In the past I talked heavily about Blackstone, and in the future I’ll discuss other players whether they’re making a splash or shaping the market (like Blackstone did). Any stories or thoughts?

Now for those interested, let’s talk about the market – especially pendings.

I hope this was interesting or helpful.

—–——– Big local monthly market update (long on purpose) —–——–

The market slumped during the second half of 2018, and now it’s an interesting spot. Let’s talk about it.

THE SHORT VERSION:

- Pendings were normal for January

- Sales volume has slumped for 8 months in a row

- Prices are barely up from last year

- Most metrics softened as expected for January

- The market is starting to wake up for the spring

- This post is long on purpose. Skim or pour a cup of coffee.

DOWNLOAD 70+ graphs: Please download all graphs here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

THE LONGER VERSION:

Here’s some of the bigger topics to consider right now.

We need time: We don’t have a totally clear picture for where the market is going yet in 2019. We still need more time. Here is what I am specifically looking for in the stats over these next few months.

Normal pendings: It’s big news that pending sales were normal this past month compared to last January. We’ve had a slump in sales volume for eight months, so what does this mean? Well, it could be the market trying to find some normalcy after two quarters of sluggishness. Though the real cause very likely stems from mortgage rates recently declining. It’s amazing how that can affect buyers and even sales volume. Remember, pendings in January will likely close in February and especially March. So if we start to see a normal level of pendings in January and February, we may see sales volume show normalcy for the time being.

Yeah, most metrics softened: We saw the typical signs we’d expect to see at this time of year with most metrics. It look longer to sell last month, prices dipped, inventory increased, and sales volume sloughed. Though overall the softening in most metrics felt way more pronounced.

Low rates are steroids: Mortgage rates declined and that’s seeming to draw some buyers back into the market. Low rates are like steroids for demand – at least temporarily.

More listings this year: There’s more listings this year compared to last year at the same time. In fact, it’s been about five years since we’ve started the year with this much housing supply.

Waking up: I’m hearing from many agents about more buyer attention on their listings lately. More traffic at open houses. More offers. It’s still to be determined what this spring market will look like exactly, but for now the spring season is starting to move.

Not seeing aggressive price gains: The rate of price change has slowed. What I mean is in years past we’d see 7-10% price increases when running stats, but now we’re seeing modest 2-3% year-over-year price gains.

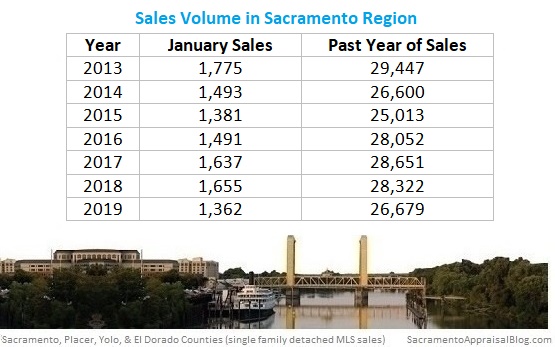

In case you need slumping trivia to impress friends: Last month we saw the worst sales volume in 11 years for a January. We’ve had eight months in a row of year-over-year sales volume declines. That’s a dismal stat and there’s no sugar-coating it. If this trend doesn’t change we’re going to have a much different market. Yet this is why seeing normal pendings for January is a big deal because today’s level of pendings could presumably show a normal number of sales in a couple of months when these properties close.

The Tallest Graph in Sacramento: Here’s a look at over 60,000 single family detached sales in Sacramento County. This graph is inspired by Jonathan Miller.

Less offers: Here’s an interesting way to see the market has slowed. Multiple offers are down about 11% this year.

More concessions in new construction: Lots of builders are offering credits and concessions to help get their deals done lately. This is a symptom of a slower market. It seems more sellers are also offering concessions and credits too. Buyers, don’t be afraid to negotiate with sellers since the market has slowed, but at the same time don’t think you are driving the market either. Keep your perception of power in check. And sellers, talk with your agent about whether credits or concessions might need to be an option on the table.

Final thought before the graphs: In closing, the market is in an interesting spot. It feels like it’s juggling uncertainty from last year with a striving for normalcy today. We only have one month of data and we need to keep watching to see how this market is going to emerge.

I could write more, but let’s get visual instead.

BIG ISSUES TO WATCH:

1) SLOWING MOMENTUM: The stats show the market is slowing down when we look at the rate of change by year. Looking at monthly, quarterly, and annual numbers helps give a balanced view of things.

2) SALES VOLUME SLUMP: It’s important to look at sales volume in a few ways to get the bigger picture. Here it is by month and year.

SACRAMENTO COUNTY:

Key Stats:

- January volume down 21.5%

- Volume is down 4.7% over the past 12 months

SACRAMENTO REGION:

Key Stats:

- January volume down 17.7%

- Volume is down 5.8% over the past 12 months

PLACER COUNTY:

Key Stats:

- January volume down 10.9%

- Volume is down 7.7% over the past 12 months

3) LAST YEAR VS THIS YEAR: Here’s a comparison of last year compared to the same time this year. What do you see?

NOTE: Placer County had very few sales this January, so I wouldn’t put much weight on the price figures for this month.

SACRAMENTO COUNTY (more graphs here):

SACRAMENTO REGION (more graphs here):

PLACER COUNTY (more graphs here):

I hope that was helpful.

DOWNLOAD 70+ graphs: Please download all graphs here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

BLOG BASH: Just a reminder I’m hosting a blog party on March 2nd from 3-7pm. You’re invited to celebrate my blog’s 10th birthday. I know, that sounds a little cheesy. But I’ll be buying the first 100 beers… Details here.

Questions: Any stories to share about who is playing the market right now? What are you experiencing right now in the trenches with buyers and sellers?

If you liked this post, subscribe by email (or RSS). Thanks for being here.

Great job as always. Let’s see what March brings.

Thanks Joe. I appreciate it. Yes indeed. Now we wait. And you just read a version I finished at 3am. I corrected some of the spelling errors. Hopefully I got ’em all…

Always loaded with info and love the Tallest Graph. Thank you for all your work on this.

Thanks Gary. I appreciate it. I made a tallest graph a few years back, but I haven’t done it since. I love it too. Hope you’re well these days.

Thanks, Ryan. Great post and fantastic data. Open Door is in some of our markets but I do not see that large of numbers as you have. I ran a quick search for one county and there were less than 10.

Thanks Shannon. Yes, I saw on their website they’re in DFW if I’m not mistaken. They had 18 metro areas listed. Good for you to stay on top of trends. We really do have to keep tabs on who is playing the market.

Great data, Ryan. I looked at your linked discussion in recent comments with Mr. Miyagi about bubbles, the Fed, and what happens next. I’m keenly interested in that, too. As for what to watch for next, I’m looking to see how data around May/June/July look to see how our peak values of the year hold up against last year. We could still be a small percent above last year’s prices now, even while we’re six months into a downward slide off last summer’s peaks that might continue sliding through this spring.

Thank you Steve. I appreciate it. I keep sharing that conversation with Mr. Miyagi as it helps articulate what I’m looking for.

You are 100% correct about prices. A market changes first in the listings and then sales volume. The trend eventually catches up to prices and shows up there. Frankly, prices are about the last thing I look at to gauge what a market is doing. I’m not saying they don’t matter, but I think there are far more clues in other metrics instead of waiting for prices to change. I’m much more interested in days on market, changes in sales volume, the sales price to original list price ratio, inventory changes, the word on the street, etc… I did a Facebook Live market update this morning with an agent and he asked me what I expect in coming time. I told him I’m taking it month by month right now. There is still an element of uncertainty, though the market seems to be flirting with normalcy in pendings. So we need to watch that closely to see how it plays out. In other words, we’ll likely gain more clarity over the next couple months in particular….

Out of curiosity, I had OpenDoor give me an estimate for my home. I was actually surprised at the range they were prepared to offer. I of course stopped the conversation there as I wasn’t selling but it was interesting. I am sure they would have only paid the lower end of the price range they offered. If not it seems as if they are working on slim margins so they would have to be buying in volume. I would love to breakdown the numbers from someone who actually goes through the whole process with them. Interesting concept though. I think a seller would get more $$$ than going through a wholesaler but less than working with an agent. Will look forward to your continued analysis on them in the coming months. I always love your insight.

Thank you Richard. I appreciate your comment. I definitely want to hear from others too. I thought about reaching out to see what they might offer me too (just to see what they would say). I’m very curious about the fee structure and if there are fees skimmed off the top after an escrow closes. On their website they state costs for updating the property would be taken out of the price after escrow closes (or that was my understanding). I have to think they are getting kickbacks or referrals from their builder relationships for the numbers to make sense. If any onlookers have insight, please speak up. I’ll continue to follow their purchases though. Thanks again Richard.

Great stuff as always, Ryan. I’m sure I am in the minority of your followers as just a prospective buyer (in no rush) trying to find the right moment to jump in. After following your posts for some time, I’ve realized I’ll never REALLY know when that time is, but these trends at least help me stay informed.

Regardless, I just want to say thanks for the info. It looks like a ton of work, but it’s super valuable.

Thank you CJ. This makes my day to hear. My big monthly update is an incredible amount of work. It’s a labor of love, but honestly a joy. I appreciate it though because it’s nice to get some encouragement here and there.

I really appreciate you following along and thinking through timing. On that note, please pitch in any thoughts or questions too. Now that you have an approved comment, you can comment freely too (just a heads-up).

I think that’s a powerful realization. There is an idea out there that timing a market is easy to do, but it’s really not. Though there are two aspects to time. On one hand we watch the market for the perfect time where prices are more affordable and a cycle feels like it is in the early stages (ideally). Then there is the aspect where a buyer will enter a market simply due to lifestyle changes (needs to relocate, gets married, has kids, etc…). I find most buyers fall into the latter category where they are buying based on lifestyle more than anything. Though we like to think we can perfectly time a market in all possible ways. It’s just not as easy as people make it out to be though. That’s my observation.

Anyway, I better not ramble. Let’s stay in touch. Thanks again.

Thanks Ryan, it sounds as if I’m still the resident bear at the zoo, but that’s ok. I’m looking forward to seeing how this spring/summer shapes up.

I’m in another market now but still have apartment buildings in Sacramento. I think almost all markets are the same right no–in the same overall cyclical shift. Kind of like when a building gets leveled by a wrecking ball some bricks hit the ground sooner than others.

We joked before about calling your blog The Appraisal Blog of the Entire United States, but I think all markets are inextricably linked now. The market I’m now in isn’t behaving much different than Sac, just maybe 3-6 months behind in the cycle. Just as Sac values have always been driven by SF money, the market I’m in now has gotten frothy by CA money (same story in every single US metro,) and the spigot is shutting off now.

Appreciate your updates as always and looking forward to see where this ship is headed!

Thanks as always Mr. Miyagi. I think my post would’ve been gloomy had pendings been down. But right now we’re in that place where the market is historically on pause and we’re waiting to see what it does exactly. For now we don’t technically have much data for 2019 yet other than to say pendings were normal for January (which is a break from the past few months for sure). As the market begins to unfold more and especially when stats come out, that will be telling. As a side note I’ve actually linked to our conversation from last month quite a few times when people ask me for my take on things.

The truth is the market is in a place where it could either show some normalcy or persist with the clear slumping trend of these past two quarters. When I say “normalcy” I don’t mean the market is perfectly healthy or things are just fine right now. I mean it is possible due to a number of factors to see “normal-ish” growth this spring. Maybe. I think we all know upward price growth is not something we can see forever though. But right now declining rates are like a steroid for the market. I’ve also been hearing echoes of 0% down conventional loans. Thus these elements are layers to the market that can end up swaying value or in some senses thwarting downward pressure. And most importantly I think we need to watch buyer sentiment. I think we can see this in the number of pendings and even the number of loan applications. Brakes or gas? That’s what I’m waiting to see, and I’m watching carefully one month at a time in this market.

It has been fascinating to watch how many markets are showing a similar dynamic. There is a real sense of connectivity in many markets right now. I definitely agree there. I would guess as migration patterns have changed in our country, it’s also changed the market. The articles I’ve read show Americans moving more toward the middle of the country. It makes sense since both coasts are so expensive. But we can’t ignore that this can change lots of things like politics, real estate prices, etc…

Let’s keep watching this ship….

I too read your blog because I am looking to buy a home and trying to understand the Sacramento market. Just wanted to say thanks for all of the information you put together. It’s incredibly helpful and very well organized. I will continue to read your blog even after I buy a house, because you always have something interesting to say:)

Thank you Sarah. I appreciate your kind words. Good luck out there. If you have questions, thoughts, or insight as you hunt for a home, do let me know. Thanks again.